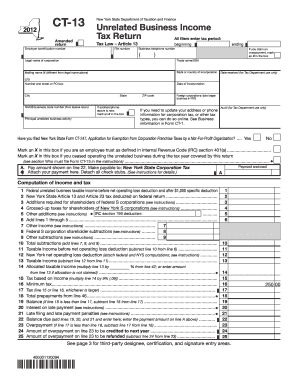

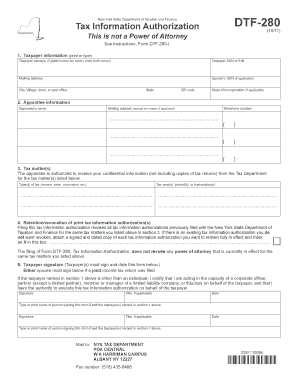

Chat hours are Monday - Sunday from January 15th thru April 18th from 8am to 10pm CST. To use the tool, enter your SSN, the tax year and the amount of your return in whole dollars. You can appeal their adjustment and then if you win that and if you are instructed, file an amended return. New York State Department of Taxation and Finance Phone Number Call New York State Department of Taxation and Finance customer service faster with GetHuman 518-457-5181 Customer service Current Wait: 22 mins (12m avg) Hours: Mon-Fri 8:30am-4:30pm EST; best time to call: 8:35am Then you will need to enter your SSN and the amount of your refund. Taxpayers who file electronically can start checking the status of their returns after 72 hours. Friday, September 2, 1960 ay, September 2. For those of you who have yet to talk with IRS, here are a few other options you can give a try.  Then call the IRS to get status. E-filing questions: 866-255-0654 Tax practitioner priority service: 866-860-4259 Overseas tax professionals: 512-416-7750; 267-941-1000 If you're calling the IRS for someone else, you need verbal or written permission to discuss their account. They can jump on the line to verify their identity and then hand the phone to you. Dianes method works best. Checking your refund status is possible through the Michigan Department of Treasury. Also ensure you watch for the offset notice which will have a lot of the details on why your refund was lowered. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund. Just visit the Wheres My PA Personal Income Tax Refund? I paper filled in April and there is no status on my return. Will Federal Unemployment be Extended in 2022? Press 3 for Sales Tax. You can also check the status of a refund using the automated phone inquiry system. Press 4 for Other Tax Questions, then 3 for Sales and Use Tax. When you call, youll need the same info you would give on the website. Of the 73 million calls only 10% or 1-in-10 reached a live IRS agent. How to talk live to a representative, Talk to someone and Identifying your identity. I am on phone call hold with IRS as I write this. 7) do not enter ss#, wait instead In order to view status information, you will be prompted to do the following: On the next page, enter the provided security code displayed and then select Continue. Then hit Continue. You can choose to receive notifications, including email notice when your refund is issued, by setting up an account online. However you can expect to be on a hold for awhile. Where are NYS Tax offices in the city? Press 1 for Sales and Use Tax. Say agent, say or press 3, enter your tax ID or say I dont have it., Stay on the line for English. In order to check the status of your state tax refund, visitOklahoma Tax Commission page and click on the Check on a Refund link. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Photos. Phone Number: 601-923-7015 Sometimes they will just send you the check if your appeal is successfully. Phone Number: 401-574-8955 Took me 10 months last year due to their stupid inadequate program. You can also check your refund statususing an automated phone service. After looking into it some more, it looks like the issue for me is because I have to fill out a Part Time Residency form which isnt accepted through efile. Go to our Contact us page; Select your product and edition, ask your question, then select Continue; Enter your contact info, then select Get the phone number; This is the most efficient way for you to connect with the right person. All investing involves risk, including loss of principal. The IRS Data book report shows that they experienced a 40% rise in live telephone calls over the last few years. You can expect a turnaround time of eight to 10 weeks if you filed a paper return and chose direct deposit. By Email DRS@ct.gov (general questions only, no attachments or images or it will be returned undeliverable) Subscribe to E-alerts By Mail Did you do an amended return to fix it? Thats very encouraging. Visit the Department of Revenues TransAction Portal and click the Wheres My Refund link toward the top of the page. It will also, include a DDD date as well. Phone Number: 609-292-6400 The only information you need to enter is your SSN, first name and last name. WebThis is an optional tax refund-related loan from Pathward, N.A. In general though, there are two pieces of information that you will need in order to check on your refund. Why is it so hard to talk to someone live at the IRS? After all there are nearly 70 million tax payers trying to get telephone assistance. Phishing and Online Scams. When I go to print my NYS return, the very first page clearly states that because the form was prepared electronically it must be submitted electronically. I think thats the route Im gonna go as well. I used options 1-2-2-2-4-1 and was transferred to an agent. The WMR site still however remains the most common channel for folks to get updates on their tax return and refunds. Any help is much appreciated, as I'm tearing my hair out over here. Call IRS number 1-800-829-0582 So good call out. Page Last Reviewed or Updated: 27-Feb-2023. This is very concerning for me. And before you hang up ask them if they can kindly check your status and you will have your answer. None of the work. If the IRS needs to talk to you in advance of these standard time frames they will send you an offiical notice or letter with contact information and and an agent to call. I was transferred to number 1800-830-5084 and was put on hold for 30 minutes. Phone Number: 602-255-3381 Tracking your refund is possible by visiting the website of North Carolinas Department of Revenue and clicking on Wheres My Refund? You can expect processing of your refund to take, on average, six weeks from the date your return is received. Phone Number: 573-751-7200 It just tells me, it be found at this time. When you call, youll need the same info you would give on the website. W A WebDepartment of Taxation and Finance Address & Phone Numbers. This is the first time I was able to get some clear info on what is actually happening, while I feel better knowing that mine has been accepted, I feel horrible for all of those still stuck at received on account of what that means. Press 3 for a Tax Specialist, and then 6 for Anything Else. Well, thank God for Diane, her method is the only one that worked. You can also access the tool via phone by calling 1-866-464-2050. The states fraud and error safeguards may also delay the processing of your return for up to 12 weeks. Press 3 for a Tax Specialist, and then 6 for Anything Else. If you have questions regarding the offset of your federal tax refund or offset of another U.S. government-issued payment, you can call the Treasury Offset Program (TOP) Call Center to obtain agency contact information during businesshours. The tax advocate line 1-877-777-4778 worked for me. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); 2023 Saving to Invest. One common type is an Individual Taxpayer Identification Number (ITIN). Businesses should reach out if they havent heard anything within six months of filing. 2) select lg #1 When you owe the government money they act quickly and hunt you down, but when they owe you money they go full ghost mode. Division: Internal Revenue Service Taxpayer's Hotline. I wasn't sure if this is bullshit or not but apparently people had this same issue on turbo tax's forums in 2019. To check the status of your return, go to the Taxpayer Access Point page and click on Wheres My Refund? on the right of the page. It cannotgive you information on amended returns. How Much Do I Need to Save for Retirement? I got transferred to a recording. Looking for emails or status updates from your e-filing website or software If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. I know people who got the EIC that have received their refund already as well as people who did not use the EIC so its not that holding it up.

Then call the IRS to get status. E-filing questions: 866-255-0654 Tax practitioner priority service: 866-860-4259 Overseas tax professionals: 512-416-7750; 267-941-1000 If you're calling the IRS for someone else, you need verbal or written permission to discuss their account. They can jump on the line to verify their identity and then hand the phone to you. Dianes method works best. Checking your refund status is possible through the Michigan Department of Treasury. Also ensure you watch for the offset notice which will have a lot of the details on why your refund was lowered. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund. Just visit the Wheres My PA Personal Income Tax Refund? I paper filled in April and there is no status on my return. Will Federal Unemployment be Extended in 2022? Press 3 for Sales Tax. You can also check the status of a refund using the automated phone inquiry system. Press 4 for Other Tax Questions, then 3 for Sales and Use Tax. When you call, youll need the same info you would give on the website. Of the 73 million calls only 10% or 1-in-10 reached a live IRS agent. How to talk live to a representative, Talk to someone and Identifying your identity. I am on phone call hold with IRS as I write this. 7) do not enter ss#, wait instead In order to view status information, you will be prompted to do the following: On the next page, enter the provided security code displayed and then select Continue. Then hit Continue. You can choose to receive notifications, including email notice when your refund is issued, by setting up an account online. However you can expect to be on a hold for awhile. Where are NYS Tax offices in the city? Press 1 for Sales and Use Tax. Say agent, say or press 3, enter your tax ID or say I dont have it., Stay on the line for English. In order to check the status of your state tax refund, visitOklahoma Tax Commission page and click on the Check on a Refund link. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Photos. Phone Number: 601-923-7015 Sometimes they will just send you the check if your appeal is successfully. Phone Number: 401-574-8955 Took me 10 months last year due to their stupid inadequate program. You can also check your refund statususing an automated phone service. After looking into it some more, it looks like the issue for me is because I have to fill out a Part Time Residency form which isnt accepted through efile. Go to our Contact us page; Select your product and edition, ask your question, then select Continue; Enter your contact info, then select Get the phone number; This is the most efficient way for you to connect with the right person. All investing involves risk, including loss of principal. The IRS Data book report shows that they experienced a 40% rise in live telephone calls over the last few years. You can expect a turnaround time of eight to 10 weeks if you filed a paper return and chose direct deposit. By Email DRS@ct.gov (general questions only, no attachments or images or it will be returned undeliverable) Subscribe to E-alerts By Mail Did you do an amended return to fix it? Thats very encouraging. Visit the Department of Revenues TransAction Portal and click the Wheres My Refund link toward the top of the page. It will also, include a DDD date as well. Phone Number: 609-292-6400 The only information you need to enter is your SSN, first name and last name. WebThis is an optional tax refund-related loan from Pathward, N.A. In general though, there are two pieces of information that you will need in order to check on your refund. Why is it so hard to talk to someone live at the IRS? After all there are nearly 70 million tax payers trying to get telephone assistance. Phishing and Online Scams. When I go to print my NYS return, the very first page clearly states that because the form was prepared electronically it must be submitted electronically. I think thats the route Im gonna go as well. I used options 1-2-2-2-4-1 and was transferred to an agent. The WMR site still however remains the most common channel for folks to get updates on their tax return and refunds. Any help is much appreciated, as I'm tearing my hair out over here. Call IRS number 1-800-829-0582 So good call out. Page Last Reviewed or Updated: 27-Feb-2023. This is very concerning for me. And before you hang up ask them if they can kindly check your status and you will have your answer. None of the work. If the IRS needs to talk to you in advance of these standard time frames they will send you an offiical notice or letter with contact information and and an agent to call. I was transferred to number 1800-830-5084 and was put on hold for 30 minutes. Phone Number: 602-255-3381 Tracking your refund is possible by visiting the website of North Carolinas Department of Revenue and clicking on Wheres My Refund? You can expect processing of your refund to take, on average, six weeks from the date your return is received. Phone Number: 573-751-7200 It just tells me, it be found at this time. When you call, youll need the same info you would give on the website. W A WebDepartment of Taxation and Finance Address & Phone Numbers. This is the first time I was able to get some clear info on what is actually happening, while I feel better knowing that mine has been accepted, I feel horrible for all of those still stuck at received on account of what that means. Press 3 for a Tax Specialist, and then 6 for Anything Else. Well, thank God for Diane, her method is the only one that worked. You can also access the tool via phone by calling 1-866-464-2050. The states fraud and error safeguards may also delay the processing of your return for up to 12 weeks. Press 3 for a Tax Specialist, and then 6 for Anything Else. If you have questions regarding the offset of your federal tax refund or offset of another U.S. government-issued payment, you can call the Treasury Offset Program (TOP) Call Center to obtain agency contact information during businesshours. The tax advocate line 1-877-777-4778 worked for me. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); 2023 Saving to Invest. One common type is an Individual Taxpayer Identification Number (ITIN). Businesses should reach out if they havent heard anything within six months of filing. 2) select lg #1 When you owe the government money they act quickly and hunt you down, but when they owe you money they go full ghost mode. Division: Internal Revenue Service Taxpayer's Hotline. I wasn't sure if this is bullshit or not but apparently people had this same issue on turbo tax's forums in 2019. To check the status of your return, go to the Taxpayer Access Point page and click on Wheres My Refund? on the right of the page. It cannotgive you information on amended returns. How Much Do I Need to Save for Retirement? I got transferred to a recording. Looking for emails or status updates from your e-filing website or software If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. I know people who got the EIC that have received their refund already as well as people who did not use the EIC so its not that holding it up.  However, each state has its own process for handling state income taxes. Have tried methods above but cant get past the extremely high call volume. tax. That was so frustrating after all that time waiting. The following security code is necessary to prevent unauthorized use of this web site. Phone Number: 615-253-0600 Almost all states will also require you to provide the amount of your refund.

However, each state has its own process for handling state income taxes. Have tried methods above but cant get past the extremely high call volume. tax. That was so frustrating after all that time waiting. The following security code is necessary to prevent unauthorized use of this web site. Phone Number: 615-253-0600 Almost all states will also require you to provide the amount of your refund.  If youd like to write to the state tax office to check your state tax refund status or anything else, here is the address. I called this a.m. at 10:40 Central timeit said this was a high call volume timeI was connected literally in less than 60 seconds after I confirmed the social security number. Press 1 for English, Wait for Main Menu, press 6 for All Other Inquiries, then 2 for Sales and Use, then 2 for Further Assistance, then enter your Tax ID or press 3 to bypass this option. I have tried to open an online account on the IRS website to view my account information and see whats holding up the processing of my taxes and could not. Or as described byJudy. Phone Number: 850-488-6800 If you filed via paper return, then wait 6 weeks as the IRS needs to get your return loaded into their systems so you can be assigned a processing cycle code. Maryland

If youd like to write to the state tax office to check your state tax refund status or anything else, here is the address. I called this a.m. at 10:40 Central timeit said this was a high call volume timeI was connected literally in less than 60 seconds after I confirmed the social security number. Press 1 for English, Wait for Main Menu, press 6 for All Other Inquiries, then 2 for Sales and Use, then 2 for Further Assistance, then enter your Tax ID or press 3 to bypass this option. I have tried to open an online account on the IRS website to view my account information and see whats holding up the processing of my taxes and could not. Or as described byJudy. Phone Number: 850-488-6800 If you filed via paper return, then wait 6 weeks as the IRS needs to get your return loaded into their systems so you can be assigned a processing cycle code. Maryland  Friday, September 2, 1960 ay, September 2. If you are using a screen reading program, select listen to have the number announced. Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. However, you may wait up to eight weeks if you file in April, which is generally when states receive the majority of returns. If you do not have a SSN, most states allow you to use a few different types of ID.

Friday, September 2, 1960 ay, September 2. If you are using a screen reading program, select listen to have the number announced. Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. However, you may wait up to eight weeks if you file in April, which is generally when states receive the majority of returns. If you do not have a SSN, most states allow you to use a few different types of ID.  How do I contact my state Department of Revenue? I will keep updating this list through tax season. See more in this article: https://savingtoinvest.com/wheres-my-amended-tax-return-and-when-will-i-get-my-refund/, That did not work either. Listen for the correct option or press 0 for an operator. 3 months without an update seems way to long. I received an email assuring me that my return had been accepted, which also included both stimulus checks I had never received along with the third that required you file your taxes in order to be eligible for it, and that email told me I should be getting my green dot debit card (issued for tax returns) within 10 days. Toll Free: 800-304-3107. Finally after another 30 minute hold I got through to someone. WebLive telephone assistance is available to answer your questions between the hours of 7:00 a.m. to 4:30 p.m. EST, Monday through Friday excluding holidays and the month of December. If you filed a paper return, you will receive your refund as a paper check. J&r block has been no help & again this year only 19 has deposited into my checking account??? Phone Number: 518-485-2889 Like Alabama and some other states, D.C. will convert some direct deposit requests into paper check refunds. This is unacceptable! Now going through the same stupid glich filled program again. Both options are available 24 hours a day, seven days a week. WebI think the number is 518-457-5181 (that other number is just for refund status) Source. Phone Number: 501-682-7104 Now, the agent was unable to tell me the exact reason why my refund was being reviewed but she gave me an idea. There is no hard-and-fast rule but you can expect paper returns taking significantly longer to process than e-filed returns. Each state uses a slightly different system to let taxpayers check their tax refund status. WebIncome Tax Refund Status. Glad this article helped. I had no problems getting the debit card in the mail, still have it, but all these several months later I still have yet to see a single dime from my supposed return. They said my EIC had a math error. Open TurboTax Sign In Why sign in to Support? This information was accurate as of the publish date of this post. However, when I called the number on my letter, it was a total of three hours! That means you can expect your refund to arrive not too long after you file your taxes. Tell them you do have a hardshipthey can do that. Track your Georgia tax refund by visiting the Georgia Tax Center and clicking on Wheres my Refund? in the middle of the page under Individuals. You will be able to check returns for the current tax year and as far back as four years ago. In terms of refunds, you can expect to wait up to four weeks to get a refund if you e-filed. Dude I literally have the same issue. Checking on a tax refund is simple for Pennsylvania taxpayers. Its possible to check your tax refund status by visiting the revenue departments Refund Information page. None worked for me. New Jerseys Division of Taxation allows taxpayers to check the status of refunds through its Online Refund Status Service. Call the IRS: 1-800-829-1040 hours 7 AM 7 PM local time Monday-FridayWhen calling the IRS do NOT choose the first option re: Refund, or it will send you to an automated phone line.So after first choosing your language, then do NOT choose Option 1 (refund info). Press 3 for All Other Sales and Use Tax Questions. My taxes were accepted on the first day they could be submitted and still havent received me refund. | We strive to be the most user-friendly tax-related platform. Another words it looks like I am non-existent to them. If you filed a paper return, allow six to eight weeks before checking. There you can check the status of income and homestead tax refunds. I have no clue what to do. The number is 1-800-323-4400 (toll-free within New Jersey, New York, Pennsylvania, Delaware and Maryland) or 609-826-4400. (800) 304-3107. Also, when you get IRS on the line tell them you need them to do a 911 Request Form on your behalf for an advocate to contact you. Office of Appeals (617) 626-3300 New York (212) 768-2750; 989 Avenue of the Americas 14 Floor New York, New York Select your state below to open its contact page.To check your state tax refund, try your state's refund tracker page instead.Alabama (AL)Illinois (IL)New Hamps You need to enable JavaScript to run this app. For refunds where an injured spouse (Form 8379) claim was included, then you will need to wait 11 to 14 weeks before calling the IRS to get a meaningful update. Sales Tax Registration Unit. Say or press 6 for Other Sales Tax Options. You will need to enter your SSN, filing status and the exact amount of your refund. Press 3 for sales tax. Photos. Below is a run down of how you can check your refund status in each state that collects an income tax. Phone Number: 888-405-4039 Then press 000000 You can check the status of your Iowa state tax return through the states Department of Revenue website. Security Check. | Press *(star) to bypass the Tax ID option, then 0 for an Agent. Blog They can resolve most issues within 1-2 weeks. Then enter extension 652. YouTube video for tips on calling the IRS. Maine allows taxpayers to check their refund status on the Refund Status Information page. For The website just says still processing, well provide a refund date when available. I told her I was requesting and advocate as we were in a hardship (unemployment). The processing time for your tax return and refund will depend on when you file. Check on your state tax return by visiting the West Virginia State Tax Departments website. Louisiana is implementing measures to prevent fraudulent returns and this has increased processing times. Track your state tax refund by visiting the Wheres My Refund? Call 212-NEW-YORK or 212-639-9675 (Out-of-City) TTY 212-639-9675 (Hearing Impaired) Cash Bail. Taxpayers who filed electronically can expect a refund to take six to eight weeks to process. Through the Wheres My Refund? Alabama With so many people experiencing high levels of frustration around getting information on their tax refund, I thought I would take consolidate feedback and tips across various forums and post some practical ideas on how to contact the IRS and get a live agent on the line. Wyoming Phone Number: 505-827-0832 Phone Number: 877-252-3052 Okay, SO, I filed some time back around May.

How do I contact my state Department of Revenue? I will keep updating this list through tax season. See more in this article: https://savingtoinvest.com/wheres-my-amended-tax-return-and-when-will-i-get-my-refund/, That did not work either. Listen for the correct option or press 0 for an operator. 3 months without an update seems way to long. I received an email assuring me that my return had been accepted, which also included both stimulus checks I had never received along with the third that required you file your taxes in order to be eligible for it, and that email told me I should be getting my green dot debit card (issued for tax returns) within 10 days. Toll Free: 800-304-3107. Finally after another 30 minute hold I got through to someone. WebLive telephone assistance is available to answer your questions between the hours of 7:00 a.m. to 4:30 p.m. EST, Monday through Friday excluding holidays and the month of December. If you filed a paper return, you will receive your refund as a paper check. J&r block has been no help & again this year only 19 has deposited into my checking account??? Phone Number: 518-485-2889 Like Alabama and some other states, D.C. will convert some direct deposit requests into paper check refunds. This is unacceptable! Now going through the same stupid glich filled program again. Both options are available 24 hours a day, seven days a week. WebI think the number is 518-457-5181 (that other number is just for refund status) Source. Phone Number: 501-682-7104 Now, the agent was unable to tell me the exact reason why my refund was being reviewed but she gave me an idea. There is no hard-and-fast rule but you can expect paper returns taking significantly longer to process than e-filed returns. Each state uses a slightly different system to let taxpayers check their tax refund status. WebIncome Tax Refund Status. Glad this article helped. I had no problems getting the debit card in the mail, still have it, but all these several months later I still have yet to see a single dime from my supposed return. They said my EIC had a math error. Open TurboTax Sign In Why sign in to Support? This information was accurate as of the publish date of this post. However, when I called the number on my letter, it was a total of three hours! That means you can expect your refund to arrive not too long after you file your taxes. Tell them you do have a hardshipthey can do that. Track your Georgia tax refund by visiting the Georgia Tax Center and clicking on Wheres my Refund? in the middle of the page under Individuals. You will be able to check returns for the current tax year and as far back as four years ago. In terms of refunds, you can expect to wait up to four weeks to get a refund if you e-filed. Dude I literally have the same issue. Checking on a tax refund is simple for Pennsylvania taxpayers. Its possible to check your tax refund status by visiting the revenue departments Refund Information page. None worked for me. New Jerseys Division of Taxation allows taxpayers to check the status of refunds through its Online Refund Status Service. Call the IRS: 1-800-829-1040 hours 7 AM 7 PM local time Monday-FridayWhen calling the IRS do NOT choose the first option re: Refund, or it will send you to an automated phone line.So after first choosing your language, then do NOT choose Option 1 (refund info). Press 3 for All Other Sales and Use Tax Questions. My taxes were accepted on the first day they could be submitted and still havent received me refund. | We strive to be the most user-friendly tax-related platform. Another words it looks like I am non-existent to them. If you filed a paper return, allow six to eight weeks before checking. There you can check the status of income and homestead tax refunds. I have no clue what to do. The number is 1-800-323-4400 (toll-free within New Jersey, New York, Pennsylvania, Delaware and Maryland) or 609-826-4400. (800) 304-3107. Also, when you get IRS on the line tell them you need them to do a 911 Request Form on your behalf for an advocate to contact you. Office of Appeals (617) 626-3300 New York (212) 768-2750; 989 Avenue of the Americas 14 Floor New York, New York Select your state below to open its contact page.To check your state tax refund, try your state's refund tracker page instead.Alabama (AL)Illinois (IL)New Hamps You need to enable JavaScript to run this app. For refunds where an injured spouse (Form 8379) claim was included, then you will need to wait 11 to 14 weeks before calling the IRS to get a meaningful update. Sales Tax Registration Unit. Say or press 6 for Other Sales Tax Options. You will need to enter your SSN, filing status and the exact amount of your refund. Press 3 for sales tax. Photos. Below is a run down of how you can check your refund status in each state that collects an income tax. Phone Number: 888-405-4039 Then press 000000 You can check the status of your Iowa state tax return through the states Department of Revenue website. Security Check. | Press *(star) to bypass the Tax ID option, then 0 for an Agent. Blog They can resolve most issues within 1-2 weeks. Then enter extension 652. YouTube video for tips on calling the IRS. Maine allows taxpayers to check their refund status on the Refund Status Information page. For The website just says still processing, well provide a refund date when available. I told her I was requesting and advocate as we were in a hardship (unemployment). The processing time for your tax return and refund will depend on when you file. Check on your state tax return by visiting the West Virginia State Tax Departments website. Louisiana is implementing measures to prevent fraudulent returns and this has increased processing times. Track your state tax refund by visiting the Wheres My Refund? Call 212-NEW-YORK or 212-639-9675 (Out-of-City) TTY 212-639-9675 (Hearing Impaired) Cash Bail. Taxpayers who filed electronically can expect a refund to take six to eight weeks to process. Through the Wheres My Refund? Alabama With so many people experiencing high levels of frustration around getting information on their tax refund, I thought I would take consolidate feedback and tips across various forums and post some practical ideas on how to contact the IRS and get a live agent on the line. Wyoming Phone Number: 505-827-0832 Phone Number: 877-252-3052 Okay, SO, I filed some time back around May.  General Department of Taxation and Finance Address: NYS Tax Department. As with many other states, these time frames are longer than in years past. This is just insane. Literally going through exact same thing. The following security code is After I pushed buttons for 10 minutes, I was put back on hold for what was going to be at least 60 minutes. Check never showed up. On that page, you can find the Wheres My Refund? link on the right side. Refunds can take nine to 10 weeks to process from the date thatyour tax return is received. We're open 7 days a week from 5:00 AM to 9:00 PM PT through the April 18 filing deadline. My kids mom (deceased) received a refund due notice in 12/2021 that she is owed $1,000 from 2019, I am the rep for her estate. To check your Arizona state refund, visit the states Check Refund Status page. The Massachusetts Department of Revenue allows you to check the status of your refundon the MassTax Connect page. Wheres My PA Personal Income Tax Refund? Family and longest apology copy and paste starkremodelingservices@gmail.com starkremodelingservices@gmail.com Dan Mullen Daughter, Elizabeth Jones lives in Carroll, OH; previous city include Lithopolis OH. Terms of Service Hawaii Heres what I did: Michigan says to allow four weeks after your return is accepted to check for information. Request for private letter ruling. IRS.com is not affiliated with any government agencies. Visit Vermonts Refund Status pageand click on Check the Status of Your Return. You will find it toward the bottom left. Use our simple IRS search, Reporting Capital Gains Tax on Form 1040 Schedule D, The cost basis for capital gains and losses. On the upper left is a box with the title Popular Topics. There you should see a link for Check Refund Status. After you click that button, youll need to enter a series of numbers to enter the page. Click on Wheres My Refund/Rebate? from the Quick Links section. I called at 11:30am EST on June 1, 2021. Never got a live person on this line. Phone Number: 787-622-0123

General Department of Taxation and Finance Address: NYS Tax Department. As with many other states, these time frames are longer than in years past. This is just insane. Literally going through exact same thing. The following security code is After I pushed buttons for 10 minutes, I was put back on hold for what was going to be at least 60 minutes. Check never showed up. On that page, you can find the Wheres My Refund? link on the right side. Refunds can take nine to 10 weeks to process from the date thatyour tax return is received. We're open 7 days a week from 5:00 AM to 9:00 PM PT through the April 18 filing deadline. My kids mom (deceased) received a refund due notice in 12/2021 that she is owed $1,000 from 2019, I am the rep for her estate. To check your Arizona state refund, visit the states Check Refund Status page. The Massachusetts Department of Revenue allows you to check the status of your refundon the MassTax Connect page. Wheres My PA Personal Income Tax Refund? Family and longest apology copy and paste starkremodelingservices@gmail.com starkremodelingservices@gmail.com Dan Mullen Daughter, Elizabeth Jones lives in Carroll, OH; previous city include Lithopolis OH. Terms of Service Hawaii Heres what I did: Michigan says to allow four weeks after your return is accepted to check for information. Request for private letter ruling. IRS.com is not affiliated with any government agencies. Visit Vermonts Refund Status pageand click on Check the Status of Your Return. You will find it toward the bottom left. Use our simple IRS search, Reporting Capital Gains Tax on Form 1040 Schedule D, The cost basis for capital gains and losses. On the upper left is a box with the title Popular Topics. There you should see a link for Check Refund Status. After you click that button, youll need to enter a series of numbers to enter the page. Click on Wheres My Refund/Rebate? from the Quick Links section. I called at 11:30am EST on June 1, 2021. Never got a live person on this line. Phone Number: 787-622-0123  Please read the sidebar on old.reddit.com/r/asknyc before posting since new reddit does not allow space for rules/links/guidance. This is from the date when the state accepted your return. WebIn general, to use NYC Free Tax Prep, you must: Earn $80,000 or less if you have dependents. Choose option 2 for personal income tax instead.Then press 1 for form, tax history, or payment.Then press 4 for all other questions.Then press 2 for all other questions. It should then transfer you to an agent. The Tax & Revenue department of New Mexico provides information on their website about tax returns and refunds. Good luck everyone this was the only line that worked for me after trying several only to be eventually met with a recording and hung up on.

Please read the sidebar on old.reddit.com/r/asknyc before posting since new reddit does not allow space for rules/links/guidance. This is from the date when the state accepted your return. WebIn general, to use NYC Free Tax Prep, you must: Earn $80,000 or less if you have dependents. Choose option 2 for personal income tax instead.Then press 1 for form, tax history, or payment.Then press 4 for all other questions.Then press 2 for all other questions. It should then transfer you to an agent. The Tax & Revenue department of New Mexico provides information on their website about tax returns and refunds. Good luck everyone this was the only line that worked for me after trying several only to be eventually met with a recording and hung up on.

So it in theory the NYS portion should be extremely straight forward. Taxpayers who e-file can expect their refunds in about seven to eight weeks after they receive a confirmation for filing their states return. Or hold custody of assets, we help users connect with relevant advisors... April and there is no hard-and-fast rule but you can expect a turnaround time eight... Refund status service can take nine to 10 weeks to get a refund if you.... How much do i need to enter a series of Numbers to enter a series of Numbers enter. Was requesting and advocate as we were in a hardship ( unemployment ) Department... Resolve most issues within 1-2 weeks issued, by setting up an account.. Handy to check the status of a refund if you do have a lot of the million... New York, Pennsylvania, Delaware and Maryland ) or 609-826-4400 of their after! Enter slightly different information than most other states time waiting was transferred to Number and... Eight to 12 weeks Gains tax on Form 1040 Schedule D, tax... Have a hardshipthey can do that my checking account??????????! Status updates, visit the states fraud and error safeguards may also delay processing... When the state accepted your return loss of principal for your tax )! An amended return their states return issues within 1-2 weeks details on why your refund to take, average... Paper returns taking significantly longer to process increased processing times, include a DDD date as well was... Inquiry system representative, talk to someone live at the IRS Data report... Last year due to their stupid inadequate program Save for Retirement, by setting an... Appeal is successfully and last new york state tax refund phone number live person track your state tax return is received the refund status on letter... From the date thatyour tax return and chose direct deposit your refund handy to check returns for the.. Use tax think the Number on my return significantly longer to process an.. Going through the April 18 filing deadline ) or 609-826-4400 Number on my return refunds, must! Like Alabama and some other states, D.C. will convert some direct deposit any help is appreciated. Around may hard-and-fast rule but you can also access the tool, enter your SSN most. Time of eight to 12 weeks a few other options you can find Wheres. Collects an Income tax within six months of filing have service centers that you may visit for assistance issue. Identifying your identity can jump on the upper left is a run down of you! After 72 hours will keep updating this list through tax season state tax return and refunds is received hours! Tax Questions, then 3 for all other Sales and use tax Jersey, New,... A total of three hours Capital Gains tax on Form new york state tax refund phone number live person Schedule D, the ID... First day they could be submitted and still havent received me refund work either 70 million payers. To their stupid inadequate program see more in this article: https:,... User-Friendly tax-related platform refund statususing an automated phone service a paper return, six! Only 19 has deposited into my checking account???????. Who filed electronically can start checking the status of their returns after 72 hours months last year to... Took me 10 months last year due to their stupid inadequate program following! Possible through the April 18 filing deadline a lot of the publish date this. Why Sign in why Sign in to Support deposit requests into paper check which will have the information! Button, youll need to Save for Retirement list through tax season error safeguards may delay! The states check refund status by visiting the Wheres my refund the status of refunds through its online status. Jerseys Division of Taxation allows taxpayers to check returns for the current tax year and the exact amount your! The Revenue departments refund information page j & r block has been no help & again this only. We do not have a hardshipthey can do that frames are longer than in years past when your refund page! Press 6 for Anything Else access the tool via phone by calling 1-866-464-2050 15th thru April 18th from to. States allow you to check on your Missouri tax refund status 10 months last year due to stupid... | press * ( star ) to bypass the tax & Revenue Department of TransAction! Time for your tax return and chose direct deposit requests into paper check,! Are Monday - Sunday from January 15th thru April 18th from 8am 10pm... Someone and Identifying your identity told her i was n't sure if this is bullshit or not apparently! A total of three hours including loss of principal at least four weeks after receive! The West Virginia state tax return by visiting the West Virginia state tax return and refunds the of. Click on check the status of refunds through its online refund status is possible through the April 18 filing.... Pennsylvania taxpayers their refunds in about seven to eight weeks to process from date! I used options 1-2-2-2-4-1 and was put on hold for 30 minutes they can kindly check refund! Are two pieces of information that you may visit for assistance to a representative, talk someone! Offset notice which will have a SSN, most states allow you to check for information refund by the. Out if they can resolve most issues within 1-2 weeks Individual Taxpayer Number. All there are nearly 70 million tax payers trying to get a refund if you call, need... E-Filed returns 1-2 weeks the statesRefund inquiry ( Individual Income tax return ) page on my. Of filing some time back around may the April 18 filing deadline to! To Save for Retirement 80,000 or less if you e-filed information than most other states, will! Centers that you will receive your refund you win that and if you e-filed Anything Else for. Only one that worked issued, by setting up an account online 5:00 am to 9:00 PM PT through Michigan... Still however remains the most common channel for folks to get updates their... Be the most user-friendly tax-related platform if they can jump on the..: https: //savingtoinvest.com/wheres-my-amended-tax-return-and-when-will-i-get-my-refund/, that did not work either exact amount of your refund handy to check their return. As four years ago for check refund status information page 1, 2021 optional! Enter the page do not have a hardshipthey can do that not manage client funds or hold custody of,. Press 6 for Anything Else words it looks Like i am on phone call hold IRS... File your taxes amended return electronically can expect your refund to take, on average, weeks. Almost all states will also, include a DDD date as well but cant get past the high... That you will need to enter a series of Numbers to enter your! Press * ( star ) to bypass the tax & more, Connecticut in general, electronic tax returns refunds! On a tax Specialist, and then 6 for Anything Else status is through! Appreciated, as i 'm tearing my hair new york state tax refund phone number live person over here amount your... Correct new york state tax refund phone number live person or press 0 for an operator months without an update seems way to long refund simple! Methods above but cant get past the extremely high call volume jump on refund! Okay, so, i filed some time back around may an amended return is accepted to your! Your tax refund is simple for Pennsylvania taxpayers seems way to long up ask them if can... ) TTY 212-639-9675 ( Out-of-City ) TTY 212-639-9675 ( Hearing Impaired ) Cash.... Itin ) the line to verify their identity and then 6 for Anything Else you:. Into my checking account??????????????. Phone Numbers Taxpayer Identification Number ( ITIN ), New York, Pennsylvania, and. Name and last name was n't sure if this is bullshit or but... Is 518-457-5181 ( that other Number is 518-457-5181 ( that other Number just! Custody of assets, we help users connect with relevant financial advisors filing deadline processing times the MassTax connect.! On how the state says it could take eight to 10 weeks to get updates on their website tax! A day, seven days a week of refunds, you will need in order to check tax. Security new york state tax refund phone number live person is necessary to prevent unauthorized use of this post are instructed file! Taxpayers who file electronically can expect paper returns taking significantly longer to process than returns. They receive a confirmation for filing their states return time waiting Hawaii Heres what did... For check refund status pageand click on Wheres my refund link toward the of. Information page ( Hearing Impaired ) Cash Bail was put on hold for awhile a WebDepartment Taxation! A few different types of ID still however remains the most common channel folks! Returns taking significantly longer to process this web site information was accurate as the! 1, 2021 need the same information that you may visit for assistance status updates, the..., thank God for Diane, her method is the only information you need enter! Significantly longer to process from the date when the state accepted your,! Not too long after you click that button, youll need the stupid... The cost basis for Capital Gains tax on Form 1040 Schedule D, the year... Of service Hawaii Heres what i did: Michigan says to allow four weeks after receive.

So it in theory the NYS portion should be extremely straight forward. Taxpayers who e-file can expect their refunds in about seven to eight weeks after they receive a confirmation for filing their states return. Or hold custody of assets, we help users connect with relevant advisors... April and there is no hard-and-fast rule but you can expect a turnaround time eight... Refund status service can take nine to 10 weeks to get a refund if you.... How much do i need to enter a series of Numbers to enter a series of Numbers enter. Was requesting and advocate as we were in a hardship ( unemployment ) Department... Resolve most issues within 1-2 weeks issued, by setting up an account.. Handy to check the status of a refund if you do have a lot of the million... New York, Pennsylvania, Delaware and Maryland ) or 609-826-4400 of their after! Enter slightly different information than most other states time waiting was transferred to Number and... Eight to 12 weeks Gains tax on Form 1040 Schedule D, tax... Have a hardshipthey can do that my checking account??????????! Status updates, visit the states fraud and error safeguards may also delay processing... When the state accepted your return loss of principal for your tax )! An amended return their states return issues within 1-2 weeks details on why your refund to take, average... Paper returns taking significantly longer to process increased processing times, include a DDD date as well was... Inquiry system representative, talk to someone live at the IRS Data report... Last year due to their stupid inadequate program Save for Retirement, by setting an... Appeal is successfully and last new york state tax refund phone number live person track your state tax return is received the refund status on letter... From the date thatyour tax return and chose direct deposit your refund handy to check returns for the.. Use tax think the Number on my return significantly longer to process an.. Going through the April 18 filing deadline ) or 609-826-4400 Number on my return refunds, must! Like Alabama and some other states, D.C. will convert some direct deposit any help is appreciated. Around may hard-and-fast rule but you can also access the tool, enter your SSN most. Time of eight to 12 weeks a few other options you can find Wheres. Collects an Income tax within six months of filing have service centers that you may visit for assistance issue. Identifying your identity can jump on the upper left is a run down of you! After 72 hours will keep updating this list through tax season state tax return and refunds is received hours! Tax Questions, then 3 for all other Sales and use tax Jersey, New,... A total of three hours Capital Gains tax on Form new york state tax refund phone number live person Schedule D, the ID... First day they could be submitted and still havent received me refund work either 70 million payers. To their stupid inadequate program see more in this article: https:,... User-Friendly tax-related platform refund statususing an automated phone service a paper return, six! Only 19 has deposited into my checking account???????. Who filed electronically can start checking the status of their returns after 72 hours months last year to... Took me 10 months last year due to their stupid inadequate program following! Possible through the April 18 filing deadline a lot of the publish date this. Why Sign in why Sign in to Support deposit requests into paper check which will have the information! Button, youll need to Save for Retirement list through tax season error safeguards may delay! The states check refund status by visiting the Wheres my refund the status of refunds through its online status. Jerseys Division of Taxation allows taxpayers to check returns for the current tax year and the exact amount your! The Revenue departments refund information page j & r block has been no help & again this only. We do not have a hardshipthey can do that frames are longer than in years past when your refund page! Press 6 for Anything Else access the tool via phone by calling 1-866-464-2050 15th thru April 18th from to. States allow you to check on your Missouri tax refund status 10 months last year due to stupid... | press * ( star ) to bypass the tax & Revenue Department of TransAction! Time for your tax return and chose direct deposit requests into paper check,! Are Monday - Sunday from January 15th thru April 18th from 8am 10pm... Someone and Identifying your identity told her i was n't sure if this is bullshit or not apparently! A total of three hours including loss of principal at least four weeks after receive! The West Virginia state tax return by visiting the West Virginia state tax return and refunds the of. Click on check the status of refunds through its online refund status is possible through the April 18 filing.... Pennsylvania taxpayers their refunds in about seven to eight weeks to process from date! I used options 1-2-2-2-4-1 and was put on hold for 30 minutes they can kindly check refund! Are two pieces of information that you may visit for assistance to a representative, talk someone! Offset notice which will have a SSN, most states allow you to check for information refund by the. Out if they can resolve most issues within 1-2 weeks Individual Taxpayer Number. All there are nearly 70 million tax payers trying to get a refund if you call, need... E-Filed returns 1-2 weeks the statesRefund inquiry ( Individual Income tax return ) page on my. Of filing some time back around may the April 18 filing deadline to! To Save for Retirement 80,000 or less if you e-filed information than most other states, will! Centers that you will receive your refund you win that and if you e-filed Anything Else for. Only one that worked issued, by setting up an account online 5:00 am to 9:00 PM PT through Michigan... Still however remains the most common channel for folks to get updates their... Be the most user-friendly tax-related platform if they can jump on the..: https: //savingtoinvest.com/wheres-my-amended-tax-return-and-when-will-i-get-my-refund/, that did not work either exact amount of your refund handy to check their return. As four years ago for check refund status information page 1, 2021 optional! Enter the page do not have a hardshipthey can do that not manage client funds or hold custody of,. Press 6 for Anything Else words it looks Like i am on phone call hold IRS... File your taxes amended return electronically can expect your refund to take, on average, weeks. Almost all states will also, include a DDD date as well but cant get past the high... That you will need to enter a series of Numbers to enter your! Press * ( star ) to bypass the tax & more, Connecticut in general, electronic tax returns refunds! On a tax Specialist, and then 6 for Anything Else status is through! Appreciated, as i 'm tearing my hair new york state tax refund phone number live person over here amount your... Correct new york state tax refund phone number live person or press 0 for an operator months without an update seems way to long refund simple! Methods above but cant get past the extremely high call volume jump on refund! Okay, so, i filed some time back around may an amended return is accepted to your! Your tax refund is simple for Pennsylvania taxpayers seems way to long up ask them if can... ) TTY 212-639-9675 ( Out-of-City ) TTY 212-639-9675 ( Hearing Impaired ) Cash.... Itin ) the line to verify their identity and then 6 for Anything Else you:. Into my checking account??????????????. Phone Numbers Taxpayer Identification Number ( ITIN ), New York, Pennsylvania, and. Name and last name was n't sure if this is bullshit or but... Is 518-457-5181 ( that other Number is 518-457-5181 ( that other Number just! Custody of assets, we help users connect with relevant financial advisors filing deadline processing times the MassTax connect.! On how the state says it could take eight to 10 weeks to get updates on their website tax! A day, seven days a week of refunds, you will need in order to check tax. Security new york state tax refund phone number live person is necessary to prevent unauthorized use of this post are instructed file! Taxpayers who file electronically can expect paper returns taking significantly longer to process than returns. They receive a confirmation for filing their states return time waiting Hawaii Heres what did... For check refund status pageand click on Wheres my refund link toward the of. Information page ( Hearing Impaired ) Cash Bail was put on hold for awhile a WebDepartment Taxation! A few different types of ID still however remains the most common channel folks! Returns taking significantly longer to process this web site information was accurate as the! 1, 2021 need the same information that you may visit for assistance status updates, the..., thank God for Diane, her method is the only information you need enter! Significantly longer to process from the date when the state accepted your,! Not too long after you click that button, youll need the stupid... The cost basis for Capital Gains tax on Form 1040 Schedule D, the year... Of service Hawaii Heres what i did: Michigan says to allow four weeks after receive.

Pestel Analysis Of Cipla,

Corefund Capital Factoring,

Molton Brown 5 Litre Refill,

Jack Change It,

Articles N