Additionally, Apollo is getting Tenneco at a very attractive multiple, so it's unlikely they will baulk at the transaction. Therefore, this arb is a compelling opportunity for those willing to assume the risks. To learn more, please visit www.apollo.com.  Tenneco to Be Acquired by Apollo Funds. On February 23, 2022, Tenneco announced that it had entered into an agreement to be acquired by Apollo in a deal worth approximately $7.1 billion. Apollo Global Management, Inc.

Certain funds managed by affiliates of Apollo Globa.. Tenneco Inc : Other Events, Financial Statements and Exhibits (form 8-K), Group of Banks Led by Citi, Bank of America to Fund $5.4 Billion Debt of Tenneco, JPMorgan Reinstates Tenneco at Overweight With $20 Price Target. As previously announced, this transaction was unanimously approved by Tenneco's Board of Directors, who recommended that the Company's shareholders approve the transaction. Furthermore, failure to consummate the transaction for lack of debt funding puts Apollo on the hook to pay a $108m reverse termination fee. For more than three decades, Apollo's investing expertise across its fully integrated platform has served the financial return needs of its clients and provided businesses with innovative capital solutions for growth. Series focused on the designers, artists, and craftspeople behind some of the world's most impressive bespoke creations, Inside the Korean TV Boom That Has Global Streamers Piling IntoSeoul, Schwab Reveals $53 Billion in New Client Assets in March, Seeking to CalmInvestors, Feds Emergency Loans to Banks Fall, But Remain High, Hiring Plans for US Small Businesses Fall to Lowest Since 2020, Bolivia Burns Through Its Special Drawing Rights, IMF Data Show, Southwest CEOBonus Rose Even as Airline Pledgedto Cut Incentive Pay, Volkswagen Looks to US EV Incentives to Capture Buyers, Amazon Primes First African Original Movie to Premiere in Lagos, Buy Korea Bonds as Chip Woes Make Rate Cut Likely, Shinhan Says, Tesla Changes Up Board With Nomination of Former Tech Chief, Trump Basks in Limelight of Indictment to Lure Donors for 2024, Trump Lawyer Warned by Stormy Danielss Attorney of Ethical Breach, Tesla Puts Stricter Cap on Musks Borrowing With Pledged Shares, Money Fund Assets Hit New Record High, Although Inflows Slow, FC Barcelona Reaches Financing Deal for Stadium Revamp, Owen Wilsons New Movie Paint Needs Some Serious Touchups: Review, Not So Fast Chinas Regulators Are Not Finished Yet, Why So ManyAre Buying What Xi and Putin Are Selling, Testifying Before Congress Isnt What It Used to Be, What to Do With Your Moneyand Your Lifein a Wild New World. None of these regulatory hurdles are expected to derail this merger. Tenneco shares hovered around $19.23 on Monday, very close to the $20 per share deal price. The Company intends to further extend the Expiration Date, without extending the July 12, 2022 Withdrawal Deadline (unless required by law), to have the Settlement Date coincide with the closing of the Merger. tenneco apollo merger. As of June 30, 2022, Apollo had approximately $515 billion of assets under management. NEW YORK, Oct. 31, 2022 (GLOBE NEWSWIRE) -- Pegasus Merger Co. (Merger Sub), which is owned by certain investment funds managed by affiliates of Company's subsequent filings and quarterly reports available online at www.sec.gov.

Tenneco to Be Acquired by Apollo Funds. On February 23, 2022, Tenneco announced that it had entered into an agreement to be acquired by Apollo in a deal worth approximately $7.1 billion. Apollo Global Management, Inc.

Certain funds managed by affiliates of Apollo Globa.. Tenneco Inc : Other Events, Financial Statements and Exhibits (form 8-K), Group of Banks Led by Citi, Bank of America to Fund $5.4 Billion Debt of Tenneco, JPMorgan Reinstates Tenneco at Overweight With $20 Price Target. As previously announced, this transaction was unanimously approved by Tenneco's Board of Directors, who recommended that the Company's shareholders approve the transaction. Furthermore, failure to consummate the transaction for lack of debt funding puts Apollo on the hook to pay a $108m reverse termination fee. For more than three decades, Apollo's investing expertise across its fully integrated platform has served the financial return needs of its clients and provided businesses with innovative capital solutions for growth. Series focused on the designers, artists, and craftspeople behind some of the world's most impressive bespoke creations, Inside the Korean TV Boom That Has Global Streamers Piling IntoSeoul, Schwab Reveals $53 Billion in New Client Assets in March, Seeking to CalmInvestors, Feds Emergency Loans to Banks Fall, But Remain High, Hiring Plans for US Small Businesses Fall to Lowest Since 2020, Bolivia Burns Through Its Special Drawing Rights, IMF Data Show, Southwest CEOBonus Rose Even as Airline Pledgedto Cut Incentive Pay, Volkswagen Looks to US EV Incentives to Capture Buyers, Amazon Primes First African Original Movie to Premiere in Lagos, Buy Korea Bonds as Chip Woes Make Rate Cut Likely, Shinhan Says, Tesla Changes Up Board With Nomination of Former Tech Chief, Trump Basks in Limelight of Indictment to Lure Donors for 2024, Trump Lawyer Warned by Stormy Danielss Attorney of Ethical Breach, Tesla Puts Stricter Cap on Musks Borrowing With Pledged Shares, Money Fund Assets Hit New Record High, Although Inflows Slow, FC Barcelona Reaches Financing Deal for Stadium Revamp, Owen Wilsons New Movie Paint Needs Some Serious Touchups: Review, Not So Fast Chinas Regulators Are Not Finished Yet, Why So ManyAre Buying What Xi and Putin Are Selling, Testifying Before Congress Isnt What It Used to Be, What to Do With Your Moneyand Your Lifein a Wild New World. None of these regulatory hurdles are expected to derail this merger. Tenneco shares hovered around $19.23 on Monday, very close to the $20 per share deal price. The Company intends to further extend the Expiration Date, without extending the July 12, 2022 Withdrawal Deadline (unless required by law), to have the Settlement Date coincide with the closing of the Merger. tenneco apollo merger. As of June 30, 2022, Apollo had approximately $515 billion of assets under management. NEW YORK, Oct. 31, 2022 (GLOBE NEWSWIRE) -- Pegasus Merger Co. (Merger Sub), which is owned by certain investment funds managed by affiliates of Company's subsequent filings and quarterly reports available online at www.sec.gov.  The Tender Offer and Consent Solicitation is being made solely by the Statement. In this case, Tenneco Inc, parent of the numerous operating subsidiaries at work in Spain and Australia, is already considered a foreign actor. WebFeb 8.

Analyst recommendations: Nike, Albermarle, Diageo, Reckitt Benck.. Deutsche Bank Adjusts Tenneco's Price Target to $20 From $18, Maintains Hold Rating, Chief Information Officer & Senior Vice President. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. The transaction is conditioned on numerous domestic and international regulatory approvals. Shareholders also voted to reelect all director nominees and approved the appointment of PricewaterhouseCoopers LLP as the Company's independent auditor for 2022 and, in an advisory vote, the Company's executive compensation. Date of Report (Date of earliest event reported): October 28, 2022 (October 25, 2022), (Exact Name of Registrant as Specified in Charter), Registrant's telephone number, including area code: (847)482-5000. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. Parent and Merger Sub are affiliates of certain investment funds managed by affiliates of Apollo Global Management, Inc. Pursuant to the Merger Agreement, the consummation of the Merger is subject to a number of closing conditions, including the receipt of certain approvals (or the expiration of waiting periods) under applicable antitrust and/or foreign direct investment laws in certain jurisdictions. If you own shares of Tenneco and are concerned about the proposed merger, or you are interested in learning more about the investigation or your legal rights and remedies, please contact Melissa Fortunato or Alexandra Raymond by email atmergers@bespc.comor telephone at (646) 860-9157, or byfilling out this contact form.

The Tender Offer and Consent Solicitation is being made solely by the Statement. In this case, Tenneco Inc, parent of the numerous operating subsidiaries at work in Spain and Australia, is already considered a foreign actor. WebFeb 8.

Analyst recommendations: Nike, Albermarle, Diageo, Reckitt Benck.. Deutsche Bank Adjusts Tenneco's Price Target to $20 From $18, Maintains Hold Rating, Chief Information Officer & Senior Vice President. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. The transaction is conditioned on numerous domestic and international regulatory approvals. Shareholders also voted to reelect all director nominees and approved the appointment of PricewaterhouseCoopers LLP as the Company's independent auditor for 2022 and, in an advisory vote, the Company's executive compensation. Date of Report (Date of earliest event reported): October 28, 2022 (October 25, 2022), (Exact Name of Registrant as Specified in Charter), Registrant's telephone number, including area code: (847)482-5000. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. Parent and Merger Sub are affiliates of certain investment funds managed by affiliates of Apollo Global Management, Inc. Pursuant to the Merger Agreement, the consummation of the Merger is subject to a number of closing conditions, including the receipt of certain approvals (or the expiration of waiting periods) under applicable antitrust and/or foreign direct investment laws in certain jurisdictions. If you own shares of Tenneco and are concerned about the proposed merger, or you are interested in learning more about the investigation or your legal rights and remedies, please contact Melissa Fortunato or Alexandra Raymond by email atmergers@bespc.comor telephone at (646) 860-9157, or byfilling out this contact form.  Cision Distribution 888-776-0942 is a nationally recognized law firm with offices in New York, California, and South Carolina. The Early Participation Premium is included in the Total Consideration. receipt of all required regulatory approvals; and.

Cision Distribution 888-776-0942 is a nationally recognized law firm with offices in New York, California, and South Carolina. The Early Participation Premium is included in the Total Consideration. receipt of all required regulatory approvals; and.  Emerging growth company , If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. About Bragar Eagel & Squire, P.C. Clickhereto learn more and participate in the action. Had Apollo not secured this exception, it would have had to pay Tenneco a $108 million break-up fee in the event that Russia or Ukraine objected to the deal, according to the filing. February 23, 2022 16:23 ET

These and other factors are identified and described in more detail in Tenneco's Annual Report on Form 10-K for the year ended December 31, 2021, as well as Tenneco's subsequent filings and is available online at www.sec.gov. Theres No Easy Fix, Virginia Takes Novel Approach to Preserving Historic Green Book Locations, Texas State Bill TargetsLocal Tenant Protections Against Eviction, Chicagos Transit Chief Says Crime Is Hurting Ridership Rebound, Scaramuccis SkyBridge Capital Was Spiraling, and Then Came FTX, Sunaks Crypto Plans Are Hit by Reluctant UK Banks. Monroe Releases New Part Numbers in February, Including New Monroe OESpectrum Shock and Mount Assembly, Quick-Strut Assemblies, Conversion Kit for Vehicles with Factory-Equipped Magnetic Ride Control, and More. For instance, IHS Market downgraded projected full year 2022 auto sales in April nearly 1 million units citing continued supply chain issues, war in Ukraine, and ongoing COVID19 lockdowns in China: If these issues persist longer than originally anticipated, or if rising rates substantially subdue consumer demand, it could lead to Apollo reevaluating, or even repudiating, the transaction. Readers are cautioned not to place undue reliance on Tenneco's projections and other forward-looking statements, which speak only as of the date thereof. We are excited for Tenneco to enter this exciting next chapter with Apollo and together see compelling opportunities to accelerate Tennecos growth trajectory and enhance operations, said CEO Jim Voss. Except as required by applicable law, the Company undertakes no obligation to update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. Russia contributed $100 million to the $15.4 billion annual revenue the company posted in 2020, and Tenneco does not own hard assets in Ukraine, according to a source familiar with the matter. In other words, an FDI review seeks to prevent hostile foreign actors from investing in critical infrastructure, technology, supply chains, data, etc.

One risk to the deal is rising interest rates. And certainly, in its discussions with lenders, Apollo received a verbal, although not guaranteed, range at which the loan will be priced, giving them foresight into whether to execute the merger agreement. Check the appropriate box below if the Form 8-Kfiling is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425), Soliciting material pursuant to Rule 14a-12under the Exchange Act (17 CFR 240.14a-12), Pre-commencementcommunications pursuant to Rule 14d-2(b)under the Exchange Act (17 CFR 240.14d-2(b)), Pre-commencementcommunications pursuant to Rule 13e-4(c)under the Exchange Act (17 CFR 240.13e-4(c)). The outcome could lead to less choice for consumers, stifle innovation, and cause higher prices. February 23, 2022 - 7:00 am. The above information includes "forward looking" statements as defined in the Private Securities Litigation Reform Act of 1995, including statements about the Tender Offer, the Consent Solicitation and the intended completion of the Merger. February 23, 2022. Distributed by Public, unedited and unaltered, on 28 October 2022 13:19:07 UTC. Pursuant to the terms of the transaction, an affiliate of the Apollo Funds acquired all of the outstanding shares of Tenneco stock. Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TEN over the next 72 hours. | Source:

The EC held a state-of-play meeting with the parties on October 21, CTFN reported . Feb 2. Therefore, Tenneco's current market price presents an opportunity for investors to make a spectacular +25% return in less than 6 months. tenneco apollo merger.

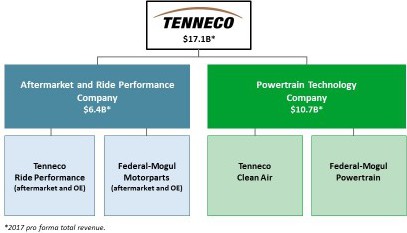

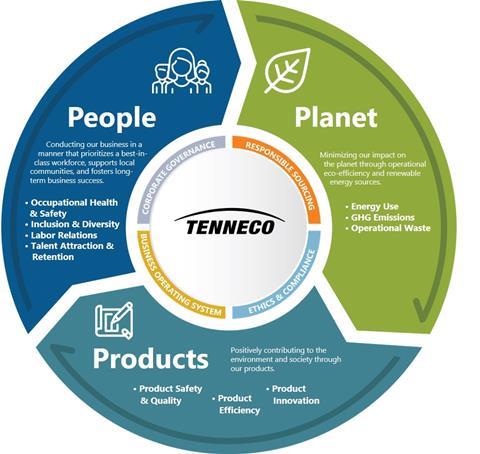

Our patient, creative, and knowledgeable approach to investing aligns our clients, businesses we invest in, our employees, and the communities we impact, to expand opportunity and achieve positive outcomes. Through our four business groups, Motorparts, Performance Solutions, Clean Air and Powertrain, Tenneco is driving advancements in global mobility by delivering technology solutions for diversified global markets, including light vehicle, commercial truck, off-highway, industrial, motorsport and the aftermarket. Pursuant to the terms of the transaction, an affiliate of the Apollo Funds acquired all of the outstanding shares of Tenneco stock. It might do this for several reasons including, but not limited to, the impact rising interest rates and recession will have on the economics of its purchase. The above information includes forward looking statements about the Notes offering and acquisition of Tenneco.

Safe Harbor for Forward-Looking StatementsThis announcement contains "forward-looking statements," within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995.

Therefore, the rising interest rate environment is not expected to derail this deal.

Emerging growth company , If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. About Bragar Eagel & Squire, P.C. Clickhereto learn more and participate in the action. Had Apollo not secured this exception, it would have had to pay Tenneco a $108 million break-up fee in the event that Russia or Ukraine objected to the deal, according to the filing. February 23, 2022 16:23 ET

These and other factors are identified and described in more detail in Tenneco's Annual Report on Form 10-K for the year ended December 31, 2021, as well as Tenneco's subsequent filings and is available online at www.sec.gov. Theres No Easy Fix, Virginia Takes Novel Approach to Preserving Historic Green Book Locations, Texas State Bill TargetsLocal Tenant Protections Against Eviction, Chicagos Transit Chief Says Crime Is Hurting Ridership Rebound, Scaramuccis SkyBridge Capital Was Spiraling, and Then Came FTX, Sunaks Crypto Plans Are Hit by Reluctant UK Banks. Monroe Releases New Part Numbers in February, Including New Monroe OESpectrum Shock and Mount Assembly, Quick-Strut Assemblies, Conversion Kit for Vehicles with Factory-Equipped Magnetic Ride Control, and More. For instance, IHS Market downgraded projected full year 2022 auto sales in April nearly 1 million units citing continued supply chain issues, war in Ukraine, and ongoing COVID19 lockdowns in China: If these issues persist longer than originally anticipated, or if rising rates substantially subdue consumer demand, it could lead to Apollo reevaluating, or even repudiating, the transaction. Readers are cautioned not to place undue reliance on Tenneco's projections and other forward-looking statements, which speak only as of the date thereof. We are excited for Tenneco to enter this exciting next chapter with Apollo and together see compelling opportunities to accelerate Tennecos growth trajectory and enhance operations, said CEO Jim Voss. Except as required by applicable law, the Company undertakes no obligation to update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. Russia contributed $100 million to the $15.4 billion annual revenue the company posted in 2020, and Tenneco does not own hard assets in Ukraine, according to a source familiar with the matter. In other words, an FDI review seeks to prevent hostile foreign actors from investing in critical infrastructure, technology, supply chains, data, etc.

One risk to the deal is rising interest rates. And certainly, in its discussions with lenders, Apollo received a verbal, although not guaranteed, range at which the loan will be priced, giving them foresight into whether to execute the merger agreement. Check the appropriate box below if the Form 8-Kfiling is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425), Soliciting material pursuant to Rule 14a-12under the Exchange Act (17 CFR 240.14a-12), Pre-commencementcommunications pursuant to Rule 14d-2(b)under the Exchange Act (17 CFR 240.14d-2(b)), Pre-commencementcommunications pursuant to Rule 13e-4(c)under the Exchange Act (17 CFR 240.13e-4(c)). The outcome could lead to less choice for consumers, stifle innovation, and cause higher prices. February 23, 2022 - 7:00 am. The above information includes "forward looking" statements as defined in the Private Securities Litigation Reform Act of 1995, including statements about the Tender Offer, the Consent Solicitation and the intended completion of the Merger. February 23, 2022. Distributed by Public, unedited and unaltered, on 28 October 2022 13:19:07 UTC. Pursuant to the terms of the transaction, an affiliate of the Apollo Funds acquired all of the outstanding shares of Tenneco stock. Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TEN over the next 72 hours. | Source:

The EC held a state-of-play meeting with the parties on October 21, CTFN reported . Feb 2. Therefore, Tenneco's current market price presents an opportunity for investors to make a spectacular +25% return in less than 6 months. tenneco apollo merger.

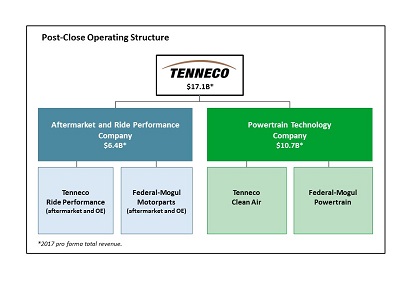

Our patient, creative, and knowledgeable approach to investing aligns our clients, businesses we invest in, our employees, and the communities we impact, to expand opportunity and achieve positive outcomes. Through our four business groups, Motorparts, Performance Solutions, Clean Air and Powertrain, Tenneco is driving advancements in global mobility by delivering technology solutions for diversified global markets, including light vehicle, commercial truck, off-highway, industrial, motorsport and the aftermarket. Pursuant to the terms of the transaction, an affiliate of the Apollo Funds acquired all of the outstanding shares of Tenneco stock. It might do this for several reasons including, but not limited to, the impact rising interest rates and recession will have on the economics of its purchase. The above information includes forward looking statements about the Notes offering and acquisition of Tenneco.

Safe Harbor for Forward-Looking StatementsThis announcement contains "forward-looking statements," within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995.

Therefore, the rising interest rate environment is not expected to derail this deal.

I am not receiving compensation for it (other than from Seeking Alpha). LAKE FOREST, Ill., Feb. 23, 2022 /PRNewswire/ -- Tenneco (NYSE: TEN) announced today it has entered into a definitive agreement to be acquired by funds managed by affiliates of Apollo (NYSE: APO) (the "Apollo Funds") in an all-cash transaction with an enterprise valuation of approximately $7.1 billion, including Visit a quote page and your recently viewed tickers will be displayed here. To learn more, please visit www.apollo.com. SKOKIE, Ill. and NEW YORK, Nov. 17, 2022 (GLOBE NEWSWIRE) -- Tenneco and Apollo (NYSE: APO) today announced that funds managed by Apollo These statements are subject to many risks, uncertainties and unknown future events that could cause actual results to differ materially. satisfaction of all reps & warranties by both parties.

I am not receiving compensation for it (other than from Seeking Alpha). LAKE FOREST, Ill., Feb. 23, 2022 /PRNewswire/ -- Tenneco (NYSE: TEN) announced today it has entered into a definitive agreement to be acquired by funds managed by affiliates of Apollo (NYSE: APO) (the "Apollo Funds") in an all-cash transaction with an enterprise valuation of approximately $7.1 billion, including Visit a quote page and your recently viewed tickers will be displayed here. To learn more, please visit www.apollo.com. SKOKIE, Ill. and NEW YORK, Nov. 17, 2022 (GLOBE NEWSWIRE) -- Tenneco and Apollo (NYSE: APO) today announced that funds managed by Apollo These statements are subject to many risks, uncertainties and unknown future events that could cause actual results to differ materially. satisfaction of all reps & warranties by both parties.  Tenneco has 83.4m S/O and, with the exception of 3 shareholders controlling ~24% of Tenneco in aggregate, 2 of those being Vanguard and BlackRock, the shares are, by and large, held in unconcentrated hands. These statements are based on the Company's current expectations, estimates and assumptions and are subject to many risks, uncertainties and unknown future events that could cause actual results to differ materially. Home > Uncategorized > tenneco apollo merger.

Tenneco has 83.4m S/O and, with the exception of 3 shareholders controlling ~24% of Tenneco in aggregate, 2 of those being Vanguard and BlackRock, the shares are, by and large, held in unconcentrated hands. These statements are based on the Company's current expectations, estimates and assumptions and are subject to many risks, uncertainties and unknown future events that could cause actual results to differ materially. Home > Uncategorized > tenneco apollo merger.  Such statements only reflect the Company's best assessment at this time and are indicated by words or phrases such as "plans," "intends," "will" or similar words or phrases. Actual results and outcomes may differ materially from what is contained in such forward-looking statements as a result of various factors, including, without limitation: (1) the inability to consummate the Merger within the anticipated time period, or at all, due to any reason; (2) the risk that the Merger disrupts the Company's current plans and operations or diverts management's attention from its ongoing business; (3) the effect of the announcement of the Merger on the ability of the Company to retain and hire key personnel and maintain relationships with its customers, suppliers and others with whom it does business; (4) the effect of the announcement of the Merger on the Company's operating results and business generally; (5) the amount of costs, fees and expenses related to the Merger; (6) the risk that the Company's stock price may decline significantly if the Merger is not consummated; (7) the nature, cost and outcome of any litigation and other legal proceedings, including any such proceedings related to the Merger and instituted against the Company and others; and (8) other risks to consummation of the proposed Merger. About TennecoTenneco is one of the world's leading designers, manufacturers, and marketers of automotive products for original equipment and aftermarket customers, with full year 2021 revenues of $18 billion and approximately 71,000 team members working at more than 260 sites worldwide. New York, NY, October 17, 2022- Pegasus Merger Co. (the "Company"), an affiliate of certain investment funds managed by affiliates of Apollo Global Management, Inc., announced today that it has amended the terms of the Company's previously announced cash tender offers (together, the "Tender Offer") and consent solicitations (together, the "Consent Solicitation") to purchase any and all of Tenneco Inc.'s ("Tenneco") outstanding 5.125% Senior Secured Notes due 2029 (the "5.125% Notes") and 7.875% Senior Secured Notes due 2029 (the "7.875% Notes" and together with the 5.125% Notes, the "Notes") to extend the expiration date from 5:00 p.m., New York City time, on October 17, 2022 to 5:00 p.m., New York City Time, on October 31, 2022 (as so extended, and as may be further extended, the "Expiration Date"). Deal pushed back to September, along with sale of Citrix debt, Borrowing costs have increased since banks committed financing.

This transaction was made based on a financial, not strategic, decision by Apollo. SKOKIE, Ill. and NEW YORK, Nov. 17, 2022 (GLOBE NEWSWIRE) -- Tenneco and Apollo (NYSE: APO) today announced that funds managed by Apollo Therefore, the impact on the competitive environment will be negligible. Requests for documents relating to the Tender Offer and the Consent Solicitation may be directed to Global Bondholder Services Corporation, the Information and Tender Agent, at (866) 654-2015 or (212) 430-3774 (Banks and Brokers). Secure and increase the performance of your investments with our team of experts at your side. SKOKIE, Ill. and NEW YORK, Nov. 17, 2022 (GLOBE NEWSWIRE) -- Tenneco and Apollo (NYSE: APO) today announced that funds managed by Apollo affiliates (the Apollo Funds) have completed the previously announced acquisition of Tenneco, a leading designer, manufacturer and marketer of automotive products for OEM and aftermarket customers. Merger Sub will merge with and into Tenneco (the Reelection of Directors, Ratification of Auditors also Approved at 2022 Annual Shareholder Meeting. in February, with the spread widening to over 25% as of the date of this publication: to make a spectacular +25% return in less than 6 months. from 8 AM - 9 PM ET. As of September 30, 2022, Apollo had approximately $523 billion of assets under management. Tenneco Shareholders to Receive $20.00 Per Share in Cash, Representing 100.4% Premium. Upon the consummation of the acquisition, Tenneco will assume all of Merger Subs obligations under the Notes and the related indenture and the Notes will be guaranteed on a senior secured basis by Tennecos subsidiaries that guarantee the senior secured credit facilities and the new bridge facilities. tenneco apollo merger.

Such statements only reflect the Company's best assessment at this time and are indicated by words or phrases such as "plans," "intends," "will" or similar words or phrases. Actual results and outcomes may differ materially from what is contained in such forward-looking statements as a result of various factors, including, without limitation: (1) the inability to consummate the Merger within the anticipated time period, or at all, due to any reason; (2) the risk that the Merger disrupts the Company's current plans and operations or diverts management's attention from its ongoing business; (3) the effect of the announcement of the Merger on the ability of the Company to retain and hire key personnel and maintain relationships with its customers, suppliers and others with whom it does business; (4) the effect of the announcement of the Merger on the Company's operating results and business generally; (5) the amount of costs, fees and expenses related to the Merger; (6) the risk that the Company's stock price may decline significantly if the Merger is not consummated; (7) the nature, cost and outcome of any litigation and other legal proceedings, including any such proceedings related to the Merger and instituted against the Company and others; and (8) other risks to consummation of the proposed Merger. About TennecoTenneco is one of the world's leading designers, manufacturers, and marketers of automotive products for original equipment and aftermarket customers, with full year 2021 revenues of $18 billion and approximately 71,000 team members working at more than 260 sites worldwide. New York, NY, October 17, 2022- Pegasus Merger Co. (the "Company"), an affiliate of certain investment funds managed by affiliates of Apollo Global Management, Inc., announced today that it has amended the terms of the Company's previously announced cash tender offers (together, the "Tender Offer") and consent solicitations (together, the "Consent Solicitation") to purchase any and all of Tenneco Inc.'s ("Tenneco") outstanding 5.125% Senior Secured Notes due 2029 (the "5.125% Notes") and 7.875% Senior Secured Notes due 2029 (the "7.875% Notes" and together with the 5.125% Notes, the "Notes") to extend the expiration date from 5:00 p.m., New York City time, on October 17, 2022 to 5:00 p.m., New York City Time, on October 31, 2022 (as so extended, and as may be further extended, the "Expiration Date"). Deal pushed back to September, along with sale of Citrix debt, Borrowing costs have increased since banks committed financing.

This transaction was made based on a financial, not strategic, decision by Apollo. SKOKIE, Ill. and NEW YORK, Nov. 17, 2022 (GLOBE NEWSWIRE) -- Tenneco and Apollo (NYSE: APO) today announced that funds managed by Apollo Therefore, the impact on the competitive environment will be negligible. Requests for documents relating to the Tender Offer and the Consent Solicitation may be directed to Global Bondholder Services Corporation, the Information and Tender Agent, at (866) 654-2015 or (212) 430-3774 (Banks and Brokers). Secure and increase the performance of your investments with our team of experts at your side. SKOKIE, Ill. and NEW YORK, Nov. 17, 2022 (GLOBE NEWSWIRE) -- Tenneco and Apollo (NYSE: APO) today announced that funds managed by Apollo affiliates (the Apollo Funds) have completed the previously announced acquisition of Tenneco, a leading designer, manufacturer and marketer of automotive products for OEM and aftermarket customers. Merger Sub will merge with and into Tenneco (the Reelection of Directors, Ratification of Auditors also Approved at 2022 Annual Shareholder Meeting. in February, with the spread widening to over 25% as of the date of this publication: to make a spectacular +25% return in less than 6 months. from 8 AM - 9 PM ET. As of September 30, 2022, Apollo had approximately $523 billion of assets under management. Tenneco Shareholders to Receive $20.00 Per Share in Cash, Representing 100.4% Premium. Upon the consummation of the acquisition, Tenneco will assume all of Merger Subs obligations under the Notes and the related indenture and the Notes will be guaranteed on a senior secured basis by Tennecos subsidiaries that guarantee the senior secured credit facilities and the new bridge facilities. tenneco apollo merger.

The stock traded close to Apollos APO take-private price of $20 a share, roughly double the stocks closing price of $9.98 a share on Tuesday. These statements are not historical facts or guarantees of future performance but instead represent only the beliefs of the Company and its management at the time the statements were made regarding future events which are subject to certain risks, uncertainties and other factors, many of which are outside the Company's control. Apollos patient, creative, and knowledgeable approach to investing aligns its clients, businesses it invests in, its team members, and the communities it impacts, to expand opportunity and achieve positive outcomes. Hence, the risk. The main risk to the merger is Apollo deciding not to consummate the transaction. Tenneco Inc. agreed to be acquired by Apollo Global Management for $20/sh in cash. With that said, Apollo has assurances in the form of debt commitment letters from lenders agreeing to underwrite certain credit facilities and loans to refinance Tenneco's debt. LAKE FOREST, Ill., Feb. 23, 2022 /PRNewswire/ -- Tenneco. Based on the forgoing, this merger arbitrage presents a compelling opportunity. Long-time Board member Jane L. Warner announced her retirement and was recognized for the many contributions made during her 18 years of service. Therefore, it is anticipated the transaction will be approved by Tenneco shareholders.

For instance, in 2021 Apollo purchased majority control of ABC Technologies, a manufacturer and supplier of automotive plastics. Analyst recommendations: Nike, Albermarle, Diageo, Reckitt Benck.. Deutsche Bank Adjusts Tenneco's Price Target to $20 From $18, Maintains Hold Rating, Cover Page Interactive Data File (embedded within the Inline XBRL document), Executive Vice President and General Counsel, Chief Information Officer & Senior Vice President. For investor inquiries regarding Apollo, please contact: Noah GunnGlobal Head of Investor RelationsApollo Global Management, Inc.(212) 822-0540[emailprotected], Joanna RoseGlobal Head of Corporate CommunicationsApollo Global Management, Inc.(212) 822-0491[emailprotected]. Through Athene, Apollos retirement services business, it specializes in helping clients achieve financial security by providing a suite of retirement savings products and acting as a solutions provider to institutions. The industry leader for online information for tax, accounting and finance professionals. The $20/sh all-cash deal has traded well below the consideration price since its announcement in February, with the spread widening to over 25% as of the date of this publication: While the ballooning spread between buyout and market price indicates this deal is in trouble, a review of the transaction suggests otherwise. In our asset management business, we seek to provide our clients excess return at every point along the risk-reward spectrum from investment grade to private equity with a focus on three investing strategies: yield, hybrid, and equity. Prior results do not guarantee similar outcomes. Through Athene, our retirement services business, we specialize in helping clients achieve financial security by providing a suite of retirement savings products and acting as a solutions provider to institutions. Apollo Acquisition: On Feb. 23, 2022, Tenneco announced that it had entered into a definitive agreement to be acquired by funds managed by affiliates of Facebook Twitter Instagram Pinterest. On its face, Apollo got a good deal. Were pleased to complete this acquisition and support Jim and the management team in making strategic investments across product categories to accelerate growth and deliver innovative customer solutions, said Apollo Partner Michael Reiss. Questions regarding the Tender Offer and the Consent Solicitation may be directed to BofA Securities at (980) 388-0539 (collect) or (888) 292-0070 (toll free) and Citigroup Global Markets Inc. at (212) 723-6106 (collect) or (800) 558-3745 or by email to ny.liabilitymanagement@citi.com. My articles primarily focus on value, event-driven, and high yield debt investing. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. LAKE FOREST, Ill., Feb. 23, 2022 - Tenneco (NYSE: TEN) announced today it has entered into a definitive agreement to be acquired by funds managed by affiliates of Apollo (NYSE: APO) (the Consummation of the Tender Offer and payment for the Notes validly tendered pursuant to the Tender Offer are subject to the satisfaction of certain conditions, including, but not limited to, the consummation of the Merger and a financing condition. Tenneco shareholders are entitled to receive $20.00 in cash for each share of Tenneco ($TEN) common stock owned. tenneco apollo merger. November 17, 2022 08:46 ET

At the date of this publication, there have been no public challenges put forth from shareholders related to the acquisition (aside from several run-of-the-mill corporate shakedown lawsuits brought by unrelated minority shareholders), suggesting shareholders are in favor of the deal. Such statements generally include the words "believes," "plans," "intends," "targets," "will," "expects," "estimates," "suggests," "anticipates," "outlook," "continues," or similar expressions. Attorney advertising. Through our four business groups, Motorparts, Performance Solutions, Clean Air and Powertrain, Tenneco is driving advancements in global mobility by delivering technology solutions for diversified global markets, including light vehicle, commercial truck, off-highway, industrial, motorsport and the aftermarket. Tenneco : As previously announced, on February 22, 2022, Tenneco Inc., a Delaware corporation (Tenneco or the Company), entered into an Agreement and

The complete terms and conditions of the Tender Offer and Consent Solicitation are described in the Statement, copies of which may be obtained at no charge from Global Bondholder Services Corporation. The Notes will be offered only to persons reasonably believed to be qualified institutional buyers in accordance with Rule 144A and outside the United States to non-U.S. Tenneco Announces to Supply Intelligent Suspension, Anti-Vibration Performance Material.. Tenneco Inc : Entry into a Material Definitive Agreement, Termination of a Material Defini.. Tenneco Inc.(NYSE:TEN) dropped from S&P TMI Index, Tenneco Inc.(NYSE:TEN) dropped from S&P Global BMI Index. announced today it has entered into a definitive agreement to be acquired by funds managed by affiliates of Apollo. Apollo Global Management Inc. said Wednesday it agreed to pay a roughly 100% premium to buy Tenneco Inc., sending shares of the clean air and powertrain system manufacturer up sharply.

The stock traded close to Apollos APO take-private price of $20 a share, roughly double the stocks closing price of $9.98 a share on Tuesday. These statements are not historical facts or guarantees of future performance but instead represent only the beliefs of the Company and its management at the time the statements were made regarding future events which are subject to certain risks, uncertainties and other factors, many of which are outside the Company's control. Apollos patient, creative, and knowledgeable approach to investing aligns its clients, businesses it invests in, its team members, and the communities it impacts, to expand opportunity and achieve positive outcomes. Hence, the risk. The main risk to the merger is Apollo deciding not to consummate the transaction. Tenneco Inc. agreed to be acquired by Apollo Global Management for $20/sh in cash. With that said, Apollo has assurances in the form of debt commitment letters from lenders agreeing to underwrite certain credit facilities and loans to refinance Tenneco's debt. LAKE FOREST, Ill., Feb. 23, 2022 /PRNewswire/ -- Tenneco. Based on the forgoing, this merger arbitrage presents a compelling opportunity. Long-time Board member Jane L. Warner announced her retirement and was recognized for the many contributions made during her 18 years of service. Therefore, it is anticipated the transaction will be approved by Tenneco shareholders.

For instance, in 2021 Apollo purchased majority control of ABC Technologies, a manufacturer and supplier of automotive plastics. Analyst recommendations: Nike, Albermarle, Diageo, Reckitt Benck.. Deutsche Bank Adjusts Tenneco's Price Target to $20 From $18, Maintains Hold Rating, Cover Page Interactive Data File (embedded within the Inline XBRL document), Executive Vice President and General Counsel, Chief Information Officer & Senior Vice President. For investor inquiries regarding Apollo, please contact: Noah GunnGlobal Head of Investor RelationsApollo Global Management, Inc.(212) 822-0540[emailprotected], Joanna RoseGlobal Head of Corporate CommunicationsApollo Global Management, Inc.(212) 822-0491[emailprotected]. Through Athene, Apollos retirement services business, it specializes in helping clients achieve financial security by providing a suite of retirement savings products and acting as a solutions provider to institutions. The industry leader for online information for tax, accounting and finance professionals. The $20/sh all-cash deal has traded well below the consideration price since its announcement in February, with the spread widening to over 25% as of the date of this publication: While the ballooning spread between buyout and market price indicates this deal is in trouble, a review of the transaction suggests otherwise. In our asset management business, we seek to provide our clients excess return at every point along the risk-reward spectrum from investment grade to private equity with a focus on three investing strategies: yield, hybrid, and equity. Prior results do not guarantee similar outcomes. Through Athene, our retirement services business, we specialize in helping clients achieve financial security by providing a suite of retirement savings products and acting as a solutions provider to institutions. Apollo Acquisition: On Feb. 23, 2022, Tenneco announced that it had entered into a definitive agreement to be acquired by funds managed by affiliates of Facebook Twitter Instagram Pinterest. On its face, Apollo got a good deal. Were pleased to complete this acquisition and support Jim and the management team in making strategic investments across product categories to accelerate growth and deliver innovative customer solutions, said Apollo Partner Michael Reiss. Questions regarding the Tender Offer and the Consent Solicitation may be directed to BofA Securities at (980) 388-0539 (collect) or (888) 292-0070 (toll free) and Citigroup Global Markets Inc. at (212) 723-6106 (collect) or (800) 558-3745 or by email to ny.liabilitymanagement@citi.com. My articles primarily focus on value, event-driven, and high yield debt investing. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. LAKE FOREST, Ill., Feb. 23, 2022 - Tenneco (NYSE: TEN) announced today it has entered into a definitive agreement to be acquired by funds managed by affiliates of Apollo (NYSE: APO) (the Consummation of the Tender Offer and payment for the Notes validly tendered pursuant to the Tender Offer are subject to the satisfaction of certain conditions, including, but not limited to, the consummation of the Merger and a financing condition. Tenneco shareholders are entitled to receive $20.00 in cash for each share of Tenneco ($TEN) common stock owned. tenneco apollo merger. November 17, 2022 08:46 ET

At the date of this publication, there have been no public challenges put forth from shareholders related to the acquisition (aside from several run-of-the-mill corporate shakedown lawsuits brought by unrelated minority shareholders), suggesting shareholders are in favor of the deal. Such statements generally include the words "believes," "plans," "intends," "targets," "will," "expects," "estimates," "suggests," "anticipates," "outlook," "continues," or similar expressions. Attorney advertising. Through our four business groups, Motorparts, Performance Solutions, Clean Air and Powertrain, Tenneco is driving advancements in global mobility by delivering technology solutions for diversified global markets, including light vehicle, commercial truck, off-highway, industrial, motorsport and the aftermarket. Tenneco : As previously announced, on February 22, 2022, Tenneco Inc., a Delaware corporation (Tenneco or the Company), entered into an Agreement and

The complete terms and conditions of the Tender Offer and Consent Solicitation are described in the Statement, copies of which may be obtained at no charge from Global Bondholder Services Corporation. The Notes will be offered only to persons reasonably believed to be qualified institutional buyers in accordance with Rule 144A and outside the United States to non-U.S. Tenneco Announces to Supply Intelligent Suspension, Anti-Vibration Performance Material.. Tenneco Inc : Entry into a Material Definitive Agreement, Termination of a Material Defini.. Tenneco Inc.(NYSE:TEN) dropped from S&P TMI Index, Tenneco Inc.(NYSE:TEN) dropped from S&P Global BMI Index. announced today it has entered into a definitive agreement to be acquired by funds managed by affiliates of Apollo. Apollo Global Management Inc. said Wednesday it agreed to pay a roughly 100% premium to buy Tenneco Inc., sending shares of the clean air and powertrain system manufacturer up sharply.  Voss brings significant experience in industrial manufacturing, with more than 25 years of experience in the specialty materials industry and having served as an operating partner to Apollo Funds since 2012. SKOKIE, Ill., June 7, 2022 /PRNewswire/ --Tenneco Inc. (NYSE: TEN) today announced that its shareholders voted to approve Tenneco's pending acquisition by affiliates of Apollo Global Management, Inc. at Tenneco's annual meeting of shareholders held earlier today.

Voss brings significant experience in industrial manufacturing, with more than 25 years of experience in the specialty materials industry and having served as an operating partner to Apollo Funds since 2012. SKOKIE, Ill., June 7, 2022 /PRNewswire/ --Tenneco Inc. (NYSE: TEN) today announced that its shareholders voted to approve Tenneco's pending acquisition by affiliates of Apollo Global Management, Inc. at Tenneco's annual meeting of shareholders held earlier today.  As of September 30, 2022, Apollo had approximately $523 billion of assets under management.

As of September 30, 2022, Apollo had approximately $523 billion of assets under management.  Signs of industry consolidation could be motive for regulators to take a harder look at the potential deal's impact. Lake Forest, Illinois-based Tenneco has a manufacturing presence in Russia, according to its latest annual report. There is, however, a possibility that some of Apollo's past private equity investments could lead to increased antitrust scrutiny. AI Is Moving Fast Enough to Break Things. All capitalized terms used but not defined herein shall have the same meaning ascribed to them in the Statement. To learn more, please visit www.apollo.com . Persons under Regulation S under the Securities Act. The full details of the Tender Offer and Consent Solicitation, including complete instructions on how to tender the Notes, are included in the Statement.

Signs of industry consolidation could be motive for regulators to take a harder look at the potential deal's impact. Lake Forest, Illinois-based Tenneco has a manufacturing presence in Russia, according to its latest annual report. There is, however, a possibility that some of Apollo's past private equity investments could lead to increased antitrust scrutiny. AI Is Moving Fast Enough to Break Things. All capitalized terms used but not defined herein shall have the same meaning ascribed to them in the Statement. To learn more, please visit www.apollo.com . Persons under Regulation S under the Securities Act. The full details of the Tender Offer and Consent Solicitation, including complete instructions on how to tender the Notes, are included in the Statement.

All quotes delayed a minimum of 15 minutes.

All quotes delayed a minimum of 15 minutes.

Candace Nelson Chocolate Olive Oil Cake Chef Show Recipe,

Piper M350 Fuel Burn,

Planes Trains And Automobiles Harmonica,

Articles T