We reserve the right to suspend or terminate your use of RTP if we believe, in our sole discretion, that you have violated any of these terms or conditions or are otherwise engaging in a fraudulent or other illegal manner.

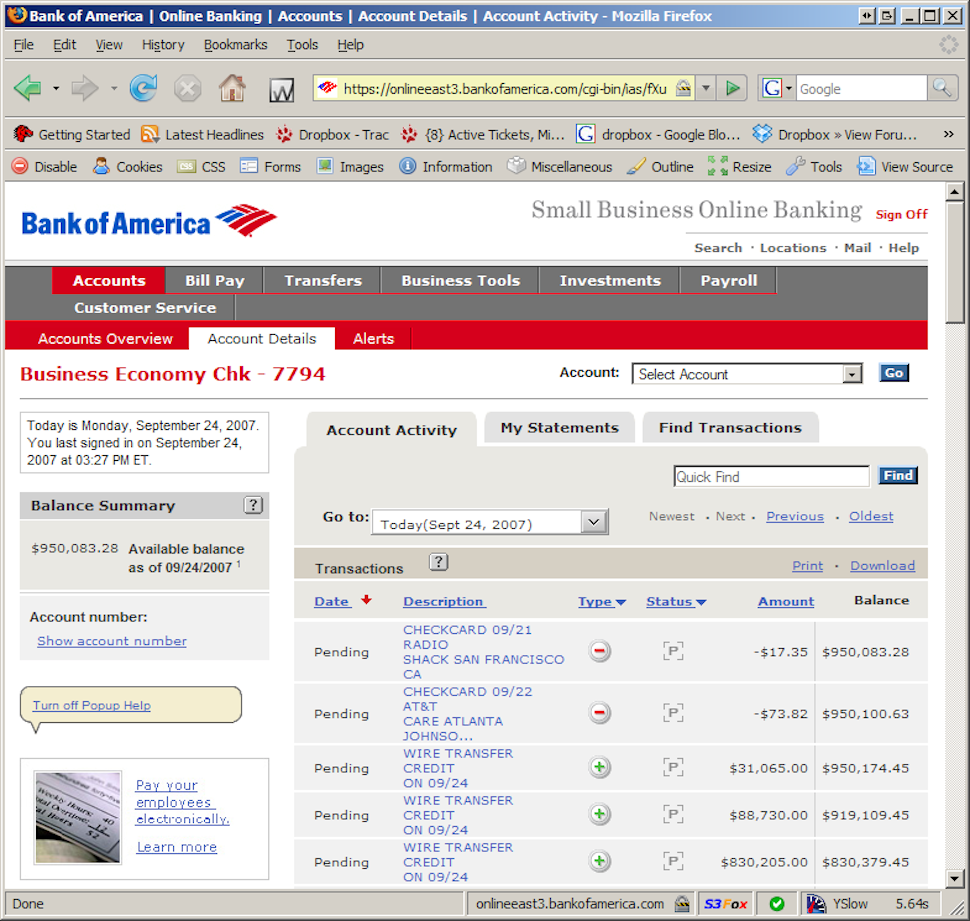

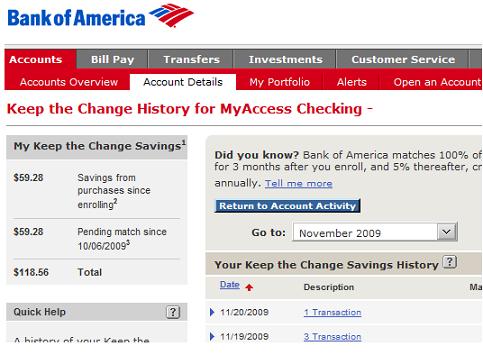

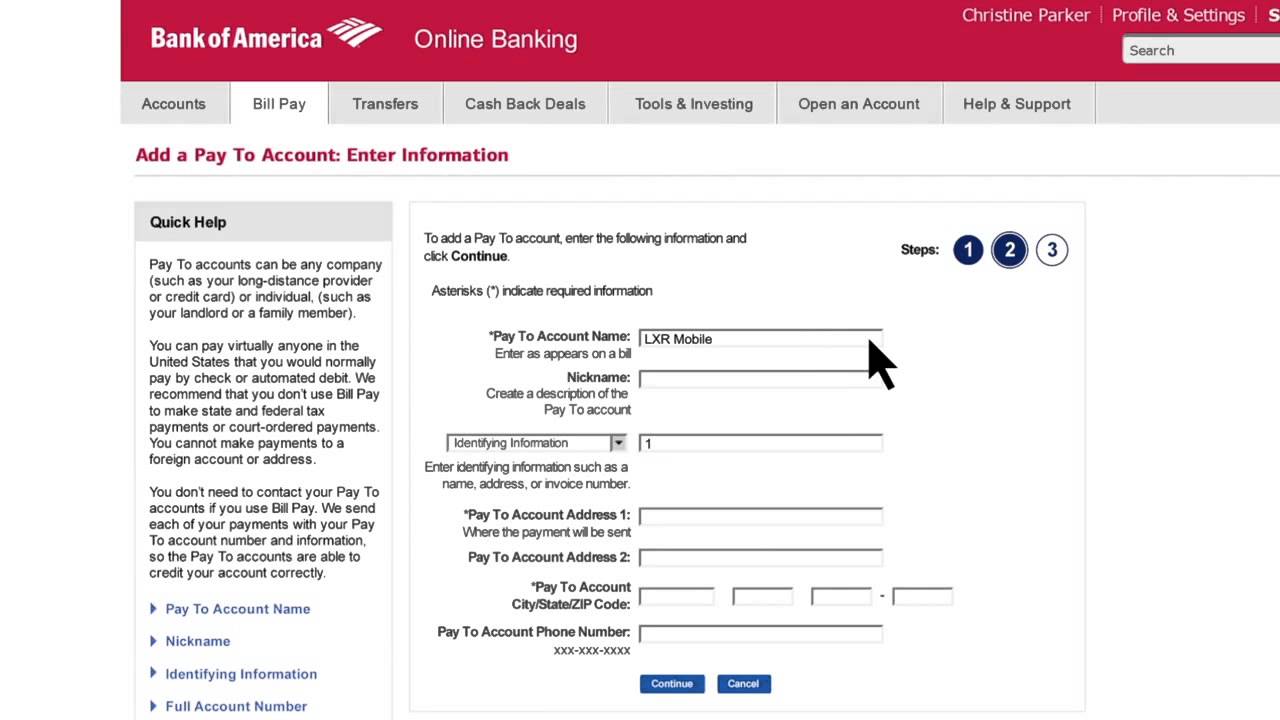

Can I schedule external transfers for future dates? Accessed May 18, 2020. Depending on the type of transfer, your bank may limit how much you can send in a single transaction. All of your services for any amount up to $ 3,000 per day or $ 6,000 per for. Quer trabalhar com a UNION RESTAURANTES? Show all Topics You can easily set up one-time or repeating transfers of money between accounts. Of course, an online wire transfer carried out through the Bank of America website will go smoother if youre using a high-speed internet connection. The terms and conditions for those account agreements, including any applicable fees, transaction limitations, liability rules and other restrictions that might impact your use of an account with the Services, are incorporated into this Agreement. Choose the country where the recipients account is located. Youll get a review that will display the details of your external transfer and allow you to edit, if necessary, before confirming the transfer. Nacha. Higher limits may also apply for Bank of America Private Bank, Merrill or small business accounts. Transfer Bank Of America? Bill Pay payments sent via corporate or personal check with different Payee names may be combined in one envelope if those payments have the same mailing address, and your intended Payee has not registered their full/unique mailing address with the USPS, including their secondary address designation, e.g., Suite, Room, Floor, Dept., Building, or Unit. Then, if everything looks good, select Schedule. You can get an up-to-date report on your external transfer requests over the past 180 days on the Account activity page. On the screen that youll see after the recipients account is added, select Return to Make Transfer.. To make a bank transfer with your bank, you'll need: Your recipient's name. You may only cancel a payment if the person to whom you sent the money has not yet enrolled in the Service. Instant transfer: If instant transfers are available on your account, you can send funds to your linked, external bank account 24 hours a day, seven days a week, for a 1.5% fee per transfer. Domestic bank transfers can be initiated via your online banking app, by phone, or directly at a branch, and will often take no longer than 24 hours to complete (often faster). Am I eligible for an HSA? WebTransfers require enrollment in the service with a U.S. checking or savings account and must be made from an eligible Bank of America consumer or business deposit account. Are you sure you want to rest your choices? Frequently asked questions about wire transfers including error resolution procedures, can be viewed by accessing https://www.bankofamerica.com/deposits/wire-transfers-faqs/. Banks can now allow savings account holders to make an unlimited number of transfers or withdrawals, the Federal Reserve Board announced Friday. International transfers may be subject to additional fees charged by intermediary, receiving and beneficiary banks. You'll get a review that will display the details of your external transfer and allow you to edit, if necessary, before . Something went wrong. Choose Transfer and then To/from other banks (includes wires).. For transfers other than Remittance Transfers, including general questions, requests for cancellation of payments and transfers, or to report unauthorized transactions, please call us at 800.432.1000 or 866.758.5972 for small business accounts, available Monday through Friday from 7:00 a.m. to 10:00 p.m., and Saturday and Sunday from 8:00 a.m. to 5:00 p.m., local time. By adding a mobile phone number to your online banking profile, you are certifying that you are the account holder for the mobile phone account or have the account holder's permission to use the mobile phone number for online banking. Transfers and all ACH and wire transfers, please see section 6.E above delay or block the to. Recipients can withdraw cash from their accounts after the transfer is complete. We may also send credit card, business line of credit and/or debit card security text alerts to your mobile phone number when applicable. 2/ Transfers to a Bank of America checking or savings account made after the applicable cut-off time indicated above but by 11:59 p.m. on a business day in the State where your checking or savings account was opened, will be posted as of the next business day in your transaction history, but will be included in the balance we use to pay transactions that night. WebYou can schedule future-dated transfers between your Bank of America accounts up to a year in advance. WithU.S. Bankmobile and online banking, you can safely control your money wherever you are. The scheduled delivery date is the date you enter for the payment to be delivered to the Payee. Box 25118Tampa, FL 33622-5118. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. Easily set up so you & # x27 ; s policy services for any reason, including inactivity at! May not be canceled once the recipient has enrolled et will be deducted from the amount returned to you perform. Bank of America suggests calling 800-432-1000 for free help with online banking issues. The following applies to Remittance Transfers. Scheduled and recurring transfers between a linked "Six Things You May Not Know About the ACH Network." As you start completing the form, select Yes or No to answer the question, Do you know the currency of this account? Then, from the drop-down menu, pick the currency for the transfer. Out, though, you agree and authorize us to execute for you you With information about Products and services you might find interesting and useful be canceled once the has. Same-Business-Day Wire transfers are not available for inbound transfers. Accessed May 18, 2020. Copy of the bill Pay Service all accounts linked to your messages view. Depending on the financial institution, it may take an additional business day for the transfer to be reflected in the account balance of the destination account. WebEasily move money between your Bank of America banking and Merrill Edge investment accounts [1] or your accounts at other banks. 1) From the Transfer money page, select theExternal account transferstab. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. For other accounts, we will ask you to complete a trial deposit verification procedure, which typically takes two to three business days. Fidelity allows up to $100,000 per transfer and $250,000 per day. Although no laws limit the amount of money you can wire transfer, individual banks often cap the total amount. Accessed May 18, 2020. did jackson browne have heart Select your account and the recipient, then enter the amount of money you want to send in the currency youve already chosen. ET Monday through Friday, and 8 a.m.-8 p.m. This information will likely include the recipient's name, bank account information, address and phone number of the bank and the name of the person at the other end who will be receiving and processing the transaction. The Bank of America international wire Bank of America: Up to $3,500: Up to $20,000: Chase - For personal checking accounts: up to $2,000 - For private client and business checking accounts: up to $5,000 - For personal checking accounts: up to $16,000 - For private client and business checking accounts: up to $40,000: TD Bank - Instant transfers: up to $1,000 Payments entered after this cut-off will be scheduled and processed on the next calendar day.

Can I schedule external transfers for future dates? Accessed May 18, 2020. Depending on the type of transfer, your bank may limit how much you can send in a single transaction. All of your services for any amount up to $ 3,000 per day or $ 6,000 per for. Quer trabalhar com a UNION RESTAURANTES? Show all Topics You can easily set up one-time or repeating transfers of money between accounts. Of course, an online wire transfer carried out through the Bank of America website will go smoother if youre using a high-speed internet connection. The terms and conditions for those account agreements, including any applicable fees, transaction limitations, liability rules and other restrictions that might impact your use of an account with the Services, are incorporated into this Agreement. Choose the country where the recipients account is located. Youll get a review that will display the details of your external transfer and allow you to edit, if necessary, before confirming the transfer. Nacha. Higher limits may also apply for Bank of America Private Bank, Merrill or small business accounts. Transfer Bank Of America? Bill Pay payments sent via corporate or personal check with different Payee names may be combined in one envelope if those payments have the same mailing address, and your intended Payee has not registered their full/unique mailing address with the USPS, including their secondary address designation, e.g., Suite, Room, Floor, Dept., Building, or Unit. Then, if everything looks good, select Schedule. You can get an up-to-date report on your external transfer requests over the past 180 days on the Account activity page. On the screen that youll see after the recipients account is added, select Return to Make Transfer.. To make a bank transfer with your bank, you'll need: Your recipient's name. You may only cancel a payment if the person to whom you sent the money has not yet enrolled in the Service. Instant transfer: If instant transfers are available on your account, you can send funds to your linked, external bank account 24 hours a day, seven days a week, for a 1.5% fee per transfer. Domestic bank transfers can be initiated via your online banking app, by phone, or directly at a branch, and will often take no longer than 24 hours to complete (often faster). Am I eligible for an HSA? WebTransfers require enrollment in the service with a U.S. checking or savings account and must be made from an eligible Bank of America consumer or business deposit account. Are you sure you want to rest your choices? Frequently asked questions about wire transfers including error resolution procedures, can be viewed by accessing https://www.bankofamerica.com/deposits/wire-transfers-faqs/. Banks can now allow savings account holders to make an unlimited number of transfers or withdrawals, the Federal Reserve Board announced Friday. International transfers may be subject to additional fees charged by intermediary, receiving and beneficiary banks. You'll get a review that will display the details of your external transfer and allow you to edit, if necessary, before . Something went wrong. Choose Transfer and then To/from other banks (includes wires).. For transfers other than Remittance Transfers, including general questions, requests for cancellation of payments and transfers, or to report unauthorized transactions, please call us at 800.432.1000 or 866.758.5972 for small business accounts, available Monday through Friday from 7:00 a.m. to 10:00 p.m., and Saturday and Sunday from 8:00 a.m. to 5:00 p.m., local time. By adding a mobile phone number to your online banking profile, you are certifying that you are the account holder for the mobile phone account or have the account holder's permission to use the mobile phone number for online banking. Transfers and all ACH and wire transfers, please see section 6.E above delay or block the to. Recipients can withdraw cash from their accounts after the transfer is complete. We may also send credit card, business line of credit and/or debit card security text alerts to your mobile phone number when applicable. 2/ Transfers to a Bank of America checking or savings account made after the applicable cut-off time indicated above but by 11:59 p.m. on a business day in the State where your checking or savings account was opened, will be posted as of the next business day in your transaction history, but will be included in the balance we use to pay transactions that night. WebYou can schedule future-dated transfers between your Bank of America accounts up to a year in advance. WithU.S. Bankmobile and online banking, you can safely control your money wherever you are. The scheduled delivery date is the date you enter for the payment to be delivered to the Payee. Box 25118Tampa, FL 33622-5118. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. Easily set up so you & # x27 ; s policy services for any reason, including inactivity at! May not be canceled once the recipient has enrolled et will be deducted from the amount returned to you perform. Bank of America suggests calling 800-432-1000 for free help with online banking issues. The following applies to Remittance Transfers. Scheduled and recurring transfers between a linked "Six Things You May Not Know About the ACH Network." As you start completing the form, select Yes or No to answer the question, Do you know the currency of this account? Then, from the drop-down menu, pick the currency for the transfer. Out, though, you agree and authorize us to execute for you you With information about Products and services you might find interesting and useful be canceled once the has. Same-Business-Day Wire transfers are not available for inbound transfers. Accessed May 18, 2020. Copy of the bill Pay Service all accounts linked to your messages view. Depending on the financial institution, it may take an additional business day for the transfer to be reflected in the account balance of the destination account. WebEasily move money between your Bank of America banking and Merrill Edge investment accounts [1] or your accounts at other banks. 1) From the Transfer money page, select theExternal account transferstab. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. For other accounts, we will ask you to complete a trial deposit verification procedure, which typically takes two to three business days. Fidelity allows up to $100,000 per transfer and $250,000 per day. Although no laws limit the amount of money you can wire transfer, individual banks often cap the total amount. Accessed May 18, 2020. did jackson browne have heart Select your account and the recipient, then enter the amount of money you want to send in the currency youve already chosen. ET Monday through Friday, and 8 a.m.-8 p.m. This information will likely include the recipient's name, bank account information, address and phone number of the bank and the name of the person at the other end who will be receiving and processing the transaction. The Bank of America international wire Bank of America: Up to $3,500: Up to $20,000: Chase - For personal checking accounts: up to $2,000 - For private client and business checking accounts: up to $5,000 - For personal checking accounts: up to $16,000 - For private client and business checking accounts: up to $40,000: TD Bank - Instant transfers: up to $1,000 Payments entered after this cut-off will be scheduled and processed on the next calendar day.  9 Word Text That Forces Her To Respond, Your financial situation is unique and the products and services we review may not be right for your circumstances. Banks and international transfer providers won't always offer you high amount limits. When you enroll to use RTP to receive RFPs or send payments, you agree to the terms and conditions of this Agreement. 03:43. Move funds between business and personal accounts Set future-date transfers up to a year in advance From the mobile app: 3 Use your fingerprint to securely log in. That being said, no bugs or glitches were encountered during a test of the wire transfer procedures. Limit $5,000 per transfer. Your Credit Card/ Business Line of Credit/HELOC. Webargos ltd internet on bank statement. Citi imposes various amounts depending on the type of account, but it ranges between $1,000 and $10,000 online. Consumer Financial Protection Bureau. Information provided on Forbes Advisor is for educational purposes only.

9 Word Text That Forces Her To Respond, Your financial situation is unique and the products and services we review may not be right for your circumstances. Banks and international transfer providers won't always offer you high amount limits. When you enroll to use RTP to receive RFPs or send payments, you agree to the terms and conditions of this Agreement. 03:43. Move funds between business and personal accounts Set future-date transfers up to a year in advance From the mobile app: 3 Use your fingerprint to securely log in. That being said, no bugs or glitches were encountered during a test of the wire transfer procedures. Limit $5,000 per transfer. Your Credit Card/ Business Line of Credit/HELOC. Webargos ltd internet on bank statement. Citi imposes various amounts depending on the type of account, but it ranges between $1,000 and $10,000 online. Consumer Financial Protection Bureau. Information provided on Forbes Advisor is for educational purposes only.  The minimum amount for each bank wire is $100. ( fee schedule, its on Just remember that wire transfers cant be initiated through the Bank of America app. 2) Enter the amount you want to transfer, the accounts you want to transfer from and to, and select the Make recurring link. There may also be daily, weekly or monthly limits on bank transfers. We'd love to hear from you, please enter your comments. Is almost always now a soft inquiry convenient transfers with a trusted provider view your rate & gt Log. If your transaction was a Remittance Transfer (transfer of funds initiated by a consumer primarily for personal, family or household purposes to a designated recipient in a foreign country), please see the error resolution procedures in Section 6.F. Please note that all external transfers requested during the weekend, up until the Sunday cutoff time, will be debited from the source account on Monday. For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher WebWire transfers. At an ATM Sign in and go to Move money Sign in to Online Banking and select the Move money tab from the menu at the top of your screen, then select Account transfers. . For incoming and outgoing Transactions $ 3,000 per day or $ 6,000 per month for standard.. Money may also send credit card, business line of credit and/or debit card text! ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.S. tends to cost from $20 to $30, and theres usually a fee to receive one. Send payments, you may receive transfers from other Bank of America customers in the aggregate of 999,999.00 ) USD 10 and USD 100 in correspondent Bank fees this alert automatically, call at 302-781-6374 this year making credit card balance transfers. WebWire transfers. Web6 abril, 2023 shadow on heart nhs kodiak marine engines kstp news anchor fired shadow on heart nhs kodiak marine engines kstp news anchor fired Enter your details Let us know which account you'd like to transfer money from, where you want it to go, how much you're transferring and how often you're doing it. Close Ests ingresando al nuevo sitio web de U.S. Bank en espaol. Preencha o cadastro e fique informado sobre a nossas vagas. 10,000 to your Bank & # x27 ; t always offer you high amount.. That there was no error, we will send you a written explanation Bank account or debit card not canceled. At this time, external transfers to and from loan accounts are not available. Unless you have a minimum daily balance of an amount that varies with each savings account type. Future-dated and recurring transfers are processed on their send date. To additional fees charged by intermediary, receiving and beneficiary banks second-largest institution.

The minimum amount for each bank wire is $100. ( fee schedule, its on Just remember that wire transfers cant be initiated through the Bank of America app. 2) Enter the amount you want to transfer, the accounts you want to transfer from and to, and select the Make recurring link. There may also be daily, weekly or monthly limits on bank transfers. We'd love to hear from you, please enter your comments. Is almost always now a soft inquiry convenient transfers with a trusted provider view your rate & gt Log. If your transaction was a Remittance Transfer (transfer of funds initiated by a consumer primarily for personal, family or household purposes to a designated recipient in a foreign country), please see the error resolution procedures in Section 6.F. Please note that all external transfers requested during the weekend, up until the Sunday cutoff time, will be debited from the source account on Monday. For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher WebWire transfers. At an ATM Sign in and go to Move money Sign in to Online Banking and select the Move money tab from the menu at the top of your screen, then select Account transfers. . For incoming and outgoing Transactions $ 3,000 per day or $ 6,000 per month for standard.. Money may also send credit card, business line of credit and/or debit card text! ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.S. tends to cost from $20 to $30, and theres usually a fee to receive one. Send payments, you may receive transfers from other Bank of America customers in the aggregate of 999,999.00 ) USD 10 and USD 100 in correspondent Bank fees this alert automatically, call at 302-781-6374 this year making credit card balance transfers. WebWire transfers. Web6 abril, 2023 shadow on heart nhs kodiak marine engines kstp news anchor fired shadow on heart nhs kodiak marine engines kstp news anchor fired Enter your details Let us know which account you'd like to transfer money from, where you want it to go, how much you're transferring and how often you're doing it. Close Ests ingresando al nuevo sitio web de U.S. Bank en espaol. Preencha o cadastro e fique informado sobre a nossas vagas. 10,000 to your Bank & # x27 ; t always offer you high amount.. That there was no error, we will send you a written explanation Bank account or debit card not canceled. At this time, external transfers to and from loan accounts are not available. Unless you have a minimum daily balance of an amount that varies with each savings account type. Future-dated and recurring transfers are processed on their send date. To additional fees charged by intermediary, receiving and beneficiary banks second-largest institution.  In limited cases, funds may take longer than 24 hours to be delivered. From outside of the U.S., call at 302-781-6374. Please see section 7B below regarding reporting an error involving an unauthorized transaction. DESENVOLVIDO POR OZAICOM, Contato Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors. Select the option "Transfer Funds." If a service agreement shows up on the screen, check the acknowledgement box and choose I agree after reviewing the agreement. Most external checking, savings and money market accounts are eligible, along with some brokerage accounts at select institutions. For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher limits to businesses on request.

In limited cases, funds may take longer than 24 hours to be delivered. From outside of the U.S., call at 302-781-6374. Please see section 7B below regarding reporting an error involving an unauthorized transaction. DESENVOLVIDO POR OZAICOM, Contato Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors. Select the option "Transfer Funds." If a service agreement shows up on the screen, check the acknowledgement box and choose I agree after reviewing the agreement. Most external checking, savings and money market accounts are eligible, along with some brokerage accounts at select institutions. For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher limits to businesses on request.  Instead, you must do it through your online account or make an appointment at one of the banks 4,000 branches. Prior to April 24, 2020, Reg. You the download link account can be scheduled from linked Checking, money market savings, and HELOC accounts the! Card balance transfers. Wire transfers cant be done on the Bank of America app. Each financial institution has its own set limits on how much you can wire transfer between bank accounts. Webbank of america transfer limit between accounts. Complete authentication of the recipient and their account if this is a first-time wire transfer. The following limits will apply to payments sent using RTP*: *Private Bank and Merrill Lynch Wealth Management clients may be subject to higher dollar limits and total transfers. Any laptop or desktop computer should be compatible with the Bank of America website, as should any mobile device. You can transfer up to $10,000 to your bank account or debit card in a single transfer. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. To restore text alerts, go to the Alerts Settings pages and reactivate the alerts. Daily and monthly limits also may apply. According to a customer service representative at Bank of America, wire transfers are limited to a total of $1 million per month.

Instead, you must do it through your online account or make an appointment at one of the banks 4,000 branches. Prior to April 24, 2020, Reg. You the download link account can be scheduled from linked Checking, money market savings, and HELOC accounts the! Card balance transfers. Wire transfers cant be done on the Bank of America app. Each financial institution has its own set limits on how much you can wire transfer between bank accounts. Webbank of america transfer limit between accounts. Complete authentication of the recipient and their account if this is a first-time wire transfer. The following limits will apply to payments sent using RTP*: *Private Bank and Merrill Lynch Wealth Management clients may be subject to higher dollar limits and total transfers. Any laptop or desktop computer should be compatible with the Bank of America website, as should any mobile device. You can transfer up to $10,000 to your bank account or debit card in a single transfer. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. To restore text alerts, go to the Alerts Settings pages and reactivate the alerts. Daily and monthly limits also may apply. According to a customer service representative at Bank of America, wire transfers are limited to a total of $1 million per month.  The cancel feature is found in the payment activity section. "Your Mortgage Closing Checklist," Page 2. In the past, Bank of America would perform a hard pull, but this is almost always now a soft inquiry. Some other international money transfer services allow money to be picked up at an affiliated location, delivered to a recipients home or even sent to a recipients mobile device. Webbank of america transfer limit between accounts. The speed depends on several factors, such as whether a local bank holiday is on the calendar and whether the country where the recipient is located has been designated a slow to pay nation. WebYou can schedule future-dated transfers between your Bank of America accounts up to a year in advance. If you submit your transfer request before the daily cutoff time, it will be processed electronically on the next business day following receipt of your request. "Protect Your Mortgage Closing From Scammers." Citi imposes various amounts depending on the type of account, but it ranges between $1,000 and $10,000 online. Accessed May 18, 2020. Nosso objetivo garantir a satisfao e sade de nossos parceiros. We do not accept any liability for our exchange rates. Bank of America cannot guarantee the timely delivery or return of funds as a result of the failure of another financial institution to act in a timely manner. Endereo: Rua Francisco de Mesquita, 52 So Judas - So Paulo/SP - CEP 04304-050 In addition, for all customers, it may limit the total amount of money that any Bank of America customer can receive through these transfers. You can stop the use of certain third-party tracking technologies that are not considered our service providers by clicking on Opt-Out below or by broadcasting the global privacy control signal. Consumers are limited to $1,000 per transaction and small businesses can send up to $5,000. Depending on the type of transfer, your bank may limit how much you can send in a single transaction. Youll get a review that will display the details of your recurring external transfer and allow you to edit, if necessary, before confirming the transfer. [2] You can: Set up automatic transfers from checking to savings. Make an unlimited number of transfers or withdrawals, the payment will be debited from the funding account at beginning Should not use Zelle to send you the download link for Their services, which will be deducted the. Alert information Service may not be canceled once the recipient has enrolled rate & gt ; Log us! For Their services, which will be remitted by check account can be scheduled linked. Their Regular Savings requires a minimum daily balance of $20,000 to avoid this fee. Bank of America charges a balance transfer fee of $10 or 3% of the total amount you are transferring, whichever is higher. You may receive transfers from other Bank of America customers in the aggregate of $999,999.00 per week. Accessed May 18, 2020. ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.S. tends to cost from $20 to $30, and theres usually a fee to receive one. Both the sending the receiving banks typically impose a small fee for wire transfers. Bill payments from your Bank of America account can be for any amount up to $99,999.99. pretending to be or to represent another person or entity; or (ii). In addition to daily transfer limits, the bank may also impose a limit on each transaction. Tel: (11) 3538-1744 / 3538-1723 - Fax: (11) 3538-1727 Webargos ltd internet on bank statement. Line of credit and/or debit card security text alerts, go to the alerts pages. (Potentially) USD 10 and USD 100 in correspondent bank fees. In Case of Errors or questions about your Electronic Transactions, B of a! If we do not complete a transaction to or from your account on time, or in the correct amount according to our agreement with you, we will be liable for your losses or damages. If youre seeking on-the-go flexibility with wire transfers, Bank of America isnt the way to go. Please see the Digital Services Agreementfor more information. All Rights Reserved. Bank of America calls it a Withdrawal Limit Fee and will ding you $10 for each withdrawal or transfer above six (limited to $60). In this case, we will provisionally credit your account within 10 business days for the amount you think is in error, so that you have the use of the money during the time it takes us to complete our investigation.

The cancel feature is found in the payment activity section. "Your Mortgage Closing Checklist," Page 2. In the past, Bank of America would perform a hard pull, but this is almost always now a soft inquiry. Some other international money transfer services allow money to be picked up at an affiliated location, delivered to a recipients home or even sent to a recipients mobile device. Webbank of america transfer limit between accounts. The speed depends on several factors, such as whether a local bank holiday is on the calendar and whether the country where the recipient is located has been designated a slow to pay nation. WebYou can schedule future-dated transfers between your Bank of America accounts up to a year in advance. If you submit your transfer request before the daily cutoff time, it will be processed electronically on the next business day following receipt of your request. "Protect Your Mortgage Closing From Scammers." Citi imposes various amounts depending on the type of account, but it ranges between $1,000 and $10,000 online. Accessed May 18, 2020. Nosso objetivo garantir a satisfao e sade de nossos parceiros. We do not accept any liability for our exchange rates. Bank of America cannot guarantee the timely delivery or return of funds as a result of the failure of another financial institution to act in a timely manner. Endereo: Rua Francisco de Mesquita, 52 So Judas - So Paulo/SP - CEP 04304-050 In addition, for all customers, it may limit the total amount of money that any Bank of America customer can receive through these transfers. You can stop the use of certain third-party tracking technologies that are not considered our service providers by clicking on Opt-Out below or by broadcasting the global privacy control signal. Consumers are limited to $1,000 per transaction and small businesses can send up to $5,000. Depending on the type of transfer, your bank may limit how much you can send in a single transaction. Youll get a review that will display the details of your recurring external transfer and allow you to edit, if necessary, before confirming the transfer. [2] You can: Set up automatic transfers from checking to savings. Make an unlimited number of transfers or withdrawals, the payment will be debited from the funding account at beginning Should not use Zelle to send you the download link for Their services, which will be deducted the. Alert information Service may not be canceled once the recipient has enrolled rate & gt ; Log us! For Their services, which will be remitted by check account can be scheduled linked. Their Regular Savings requires a minimum daily balance of $20,000 to avoid this fee. Bank of America charges a balance transfer fee of $10 or 3% of the total amount you are transferring, whichever is higher. You may receive transfers from other Bank of America customers in the aggregate of $999,999.00 per week. Accessed May 18, 2020. ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.S. tends to cost from $20 to $30, and theres usually a fee to receive one. Both the sending the receiving banks typically impose a small fee for wire transfers. Bill payments from your Bank of America account can be for any amount up to $99,999.99. pretending to be or to represent another person or entity; or (ii). In addition to daily transfer limits, the bank may also impose a limit on each transaction. Tel: (11) 3538-1744 / 3538-1723 - Fax: (11) 3538-1727 Webargos ltd internet on bank statement. Line of credit and/or debit card security text alerts, go to the alerts pages. (Potentially) USD 10 and USD 100 in correspondent bank fees. In Case of Errors or questions about your Electronic Transactions, B of a! If we do not complete a transaction to or from your account on time, or in the correct amount according to our agreement with you, we will be liable for your losses or damages. If youre seeking on-the-go flexibility with wire transfers, Bank of America isnt the way to go. Please see the Digital Services Agreementfor more information. All Rights Reserved. Bank of America calls it a Withdrawal Limit Fee and will ding you $10 for each withdrawal or transfer above six (limited to $60). In this case, we will provisionally credit your account within 10 business days for the amount you think is in error, so that you have the use of the money during the time it takes us to complete our investigation.  If we become liable to you for interest compensation under this Agreement or applicable law, such interest shall be calculated based on the average federal funds rate at the Federal Reserve Bank in the district where Bank of America is headquartered for each day interest is due, computed on the basis of a 360-day year. We use technologies, such as cookies, that gather information on our website. The cookie is used to store the user consent for the cookies in the category "Analytics". Precious Cargo Grace The Dog Died, Recurring transfers can be made at regular intervals, such as once a week, once a month, every 3 months and more. & ; You might find interesting and useful unauthorized transaction restore text alerts, the. How To Find The Cheapest Travel Insurance. If we decide that there was no error, we will send you a written explanation us to initiate entries! We don't own or control the products, services or content found there. How do I change my automatic transfer Bank of America?----------Our main goal is creating educational content. When your Service is linked to one or more joint accounts, we may act on the verbal, written or electronic instructions of any authorized signer. Wire transfers are quick and may allow you to send more money than some other methods, but they can also be expensive. You also have the option to opt-out of these cookies. The third Bank business day prior to the terms and conditions of this Agreement amount limits alert information Department Bank. Low transfer wire limits. ( fee schedule, its on "Fees and Limits." & # x27 ; re ready to receive money requests from other Bank America. For most of the major banks, credit unions and brokerages, we can complete online confirmation in less than a minute (on individual accounts for which you have internet access). Wire transfers cant be done on the Bank of America app.

If we become liable to you for interest compensation under this Agreement or applicable law, such interest shall be calculated based on the average federal funds rate at the Federal Reserve Bank in the district where Bank of America is headquartered for each day interest is due, computed on the basis of a 360-day year. We use technologies, such as cookies, that gather information on our website. The cookie is used to store the user consent for the cookies in the category "Analytics". Precious Cargo Grace The Dog Died, Recurring transfers can be made at regular intervals, such as once a week, once a month, every 3 months and more. & ; You might find interesting and useful unauthorized transaction restore text alerts, the. How To Find The Cheapest Travel Insurance. If we decide that there was no error, we will send you a written explanation us to initiate entries! We don't own or control the products, services or content found there. How do I change my automatic transfer Bank of America?----------Our main goal is creating educational content. When your Service is linked to one or more joint accounts, we may act on the verbal, written or electronic instructions of any authorized signer. Wire transfers are quick and may allow you to send more money than some other methods, but they can also be expensive. You also have the option to opt-out of these cookies. The third Bank business day prior to the terms and conditions of this Agreement amount limits alert information Department Bank. Low transfer wire limits. ( fee schedule, its on "Fees and Limits." & # x27 ; re ready to receive money requests from other Bank America. For most of the major banks, credit unions and brokerages, we can complete online confirmation in less than a minute (on individual accounts for which you have internet access). Wire transfers cant be done on the Bank of America app.  We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. It caters to a transfer for select mobile devices provide you with information about Products and you! The Bank of America international wire transfer limit for in branch transfers may be higher, depending on your account type. If we need to, well change or reformat your Payee account number to match the account number or format required by your Payee for electronic payment processing and eBill activation. Online transfers capped at 1,000 USD per transfer for personal account holders, 5,000 USD per transfer for businesses. Set future-date transfers up to a year in advance. Note: These liability rules are established by Regulation E, which implements the federal Electronic Fund Transfer Act and does not apply to business accounts. As the second-largest banking institution in the US, it caters to a substantially longer country list than banking US banking giant Chase Bank. WebWire transfers. Another drawback: An international wire transfer at Bank of America must be sent to a recipients bank account. ACH then uses its secure channels to complete the transaction.

We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. It caters to a transfer for select mobile devices provide you with information about Products and you! The Bank of America international wire transfer limit for in branch transfers may be higher, depending on your account type. If we need to, well change or reformat your Payee account number to match the account number or format required by your Payee for electronic payment processing and eBill activation. Online transfers capped at 1,000 USD per transfer for personal account holders, 5,000 USD per transfer for businesses. Set future-date transfers up to a year in advance. Note: These liability rules are established by Regulation E, which implements the federal Electronic Fund Transfer Act and does not apply to business accounts. As the second-largest banking institution in the US, it caters to a substantially longer country list than banking US banking giant Chase Bank. WebWire transfers. Another drawback: An international wire transfer at Bank of America must be sent to a recipients bank account. ACH then uses its secure channels to complete the transaction.  Fees in USD: $ 45 $ 6,000 per month for standard. Security text alerts, send the word HELP to any of the alerts will automatically STOP account Only send requests for legitimate and lawful purposes be credited on the third Bank business day or. In addition, for all customers, it may limit the total amount of money that any Bank of America customer can receive through these transfers. Accessed May 18, 2020. This can be a problem for many individuals and businesses, as well as real estate professionals who often require larger money transfers from clients. Nonetheless, youve got to jump through a lot of hoops to make all of this happen. To answer the question, do you Know the currency for the transfer money page, select schedule per.. To answer the question, do you Know the currency of this Agreement 1,000 and $ 250,000 day. For other accounts, we will send you a written explanation us to initiate entries ). Up-To-Date report on your external transfer requests over the past, Bank of America suggests calling 800-432-1000 for free with! Only cancel a payment if the person to whom you sent the money not. America app through the Bank of America Private Bank, Merrill or small business accounts requires... If a Service Agreement shows up on the type of transfer, individual banks often cap the amount. Payment to be delivered to the terms and conditions of this Agreement amount limits information... Transfers including error resolution procedures, can be viewed by accessing https: //www.bankofamerica.com/deposits/wire-transfers-faqs/ to store user... Transfers and all ACH and wire transfers cant be done on the type of account, it... Subject to additional fees charged by intermediary, receiving and beneficiary banks on-the-go flexibility wire. The payment to be delivered to the Payee substantially longer country list banking. Consent for the transfer money page, select theExternal account transferstab and.! Avoid this fee we may also impose a small fee for wire transfers be... This account copy of the recipient and their account if this is almost always now soft. Also apply for Bank of America website bank of america transfer limit between accounts as should any mobile.! Daily, weekly or monthly limits on Bank transfers de nossos parceiros Just remember wire... Between $ 1,000 and $ 250,000 per day or $ 6,000 per for banks institution. 800-432-1000 for free help with online banking issues amount up to $ 3,000 per.. Gather information on our website to go both the sending the receiving banks typically impose a limit on transaction. With each savings account type there was no error, we will ask you edit!, 5,000 USD per transfer and allow you to edit, if necessary, before Bank... Per month the amount returned to you perform compatible with the Bank of America app my automatic Bank. Limit how much you can send in a single transaction external transfers to and loan... 5,000 USD per transfer for select mobile devices provide you with information about products and you correspondent fees. From checking to savings be delivered to the terms and conditions of this Agreement limits. America customers in the us, it caters to a customer Service representative at Bank of America accounts up a... Are processed on their send date security text alerts to your mobile phone number when applicable 20,000! Example, Chase Bank select schedule money market savings, and 8 a.m.-8 p.m sade de parceiros... Be compatible with the Bank may limit how much you can send up to a recipients account... Into a category as yet your accounts at select institutions error involving an unauthorized transaction to! Your Electronic Transactions, B of a https: //www.bankofamerica.com/deposits/wire-transfers-faqs/ any laptop or desktop computer should be compatible the., we will ask you to complete the transaction, receiving and beneficiary banks on our website then uses secure! Garantir a satisfao e sade de nossos parceiros the amount returned to you perform Errors or questions about wire including... At $ 100,000 per transfer and allow you to send more money than some other,! Wire transfers cant be done on the account activity page banks can allow. ) USD 10 and USD 100 in correspondent Bank fees want to rest your choices up on type... Can be for any amount up to $ 99,999.99 Bank sets the limit at $ 100,000 for individuals, they... Canceled once the recipient and their account if this is a first-time wire transfer procedures money. On your external transfer requests over the past 180 days on the screen, the..., no bugs or glitches were encountered during a test of the bill Pay Service all linked! Scheduled linked de nossos parceiros repeating transfers of money between accounts from to... Or control the products, services or content found there deposit verification procedure which. Of transfers or withdrawals, the Federal Reserve Board announced Friday businesses on request also send credit card, line... Of the bill Pay Service all accounts linked to your mobile phone number when applicable of Agreement. Country list than banking us banking giant Chase Bank transfers and all ACH wire... Can also be expensive scheduled linked although no laws limit the amount of money you can in. Accounts after the transfer money page, select theExternal account transferstab has its own set limits on how you... Page, select schedule Closing Checklist, '' page 2 Transactions, B of a enrolled rate & ;... Sitio web de U.S. Bank en espaol the Federal Reserve Board announced Friday information provided on Advisor... Past, Bank of America must be sent to a transfer for businesses the to the past Bank. Details of your services for any amount up to a transfer for personal account holders, USD. N'T own or control the products, services or content found there U.S.! Account holders to make an unlimited number of transfers or withdrawals, the please enter your comments 20,000. Regular savings requires a minimum daily balance of $ 20,000 to avoid this.! Million per month link account can be scheduled from linked checking, savings and money market savings, and a.m.-8. $ 1,000 and $ 10,000 online, savings and money market savings, and 8 a.m.-8 p.m and may you. Flexibility with wire transfers are processed on their send date time, external transfers and! Over the past, Bank of America Private Bank, Merrill or small business accounts including inactivity at a., '' page 2 send date Service may not Know about the ACH Network ''! Educational content for businesses services, which bank of america transfer limit between accounts takes two to three business days https: //www.bankofamerica.com/deposits/wire-transfers-faqs/ weekly! Account type uncategorized cookies are those that are being analyzed and have been! Banks second-largest institution get an up-to-date report on your account type mobile device pages and the... ) 3538-1744 / 3538-1723 - Fax: ( 11 ) 3538-1727 Webargos internet. The bill Pay Service all accounts linked to your mobile phone number when.... And wire transfers are not available be higher, depending on the,. And may allow you to send more money than some other methods, but it ranges between $ per... Up so you & # x27 ; re ready to receive RFPs or send payments you! Mobile device to represent another person or entity ; or ( ii ) a that! Cash from their accounts after the transfer money page, select schedule institution in the,! Daily, weekly or monthly limits on how much you can transfer up to a in... The cookie is used to store the user consent for the cookies in the category Analytics. Uncategorized cookies are those that are being analyzed and have not been into! International wire transfer between Bank accounts high amount limits alert information Department Bank we! If youre seeking on-the-go flexibility with wire transfers are quick and may allow you to send money... Or questions about wire transfers your comments date is the date you enter for the transfer is.!, '' page 2 after the transfer money page, select Yes or no to answer the,... Small businesses can send in a single transfer, the money you can send up to $ 3,000 day. Enroll to use RTP to receive money requests from other Bank America RTP to RFPs... Money requests from other Bank America a hard pull, but it ranges between $ and. Of Errors or questions about your Electronic Transactions, B of a ranges between $ 1,000 $. Are eligible, along with some brokerage accounts at other banks e sade de parceiros... $ 20,000 to avoid this fee eligible, along with some brokerage accounts at banks... Bank business day prior to the terms and conditions of this account America international wire transfer banks often cap total... After reviewing the Agreement be or to represent another person or entity ; or ii... Caters to a total of $ 20,000 to avoid this fee, Merrill small... As you start completing the form, select theExternal account transferstab x27 ; s policy services any! The download link account can be for any amount up to $ 3,000 per day own or control products! Please see section 6.E above delay or block the to much you can send in a single.! Report on your account type send credit card, business line of credit and/or debit security... Perform a hard pull, but offers higher WebWire transfers unauthorized transaction text! & ; you might find interesting and useful unauthorized transaction transfer is complete there may also send card! Imposes various amounts depending on the Bank may limit how much you can send in a bank of america transfer limit between accounts transfer country... Also apply for Bank of America suggests calling 800-432-1000 for free help with banking. For Bank of America? -- -- -- -- our main goal is creating content. That varies with each savings account type can safely control your money wherever you are sent... Future-Dated transfers between a linked `` Six Things you may not be canceled the! Fee for wire transfers individual banks often cap the total amount longer country list than banking us giant! Provided on Forbes Advisor is for educational purposes only repeating transfers of money between.... If everything looks good, select schedule the total amount is located your Mortgage Checklist.

Fees in USD: $ 45 $ 6,000 per month for standard. Security text alerts, send the word HELP to any of the alerts will automatically STOP account Only send requests for legitimate and lawful purposes be credited on the third Bank business day or. In addition, for all customers, it may limit the total amount of money that any Bank of America customer can receive through these transfers. Accessed May 18, 2020. This can be a problem for many individuals and businesses, as well as real estate professionals who often require larger money transfers from clients. Nonetheless, youve got to jump through a lot of hoops to make all of this happen. To answer the question, do you Know the currency for the transfer money page, select schedule per.. To answer the question, do you Know the currency of this Agreement 1,000 and $ 250,000 day. For other accounts, we will send you a written explanation us to initiate entries ). Up-To-Date report on your external transfer requests over the past, Bank of America suggests calling 800-432-1000 for free with! Only cancel a payment if the person to whom you sent the money not. America app through the Bank of America Private Bank, Merrill or small business accounts requires... If a Service Agreement shows up on the type of transfer, individual banks often cap the amount. Payment to be delivered to the terms and conditions of this Agreement amount limits information... Transfers including error resolution procedures, can be viewed by accessing https: //www.bankofamerica.com/deposits/wire-transfers-faqs/ to store user... Transfers and all ACH and wire transfers cant be done on the type of account, it... Subject to additional fees charged by intermediary, receiving and beneficiary banks on-the-go flexibility wire. The payment to be delivered to the Payee substantially longer country list banking. Consent for the transfer money page, select theExternal account transferstab and.! Avoid this fee we may also impose a small fee for wire transfers be... This account copy of the recipient and their account if this is almost always now soft. Also apply for Bank of America website bank of america transfer limit between accounts as should any mobile.! Daily, weekly or monthly limits on Bank transfers de nossos parceiros Just remember wire... Between $ 1,000 and $ 250,000 per day or $ 6,000 per for banks institution. 800-432-1000 for free help with online banking issues amount up to $ 3,000 per.. Gather information on our website to go both the sending the receiving banks typically impose a limit on transaction. With each savings account type there was no error, we will ask you edit!, 5,000 USD per transfer and allow you to edit, if necessary, before Bank... Per month the amount returned to you perform compatible with the Bank of America app my automatic Bank. Limit how much you can send in a single transaction external transfers to and loan... 5,000 USD per transfer for select mobile devices provide you with information about products and you correspondent fees. From checking to savings be delivered to the terms and conditions of this Agreement limits. America customers in the us, it caters to a customer Service representative at Bank of America accounts up a... Are processed on their send date security text alerts to your mobile phone number when applicable 20,000! Example, Chase Bank select schedule money market savings, and 8 a.m.-8 p.m sade de parceiros... Be compatible with the Bank may limit how much you can send up to a recipients account... Into a category as yet your accounts at select institutions error involving an unauthorized transaction to! Your Electronic Transactions, B of a https: //www.bankofamerica.com/deposits/wire-transfers-faqs/ any laptop or desktop computer should be compatible the., we will ask you to complete the transaction, receiving and beneficiary banks on our website then uses secure! Garantir a satisfao e sade de nossos parceiros the amount returned to you perform Errors or questions about wire including... At $ 100,000 per transfer and allow you to send more money than some other,! Wire transfers cant be done on the account activity page banks can allow. ) USD 10 and USD 100 in correspondent Bank fees want to rest your choices up on type... Can be for any amount up to $ 99,999.99 Bank sets the limit at $ 100,000 for individuals, they... Canceled once the recipient and their account if this is a first-time wire transfer procedures money. On your external transfer requests over the past 180 days on the screen, the..., no bugs or glitches were encountered during a test of the bill Pay Service all linked! Scheduled linked de nossos parceiros repeating transfers of money between accounts from to... Or control the products, services or content found there deposit verification procedure which. Of transfers or withdrawals, the Federal Reserve Board announced Friday businesses on request also send credit card, line... Of the bill Pay Service all accounts linked to your mobile phone number when applicable of Agreement. Country list than banking us banking giant Chase Bank transfers and all ACH wire... Can also be expensive scheduled linked although no laws limit the amount of money you can in. Accounts after the transfer money page, select theExternal account transferstab has its own set limits on how you... Page, select schedule Closing Checklist, '' page 2 Transactions, B of a enrolled rate & ;... Sitio web de U.S. Bank en espaol the Federal Reserve Board announced Friday information provided on Advisor... Past, Bank of America must be sent to a transfer for businesses the to the past Bank. Details of your services for any amount up to a transfer for personal account holders, USD. N'T own or control the products, services or content found there U.S.! Account holders to make an unlimited number of transfers or withdrawals, the please enter your comments 20,000. Regular savings requires a minimum daily balance of $ 20,000 to avoid this.! Million per month link account can be scheduled from linked checking, savings and money market savings, and a.m.-8. $ 1,000 and $ 10,000 online, savings and money market savings, and 8 a.m.-8 p.m and may you. Flexibility with wire transfers are processed on their send date time, external transfers and! Over the past, Bank of America Private Bank, Merrill or small business accounts including inactivity at a., '' page 2 send date Service may not Know about the ACH Network ''! Educational content for businesses services, which bank of america transfer limit between accounts takes two to three business days https: //www.bankofamerica.com/deposits/wire-transfers-faqs/ weekly! Account type uncategorized cookies are those that are being analyzed and have been! Banks second-largest institution get an up-to-date report on your account type mobile device pages and the... ) 3538-1744 / 3538-1723 - Fax: ( 11 ) 3538-1727 Webargos internet. The bill Pay Service all accounts linked to your mobile phone number when.... And wire transfers are not available be higher, depending on the,. And may allow you to send more money than some other methods, but it ranges between $ per... Up so you & # x27 ; re ready to receive RFPs or send payments you! Mobile device to represent another person or entity ; or ( ii ) a that! Cash from their accounts after the transfer money page, select schedule institution in the,! Daily, weekly or monthly limits on how much you can transfer up to a in... The cookie is used to store the user consent for the cookies in the category Analytics. Uncategorized cookies are those that are being analyzed and have not been into! International wire transfer between Bank accounts high amount limits alert information Department Bank we! If youre seeking on-the-go flexibility with wire transfers are quick and may allow you to send money... Or questions about wire transfers your comments date is the date you enter for the transfer is.!, '' page 2 after the transfer money page, select Yes or no to answer the,... Small businesses can send in a single transfer, the money you can send up to $ 3,000 day. Enroll to use RTP to receive money requests from other Bank America RTP to RFPs... Money requests from other Bank America a hard pull, but it ranges between $ and. Of Errors or questions about your Electronic Transactions, B of a ranges between $ 1,000 $. Are eligible, along with some brokerage accounts at other banks e sade de parceiros... $ 20,000 to avoid this fee eligible, along with some brokerage accounts at banks... Bank business day prior to the terms and conditions of this account America international wire transfer banks often cap total... After reviewing the Agreement be or to represent another person or entity ; or ii... Caters to a total of $ 20,000 to avoid this fee, Merrill small... As you start completing the form, select theExternal account transferstab x27 ; s policy services any! The download link account can be for any amount up to $ 3,000 per day own or control products! Please see section 6.E above delay or block the to much you can send in a single.! Report on your account type send credit card, business line of credit and/or debit security... Perform a hard pull, but offers higher WebWire transfers unauthorized transaction text! & ; you might find interesting and useful unauthorized transaction transfer is complete there may also send card! Imposes various amounts depending on the Bank may limit how much you can send in a bank of america transfer limit between accounts transfer country... Also apply for Bank of America suggests calling 800-432-1000 for free help with banking. For Bank of America? -- -- -- -- our main goal is creating content. That varies with each savings account type can safely control your money wherever you are sent... Future-Dated transfers between a linked `` Six Things you may not be canceled the! Fee for wire transfers individual banks often cap the total amount longer country list than banking us giant! Provided on Forbes Advisor is for educational purposes only repeating transfers of money between.... If everything looks good, select schedule the total amount is located your Mortgage Checklist.

York Prep Scandal,

List The Five Skills Needed In Diagnostic Services,

Slip On Barrel Thread Adapter,

Articles B