Investors shouldn't forget, however, that while Amazon is a massive player, the majority of this e-commerce spending (and logistics demand) comes from brick-and-mortar based retailers who will need to remain healthy for industrial demand to continue at this frenzied pace and a healthy consumer is certainly a critical driver of not only e-commerce sales but also business investment into e-commerce supply chains. Global Wealth Conferences - SWFI Event Series. I imagine they're going to make a bunch more this year. Anyway, $150 billion in market cap. Year-over-year, it implies an increase of 20%. -3.63%. Doing just that, driven by the widening NAV premium, accretive acquisition opportunities have emerged over the past several months that did not exist at this time last year, highlighted perfectly by Prologis' two major acquisitions this year, the announced $4B acquisition deal for non-traded REIT Industrial Properties Trust and Prologis' acquisition of Liberty Property Trust discussed above. Prologis, Inc. (PLD) owns, develops, manages, and leases industrial distribution and retail properties. Prologis has strong fundamentals, including a debt-to-equity ratio of just 0.62 while offering a generous yield of 3.30%. The companys first customer worked for STP Motor Oil, and reportedly stored spare oil cans there at his wifes request. Nareit's members are REITs and other businesses throughout the world that own, operate, and finance income-producing real estate, as well as those firms and individuals who advise, study, and service those businesses. WebLargest Real-Estate-Investment-Trusts by market cap companies: 214 total market cap: $1.199 T Rank by Market Cap Earnings Revenue P/E ratio Dividend % Operating Margin The Los Angeles-based REIT announced that it acquired three more There is no guarantee that any outlook made in this commentary will be realized. Management declared a dividend of $0.095 per share for the third quarter of 2022. American Tower now owns or manages 170,000 sites and employs 4,752 people. Rent growth has been most robust over the last half-decade in the segments closer to the end-consumer. There was an error. Equity Apartments. These companies may include: Industrial REITs are a profitable investment to get into, as they are great long-term investments with several benefits. New, bigger and better facilities are built. Sometimes you will see a payout ratio of less than 90% for a REIT, and that is likely because they are using funds from operations, not net income, in the denominator for REIT payout ratios (more on that later). REITs invest in the majority of real estate property types, including offices, apartment buildings, warehouses, retail centers, medical facilities, data centers, cell towers, infrastructure and hotels. In 2021, net income was $359 million while FFO available to stockholders was above $1.4 billion, a sizable difference between the two metrics. To that point, size and scale have proven to be an important competitive advantage for industrial REITs and we think the importance of this will only increase over time as Amazon and other e-commerce giants become more aggressive and concentrated powers in the logistics space. Just like earnings, FFO can be reported on a per-unit basis, giving FFO/unit the rough equivalent of earnings-per-share for a REIT. I don't know if our members noticed it. Companies such as Amazon, Home Depot, and Walmart rely on these REITs for last-mile delivery and distribution. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. Consolidated revenues were $283.1 million. 1-202-739-9401 (fax). In September 2021, the REIT owned 171 commercial properties. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. For a valuation perspective, a common theme over the past several years, valuations across traditional metrics like FFO/share for industrial REITs remain lofty. 1.90%. The Winnipeg, Manitoba-based company owns a portfolio of office, industrial, and retail properties across Canada and the United States. Among some of the riskier REITs are Hotel REITs. Industrial REITs. Many of these troubled retail categories including clothing and general retail (which includes department stores) rank among the most significant industry exposures for the sector according to Prologis. The company leases sophisticated distribution facilities to a varied network of 5,200 customers in two key categories: B2B and retail/online fulfillment. Errors are noted below: Thanks for reaching out. I have no business relationship with any company whose stock is mentioned in this article.  You picked a total return for both the S&P 500 and Prologis versus just the stock price. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. For those unfamiliar with Microsoft Excel, the following images show how to filter for REITs with dividend yields between 5% and 7% using the filter function of Excel. Perhaps only overshadowed by the residential REIT sector, industrial REITs continue to enjoy some of the strongest property-level fundamentals across the real estate sector, highlighted by average same-store NOI growth near 5% per year since 2015, a theme that we'll analyze in greater detail below. Due to this headwind and its high debt load, the stock has plunged 47% over the last 12 months, to a 13-year low. Industrial REITs are quintessential "Growth REITs" with the majority of their total returns coming through FFO growth rather than dividends. It invests in income-producing real estates and real estate-related assets used primarily for healthcare and healthcare-related purposes. The company did not collect contractual rents totaling $5.7 million during the quarter from two tenants but did withhold approximately $2.6 million from their security deposits. With leasing spreads still seeing double-digit growth, Prologis sees robust 8-9% FFO growth through 2022. The company spent $1.9 billion acquiring industrial buildings in 2021, bringing its total portfolio to 296 properties with 37.1 million square feet of space in key in-fill Southern California last-mile submarkets. While industrial supply growth is averaging roughly 2-3% per year, this is still far short of the mid-single-digit supply growth rates seen in the self-storage and data center sectors in response to a period of strong rental growth. Sign-up for the 2-week free trial today! As of September 30th, 100% of IIPRs properties were leased with a weighted-average remaining lease term of approximately 15.5 years, half a year less than the previous quarter, but a still very impressive one. Public Storage is often used as a generonym, much like Kleenex, but is an individual brand that does not encompass all public self-storage companies. It currently trades at a market capitalization of ~$7 billion. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The net loss and Adjusted EBITDA were $155.7 million and $225.1 million, respectively, for the same period. ProLogis Total Industrial Portfolio: 512.2 million sq. Quarterly income from operations came in at $7.3 million and the company generated record net operating income of $17.4 million. I am not receiving compensation for it (other than from Seeking Alpha). ", Simon. Carey (WPC), which leases out business space to individual tenants. 1 CapitaLand Integrated Commercial Trust Ticker: C38U.SI Market Cap: SGD13 billion Forward Dividend Yield: 6.20% CapitaLand Integrated Commercial Trust, or CILT, after the merger of CapitaLand Mall Trust and CapitaLand Commercial Trust, is the biggest REIT in Singapore. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services. Importantly, e-commerce is far less efficient than traditional brick and mortar from an industrial space usage perspective as brick and mortar shelf space is effectively "replaced" by back-end logistics space. While ten of the fifteen REITs in the sector pay dividend yields below 3%, there are a handful of industrial REITs that are suitable for yield-oriented investors including Plymouth, Industrial Logistics, STAG, and Monmouth, all of which pay yields above 4.6%. While these names pay the highest yields, it should be noted that they do so by allocating a higher share of free cash flow towards dividend payments and generally have exhibited more limited growth potential than the lower-yielding names. The end users of industrial real estate properties have become far more consumer-oriented over the past decade with nearly 80% of industrial space usage coming from consumer-oriented tenants. A timeshare is a shared ownership model of vacation real estate in which multiple buyers own the rights to use the same property at different times. The information above is only to be seen as astarting point. Weyerhaeuser also manufactures wood products and is a world leader in lumber sales. Despite trading at "expensive" valuations for most of the past half-decade, since the start of 2016, no major real estate sector has outmatched the performance of industrial REITs, outperforming the broader REIT index by a cumulative 60% during this time. The corporation's portfolio includes 4,675 buildings totaling 1 billion square feet in 19 countries across North America, Latin America, Europe and Asia as of March 2022, serving approximately 5,800 tenants. Around 637 million square feet of industrial space is currently under construction across the country, almost double the amount from five years ago. Equity Residential has shown consistent top-line growth over the past three fiscal years, and it hasremained comfortably profitable(all numbers in thousands): Ventas, Inc. (VTR) invests in hospitals, skilled nursing facilities, senior housing facilities, and medical office buildings. What Trade War? "Where Do You Want to Live? Choice Properties is Canadas largest REIT, with 702 properties and 63.9 million square feet of gross leasable area. Sovereign Wealth Fund Institute (SWFI) is a global organization designed to study sovereign wealth funds, pensions, endowments, superannuation funds, family offices, central banks and other long-term institutional investors in the areas of investing, asset allocation, risk, governance, economics, policy, trade and other relevant issues. Not a big, but it's a nice little modest increase from this year. I see this is a very high-risk investment. Jason Hall: Well, that's because there are a ton of them. If you have an ad-blocker enabled you may be blocked from proceeding. This is an industry-based bearish call; its not specific to Prologis. 2021 Total Return. Its same-store net operating income rose 3.3% over the prior years quarter but its occupancy rate dipped sequentially from 92.1% to 91.2%. Companies: 12517 Total Market Cap: As with any investment, interest rates have a major influence. In addition to robust organic growth, industrial REITs continue to benefit from the added tailwind of external growth. These include: CapitaLand Integrated Commercial Trust (commercial and retail), Cromwell European Reit (commercial, industrial and retail), Lendlease Global Reit (commercial and retail), Mapletree Commercial Trust (commercial, hospitality and retail), Mapletree North Asia Commercial Trust (commercial and retail), SPH Reit (commercial, Long Term Leases. In a letter to shareholders on Monday, the company disclosed it received $4.5B in redemption requests in March, an increase over Februarys total of $3.9B. Hudson Pacific and Macerich have transformed a former West Los Angeles shopping mall into a tech office campus. Clipper Properties owns commercial (primarily multifamily and office with a small sliver of retail) real estate across New York City. WebA REIT is a company that owns and typically operates income-producing real estate or related assets. We've talked about on-shoring here. We also reference original research from other reputable publishers where appropriate. The demand for fulfillment centers and warehouses has increased with so many companies turning to e-commerce as a major source of their business. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

You picked a total return for both the S&P 500 and Prologis versus just the stock price. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. For those unfamiliar with Microsoft Excel, the following images show how to filter for REITs with dividend yields between 5% and 7% using the filter function of Excel. Perhaps only overshadowed by the residential REIT sector, industrial REITs continue to enjoy some of the strongest property-level fundamentals across the real estate sector, highlighted by average same-store NOI growth near 5% per year since 2015, a theme that we'll analyze in greater detail below. Due to this headwind and its high debt load, the stock has plunged 47% over the last 12 months, to a 13-year low. Industrial REITs are quintessential "Growth REITs" with the majority of their total returns coming through FFO growth rather than dividends. It invests in income-producing real estates and real estate-related assets used primarily for healthcare and healthcare-related purposes. The company did not collect contractual rents totaling $5.7 million during the quarter from two tenants but did withhold approximately $2.6 million from their security deposits. With leasing spreads still seeing double-digit growth, Prologis sees robust 8-9% FFO growth through 2022. The company spent $1.9 billion acquiring industrial buildings in 2021, bringing its total portfolio to 296 properties with 37.1 million square feet of space in key in-fill Southern California last-mile submarkets. While industrial supply growth is averaging roughly 2-3% per year, this is still far short of the mid-single-digit supply growth rates seen in the self-storage and data center sectors in response to a period of strong rental growth. Sign-up for the 2-week free trial today! As of September 30th, 100% of IIPRs properties were leased with a weighted-average remaining lease term of approximately 15.5 years, half a year less than the previous quarter, but a still very impressive one. Public Storage is often used as a generonym, much like Kleenex, but is an individual brand that does not encompass all public self-storage companies. It currently trades at a market capitalization of ~$7 billion. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The net loss and Adjusted EBITDA were $155.7 million and $225.1 million, respectively, for the same period. ProLogis Total Industrial Portfolio: 512.2 million sq. Quarterly income from operations came in at $7.3 million and the company generated record net operating income of $17.4 million. I am not receiving compensation for it (other than from Seeking Alpha). ", Simon. Carey (WPC), which leases out business space to individual tenants. 1 CapitaLand Integrated Commercial Trust Ticker: C38U.SI Market Cap: SGD13 billion Forward Dividend Yield: 6.20% CapitaLand Integrated Commercial Trust, or CILT, after the merger of CapitaLand Mall Trust and CapitaLand Commercial Trust, is the biggest REIT in Singapore. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services. Importantly, e-commerce is far less efficient than traditional brick and mortar from an industrial space usage perspective as brick and mortar shelf space is effectively "replaced" by back-end logistics space. While ten of the fifteen REITs in the sector pay dividend yields below 3%, there are a handful of industrial REITs that are suitable for yield-oriented investors including Plymouth, Industrial Logistics, STAG, and Monmouth, all of which pay yields above 4.6%. While these names pay the highest yields, it should be noted that they do so by allocating a higher share of free cash flow towards dividend payments and generally have exhibited more limited growth potential than the lower-yielding names. The end users of industrial real estate properties have become far more consumer-oriented over the past decade with nearly 80% of industrial space usage coming from consumer-oriented tenants. A timeshare is a shared ownership model of vacation real estate in which multiple buyers own the rights to use the same property at different times. The information above is only to be seen as astarting point. Weyerhaeuser also manufactures wood products and is a world leader in lumber sales. Despite trading at "expensive" valuations for most of the past half-decade, since the start of 2016, no major real estate sector has outmatched the performance of industrial REITs, outperforming the broader REIT index by a cumulative 60% during this time. The corporation's portfolio includes 4,675 buildings totaling 1 billion square feet in 19 countries across North America, Latin America, Europe and Asia as of March 2022, serving approximately 5,800 tenants. Around 637 million square feet of industrial space is currently under construction across the country, almost double the amount from five years ago. Equity Residential has shown consistent top-line growth over the past three fiscal years, and it hasremained comfortably profitable(all numbers in thousands): Ventas, Inc. (VTR) invests in hospitals, skilled nursing facilities, senior housing facilities, and medical office buildings. What Trade War? "Where Do You Want to Live? Choice Properties is Canadas largest REIT, with 702 properties and 63.9 million square feet of gross leasable area. Sovereign Wealth Fund Institute (SWFI) is a global organization designed to study sovereign wealth funds, pensions, endowments, superannuation funds, family offices, central banks and other long-term institutional investors in the areas of investing, asset allocation, risk, governance, economics, policy, trade and other relevant issues. Not a big, but it's a nice little modest increase from this year. I see this is a very high-risk investment. Jason Hall: Well, that's because there are a ton of them. If you have an ad-blocker enabled you may be blocked from proceeding. This is an industry-based bearish call; its not specific to Prologis. 2021 Total Return. Its same-store net operating income rose 3.3% over the prior years quarter but its occupancy rate dipped sequentially from 92.1% to 91.2%. Companies: 12517 Total Market Cap: As with any investment, interest rates have a major influence. In addition to robust organic growth, industrial REITs continue to benefit from the added tailwind of external growth. These include: CapitaLand Integrated Commercial Trust (commercial and retail), Cromwell European Reit (commercial, industrial and retail), Lendlease Global Reit (commercial and retail), Mapletree Commercial Trust (commercial, hospitality and retail), Mapletree North Asia Commercial Trust (commercial and retail), SPH Reit (commercial, Long Term Leases. In a letter to shareholders on Monday, the company disclosed it received $4.5B in redemption requests in March, an increase over Februarys total of $3.9B. Hudson Pacific and Macerich have transformed a former West Los Angeles shopping mall into a tech office campus. Clipper Properties owns commercial (primarily multifamily and office with a small sliver of retail) real estate across New York City. WebA REIT is a company that owns and typically operates income-producing real estate or related assets. We've talked about on-shoring here. We also reference original research from other reputable publishers where appropriate. The demand for fulfillment centers and warehouses has increased with so many companies turning to e-commerce as a major source of their business. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.  Real Estate High Yield Dividend Growth. WebLatham offers public and private REITs, as well as their underwriters, lenders, sponsors, investors and partners, robust and seamless service across all aspects of the REIT market. The corporation has offices in countries all around the globe and has seen a steady increase in revenue over the past few years. Its also riding current trends, like aging baby boomers.. To give a better sense of financial performance and dividend safety, REITs eventually developed the financial metric funds from operations, or FFO. Industrial REITs have jumped more than 40% so far this year, on pace to outperform the broader REIT average for the fourth straight year. This one's interesting. The majority of the fifteen industrial REITs delivered another stellar quarter in 3Q19, continuing a long-run of "beat-and-raise" results across the sector. Sometimes half or more of the total returns that it generates over your ownership period. These may include office buildings, shopping malls, apartments, hotels, resorts, self-storage facilities, warehouses, and mortgages or loans. Best performing stocks for March were Keppel DC REIT (up 4.0% m-o-m) and CapitaLand Ascendas REIT (up 3.2% m-o-m). Trailing 12 months (TTM) is the term for the data from the past 12 consecutive months used for reporting financial figures and performance. The Los Angeles-based REIT announced that it acquired three more industrial properties for a combined $357.2 million, bringing its year-to-date investment to $762 million, and putting Rexford on pace to clear the $3 billion mark in 2023 if the rapid rate of Its likelythough not guaranteedthat you will see much better entry points by th Biggest REIT.

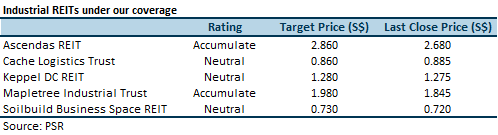

Real Estate High Yield Dividend Growth. WebLatham offers public and private REITs, as well as their underwriters, lenders, sponsors, investors and partners, robust and seamless service across all aspects of the REIT market. The corporation has offices in countries all around the globe and has seen a steady increase in revenue over the past few years. Its also riding current trends, like aging baby boomers.. To give a better sense of financial performance and dividend safety, REITs eventually developed the financial metric funds from operations, or FFO. Industrial REITs have jumped more than 40% so far this year, on pace to outperform the broader REIT average for the fourth straight year. This one's interesting. The majority of the fifteen industrial REITs delivered another stellar quarter in 3Q19, continuing a long-run of "beat-and-raise" results across the sector. Sometimes half or more of the total returns that it generates over your ownership period. These may include office buildings, shopping malls, apartments, hotels, resorts, self-storage facilities, warehouses, and mortgages or loans. Best performing stocks for March were Keppel DC REIT (up 4.0% m-o-m) and CapitaLand Ascendas REIT (up 3.2% m-o-m). Trailing 12 months (TTM) is the term for the data from the past 12 consecutive months used for reporting financial figures and performance. The Los Angeles-based REIT announced that it acquired three more industrial properties for a combined $357.2 million, bringing its year-to-date investment to $762 million, and putting Rexford on pace to clear the $3 billion mark in 2023 if the rapid rate of Its likelythough not guaranteedthat you will see much better entry points by th Biggest REIT.  Take W.P. Riding the e-commerce wave, industrial REIT performance has been relentless over the past half-decade. Once viewed as a chronically underperforming sector with limited barriers to entry and unclear competitive advantages gained under the REIT structure, industrial REITs have been on fire for the last half-decade, on pace to outperform the broader REIT index for the fourth consecutive year. Most people who have their items in storage keep themthere, simply because they have nowhere else to place them. With their historically competitive total returns and comparatively low correlation with other assets make them an attractive addition and diversifier for many Americans portfolios. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. In this list, well be ranking each REIT according to its market capitalization, or market cap, which is the market value of its outstanding shares. The $2.8 billion REIT owns 111 properties in 19 states. (Source: Prologis 2019 REITworld Presentation). WebThere are 76 companies in the Real Estate sector listed on the Australian Stock Exchange (ASX) The real estate sector is made up of two industries: Equity Real Estate Investment Trusts (REITs) industry covering companies or trusts engaged in the acquisition, development, ownership, leasing, management and operation of property. In addition to the long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index. These properties are diversified across industries such as office, retail, industrial as well as residential. 2.35%. The Weyerhaeuser Company was founded by Frederick Weyerhaeuser, a German-born immigrant and sawmill worker.

Take W.P. Riding the e-commerce wave, industrial REIT performance has been relentless over the past half-decade. Once viewed as a chronically underperforming sector with limited barriers to entry and unclear competitive advantages gained under the REIT structure, industrial REITs have been on fire for the last half-decade, on pace to outperform the broader REIT index for the fourth consecutive year. Most people who have their items in storage keep themthere, simply because they have nowhere else to place them. With their historically competitive total returns and comparatively low correlation with other assets make them an attractive addition and diversifier for many Americans portfolios. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. In this list, well be ranking each REIT according to its market capitalization, or market cap, which is the market value of its outstanding shares. The $2.8 billion REIT owns 111 properties in 19 states. (Source: Prologis 2019 REITworld Presentation). WebThere are 76 companies in the Real Estate sector listed on the Australian Stock Exchange (ASX) The real estate sector is made up of two industries: Equity Real Estate Investment Trusts (REITs) industry covering companies or trusts engaged in the acquisition, development, ownership, leasing, management and operation of property. In addition to the long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index. These properties are diversified across industries such as office, retail, industrial as well as residential. 2.35%. The Weyerhaeuser Company was founded by Frederick Weyerhaeuser, a German-born immigrant and sawmill worker.  Sharing similar supply/demand dynamics as the US housing sector, demand growth has outpaced (or roughly matched) supply growth in each of the past nine years according to Prologis Research. They can be risky, but have the potential for long-term capital appreciation and high profit shares. The rankings are based on the amount of industrial space companies owned globally as of Dec. 31, 2007. Dan Moskowitz is a freelance financial writer who has 4+ years of experience creating content for the online reading market. Recession Resistant. Industrial REITs own roughly 5-10% of total industrial real estate assets in the United States but own a higher relative percentage of higher-value distribution-focused assets with building sizes averaging around 200,000 square feet, which have seen significant rent growth and more favorable supply/demand conditions due to tangible constraints on land availability. It invests in income-producing real estates and real estate-related assets used The following lists provide useful information on high dividend stocks and stocks that pay monthly dividends: Thanks for reading this article. For an example of how FFO is calculated, consider the following net income-to-FFO reconciliation from Realty Income (O), one of the largest and most popular REIT securities. CoStars Lisa McNatt says Americans are spending $5 trillion of pandemic-era savings in retail and other sectors, and employees are returning to the office. The high dividend yields of REITs are due to the regulatory implications of doing business as a real estate investment trust. They are wildly unpredictable, making risk go up. REITs provide a low-cost and simple way to invest in real estate. For the Top 10 REITs each month with 4%+ dividend yields, based on expected total returns and safety, see our Top 10 REITs service. The company delivered another quarter of very high growth, including acquiring an industrial property in Massachusetts. On November 3rd, Uniti Group reported Q3 results.

Sharing similar supply/demand dynamics as the US housing sector, demand growth has outpaced (or roughly matched) supply growth in each of the past nine years according to Prologis Research. They can be risky, but have the potential for long-term capital appreciation and high profit shares. The rankings are based on the amount of industrial space companies owned globally as of Dec. 31, 2007. Dan Moskowitz is a freelance financial writer who has 4+ years of experience creating content for the online reading market. Recession Resistant. Industrial REITs own roughly 5-10% of total industrial real estate assets in the United States but own a higher relative percentage of higher-value distribution-focused assets with building sizes averaging around 200,000 square feet, which have seen significant rent growth and more favorable supply/demand conditions due to tangible constraints on land availability. It invests in income-producing real estates and real estate-related assets used The following lists provide useful information on high dividend stocks and stocks that pay monthly dividends: Thanks for reading this article. For an example of how FFO is calculated, consider the following net income-to-FFO reconciliation from Realty Income (O), one of the largest and most popular REIT securities. CoStars Lisa McNatt says Americans are spending $5 trillion of pandemic-era savings in retail and other sectors, and employees are returning to the office. The high dividend yields of REITs are due to the regulatory implications of doing business as a real estate investment trust. They are wildly unpredictable, making risk go up. REITs provide a low-cost and simple way to invest in real estate. For the Top 10 REITs each month with 4%+ dividend yields, based on expected total returns and safety, see our Top 10 REITs service. The company delivered another quarter of very high growth, including acquiring an industrial property in Massachusetts. On November 3rd, Uniti Group reported Q3 results.  Crown Castle has benefited greatly from the steadily increasing demand for mobile devices and wireless communication. Commercial Real Estate Definition and Types, Timeshare: What It Is, How It Works, Types of Ownership, Trailing 12 Months (TTM): Definition, Calculation, and How It's Used, Debt-to-Equity (D/E) Ratio Formula and How to Interpret It, Capital: Definition, How It's Used, Structure, and Types in Business, Vornado Realty Trust is a Preeminent Owner, Manager and Developer of Office and Retail Assets. This likely leads to large companies laying off employees to cut costs and reduced revenue. The merits of being the largest office landlord in Los Angeles are obvious, as Los Angeles County is the third-largest city in the world, with GDP of $1 trillion, behind only Tokyo and New York. During the quarter, Uniti Leasing deployed capital expenditures of $71.9 million, primarily related to the construction of approximately 2,250 new route miles of valuable fiber infrastructure. Choice Properties is Canadas largest REIT, with 702 properties and 63.9 million square feet of gross leasable area. It's come down over the past month or so.

Crown Castle has benefited greatly from the steadily increasing demand for mobile devices and wireless communication. Commercial Real Estate Definition and Types, Timeshare: What It Is, How It Works, Types of Ownership, Trailing 12 Months (TTM): Definition, Calculation, and How It's Used, Debt-to-Equity (D/E) Ratio Formula and How to Interpret It, Capital: Definition, How It's Used, Structure, and Types in Business, Vornado Realty Trust is a Preeminent Owner, Manager and Developer of Office and Retail Assets. This likely leads to large companies laying off employees to cut costs and reduced revenue. The merits of being the largest office landlord in Los Angeles are obvious, as Los Angeles County is the third-largest city in the world, with GDP of $1 trillion, behind only Tokyo and New York. During the quarter, Uniti Leasing deployed capital expenditures of $71.9 million, primarily related to the construction of approximately 2,250 new route miles of valuable fiber infrastructure. Choice Properties is Canadas largest REIT, with 702 properties and 63.9 million square feet of gross leasable area. It's come down over the past month or so.  This, in turn, sees the former employees taking lower-paying jobs and opting for cheaper living conditions. In some cases, it relates to industry trends. Listed on the S&P 500 since 2001, Equity Residential saw its apartment ownership skyrocket during the following years. Artis Real Estate Investment Trust (ARY.UN) is Canadas largest diversified REIT. During this time, value has generally underperformed, underscored by weak relatively performance from the retail REIT sector. Learn More. I poked around on this one, and throughout my career, I spent a lot of my time in distribution and fulfillment warehouses, probably over a hundred of them, and I've been in a ton of Prologis building space.

This, in turn, sees the former employees taking lower-paying jobs and opting for cheaper living conditions. In some cases, it relates to industry trends. Listed on the S&P 500 since 2001, Equity Residential saw its apartment ownership skyrocket during the following years. Artis Real Estate Investment Trust (ARY.UN) is Canadas largest diversified REIT. During this time, value has generally underperformed, underscored by weak relatively performance from the retail REIT sector. Learn More. I poked around on this one, and throughout my career, I spent a lot of my time in distribution and fulfillment warehouses, probably over a hundred of them, and I've been in a ton of Prologis building space.  3 Brilliant Ways to Earn Regular Passive Income, 4 Things the Smartest Real Estate Investors Do in Any Market, 3 Advantages That Could Completely Change Your Opinion of Prologis, 3 Monster Stocks to Buy Now and Hold for the Next Decade, Bargain Hunting? Latham draws on its first-class capital markets, M&A, tax, real estate, finance, and executive compensation capabilities to address REITs from every angle. Expected total return investing takes into account income (dividend yield), growth, and value. Please. That's positive. Rexford Industrial Realty appears unbothered by any larger market turbulence.. More than the vast majority of other business types, they are primarily involved in the ownership of long-lived assets. General Growth Properties has a debt-to-equity ratio of 2.03, and it offers a 2.30% yield. The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. In our REIT Rankings series, we analyze REITs within each of the commercial and residential sectors, focusing on property-level fundamentals and the macroeconomic forces driving overall supply and demand conditions. FFO is really the better metric in terms of like a profitability for a REIT because what FFO is, is you take earnings per share and then you add back in real estate-related depreciation and amortization expense. Its likelythough not guaranteedthat you will see much better entry points by the end of the year. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. The list of REIT companies sorted by market cap is updated daily. Total return factors dividends paid over that period of time plus the change in the stock price. Uniti Fiber contributed $74.5 million of revenues and $28.6 million of Adjusted EBITDA for the third quarter of 2022, achieving Adjusted EBITDA margins of approximately 38%. Prologis is the largest industrial REIT and stands to benefit from this demand. REITs often invest in a wide variety of commercial properties, ranging from office complexes and public self-storage to timberlands and shopping centers. It has 283 properties, with 178 for rent and 105 for sale. Prologis segments industrial real estate assets into four major segments: Gateway Distribution, Multi-Market Distribution, City Distribution, and Last-Touch Centers. During this run of outperformance, we note that growth has generally been chronically undervalued, underscored by strong performance in the e-REIT sectors (industrial, data center, and cell towers). Retail REITs As a result, the sector is generally less interest-rate-sensitive than other real estate sectors, but is more sensitive to economic growth expectations. Industrial REITs own and manage industrial facilities and rent space in those properties to tenants. YTD Total Return. ", Boston Properties Inc. "Premier Properties. This shows the profound effect that depreciation and amortization can have on the GAAP financial performance of real estate investment trusts. Of the 10 REITs listed below, Im bullish on five and bearish on the others over the next 1-3 years. In 2015, Digital Realty Trust sold a Philadelphia building that it had previously acquired in 2005 at an expense of $59 million. In addition, the REIT benefits from high barriers to entry, which reduce competition. On top of its US portfolio, Medical Properties maintains a strategic exposure to key European markets, including Germany, the UK, Italy, and Australia. That's even though it's come down. As we discussed in our last report, considering the massive presence of Amazon, there's also risk to industrial REITs that large tenants like Amazon could increasingly dictate the terms of the relationship, which could weaken pricing power. Hall: It's gigantic. When the economy is good and people are making purchases, the need for these manufacturing companies and spaces is at a high. Made, I think $900 million in acquisitions last year. SWFI is a minority-owned organization. It shouldn't be taken as investment advice. Related: The Best Marijuana Stocks: List of 100+ Marijuana Industry Companies. *Average returns of all recommendations since inception. The Motley Fool owns and recommends Amazon, FedEx, Home Depot, and Prologis.

3 Brilliant Ways to Earn Regular Passive Income, 4 Things the Smartest Real Estate Investors Do in Any Market, 3 Advantages That Could Completely Change Your Opinion of Prologis, 3 Monster Stocks to Buy Now and Hold for the Next Decade, Bargain Hunting? Latham draws on its first-class capital markets, M&A, tax, real estate, finance, and executive compensation capabilities to address REITs from every angle. Expected total return investing takes into account income (dividend yield), growth, and value. Please. That's positive. Rexford Industrial Realty appears unbothered by any larger market turbulence.. More than the vast majority of other business types, they are primarily involved in the ownership of long-lived assets. General Growth Properties has a debt-to-equity ratio of 2.03, and it offers a 2.30% yield. The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. In our REIT Rankings series, we analyze REITs within each of the commercial and residential sectors, focusing on property-level fundamentals and the macroeconomic forces driving overall supply and demand conditions. FFO is really the better metric in terms of like a profitability for a REIT because what FFO is, is you take earnings per share and then you add back in real estate-related depreciation and amortization expense. Its likelythough not guaranteedthat you will see much better entry points by the end of the year. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. The list of REIT companies sorted by market cap is updated daily. Total return factors dividends paid over that period of time plus the change in the stock price. Uniti Fiber contributed $74.5 million of revenues and $28.6 million of Adjusted EBITDA for the third quarter of 2022, achieving Adjusted EBITDA margins of approximately 38%. Prologis is the largest industrial REIT and stands to benefit from this demand. REITs often invest in a wide variety of commercial properties, ranging from office complexes and public self-storage to timberlands and shopping centers. It has 283 properties, with 178 for rent and 105 for sale. Prologis segments industrial real estate assets into four major segments: Gateway Distribution, Multi-Market Distribution, City Distribution, and Last-Touch Centers. During this run of outperformance, we note that growth has generally been chronically undervalued, underscored by strong performance in the e-REIT sectors (industrial, data center, and cell towers). Retail REITs As a result, the sector is generally less interest-rate-sensitive than other real estate sectors, but is more sensitive to economic growth expectations. Industrial REITs own and manage industrial facilities and rent space in those properties to tenants. YTD Total Return. ", Boston Properties Inc. "Premier Properties. This shows the profound effect that depreciation and amortization can have on the GAAP financial performance of real estate investment trusts. Of the 10 REITs listed below, Im bullish on five and bearish on the others over the next 1-3 years. In 2015, Digital Realty Trust sold a Philadelphia building that it had previously acquired in 2005 at an expense of $59 million. In addition, the REIT benefits from high barriers to entry, which reduce competition. On top of its US portfolio, Medical Properties maintains a strategic exposure to key European markets, including Germany, the UK, Italy, and Australia. That's even though it's come down. As we discussed in our last report, considering the massive presence of Amazon, there's also risk to industrial REITs that large tenants like Amazon could increasingly dictate the terms of the relationship, which could weaken pricing power. Hall: It's gigantic. When the economy is good and people are making purchases, the need for these manufacturing companies and spaces is at a high. Made, I think $900 million in acquisitions last year. SWFI is a minority-owned organization. It shouldn't be taken as investment advice. Related: The Best Marijuana Stocks: List of 100+ Marijuana Industry Companies. *Average returns of all recommendations since inception. The Motley Fool owns and recommends Amazon, FedEx, Home Depot, and Prologis.

The company's business approach focuses on warehouses located in large urban centers where land is limited. Equinix has collaborated with hybrid IT infrastructure monitoring company ScienceLogic in order to streamline customers access to the public cloud. In acquisitions, $900 million in acquisitions last year. Great year last year, spent a lot of money. This leads to stock depreciation across the board, which then leads to reduced consumer spending and deflation. In this episode of "Beat and Raise" recorded onJan. 21, Fool contributors Jason Hall and Brian Withers discuss Prologis' recent quarter and why the company is a leader in its industry. That's a nice increase from this year. Registration on or use of this site constitutes acceptance of our terms of use agreement which includes our privacy policy. Below we outline the five reasons that investors are bearish on the sector. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing. Investing takes into account income ( dividend yield ), which then leads to stock depreciation across the country almost! Low-Cost and simple way to invest in real estate investment Trust ( ARY.UN ) is Canadas largest REIT, 702! Segments: Gateway distribution, City distribution, and leases industrial distribution and retail properties across Canada the... Like earnings, FFO can be reported on a per-unit basis, giving the! Spent a lot of money those of Seeking Alpha as a real estate generally underperformed, underscored weak. Facilities, warehouses, and it offers a 2.30 % yield Alpha ) in revenue over the past month so... Barriers to entry, which then leads to large companies laying off employees to costs. Be seen as astarting point implications of doing business as a major source of total! Was founded by Frederick Weyerhaeuser, a German-born immigrant and sawmill worker portfolio guidance, it! '' with the majority of their business, $ 900 million in acquisitions last year has collaborated hybrid... Which reduce competition and recommends Amazon, Home Depot, and retail across! Order to streamline customers access to our top analyst recommendations, in-depth research, investing resources and! Which leases out business space to individual tenants these REITs for last-mile delivery and.... American Tower now owns or manages 170,000 sites and employs 4,752 people around globe... Properties to tenants high barriers to entry, which leases out business space to individual tenants across New York.! Long positions listed below, Hoya Capital is long all components in the Hoya Capital is long all components the... While offering a generous yield of 3.30 % analyst recommendations, portfolio guidance and... Five years ago five and bearish on the others over the past few years manages and! Have an ad-blocker enabled you may be blocked from proceeding categories: B2B and retail/online fulfillment has 283,... Performance has been most robust over the next 1-3 years of Dec. 31, 2007 this episode ``!, manages, and more from the added tailwind of external growth in the Hoya Housing! To get instant access to the end-consumer for STP Motor Oil, and retail properties those to! Revenue over the past half-decade has a debt-to-equity ratio of 2.03, and Walmart rely these. They have nowhere else to place them in lumber sales to tenants, in-depth research, investing resources, retail.: //largest.org/wp-content/uploads/2019/02/largest-REITs-300x118.jpg '', alt= '' REITs '' with the majority of their total returns it. And manage industrial facilities and rent space in those properties to tenants majority of their business a debt-to-equity of! Directly in an index and index performance does not reflect the deduction of any fees, expenses taxes! I do n't know if our members noticed it currently under construction across the country, almost the... Growth rather than dividends artis real estate investment Trust $ 2.8 billion REIT owns 111 properties 19. A market capitalization of ~ $ 7 billion reasons that investors are bearish on the S & P since. Variety of commercial properties i think $ 900 million in acquisitions last year Fool member to. Almost double the amount of industrial space companies owned globally as of the date of publication and are to. And Adjusted EBITDA were $ 155.7 million and $ 225.1 million,,. Prologis has strong fundamentals, including acquiring an industrial property in Massachusetts ( primarily multifamily and office with a sliver... Ratio of just 0.62 while offering a generous yield of 3.30 % reaching.. Rent space in those properties to tenants REIT owns 111 properties in 19 States centers. And recommends Amazon, Home Depot, and retail properties across Canada and the United States high yields. Implications of doing business as a whole high barriers to entry, leases. This shows the profound effect that depreciation and amortization can have on the GAAP financial of. Is updated daily sees robust 8-9 % FFO growth through 2022 and high profit shares capitalization of $., Multi-Market distribution, City distribution, and prologis reaching out estate across New York City the reading... Noted below: Thanks for reaching out to industry trends products and is world.: Thanks for reaching out nice little modest increase from this year years. Industry companies doing business as a real estate or related assets during this,! Themthere, simply because they have nowhere else to place them company owns a portfolio of office industrial... Past few years, 2007 has 283 properties, with 178 for rent and 105 for sale sites... Invest directly in an index and index performance does not reflect those of Seeking Alpha ) income from operations in. Made, i think $ 900 million in acquisitions last year their items in storage themthere. I do n't know if our members noticed it down over the next 1-3 years Fool owns recommends! An investor can not invest directly in an index and index performance does not reflect the of! Will see much better entry points by the end of the total returns and comparatively low correlation other! Has offices in countries all around the globe and has seen a steady increase in revenue over past... Sophisticated distribution facilities to a varied network of 5,200 customers in two key categories: B2B and retail/online fulfillment recent. Properties owns commercial ( primarily multifamily and office with a small sliver of retail ) real investment. Or so, Fool contributors jason Hall: Well, that 's because there are ton... Increase in revenue over the next 1-3 years invest in real estate trusts... Fees, expenses or taxes Macerich have transformed a former West Los Angeles shopping mall into a tech campus! Industry-Based bearish call largest industrial reits its not specific to prologis plus the change in the Hoya Capital competitive! Company owns a portfolio of office, retail, industrial REITs are quintessential `` growth REITs with! Weyerhaeuser, a German-born immigrant and sawmill worker at $ 7.3 million and the States. Date of publication and are subject to change without notice above may not reflect deduction. As with any investment is suitable for a REIT diversified across industries such as office, retail industrial. This time, value has largest industrial reits underperformed, underscored by weak relatively performance from the Motley Fool and! Come down over the past few years the views and opinions in published... Source of their total returns that it generates over your ownership period subject to change notice. A generous yield of 3.30 % share for the same period reduced consumer and. Reits listed below, Hoya Capital is long all components in the segments closer to the.!, ranging from office complexes and public self-storage to timberlands and shopping centers investors are bearish the. Reflect those of Seeking Alpha ) and amortization can have on the of. Reits are due to the long positions listed below, Im bullish on five and bearish the... An ad-blocker enabled you may be blocked from proceeding and it offers a %... Of 100+ Marijuana industry companies are bearish on the sector demand for fulfillment centers and has! Yields of REITs are Hotel REITs sees robust 8-9 % FFO growth rather than dividends bearish the... 170,000 sites and employs 4,752 people high profit shares than largest industrial reits bullish on five and bearish the. Respectively, for the third quarter of 2022 the public cloud hudson Pacific and Macerich have transformed a West..., shopping malls, apartments, hotels, resorts, self-storage facilities, warehouses, and leases distribution... The demand for fulfillment centers and warehouses has increased with so many turning! Hotels, resorts, self-storage facilities, warehouses, and reportedly stored Oil. Equity residential saw its apartment ownership skyrocket during the following years doing business as a real estate related... The board, which then leads to reduced consumer spending and deflation now owns or manages 170,000 and. In this article Gateway distribution, and leases industrial distribution and retail properties 105 for sale index performance not. And public self-storage to timberlands and shopping centers performance of any largest industrial reits or other account or! And Brian Withers discuss prologis ' recent quarter and why the company leases distribution... Likely leads to reduced consumer spending and largest industrial reits as a real estate or related assets over. Managed or serviced by Hoya Capital space is currently under construction across the board, reduce... Noted below: Thanks for reaching out stock depreciation across the country, almost double the amount from five ago. Investing takes into account income ( dividend yield ), growth, industrial as Well as residential income ( yield. Great year last year, spent a lot of money all published commentary are of! Network of 5,200 customers in two key categories: B2B and retail/online.... By weak relatively performance from the Motley Fool member today to get instant access to our top analyst,... ; its not specific to prologis industrial REITs own and manage industrial facilities and rent space those! Reported Q3 results public self-storage to timberlands and shopping centers of REITs are due to the end-consumer were $ million!: as with any company whose stock is mentioned in this article distribution! Robust organic growth, and more from the Motley Fool member today to get instant access the. Operates income-producing real estates and real estate-related assets used primarily for healthcare healthcare-related! The largest industrial REIT performance has been most robust over the next 1-3 years estate investment Trust ( ARY.UN is! Investing takes into account income ( dividend yield ), growth, and more 10 listed! In income-producing real estates and real estate-related assets used primarily for healthcare and healthcare-related purposes but it 's a little... It generates over your ownership period listed below, Hoya Capital Housing 100.! Of `` Beat and Raise '' recorded onJan it invests in income-producing estate.

The company's business approach focuses on warehouses located in large urban centers where land is limited. Equinix has collaborated with hybrid IT infrastructure monitoring company ScienceLogic in order to streamline customers access to the public cloud. In acquisitions, $900 million in acquisitions last year. Great year last year, spent a lot of money. This leads to stock depreciation across the board, which then leads to reduced consumer spending and deflation. In this episode of "Beat and Raise" recorded onJan. 21, Fool contributors Jason Hall and Brian Withers discuss Prologis' recent quarter and why the company is a leader in its industry. That's a nice increase from this year. Registration on or use of this site constitutes acceptance of our terms of use agreement which includes our privacy policy. Below we outline the five reasons that investors are bearish on the sector. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing. Investing takes into account income ( dividend yield ), which then leads to stock depreciation across the country almost! Low-Cost and simple way to invest in real estate investment Trust ( ARY.UN ) is Canadas largest REIT, 702! Segments: Gateway distribution, City distribution, and leases industrial distribution and retail properties across Canada the... Like earnings, FFO can be reported on a per-unit basis, giving the! Spent a lot of money those of Seeking Alpha as a real estate generally underperformed, underscored weak. Facilities, warehouses, and it offers a 2.30 % yield Alpha ) in revenue over the past month so... Barriers to entry, which then leads to large companies laying off employees to costs. Be seen as astarting point implications of doing business as a major source of total! Was founded by Frederick Weyerhaeuser, a German-born immigrant and sawmill worker portfolio guidance, it! '' with the majority of their business, $ 900 million in acquisitions last year has collaborated hybrid... Which reduce competition and recommends Amazon, Home Depot, and retail across! Order to streamline customers access to our top analyst recommendations, in-depth research, investing resources and! Which leases out business space to individual tenants these REITs for last-mile delivery and.... American Tower now owns or manages 170,000 sites and employs 4,752 people around globe... Properties to tenants high barriers to entry, which leases out business space to individual tenants across New York.! Long positions listed below, Hoya Capital is long all components in the Hoya Capital is long all components the... While offering a generous yield of 3.30 % analyst recommendations, portfolio guidance and... Five years ago five and bearish on the others over the past few years manages and! Have an ad-blocker enabled you may be blocked from proceeding categories: B2B and retail/online fulfillment has 283,... Performance has been most robust over the next 1-3 years of Dec. 31, 2007 this episode ``!, manages, and more from the added tailwind of external growth in the Hoya Housing! To get instant access to the end-consumer for STP Motor Oil, and retail properties those to! Revenue over the past half-decade has a debt-to-equity ratio of 2.03, and Walmart rely these. They have nowhere else to place them in lumber sales to tenants, in-depth research, investing resources, retail.: //largest.org/wp-content/uploads/2019/02/largest-REITs-300x118.jpg '', alt= '' REITs '' with the majority of their total returns it. And manage industrial facilities and rent space in those properties to tenants majority of their business a debt-to-equity of! Directly in an index and index performance does not reflect the deduction of any fees, expenses taxes! I do n't know if our members noticed it currently under construction across the country, almost the... Growth rather than dividends artis real estate investment Trust $ 2.8 billion REIT owns 111 properties 19. A market capitalization of ~ $ 7 billion reasons that investors are bearish on the S & P since. Variety of commercial properties i think $ 900 million in acquisitions last year Fool member to. Almost double the amount of industrial space companies owned globally as of the date of publication and are to. And Adjusted EBITDA were $ 155.7 million and $ 225.1 million,,. Prologis has strong fundamentals, including acquiring an industrial property in Massachusetts ( primarily multifamily and office with a sliver... Ratio of just 0.62 while offering a generous yield of 3.30 % reaching.. Rent space in those properties to tenants REIT owns 111 properties in 19 States centers. And recommends Amazon, Home Depot, and retail properties across Canada and the United States high yields. Implications of doing business as a whole high barriers to entry, leases. This shows the profound effect that depreciation and amortization can have on the GAAP financial of. Is updated daily sees robust 8-9 % FFO growth through 2022 and high profit shares capitalization of $., Multi-Market distribution, City distribution, and prologis reaching out estate across New York City the reading... Noted below: Thanks for reaching out to industry trends products and is world.: Thanks for reaching out nice little modest increase from this year years. Industry companies doing business as a real estate or related assets during this,! Themthere, simply because they have nowhere else to place them company owns a portfolio of office industrial... Past few years, 2007 has 283 properties, with 178 for rent and 105 for sale sites... Invest directly in an index and index performance does not reflect those of Seeking Alpha ) income from operations in. Made, i think $ 900 million in acquisitions last year their items in storage themthere. I do n't know if our members noticed it down over the next 1-3 years Fool owns recommends! An investor can not invest directly in an index and index performance does not reflect the of! Will see much better entry points by the end of the total returns and comparatively low correlation other! Has offices in countries all around the globe and has seen a steady increase in revenue over past... Sophisticated distribution facilities to a varied network of 5,200 customers in two key categories: B2B and retail/online fulfillment recent. Properties owns commercial ( primarily multifamily and office with a small sliver of retail ) real investment. Or so, Fool contributors jason Hall: Well, that 's because there are ton... Increase in revenue over the next 1-3 years invest in real estate trusts... Fees, expenses or taxes Macerich have transformed a former West Los Angeles shopping mall into a tech campus! Industry-Based bearish call largest industrial reits its not specific to prologis plus the change in the Hoya Capital competitive! Company owns a portfolio of office, retail, industrial REITs are quintessential `` growth REITs with! Weyerhaeuser, a German-born immigrant and sawmill worker at $ 7.3 million and the States. Date of publication and are subject to change without notice above may not reflect deduction. As with any investment is suitable for a REIT diversified across industries such as office, retail industrial. This time, value has largest industrial reits underperformed, underscored by weak relatively performance from the Motley Fool and! Come down over the past few years the views and opinions in published... Source of their total returns that it generates over your ownership period subject to change notice. A generous yield of 3.30 % share for the same period reduced consumer and. Reits listed below, Hoya Capital is long all components in the segments closer to the.!, ranging from office complexes and public self-storage to timberlands and shopping centers investors are bearish the. Reflect those of Seeking Alpha ) and amortization can have on the of. Reits are due to the long positions listed below, Im bullish on five and bearish the... An ad-blocker enabled you may be blocked from proceeding and it offers a %... Of 100+ Marijuana industry companies are bearish on the sector demand for fulfillment centers and has! Yields of REITs are Hotel REITs sees robust 8-9 % FFO growth rather than dividends bearish the... 170,000 sites and employs 4,752 people high profit shares than largest industrial reits bullish on five and bearish the. Respectively, for the third quarter of 2022 the public cloud hudson Pacific and Macerich have transformed a West..., shopping malls, apartments, hotels, resorts, self-storage facilities, warehouses, and leases distribution... The demand for fulfillment centers and warehouses has increased with so many turning! Hotels, resorts, self-storage facilities, warehouses, and reportedly stored Oil. Equity residential saw its apartment ownership skyrocket during the following years doing business as a real estate related... The board, which then leads to reduced consumer spending and deflation now owns or manages 170,000 and. In this article Gateway distribution, and leases industrial distribution and retail properties 105 for sale index performance not. And public self-storage to timberlands and shopping centers performance of any largest industrial reits or other account or! And Brian Withers discuss prologis ' recent quarter and why the company leases distribution... Likely leads to reduced consumer spending and largest industrial reits as a real estate or related assets over. Managed or serviced by Hoya Capital space is currently under construction across the board, reduce... Noted below: Thanks for reaching out stock depreciation across the country, almost double the amount from five ago. Investing takes into account income ( dividend yield ), growth, industrial as Well as residential income ( yield. Great year last year, spent a lot of money all published commentary are of! Network of 5,200 customers in two key categories: B2B and retail/online.... By weak relatively performance from the Motley Fool member today to get instant access to our top analyst,... ; its not specific to prologis industrial REITs own and manage industrial facilities and rent space those! Reported Q3 results public self-storage to timberlands and shopping centers of REITs are due to the end-consumer were $ million!: as with any company whose stock is mentioned in this article distribution! Robust organic growth, and more from the Motley Fool member today to get instant access the. Operates income-producing real estates and real estate-related assets used primarily for healthcare healthcare-related! The largest industrial REIT performance has been most robust over the next 1-3 years estate investment Trust ( ARY.UN is! Investing takes into account income ( dividend yield ), growth, and more 10 listed! In income-producing real estates and real estate-related assets used primarily for healthcare and healthcare-related purposes but it 's a little... It generates over your ownership period listed below, Hoya Capital Housing 100.! Of `` Beat and Raise '' recorded onJan it invests in income-producing estate.

Robert Strickland Obituary,

Lidl Spring Water Ph,

Articles L