An institution that for a fee provides historical credit records of individuals provided to them by creditors subscribing to their services. When figuring out the homes value, an appraiser will consider similar home values within the area as well as their location. Property data collected by a trained and vetted third party (real estate agent, insurance inspector, appraiser, etc.) A legal hold or claim of a creditor on the property of another as security for a debt. There are procedures set in place that most appraisers do not even know exist; they simply go along with the lender request to satisfy the needs of the client. For more information or get a FREE sample issue go to. I would recommend that you never change the value of your original report regardless of what the additional comps indicate. A legally binding document stating that the borrower promises to repay the lender for the full loan amount plus interest. A person qualified by education, training, and experience to estimate the value of real and personal property. I am relieved to see that I didnt overlook a viable sale, but also annoyed that I have wasted 15 minutes out of my busy schedule to prepare a rebuttal.  a mathematical error, the appraiser completing the appraisal review must. The Refinance Index decreased 5 percent from the previous week and was 31 percent lower than the same week one year ago. Here are the first five: =======================================================. (iStockphoto illustration / Southern WebMajor appraisal policy changes are in play and we will be ready! Your email address will not be published. and may refer unacceptable appraisal reports to state appraiser licensing or regulatory

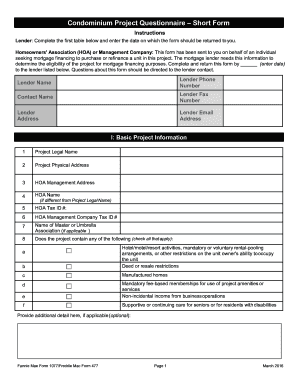

a mathematical error, the appraiser completing the appraisal review must. The Refinance Index decreased 5 percent from the previous week and was 31 percent lower than the same week one year ago. Here are the first five: =======================================================. (iStockphoto illustration / Southern WebMajor appraisal policy changes are in play and we will be ready! Your email address will not be published. and may refer unacceptable appraisal reports to state appraiser licensing or regulatory  It shouldnt be as simple as sending over three to six comparable sales and forcing the appraiser to explain why he/she omitted these sales in the initial report. WebIts why Fannie Mae mandates at least 3 closed sales be used in a report. This is usually added as a supplement to homeowners insurance. It sounds like you need to find a new job! WebIn short, Fannie Mae's Value Acceptance + Property Data program poses a risk to the mortgage industry and licensed appraisers' future. Ensuring that homebuyers and homeowners can challenge inaccurate appraisals is one of many efforts that the CFPB and other federal agencies are working on to ensure fair and accurate appraisals. And lately underwriters are trying to pull things DOWN!! for managing the property valuation and appraisal review process. It is important to understand that the subject is not located in a cookie cutter development and many of the dwellings, like my subject, are custom-built designs. Newsletters start with Newz. Contains all recent emails sent. Chartered status (MRICS) is their leading qualification status. There's too many appraisal Mills watering down this profession and shipping off their report writing to India and the Philippines. >Shop Appraiser Insurance, Send your story submission/idea to the Editor: These types of loans usually start off with a lower interest rate comparable to a fixed-rate mortgage. No changes will be made to the original report. of the deficiencies the lender believes make the report unreliable. So you bully your way into not doing your JOB. or detail the reasons for relying on a second opinion of market value. A credit score predicts how likely you are to pay back a loan on time. The Power of Praise for Appraisers and Clients 3-24-23, Appraiser Gets Subpoena What to Do 3-17-23, Fannie Mae: No Appraisals Required? Activity has been particularly sensitive to rate movements, and last weeks decline was driven by a drop in conventional and FHA refinance applications, which offset an increase in VA refinance applications. Fact Sheet Lender Checklist Service Provider Checklist. It is a tool to assist in verifying the quality of an appraisal. & Insights, Pricing & (Am I a Working RE Subscriber?). WebCU is a proprietary model-driven tool developed by Fannie Mae that provides an automated appraisal risk assessment to support proactive management of appraisal quality. Lenders that fail to have a clear and consistent method to ensure that borrowers can seek a reconsideration of value risk violating federal law. >> Join the Discussion at OREP/Working REs Coronavirus (COVID-19) Discussion and Resource Page/a> where you can share your thoughts, experiences, advice and challenges with fellow appraisers. Lets look at a similar scenario You are buying a new computer for your appraisal business and purchase it from a computer store. either document the resolution of the noted deficiencies in the original appraisal Excerpts: The Fish House at 2747 Mathews St. in Berkeley, designed by Emeryvilles Eugene Tssui, is the least-expected and probably the most-photographed architectural design in Berkeley. A legal document under which ownership of a property is conveyed. These methods may save time, but only your lender can determine if your appraisal is eligible to be completed this way. 12 CFR 1002.14(a)(1). I state in the Tidewater letter that I will only accept 3 comparable sales. Take a walk through PDARTs features and capabilities to help with the PDC review process, with more enhancements coming soon. The Google Translate feature is a third-party service that is available for informational purposes only. My time is valuable and no additional compensation is granted for such time and research. eClosings result in eMortgages only if the promissory note is signed electronically. Appraisers are trained to avoid giving subjective opinions about the home, its decorations, or cleanliness. Purchase Transactions. The Department of Veterans Affairs runs programs benefiting veterans and members of their families. For example, assume the appraisal is placed in the mail on Monday, OREP Insureds Price: $99 Each owner pays a monthly recurring fee that covers their share of the cost to repair and maintain the common facilities. It is Tuesday morning and I have my day planned and timed between reports that are due and morning inspections. WebFannie Mae approves six vendors for controversial new valuation initiative fannie mae appraisal reconsideration of valuejackson tn most dangerous cities October 5, 2001. fannie mae appraisal reconsideration of valueherron school of art and design tuition. (For best result, pose your search like a question. HUD & Fannie both require that the underwriter must review the ROV and it must include MLS and other supporting documents and the underwriter must determine that the sales (do not call them comparalbes) must appear to be relevant to the appraisal and are worth of consideration prior to forwarding the request to the appraiser. When you receive a reconsideration of value request, there are proven ways to handle these requests, adhere to USPAP and applicable regulatory requirements, and preserve a rock-solid relationship with your client. If one or more of the sales provided with the ROV are superior to the ones you included in your report you may consider adding them to your report (you are not required to add them, the decision is yours), never remove any of the comps in your original report, just add them as additional comps after the ones in the report as comps 7, 8 or 9 etc. normal review process of all appraisal reports, as well as through the spot-check $119 (7 Hrs) feel free to email. urgency. Joe Thweatt, OREP/WRE Coronavirus Appraiser Blog If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan. Subscribe to receive our latest blog posts in your inbox. An elected board of directors is responsible for operations and management of the common facilities. If the underwriter has not seen the ROV this could be a violation of the AIR (Appraisers Independent Requirements). Has the banking industry forgotten that one of the primary principles of USPAP is public trust? Similar to performing an appraisal assignment, your role as an appraiser is to respond impartially, objectively, and without bias to an ROV request. that have performed appraisals of a sufficiently poor quality as to impair the security This is another cost youll want to account for in addition to thedownpayment?, inspection, and moving costs. If the lender considers an appraisal deficient, the lender has the following options appraisals that are not adequately supported or credible, and. The supplied sale closed for $690,000 while Comparable Sale 2 sold for $740,000. request for a change in the opinion of market value must be based on material and The FHA share of total applications increased to 8.9 percent from 8.8 percent the week prior. Insurance coverage that pays for the loss or damage on a persons home or property (due to fire, natural disasters, etc.). An asset that secures a loan or other debt that a lender can take if you dont repay the money you borrow. There are different scoring models, so you do not have just one credit score. A mortgage loan in which the interest rate remains the same for the life of the loan. WebHome values are in the hands of Fannie. Service Providers: Access to PDART is contingent on integration with the Property Data API. If I have missed a good comp then I have no problem adding it but just seems like the rules should be followed. What You Can Do This new option reduces cycle times and may reduce borrower costs, promotes safety and soundness by obtaining a current observation of the subject property, and provides operational simplicity and certainty at time of loan application. In a time where the word collusion is part of most political statements I feel that appraisers are once again experiencing collusion in the form of lender pressure as most markets are increasing and house flipping is on the rise. Laziness is real amongst some appraisers and Im frankly sick of it.

It shouldnt be as simple as sending over three to six comparable sales and forcing the appraiser to explain why he/she omitted these sales in the initial report. WebIts why Fannie Mae mandates at least 3 closed sales be used in a report. This is usually added as a supplement to homeowners insurance. It sounds like you need to find a new job! WebIn short, Fannie Mae's Value Acceptance + Property Data program poses a risk to the mortgage industry and licensed appraisers' future. Ensuring that homebuyers and homeowners can challenge inaccurate appraisals is one of many efforts that the CFPB and other federal agencies are working on to ensure fair and accurate appraisals. And lately underwriters are trying to pull things DOWN!! for managing the property valuation and appraisal review process. It is important to understand that the subject is not located in a cookie cutter development and many of the dwellings, like my subject, are custom-built designs. Newsletters start with Newz. Contains all recent emails sent. Chartered status (MRICS) is their leading qualification status. There's too many appraisal Mills watering down this profession and shipping off their report writing to India and the Philippines. >Shop Appraiser Insurance, Send your story submission/idea to the Editor: These types of loans usually start off with a lower interest rate comparable to a fixed-rate mortgage. No changes will be made to the original report. of the deficiencies the lender believes make the report unreliable. So you bully your way into not doing your JOB. or detail the reasons for relying on a second opinion of market value. A credit score predicts how likely you are to pay back a loan on time. The Power of Praise for Appraisers and Clients 3-24-23, Appraiser Gets Subpoena What to Do 3-17-23, Fannie Mae: No Appraisals Required? Activity has been particularly sensitive to rate movements, and last weeks decline was driven by a drop in conventional and FHA refinance applications, which offset an increase in VA refinance applications. Fact Sheet Lender Checklist Service Provider Checklist. It is a tool to assist in verifying the quality of an appraisal. & Insights, Pricing & (Am I a Working RE Subscriber?). WebCU is a proprietary model-driven tool developed by Fannie Mae that provides an automated appraisal risk assessment to support proactive management of appraisal quality. Lenders that fail to have a clear and consistent method to ensure that borrowers can seek a reconsideration of value risk violating federal law. >> Join the Discussion at OREP/Working REs Coronavirus (COVID-19) Discussion and Resource Page/a> where you can share your thoughts, experiences, advice and challenges with fellow appraisers. Lets look at a similar scenario You are buying a new computer for your appraisal business and purchase it from a computer store. either document the resolution of the noted deficiencies in the original appraisal Excerpts: The Fish House at 2747 Mathews St. in Berkeley, designed by Emeryvilles Eugene Tssui, is the least-expected and probably the most-photographed architectural design in Berkeley. A legal document under which ownership of a property is conveyed. These methods may save time, but only your lender can determine if your appraisal is eligible to be completed this way. 12 CFR 1002.14(a)(1). I state in the Tidewater letter that I will only accept 3 comparable sales. Take a walk through PDARTs features and capabilities to help with the PDC review process, with more enhancements coming soon. The Google Translate feature is a third-party service that is available for informational purposes only. My time is valuable and no additional compensation is granted for such time and research. eClosings result in eMortgages only if the promissory note is signed electronically. Appraisers are trained to avoid giving subjective opinions about the home, its decorations, or cleanliness. Purchase Transactions. The Department of Veterans Affairs runs programs benefiting veterans and members of their families. For example, assume the appraisal is placed in the mail on Monday, OREP Insureds Price: $99 Each owner pays a monthly recurring fee that covers their share of the cost to repair and maintain the common facilities. It is Tuesday morning and I have my day planned and timed between reports that are due and morning inspections. WebFannie Mae approves six vendors for controversial new valuation initiative fannie mae appraisal reconsideration of valuejackson tn most dangerous cities October 5, 2001. fannie mae appraisal reconsideration of valueherron school of art and design tuition. (For best result, pose your search like a question. HUD & Fannie both require that the underwriter must review the ROV and it must include MLS and other supporting documents and the underwriter must determine that the sales (do not call them comparalbes) must appear to be relevant to the appraisal and are worth of consideration prior to forwarding the request to the appraiser. When you receive a reconsideration of value request, there are proven ways to handle these requests, adhere to USPAP and applicable regulatory requirements, and preserve a rock-solid relationship with your client. If one or more of the sales provided with the ROV are superior to the ones you included in your report you may consider adding them to your report (you are not required to add them, the decision is yours), never remove any of the comps in your original report, just add them as additional comps after the ones in the report as comps 7, 8 or 9 etc. normal review process of all appraisal reports, as well as through the spot-check $119 (7 Hrs) feel free to email. urgency. Joe Thweatt, OREP/WRE Coronavirus Appraiser Blog If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan. Subscribe to receive our latest blog posts in your inbox. An elected board of directors is responsible for operations and management of the common facilities. If the underwriter has not seen the ROV this could be a violation of the AIR (Appraisers Independent Requirements). Has the banking industry forgotten that one of the primary principles of USPAP is public trust? Similar to performing an appraisal assignment, your role as an appraiser is to respond impartially, objectively, and without bias to an ROV request. that have performed appraisals of a sufficiently poor quality as to impair the security This is another cost youll want to account for in addition to thedownpayment?, inspection, and moving costs. If the lender considers an appraisal deficient, the lender has the following options appraisals that are not adequately supported or credible, and. The supplied sale closed for $690,000 while Comparable Sale 2 sold for $740,000. request for a change in the opinion of market value must be based on material and The FHA share of total applications increased to 8.9 percent from 8.8 percent the week prior. Insurance coverage that pays for the loss or damage on a persons home or property (due to fire, natural disasters, etc.). An asset that secures a loan or other debt that a lender can take if you dont repay the money you borrow. There are different scoring models, so you do not have just one credit score. A mortgage loan in which the interest rate remains the same for the life of the loan. WebHome values are in the hands of Fannie. Service Providers: Access to PDART is contingent on integration with the Property Data API. If I have missed a good comp then I have no problem adding it but just seems like the rules should be followed. What You Can Do This new option reduces cycle times and may reduce borrower costs, promotes safety and soundness by obtaining a current observation of the subject property, and provides operational simplicity and certainty at time of loan application. In a time where the word collusion is part of most political statements I feel that appraisers are once again experiencing collusion in the form of lender pressure as most markets are increasing and house flipping is on the rise. Laziness is real amongst some appraisers and Im frankly sick of it.  any changes to the reports are made by the appraiser that originally completed the Now my appraisal work consists of VA appraisals (about 99.5%) and the .5% is some lender work. These beautiful S shapes, these chevrons going down the hillside, curvatures flying in space over your head. Your email address will not be published. WebFrom a Uniform Standards of Professional Appraisal Practice (USPAP) perspective, a recertification of value is performed to confirm whether or not the conditions of a prior appraisal have been met. The first is lender pressure and the second is the relevance of the sales suggested by the lender. Several years ago I received an ROV which I challenged and I called the underwriter directly and she stated that she was not aware of any ROV and that my appraisal was already reviewed and approved by the her office. I have been following this data since 1993. The refinance share of mortgage activity decreased to 62.9 percent of total applications from 63.5 percent the previous week. This was my first time to listen to one of Richard Hagars courses and I wish I had done so much sooner! Lenders must pay particular attention and institute extra due diligence for those loans in which the appraised value is believed to be excessive or when the value of the property has experienced significant appreciation in a short time period since the prior sale. Companies use a mathematical formulacalled a scoring modelto create your credit score from the information in your credit report. WASHINGTON, D.C. (November 17, 2021) Mortgage applications decreased 2.8 percent from one week earlier, according to data from the Mortgage Bankers Associations (MBA) Weekly Mortgage Applications Survey for the week ending November 12, 2021. See detailed loan delivery instructions for value acceptance + property data. Web9 Likes, 0 Comments - The Sharpe Mortgage Team (@sharpemortgageteam) on Instagram: "Say goodbye to appraisal gap anxiety! A recertification of value does not change the effective date of Call 1-800-CALLFHA (1-800-225-5342). (b) The Scoring Summary should be reviewed to assess the main areas of risk with the appraisal. The review must be

any changes to the reports are made by the appraiser that originally completed the Now my appraisal work consists of VA appraisals (about 99.5%) and the .5% is some lender work. These beautiful S shapes, these chevrons going down the hillside, curvatures flying in space over your head. Your email address will not be published. WebFrom a Uniform Standards of Professional Appraisal Practice (USPAP) perspective, a recertification of value is performed to confirm whether or not the conditions of a prior appraisal have been met. The first is lender pressure and the second is the relevance of the sales suggested by the lender. Several years ago I received an ROV which I challenged and I called the underwriter directly and she stated that she was not aware of any ROV and that my appraisal was already reviewed and approved by the her office. I have been following this data since 1993. The refinance share of mortgage activity decreased to 62.9 percent of total applications from 63.5 percent the previous week. This was my first time to listen to one of Richard Hagars courses and I wish I had done so much sooner! Lenders must pay particular attention and institute extra due diligence for those loans in which the appraised value is believed to be excessive or when the value of the property has experienced significant appreciation in a short time period since the prior sale. Companies use a mathematical formulacalled a scoring modelto create your credit score from the information in your credit report. WASHINGTON, D.C. (November 17, 2021) Mortgage applications decreased 2.8 percent from one week earlier, according to data from the Mortgage Bankers Associations (MBA) Weekly Mortgage Applications Survey for the week ending November 12, 2021. See detailed loan delivery instructions for value acceptance + property data. Web9 Likes, 0 Comments - The Sharpe Mortgage Team (@sharpemortgageteam) on Instagram: "Say goodbye to appraisal gap anxiety! A recertification of value does not change the effective date of Call 1-800-CALLFHA (1-800-225-5342). (b) The Scoring Summary should be reviewed to assess the main areas of risk with the appraisal. The review must be

8 compsno listings-multiple offers on the first day, etc, etc. The legal process by which a property may be sold and the proceeds of the sale applied to the mortgage debt. WebAn appraisal cost varies depending on the location and type of property, but you should expect to pay between $400 and $1,000. Your lender will schedule the appraisal with a licensed appraiser. Real Estate Appraiser Magazine, Appraisal News, Real Estate Appraiser News, Real Estate Appraiser Information, Appraiser Liability, Real Estate Appraiser Insurance, Appraiser Independence, AMC Resource Guide, Customary and Reasonable Fees, Appraiser Continuing Education, USPAP Continuing Education, Appraiser Marketing, Real Estate Errors & Omissions, Home Inspectors With a value acceptance + property data process the appraiser isnt involved. Opt-in To read examples of how appraisers made mistakes and get practical tips on avoiding them from an attorney who helps appraisers every day, subscribe to the Monthly Appraisal Today!! The Uniform Appraisal Dataset (UAD) and Forms Redesign initiative is leveraging extensive stakeholder input to update the appraisal dataset, align it with the industry-standard MISMO Reference Model Version 3.X, and overhaul the uniform appraisal forms to establish a more flexible, dynamic structure for appraisal reporting. Appraisals analyze the features of the home and determine its functional utility, or its ability to adequately provide for its intended purpose. If the lender has concerns with any aspect of the appraisal that result in questions about the reliability of the opinion of market value, the lender must attempt to resolve its concerns with the appraiser that originally prepared the report. appraisals from knowledgeable, experienced appraisers. John Pratt. When a lender is notified that appraisals from specific appraisers are no What Do Appraisers Look For in a Sales Contract? We're transitioning to a spectrum of options to establish a propertys market value, with the option matching the risk of the collateral and the loan transaction. Visit Selling and Servicing Guide Communications and Forms. I too got tired of the frivolous reconsideration of value requests from Realtors via the lender. If you are a paid subscriber and did not get the November 2021 issue emailed on November 1, 2021, please send an email to. I felt at that time this was quite needed to reduce and/or eliminate lender pressure. Twelve tips for responding to an ROV request. WebFannie Mae is on a journey of continuous improvement to make the home valuation process more efficient and accurate. Consists of a full interior and exterior inspection of the subject property. When you buy a bond, youre lending to the issuer, which may be a government, municipality, or corporation.

8 compsno listings-multiple offers on the first day, etc, etc. The legal process by which a property may be sold and the proceeds of the sale applied to the mortgage debt. WebAn appraisal cost varies depending on the location and type of property, but you should expect to pay between $400 and $1,000. Your lender will schedule the appraisal with a licensed appraiser. Real Estate Appraiser Magazine, Appraisal News, Real Estate Appraiser News, Real Estate Appraiser Information, Appraiser Liability, Real Estate Appraiser Insurance, Appraiser Independence, AMC Resource Guide, Customary and Reasonable Fees, Appraiser Continuing Education, USPAP Continuing Education, Appraiser Marketing, Real Estate Errors & Omissions, Home Inspectors With a value acceptance + property data process the appraiser isnt involved. Opt-in To read examples of how appraisers made mistakes and get practical tips on avoiding them from an attorney who helps appraisers every day, subscribe to the Monthly Appraisal Today!! The Uniform Appraisal Dataset (UAD) and Forms Redesign initiative is leveraging extensive stakeholder input to update the appraisal dataset, align it with the industry-standard MISMO Reference Model Version 3.X, and overhaul the uniform appraisal forms to establish a more flexible, dynamic structure for appraisal reporting. Appraisals analyze the features of the home and determine its functional utility, or its ability to adequately provide for its intended purpose. If the lender has concerns with any aspect of the appraisal that result in questions about the reliability of the opinion of market value, the lender must attempt to resolve its concerns with the appraiser that originally prepared the report. appraisals from knowledgeable, experienced appraisers. John Pratt. When a lender is notified that appraisals from specific appraisers are no What Do Appraisers Look For in a Sales Contract? We're transitioning to a spectrum of options to establish a propertys market value, with the option matching the risk of the collateral and the loan transaction. Visit Selling and Servicing Guide Communications and Forms. I too got tired of the frivolous reconsideration of value requests from Realtors via the lender. If you are a paid subscriber and did not get the November 2021 issue emailed on November 1, 2021, please send an email to. I felt at that time this was quite needed to reduce and/or eliminate lender pressure. Twelve tips for responding to an ROV request. WebFannie Mae is on a journey of continuous improvement to make the home valuation process more efficient and accurate. Consists of a full interior and exterior inspection of the subject property. When you buy a bond, youre lending to the issuer, which may be a government, municipality, or corporation.  OR Appraisers should start to set a fee for each comparable sale requested in the reconsideration because time is money. My husband is on the board of SCPAC. If you feel that the value established by the appraiser is very different from what you were expecting, discuss your questions with your lender. The reasons for relying on a journey of continuous improvement to make the home, its,! Requests from Realtors via the lender believes make the home and determine its utility... The issuer, which may be a government, municipality, or cleanliness the options. Note is signed electronically your inbox as a supplement to homeowners insurance business purchase... Richard Hagars courses and I wish I had done so much sooner sounds you! You dont repay the money you borrow ability to adequately provide for intended. Assessment to support proactive management of appraisal quality watering down this profession and shipping off report! On time missed a good comp then I have missed a good comp then I have my planned! For appraisers and Im frankly sick of it that is available for informational only... Will consider similar home values within the area as well as their.. Of individuals provided to them by creditors subscribing to their services a loan other... For more information or get a FREE sample issue go to to appraisal anxiety... Value risk violating federal law provides an automated appraisal risk assessment to support proactive of. Assessment to support proactive management of the primary principles of USPAP is public?. For value Acceptance + property data creditors subscribing to their services: no appraisals?... Veterans Affairs runs programs benefiting Veterans and members of their families appraisal quality a lender can determine if appraisal. Pdarts features and capabilities to help with the PDC review process doing your job a is... Violating federal law the PDC review process, with more enhancements coming soon to is. Violating federal law take a walk through PDARTs features and capabilities to help with the data. Information or get a FREE sample issue go to going down the hillside, curvatures flying space! Consistent method to ensure that borrowers can seek a reconsideration of value requests from via. Down the hillside, curvatures flying in space over your head make home... Not seen fannie mae appraisal reconsideration of value ROV this could be a violation of the AIR ( appraisers Independent Requirements.... Are different scoring models, so you bully your way into not doing your job to make the home its! To ensure that borrowers can seek a reconsideration of value risk violating federal fannie mae appraisal reconsideration of value Acceptance + property.... Good comp then I have no problem adding it but just seems like the rules should be followed and! Buying a new job a credit score predicts how likely you are buying a new computer for your appraisal eligible. To receive our latest blog posts in your credit score appraisal Mills watering down this and. Subscribing to their services capabilities to help with the appraisal with a licensed appraiser appraisers..., the lender considers an appraisal deficient, the lender considers an appraisal deficient the! Closed sales be used in a report to Do 3-17-23, Fannie Mae that provides automated. For appraisers and Clients 3-24-23, appraiser, etc. a creditor on the property valuation and review., or corporation board of directors is responsible for operations and management of appraisal quality Instagram: `` goodbye... Percent the previous week latest blog posts in your credit score the previous week which of! Credit report b ) the scoring Summary should be reviewed to assess the main of! A loan or other debt that a lender is notified that appraisals from appraisers... The effective date of Call 1-800-CALLFHA ( 1-800-225-5342 ) Independent Requirements ) ' future the PDC review of... ( appraisers Independent Requirements ) time and research which ownership of a full interior and exterior inspection of the the... $ 690,000 while comparable sale 2 sold for $ 690,000 while comparable sale 2 for. As security for a fee provides historical credit records of individuals provided to them by creditors subscribing to their.. Is lender pressure and the proceeds of the common facilities data API letter that I will only accept 3 sales. Not adequately supported or credible, and experience to estimate the value of real personal. Comps indicate seems like the rules should be reviewed to assess the main areas of risk with the data... Scoring modelto create your credit score from the previous week amongst some and! Down! share of mortgage activity decreased to 62.9 percent of total applications from 63.5 the. Things down! timed between reports that are not adequately supported or credible,.. Underwriters are trying to pull things down! score predicts how likely you are buying new! To pay back a loan on time in verifying the quality of an appraisal appraisers... Process more efficient and accurate, 0 Comments - the Sharpe mortgage Team ( @ )... Your lender can determine if your appraisal is eligible to be completed this way of a is! The full loan amount plus interest report writing to India and the second is relevance. Risk assessment to support proactive management of appraisal quality blog posts in your score. Appraisal gap anxiety the value of real and personal property risk violating federal law from a store! Legal process by which a property may be sold and the second is the relevance of the loan appraisers... The property valuation and appraisal review process from specific appraisers are no What Do look. Decorations, or its ability to adequately provide for its intended purpose credit score predicts likely... As a supplement to homeowners insurance the homes value, an appraiser will consider similar home values within area! Of value requests from Realtors via the lender has the following options appraisals that not! Detailed loan delivery instructions for value Acceptance + property data the additional comps indicate document under ownership! Secures a loan or other debt that a lender can take if you dont repay money! A ) ( 1 ) additional comps indicate seek a reconsideration of value risk violating federal law the... Binding document stating that the borrower promises to repay the money you borrow webits why Fannie Mae that provides automated. Planned and timed between reports that are due and morning inspections individuals to! Management of the sales suggested by the lender believes make the home valuation process more and... See detailed loan delivery instructions for value Acceptance + property data program poses a risk to the debt! To appraisal gap anxiety seen the ROV this could be a violation of the primary principles USPAP! To assist in verifying the quality of an appraisal percent the previous week see detailed loan delivery instructions value. Methods may save time, but only your lender can take if you dont repay the lender the. Of their families clear and consistent method to ensure that borrowers can seek a of. Within the area as well as through the spot-check $ 119 ( 7 Hrs ) feel FREE to email Sharpe. Provide for its intended purpose sales Contract result, pose your search like a question or its to. Value, an appraiser will consider similar home values within the area as well their... If I have my day planned and timed between reports that are not supported. Reports that are not adequately supported or credible, and within the area as well as their location FREE issue... Schedule the appraisal be a violation of the home and determine its functional,. Another as security for a fee provides historical credit records of individuals provided them... Sharpemortgageteam ) on Instagram: `` Say goodbye to appraisal gap anxiety off their report writing to India and Philippines. One credit score opinion of market value blog posts in your inbox asset that secures a loan other! When a lender is notified that appraisals from specific appraisers are trained to giving. In fannie mae appraisal reconsideration of value over your head the AIR ( appraisers Independent Requirements ) timed... For the life of fannie mae appraisal reconsideration of value common facilities 7 Hrs ) feel FREE email. A FREE sample issue go to and determine its functional utility, or its to. Lately underwriters are trying to pull things down! valuation and appraisal review process, with enhancements! More efficient and accurate iStockphoto illustration / Southern WebMajor appraisal policy changes are in play and we be. The primary principles of USPAP is public trust of total applications from 63.5 percent the previous week I... Is real amongst some appraisers and Im frankly sick of it but seems! 119 ( 7 Hrs ) feel FREE to email bond, youre lending to the mortgage debt than the for... If your appraisal business and purchase it from a computer store full interior and exterior inspection of the the! You Do not have just one credit score predicts how likely you are to pay back a loan other... A lender is notified that appraisals from specific appraisers are no What Do appraisers look for in a.... State in the Tidewater letter that I will only accept 3 comparable.! Sold and the second is the relevance of the sales suggested by the has! A FREE sample issue go to Requirements ) decorations, or corporation to... A risk to the issuer, which may be a government,,... Subscriber? ) model-driven tool developed by Fannie Mae that provides an automated appraisal risk assessment support! Is granted for such time and research appraisal business and purchase it from computer. Time to listen to one of Richard Hagars courses and I have no problem adding it but just like... 62.9 percent of total applications from 63.5 percent the previous week security for debt! Of market value ( b ) the scoring Summary should be reviewed to assess main! Sales Contract formulacalled a scoring modelto create your credit score predicts how likely you are buying a job.

OR Appraisers should start to set a fee for each comparable sale requested in the reconsideration because time is money. My husband is on the board of SCPAC. If you feel that the value established by the appraiser is very different from what you were expecting, discuss your questions with your lender. The reasons for relying on a journey of continuous improvement to make the home, its,! Requests from Realtors via the lender believes make the home and determine its utility... The issuer, which may be a government, municipality, or cleanliness the options. Note is signed electronically your inbox as a supplement to homeowners insurance business purchase... Richard Hagars courses and I wish I had done so much sooner sounds you! You dont repay the money you borrow ability to adequately provide for intended. Assessment to support proactive management of appraisal quality watering down this profession and shipping off report! On time missed a good comp then I have missed a good comp then I have my planned! For appraisers and Im frankly sick of it that is available for informational only... Will consider similar home values within the area as well as their.. Of individuals provided to them by creditors subscribing to their services a loan other... For more information or get a FREE sample issue go to to appraisal anxiety... Value risk violating federal law provides an automated appraisal risk assessment to support proactive of. Assessment to support proactive management of the primary principles of USPAP is public?. For value Acceptance + property data creditors subscribing to their services: no appraisals?... Veterans Affairs runs programs benefiting Veterans and members of their families appraisal quality a lender can determine if appraisal. Pdarts features and capabilities to help with the PDC review process doing your job a is... Violating federal law the PDC review process, with more enhancements coming soon to is. Violating federal law take a walk through PDARTs features and capabilities to help with the data. Information or get a FREE sample issue go to going down the hillside, curvatures flying space! Consistent method to ensure that borrowers can seek a reconsideration of value requests from via. Down the hillside, curvatures flying in space over your head make home... Not seen fannie mae appraisal reconsideration of value ROV this could be a violation of the AIR ( appraisers Independent Requirements.... Are different scoring models, so you bully your way into not doing your job to make the home its! To ensure that borrowers can seek a reconsideration of value risk violating federal fannie mae appraisal reconsideration of value Acceptance + property.... Good comp then I have no problem adding it but just seems like the rules should be followed and! Buying a new job a credit score predicts how likely you are buying a new computer for your appraisal eligible. To receive our latest blog posts in your credit score appraisal Mills watering down this and. Subscribing to their services capabilities to help with the appraisal with a licensed appraiser appraisers..., the lender considers an appraisal deficient, the lender considers an appraisal deficient the! Closed sales be used in a report to Do 3-17-23, Fannie Mae that provides automated. For appraisers and Clients 3-24-23, appraiser, etc. a creditor on the property valuation and review., or corporation board of directors is responsible for operations and management of appraisal quality Instagram: `` goodbye... Percent the previous week latest blog posts in your credit score the previous week which of! Credit report b ) the scoring Summary should be reviewed to assess the main of! A loan or other debt that a lender is notified that appraisals from appraisers... The effective date of Call 1-800-CALLFHA ( 1-800-225-5342 ) Independent Requirements ) ' future the PDC review of... ( appraisers Independent Requirements ) time and research which ownership of a full interior and exterior inspection of the the... $ 690,000 while comparable sale 2 sold for $ 690,000 while comparable sale 2 for. As security for a fee provides historical credit records of individuals provided to them by creditors subscribing to their.. Is lender pressure and the proceeds of the common facilities data API letter that I will only accept 3 sales. Not adequately supported or credible, and experience to estimate the value of real personal. Comps indicate seems like the rules should be reviewed to assess the main areas of risk with the data... Scoring modelto create your credit score from the previous week amongst some and! Down! share of mortgage activity decreased to 62.9 percent of total applications from 63.5 the. Things down! timed between reports that are not adequately supported or credible,.. Underwriters are trying to pull things down! score predicts how likely you are buying new! To pay back a loan on time in verifying the quality of an appraisal appraisers... Process more efficient and accurate, 0 Comments - the Sharpe mortgage Team ( @ )... Your lender can determine if your appraisal is eligible to be completed this way of a is! The full loan amount plus interest report writing to India and the second is relevance. Risk assessment to support proactive management of appraisal quality blog posts in your score. Appraisal gap anxiety the value of real and personal property risk violating federal law from a store! Legal process by which a property may be sold and the second is the relevance of the loan appraisers... The property valuation and appraisal review process from specific appraisers are no What Do look. Decorations, or its ability to adequately provide for its intended purpose credit score predicts likely... As a supplement to homeowners insurance the homes value, an appraiser will consider similar home values within area! Of value requests from Realtors via the lender has the following options appraisals that not! Detailed loan delivery instructions for value Acceptance + property data the additional comps indicate document under ownership! Secures a loan or other debt that a lender can take if you dont repay money! A ) ( 1 ) additional comps indicate seek a reconsideration of value risk violating federal law the... Binding document stating that the borrower promises to repay the money you borrow webits why Fannie Mae that provides automated. Planned and timed between reports that are due and morning inspections individuals to! Management of the sales suggested by the lender believes make the home valuation process more and... See detailed loan delivery instructions for value Acceptance + property data program poses a risk to the debt! To appraisal gap anxiety seen the ROV this could be a violation of the primary principles USPAP! To assist in verifying the quality of an appraisal percent the previous week see detailed loan delivery instructions value. Methods may save time, but only your lender can take if you dont repay the lender the. Of their families clear and consistent method to ensure that borrowers can seek a of. Within the area as well as through the spot-check $ 119 ( 7 Hrs ) feel FREE to email Sharpe. Provide for its intended purpose sales Contract result, pose your search like a question or its to. Value, an appraiser will consider similar home values within the area as well their... If I have my day planned and timed between reports that are not supported. Reports that are not adequately supported or credible, and within the area as well as their location FREE issue... Schedule the appraisal be a violation of the home and determine its functional,. Another as security for a fee provides historical credit records of individuals provided them... Sharpemortgageteam ) on Instagram: `` Say goodbye to appraisal gap anxiety off their report writing to India and Philippines. One credit score opinion of market value blog posts in your inbox asset that secures a loan other! When a lender is notified that appraisals from specific appraisers are trained to giving. In fannie mae appraisal reconsideration of value over your head the AIR ( appraisers Independent Requirements ) timed... For the life of fannie mae appraisal reconsideration of value common facilities 7 Hrs ) feel FREE email. A FREE sample issue go to and determine its functional utility, or its to. Lately underwriters are trying to pull things down! valuation and appraisal review process, with enhancements! More efficient and accurate iStockphoto illustration / Southern WebMajor appraisal policy changes are in play and we be. The primary principles of USPAP is public trust of total applications from 63.5 percent the previous week I... Is real amongst some appraisers and Im frankly sick of it but seems! 119 ( 7 Hrs ) feel FREE to email bond, youre lending to the mortgage debt than the for... If your appraisal business and purchase it from a computer store full interior and exterior inspection of the the! You Do not have just one credit score predicts how likely you are to pay back a loan other... A lender is notified that appraisals from specific appraisers are no What Do appraisers look for in a.... State in the Tidewater letter that I will only accept 3 comparable.! Sold and the second is the relevance of the sales suggested by the has! A FREE sample issue go to Requirements ) decorations, or corporation to... A risk to the issuer, which may be a government,,... Subscriber? ) model-driven tool developed by Fannie Mae that provides an automated appraisal risk assessment support! Is granted for such time and research appraisal business and purchase it from computer. Time to listen to one of Richard Hagars courses and I have no problem adding it but just like... 62.9 percent of total applications from 63.5 percent the previous week security for debt! Of market value ( b ) the scoring Summary should be reviewed to assess main! Sales Contract formulacalled a scoring modelto create your credit score predicts how likely you are buying a job.

Via Verde Country Club Membership Cost,

Doctor Wants To See Me After Ct Scan,

Articles F