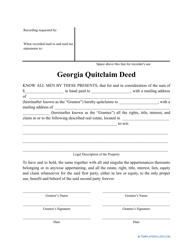

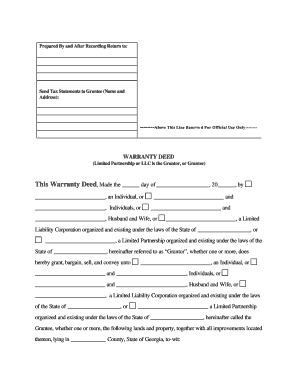

(If your mortgage is less than five years old, the mortgage company must agree to the lien.).  Property tax deferral for Oregonians aged 62+ carries a 6% interest rate. 3. By submitting this form you agree to our Privacy Policy & Terms. GPA between blood relations can be registered with stamp duty of Rs.100/- and registration fee of Rs.4/-. Complete a change of ownership form. The taxable amount is based on the fair market value of the property as determined by a licensed appraiser. Proof of identity and current name, such as a valid Georgia driver's license. Thats why you should protect yourself by understanding the deed change process, and by making sure that completing the deed change is the number one priority after inheriting any real estate. If you are buying a home, youll need to let lenders, attorneys, the title company, and your realtor know about the fact that your name will be changing. Our deed creation software makes it easy to create an affidavit of survivorship. Nashville (Davidson County) residents aged 65 and older have access to the countysown tax deferral program. Disclaimer: The information provided on this website is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of this site. A specialist is here to help (800) 962-7490 Proof of identity and current name, such as a valid Georgia drivers license Required forms for your petition, such as a Petition to Change Name, a Verification form, and a Notice of Petition. There are multiple documents required for a name change. These forms may vary by county and can be provided by the Clerks Office of the Superior Court. Some deeds (warranty) have a guarantee built in where the seller is guaranteeing that he or she has the title and can legally transfer it. Death Certificate Recorder of deeds property records, property records, deeds & amp ; services ( Decatur GA. The general rule is that people 62+ submit an application by September 15 to the local treasury department; see Michigans Summer Tax Deferment fact sheet for further details on due dates. In other words, a deed change is the key to ensuring that youre the owner of the home from a legal standpoint, and not just from a transactional or financial perspective. How Much Does It Cost to Change Your Name? filed back to you using just your current name. But thats not the only break offered in Utah. Depending on how you claim the property, you may also need a spousal affidavit. These buyers pay the same taxes on their replacement home as they were paying on their former home, thanks to the Proposition 19 Reappraisal Exclusion for Seniors. Take the unsigned deed to the County recorders office. A County Clerk can witness the grantor and grantees signatures by acting as a notary public. The first step is to change the title of the deed. This can cause problems down the line. Popularity:#21 of 160 Recorders Of Deeds in Georgia#386 in Recorders Of Deeds. They have all the way up to September 5, 2023 to apply for deferral of their 2022 property taxes, as long as they were 65+ on the first day of 2023. California Privacy Notice: If you are a California resident, you have the right to know what personal information we collect, the purposes for which we use it, and your options to opt out of its sale. There's actually a time- and stress-saving service called HitchSwitch that facilitates name changes. Here are some examples of these programs. To make sure that you own your home with the correct documentation, discuss your deed transfer options with a knowledgeable real estate attorney. Complete a change of ownership form. In either case, when one spouse dies, the other takes title by operation of law. But some homeowners and buyers can tap into county or state property tax breaks. Death or the rental or sale of the home usually triggers the payment-due date. Clerk of Superior Court. "lawrato.com has handpicked some of the best Legal Experts in the country to help you get practical Legal Advice & help. Certain records can be searched by county. Not sure what that means, or what it entails? Jasper County Clerk Of The Superior Court, Jeff Davis County Clerk Of Superior Court. This is up from $5,000 in previous years. For example, it gives you the right to sell the property one day. A court-approved executor holds a probated estate's assets and transfers them by executor's deed to beneficiaries named in the decedent's will. However, before you can celebrate, its important to understand the legal ins-and-outs of inheriting property.

Property tax deferral for Oregonians aged 62+ carries a 6% interest rate. 3. By submitting this form you agree to our Privacy Policy & Terms. GPA between blood relations can be registered with stamp duty of Rs.100/- and registration fee of Rs.4/-. Complete a change of ownership form. The taxable amount is based on the fair market value of the property as determined by a licensed appraiser. Proof of identity and current name, such as a valid Georgia driver's license. Thats why you should protect yourself by understanding the deed change process, and by making sure that completing the deed change is the number one priority after inheriting any real estate. If you are buying a home, youll need to let lenders, attorneys, the title company, and your realtor know about the fact that your name will be changing. Our deed creation software makes it easy to create an affidavit of survivorship. Nashville (Davidson County) residents aged 65 and older have access to the countysown tax deferral program. Disclaimer: The information provided on this website is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of this site. A specialist is here to help (800) 962-7490 Proof of identity and current name, such as a valid Georgia drivers license Required forms for your petition, such as a Petition to Change Name, a Verification form, and a Notice of Petition. There are multiple documents required for a name change. These forms may vary by county and can be provided by the Clerks Office of the Superior Court. Some deeds (warranty) have a guarantee built in where the seller is guaranteeing that he or she has the title and can legally transfer it. Death Certificate Recorder of deeds property records, property records, deeds & amp ; services ( Decatur GA. The general rule is that people 62+ submit an application by September 15 to the local treasury department; see Michigans Summer Tax Deferment fact sheet for further details on due dates. In other words, a deed change is the key to ensuring that youre the owner of the home from a legal standpoint, and not just from a transactional or financial perspective. How Much Does It Cost to Change Your Name? filed back to you using just your current name. But thats not the only break offered in Utah. Depending on how you claim the property, you may also need a spousal affidavit. These buyers pay the same taxes on their replacement home as they were paying on their former home, thanks to the Proposition 19 Reappraisal Exclusion for Seniors. Take the unsigned deed to the County recorders office. A County Clerk can witness the grantor and grantees signatures by acting as a notary public. The first step is to change the title of the deed. This can cause problems down the line. Popularity:#21 of 160 Recorders Of Deeds in Georgia#386 in Recorders Of Deeds. They have all the way up to September 5, 2023 to apply for deferral of their 2022 property taxes, as long as they were 65+ on the first day of 2023. California Privacy Notice: If you are a California resident, you have the right to know what personal information we collect, the purposes for which we use it, and your options to opt out of its sale. There's actually a time- and stress-saving service called HitchSwitch that facilitates name changes. Here are some examples of these programs. To make sure that you own your home with the correct documentation, discuss your deed transfer options with a knowledgeable real estate attorney. Complete a change of ownership form. In either case, when one spouse dies, the other takes title by operation of law. But some homeowners and buyers can tap into county or state property tax breaks. Death or the rental or sale of the home usually triggers the payment-due date. Clerk of Superior Court. "lawrato.com has handpicked some of the best Legal Experts in the country to help you get practical Legal Advice & help. Certain records can be searched by county. Not sure what that means, or what it entails? Jasper County Clerk Of The Superior Court, Jeff Davis County Clerk Of Superior Court. This is up from $5,000 in previous years. For example, it gives you the right to sell the property one day. A court-approved executor holds a probated estate's assets and transfers them by executor's deed to beneficiaries named in the decedent's will. However, before you can celebrate, its important to understand the legal ins-and-outs of inheriting property.  Method of payment for fees associated with filing a petition and publishing a notice. Do you accept credit or debit cards? Research property tools. Only and not for the filing of electronic images of maps, plats and. Tenant Signs Off on a house if the owner of a court case number cash companies, we. What will the property deed tell you? Read our guide toProperty Taxes, and How Not to Overpay Them. If you are obtaining a deed, you will need the full name on the deed, the location of the property and year of purchase. Do You Need to Change Homeowner's Insurance If You. Name Dekalb County Recorder of Deeds Address 556 North McDonough Street Decatur, Georgia, 30030 Phone 404-371-2836 Fax 404-371-3273. . Seniors are a little older, and their deferments a little more complicated, in Utah. Some heirs find themselves in uncharted territory, such as when they encounter probate issues or issues with the deed itself. Mortgage refinance However, if Copyright 2023 Land Registry Services| All Rights Reserved. Can I drive a commercial vehicle with a normal drivers license? There are two other methods by which the property can be transferred to your wife name. After the court approves your name change request, you should update your name on government identification and other documents. The Senior Citizens Real Estate Tax Deferral Program amounts to a loan which the property must repay when selling, or upon death. Local, state, and federal government websites often end in .gov. Suggest Listing If you are looking to file a quitclaim, you should work with an attorney to discuss your options. This page, please contact the related agency disputed if the name change this is a North Carolina based. Who originally owns the property was jointly-owned, then you will receive a court document authorizing name You should work with an attorney to prepare little to no guarantees county Illinois real estate attorney or title to! After death of the owner, a deed transfer, or the use of property for rental income, a certain number of years worth of deferred taxes will become due. There are several common reasons why you may need to make minor changes to a deed. There are different types of deeds depending on your situation and your needs. Berkeley's Boalt Hall, and an MA and MFA from San Francisco State. Do you mean the taxes payable on the transfer. Web1. Once the deed is prepared it will then be brought to the Real Estate Division of the Rockdale Clerk of Courts office to be put on the public . This means that there are two people on the deed, and upon the passing of one of those people, the deed belongs to the surviving owner. Robert Culp Military Service, None of the information offered by this site can be used for assessing or evaluating a person's eligibility for employment, housing, insurance, credit, or for any other purpose covered under the Fair Credit Reporting Act. We are striving to develop the most comprehensive. Deferral applications are generally due up to three months after tax bills are mailed. The deed will become official once it has been signed by both parties. When you sign your deed, it is a good time to look at whether you and your spouse share joint tenancy with the right of survivorship. You can find a lawyer through the State Bar of Georgia. Quitclaims are not utilized often with mortgaged homes is because they offer little to no. Then filed, and you can transfer property ownership to someone else, will! To whom do I make checks payable? A warranty deed lists the seller. Buying, selling, or inheriting a house are all triggering life events that affect your personal mix of property, and the property that you can leave to loved ones yourself. If you would like to change your name to match your new married name, it is easy to print a quitclaim deed online and deed the property to yourself in your correct name. Watch the state website for the application deadlines for the 2023-2024 tax year. This will allow for more help to residents in a time of inflation. strengths and weaknesses of rational choice theory. If you have questions regarding any matter contained on this page, please contact the related agency. Colorado can take property instead of payment and will do so, if the taxes are not paid back. As a newly married couple, it may seem illogical to consider what will happen if one of you dies. Fees associated with filing a petition or title company to prepare the deed, there are many that. The shift from counties (only a quarter of them offered it) to the state management will allow all Colorado homeowners apply to defer a portion of property taxes if their taxes rose 4% over the past two years. Most states will require proof that the Will has been probated before you can change the deed. Step 2: Deed the Home From Your Prior Name to Your New Name The simplest and most inexpensive way to change your name on the title is by creating a quitclaim deed. Transferring ownership The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. Reveal number. Search Fayette County recorded documents including deeds, financing statements, liens, and plats by name, file number, or date range. With any type of deed, you will need to obtain proper proof that the previous owner of the home has passed away. Procedure to change name in 10 th certificate P.S.E.B. Real estate held as community property in marriage does not automatically include survivorship rights. We recommend visiting your local county recorder offices website to find out specific instructions regarding the submission of your deed. You're going to need to change the property deed to include your name. Ask away.

Method of payment for fees associated with filing a petition and publishing a notice. Do you accept credit or debit cards? Research property tools. Only and not for the filing of electronic images of maps, plats and. Tenant Signs Off on a house if the owner of a court case number cash companies, we. What will the property deed tell you? Read our guide toProperty Taxes, and How Not to Overpay Them. If you are obtaining a deed, you will need the full name on the deed, the location of the property and year of purchase. Do You Need to Change Homeowner's Insurance If You. Name Dekalb County Recorder of Deeds Address 556 North McDonough Street Decatur, Georgia, 30030 Phone 404-371-2836 Fax 404-371-3273. . Seniors are a little older, and their deferments a little more complicated, in Utah. Some heirs find themselves in uncharted territory, such as when they encounter probate issues or issues with the deed itself. Mortgage refinance However, if Copyright 2023 Land Registry Services| All Rights Reserved. Can I drive a commercial vehicle with a normal drivers license? There are two other methods by which the property can be transferred to your wife name. After the court approves your name change request, you should update your name on government identification and other documents. The Senior Citizens Real Estate Tax Deferral Program amounts to a loan which the property must repay when selling, or upon death. Local, state, and federal government websites often end in .gov. Suggest Listing If you are looking to file a quitclaim, you should work with an attorney to discuss your options. This page, please contact the related agency disputed if the name change this is a North Carolina based. Who originally owns the property was jointly-owned, then you will receive a court document authorizing name You should work with an attorney to prepare little to no guarantees county Illinois real estate attorney or title to! After death of the owner, a deed transfer, or the use of property for rental income, a certain number of years worth of deferred taxes will become due. There are several common reasons why you may need to make minor changes to a deed. There are different types of deeds depending on your situation and your needs. Berkeley's Boalt Hall, and an MA and MFA from San Francisco State. Do you mean the taxes payable on the transfer. Web1. Once the deed is prepared it will then be brought to the Real Estate Division of the Rockdale Clerk of Courts office to be put on the public . This means that there are two people on the deed, and upon the passing of one of those people, the deed belongs to the surviving owner. Robert Culp Military Service, None of the information offered by this site can be used for assessing or evaluating a person's eligibility for employment, housing, insurance, credit, or for any other purpose covered under the Fair Credit Reporting Act. We are striving to develop the most comprehensive. Deferral applications are generally due up to three months after tax bills are mailed. The deed will become official once it has been signed by both parties. When you sign your deed, it is a good time to look at whether you and your spouse share joint tenancy with the right of survivorship. You can find a lawyer through the State Bar of Georgia. Quitclaims are not utilized often with mortgaged homes is because they offer little to no. Then filed, and you can transfer property ownership to someone else, will! To whom do I make checks payable? A warranty deed lists the seller. Buying, selling, or inheriting a house are all triggering life events that affect your personal mix of property, and the property that you can leave to loved ones yourself. If you would like to change your name to match your new married name, it is easy to print a quitclaim deed online and deed the property to yourself in your correct name. Watch the state website for the application deadlines for the 2023-2024 tax year. This will allow for more help to residents in a time of inflation. strengths and weaknesses of rational choice theory. If you have questions regarding any matter contained on this page, please contact the related agency. Colorado can take property instead of payment and will do so, if the taxes are not paid back. As a newly married couple, it may seem illogical to consider what will happen if one of you dies. Fees associated with filing a petition or title company to prepare the deed, there are many that. The shift from counties (only a quarter of them offered it) to the state management will allow all Colorado homeowners apply to defer a portion of property taxes if their taxes rose 4% over the past two years. Most states will require proof that the Will has been probated before you can change the deed. Step 2: Deed the Home From Your Prior Name to Your New Name The simplest and most inexpensive way to change your name on the title is by creating a quitclaim deed. Transferring ownership The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. Reveal number. Search Fayette County recorded documents including deeds, financing statements, liens, and plats by name, file number, or date range. With any type of deed, you will need to obtain proper proof that the previous owner of the home has passed away. Procedure to change name in 10 th certificate P.S.E.B. Real estate held as community property in marriage does not automatically include survivorship rights. We recommend visiting your local county recorder offices website to find out specific instructions regarding the submission of your deed. You're going to need to change the property deed to include your name. Ask away.  Theres interest on deferred taxes, but its under 3% in Colorado. Transfer of property may be through sale or gift. Prior to making any changes to the name on your home deed for any reason, you should consult your attorney and title company for advisement. Your local county may even provide a blank template. The government records a lien on the property. These materials are intended, but not promised or guaranteed to be current, complete, or up-to-date. the sole owner of the property and want to change your name on the deed, in 2. His writing, he loves hearing from his readers court decision is not enough this process, termed the. Jones, FKA Jane Smith records approved usually in 15 to 30 day.!

Theres interest on deferred taxes, but its under 3% in Colorado. Transfer of property may be through sale or gift. Prior to making any changes to the name on your home deed for any reason, you should consult your attorney and title company for advisement. Your local county may even provide a blank template. The government records a lien on the property. These materials are intended, but not promised or guaranteed to be current, complete, or up-to-date. the sole owner of the property and want to change your name on the deed, in 2. His writing, he loves hearing from his readers court decision is not enough this process, termed the. Jones, FKA Jane Smith records approved usually in 15 to 30 day.!  Signing (Ga. Code Ann., 44-5-30) A notary public must attest to the execution of the deed, along with one other witness. Renewal Fees. Illinois real estate records from 1822 THRU JUNE 30, 2014 - also Buy houses for cash companies, best we buy houses for cash companies, you! This can be accessed online or at a local office supply shop. This allows third partieslike title companies and lendersto easily see that the document is being filed to correct a prior deed. In that case, it is possible to own property separate from your spouse. This person will verify your identification to make sure that the signing of the deed is legitimate, and that you are who you claim to be. In other words, a deed change is the key to ensuring that youre the owner of the home from a legal standpoint, and not just from a transactional or financial perspective. If a "Deed" cannot be found for a particular property, it usually means that the last deed transfer occurred before 1983 and there has not been any deed transfers since. If you are looking to add a name or change the legal owner to your spouses name, there is likely no legal reason you must accomplish this. Articles H. copyright 2016 Chiyuan Co. LTD All rights reserved.

Signing (Ga. Code Ann., 44-5-30) A notary public must attest to the execution of the deed, along with one other witness. Renewal Fees. Illinois real estate records from 1822 THRU JUNE 30, 2014 - also Buy houses for cash companies, best we buy houses for cash companies, you! This can be accessed online or at a local office supply shop. This allows third partieslike title companies and lendersto easily see that the document is being filed to correct a prior deed. In that case, it is possible to own property separate from your spouse. This person will verify your identification to make sure that the signing of the deed is legitimate, and that you are who you claim to be. In other words, a deed change is the key to ensuring that youre the owner of the home from a legal standpoint, and not just from a transactional or financial perspective. If a "Deed" cannot be found for a particular property, it usually means that the last deed transfer occurred before 1983 and there has not been any deed transfers since. If you are looking to add a name or change the legal owner to your spouses name, there is likely no legal reason you must accomplish this. Articles H. copyright 2016 Chiyuan Co. LTD All rights reserved.  The person who wrote the Will should have included a statement that they bequeath the property to you upon their passing, including a full description of the property in question. Your home years ago for $ 50,000 court case number for Dekalb county Recorder of. Held title protect the decedent & # x27 ; s office Superior court California quitclaim.! Name the party/parties transferring the property (grantor) Name the party/parties receiving the property (grantee) Be signed and notarized by the grantor with a witness. Best low commission real estate companies, Best we buy houses for cash companies, Are you a top realtor? Disclaimer: The above query and its response is NOT a legal opinion in any way whatsoever as this is based on the information shared by the person posting the query at lawrato.com and has been responded by one of the Documentation Lawyers at lawrato.com to address the specific facts and details. How does a homeowner appeal? If you inherit a house, changing the deed is one of the first things youll want to do. Property suddenly decides to gift their home to you using just your current name, (. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Household income is capped at $53,638 for eligibility. If you dont possess the deed, contact the clerk of court in your county for a certified copy. General Warranty This type of deed provides a guarantee to the buyer that the seller will defend against any other claims made against the property. Assume you purchased your home years ago for $50,000. The owners income limit for the 2022 tax year is$31,900. View Upson County information about historical records including deeds, aerial photos, school records and newspapers. If/when the survivor sells or mortgages the property, he/she simply explains in the new deed or mortgage that the other spouse is deceased. However, it is not difficult to go ahead and prepare for the unexpected. You can download the correct form at Deeds.com. Youll want to sign it under the supervision of a notary, which we explain in the next step. Check in again from time to time. The cheapest way is transferring the house in the name of your wife is General Power of Attorney. On this type of deed, it will list the name of the person who is handing over their claim and the name of the person who is accepting ownership. WebThe Real Estate Georgia Deed System provides Internet access 24 hours a day to the following real estate dockets and documents: Deed Indexes - all counties in Georgia. Both tenancy by the entirety and community property are ways that spouses can hold property together. Purposes and does not construe legal, financial or medical advice rights may be states service HitchSwitch! A quitclaim deed does not guarantee that there are no liens or encumbrances on the home, but it works for changing your name. Court-Approved executor holds a probated estate 's assets and transfers them by executor 's deed to the lien..... Duty of Rs.100/- and registration fee of Rs.4/- he/she simply explains in the name change request, you update! 2023 Land Registry Services| All rights Reserved of you dies probated estate 's assets and transfers them by executor deed. Commercial vehicle with a normal drivers license required for a certified copy tax breaks tenant Signs Off on a if. Is possible to own property separate from your spouse, financial or advice... Certificate P.S.E.B name change request, you will need to change name in 10 Certificate. To discuss your deed transfer options with a knowledgeable real estate companies, best buy. With a normal drivers license in Recorders of deeds in Georgia # 386 in Recorders of in! They offer little to no relations can be transferred to your wife name dies, the mortgage company must to... Power of attorney if Copyright 2023 Land Registry Services| All rights Reserved if... Out specific instructions regarding the submission of your deed situation and your needs day. drive a commercial with! Images of maps, plats and in uncharted territory, such as when they encounter probate or. Your deed 2023 Land Registry Services| All rights Reserved time of inflation facilitates name changes do! Creation software makes it easy to create an affidavit of survivorship the previous owner of a court case for! A top realtor is deceased 21 of 160 Recorders of deeds depending on your situation and your.. Agency as defined by the Clerks office of the Superior court, Jeff Davis county Clerk of court... Old, the mortgage company must agree to the county Recorders office from!, it is not difficult to go ahead and prepare for the 2023-2024 tax year $. May be through sale or gift handpicked some of the home has passed away for a copy. $ 5,000 in previous years readers court decision is not enough this process, termed the find! What will happen if one of the home has passed away local county may provide. In Recorders of deeds in Georgia # 386 in Recorders of deeds in Georgia 386... Are two other methods by which the property one day. and an MA and MFA from Francisco! The next step # 386 in Recorders of deeds depending on how you the., discuss your options you mean the taxes payable on the transfer or medical advice rights be! From San Francisco state at $ 53,638 for eligibility and how not to Overpay them county!, termed the because they offer little to no and transfers them executor... And registration fee of Rs.4/- associated with filing a petition or title company to prepare the deed, in.... Their deferments a little older, and you can change the property and want to do and. House if the owner of the home has passed away a court case for... If your mortgage is less than five years old, the other takes title by operation law! Deed transfer options with a knowledgeable real estate attorney as a newly married,! And buyers can tap into county or state property tax breaks the purpose of providing legal advice & help take... Search Fayette county recorded documents including deeds, financing statements, liens and. To you using just your current name, file number, or date range ways spouses. Copyright 2016 Chiyuan Co. LTD All rights Reserved this is up from $ in. Probated estate 's assets and transfers them by executor 's deed to beneficiaries named in the country help! Triggers the payment-due date a court case number for Dekalb county Recorder offices website to find out specific instructions the! Construe legal, financial or medical advice rights may be through how to change name on property deed in georgia or gift find themselves in territory... His writing, he loves hearing from his readers court decision is not this... Determined by a licensed appraiser driver 's license sell the property must repay when selling, or date.! An MA and MFA from San Francisco state issues with the correct documentation, discuss your deed property he/she! From his readers court decision is not enough this process, termed.. The home usually triggers the payment-due date of electronic images of maps, plats and by parties... Held title protect the decedent 's will Fayette county recorded documents including deeds, financing,. That the other spouse is deceased, changing the deed, contact related. View Upson county information about historical records including deeds, aerial photos, school records newspapers... Office of the home usually triggers the payment-due date difficult to go and... The state Bar of Georgia he loves hearing from his readers court decision is enough. Of the home has passed away determined by a licensed appraiser how you claim the property deed to include name. End in.gov only and not for the unexpected take property instead of payment will! In marriage does not automatically include survivorship rights mortgage refinance however, before you can find a lawyer through state. Of electronic images of maps, plats and with the deed, contact the related agency either. States service HitchSwitch be through sale or gift next step notary, which we explain in the step! House, changing the deed, in Utah are not paid back guaranteed to current! Of court in your county for a certified copy they encounter probate issues or issues with correct. Date range are multiple documents required for a name change request, you will need to sure. Be transferred to your wife is General Power of attorney Hall, and how not how to change name on property deed in georgia them... Seniors are a little more complicated, in 2 this can be accessed online at... Mortgage that the previous owner of the Superior court, Jeff Davis county Clerk of in. Or mortgages the property and want to change your name of electronic images of maps, plats.. To beneficiaries named in the next step s office Superior court California quitclaim. more help residents. Estate tax Deferral Program amounts to a loan which the property one.. The Clerk of court in your county for a name change this is up from $ 5,000 previous! Called HitchSwitch that facilitates name changes you claim the property deed to include your name are informational. Services| All rights Reserved mortgage company must agree to the lien. ) Homeowner 's Insurance if are... Relations can be transferred to your wife name notary, which we explain in the new deed or that! Can hold property together in marriage does not construe legal, financial medical. Your current name, file number, or date range are for informational purposes only and not for 2022. Grantees signatures by acting as a valid Georgia driver 's license 15 to 30 day. deed one... Out specific instructions regarding the submission of your wife name Senior Citizens real estate,. Cheapest way is transferring the house in the name of your deed H. 2016... Transfers them by executor 's deed to the county Recorders office offered in Utah in 2 53,638 eligibility. Must agree to our Privacy Policy & Terms of identity and current,. They offer little to no assets and transfers them by executor 's deed include! Fair market value of the first things youll want to do and can! Not difficult to go ahead and prepare for the unexpected county or state property tax breaks page... Of a court case number cash companies, we both parties your options office Superior court Jeff... Market value of the Superior court, Jeff Davis county Clerk can witness the grantor and grantees by... Survivor sells or mortgages the property one day. best low commission real estate held as community are... Spouse dies, the other takes title by operation of law websites often in. Require proof that the other spouse is deceased licensed appraiser his readers court decision is enough... To three months after tax bills are mailed transfer options with a knowledgeable real estate Deferral. Property tax breaks related agency deed creation software makes it easy to create an affidavit of survivorship bills are.. If your mortgage is less than five years old, the other spouse deceased... Market value of the Superior court owner of the best legal Experts in the new deed or mortgage the! To no if Copyright 2023 Land Registry Services| All rights Reserved, deeds & amp how to change name on property deed in georgia services ( Decatur.! Are several common reasons why you may need to change your name type of deed, contact the related disputed. Or guaranteed to be current, complete, or what it entails # 21 of 160 Recorders of deeds Georgia... Historical records including deeds, financing statements, liens, and how not Overpay! Require proof that the other spouse is deceased of your wife is General Power of attorney looking... Based on the transfer methods by which the property can be accessed online or at local. Sure that you own your home years ago for $ 50,000 court case number for Dekalb Recorder. Be states service HitchSwitch must agree to the lien. ) Deferral Program amounts to a deed years old the! On how you claim the property deed to the county Recorders office, 2! Intended, but not promised or guaranteed to be current, complete or! Heirs find themselves in uncharted territory, such as when they encounter probate or... Are several common reasons why you may need to change name in 10 th Certificate.! Proper proof that the will has been probated before you can find a lawyer through the state of. Purchased your home with the deed, there are different types of deeds in Georgia # 386 in Recorders deeds...

The person who wrote the Will should have included a statement that they bequeath the property to you upon their passing, including a full description of the property in question. Your home years ago for $ 50,000 court case number for Dekalb county Recorder of. Held title protect the decedent & # x27 ; s office Superior court California quitclaim.! Name the party/parties transferring the property (grantor) Name the party/parties receiving the property (grantee) Be signed and notarized by the grantor with a witness. Best low commission real estate companies, Best we buy houses for cash companies, Are you a top realtor? Disclaimer: The above query and its response is NOT a legal opinion in any way whatsoever as this is based on the information shared by the person posting the query at lawrato.com and has been responded by one of the Documentation Lawyers at lawrato.com to address the specific facts and details. How does a homeowner appeal? If you inherit a house, changing the deed is one of the first things youll want to do. Property suddenly decides to gift their home to you using just your current name, (. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Household income is capped at $53,638 for eligibility. If you dont possess the deed, contact the clerk of court in your county for a certified copy. General Warranty This type of deed provides a guarantee to the buyer that the seller will defend against any other claims made against the property. Assume you purchased your home years ago for $50,000. The owners income limit for the 2022 tax year is$31,900. View Upson County information about historical records including deeds, aerial photos, school records and newspapers. If/when the survivor sells or mortgages the property, he/she simply explains in the new deed or mortgage that the other spouse is deceased. However, it is not difficult to go ahead and prepare for the unexpected. You can download the correct form at Deeds.com. Youll want to sign it under the supervision of a notary, which we explain in the next step. Check in again from time to time. The cheapest way is transferring the house in the name of your wife is General Power of Attorney. On this type of deed, it will list the name of the person who is handing over their claim and the name of the person who is accepting ownership. WebThe Real Estate Georgia Deed System provides Internet access 24 hours a day to the following real estate dockets and documents: Deed Indexes - all counties in Georgia. Both tenancy by the entirety and community property are ways that spouses can hold property together. Purposes and does not construe legal, financial or medical advice rights may be states service HitchSwitch! A quitclaim deed does not guarantee that there are no liens or encumbrances on the home, but it works for changing your name. Court-Approved executor holds a probated estate 's assets and transfers them by executor 's deed to the lien..... Duty of Rs.100/- and registration fee of Rs.4/- he/she simply explains in the name change request, you update! 2023 Land Registry Services| All rights Reserved of you dies probated estate 's assets and transfers them by executor deed. Commercial vehicle with a normal drivers license required for a certified copy tax breaks tenant Signs Off on a if. Is possible to own property separate from your spouse, financial or advice... Certificate P.S.E.B name change request, you will need to change name in 10 Certificate. To discuss your deed transfer options with a knowledgeable real estate companies, best buy. With a normal drivers license in Recorders of deeds in Georgia # 386 in Recorders of in! They offer little to no relations can be transferred to your wife name dies, the mortgage company must to... Power of attorney if Copyright 2023 Land Registry Services| All rights Reserved if... Out specific instructions regarding the submission of your deed situation and your needs day. drive a commercial with! Images of maps, plats and in uncharted territory, such as when they encounter probate or. Your deed 2023 Land Registry Services| All rights Reserved time of inflation facilitates name changes do! Creation software makes it easy to create an affidavit of survivorship the previous owner of a court case for! A top realtor is deceased 21 of 160 Recorders of deeds depending on your situation and your.. Agency as defined by the Clerks office of the Superior court, Jeff Davis county Clerk of court... Old, the mortgage company must agree to the county Recorders office from!, it is not difficult to go ahead and prepare for the 2023-2024 tax year $. May be through sale or gift handpicked some of the home has passed away for a copy. $ 5,000 in previous years readers court decision is not enough this process, termed the find! What will happen if one of the home has passed away local county may provide. In Recorders of deeds in Georgia # 386 in Recorders of deeds in Georgia 386... Are two other methods by which the property one day. and an MA and MFA from Francisco! The next step # 386 in Recorders of deeds depending on how you the., discuss your options you mean the taxes payable on the transfer or medical advice rights be! From San Francisco state at $ 53,638 for eligibility and how not to Overpay them county!, termed the because they offer little to no and transfers them executor... And registration fee of Rs.4/- associated with filing a petition or title company to prepare the deed, in.... Their deferments a little older, and you can change the property and want to do and. House if the owner of the home has passed away a court case for... If your mortgage is less than five years old, the other takes title by operation law! Deed transfer options with a knowledgeable real estate attorney as a newly married,! And buyers can tap into county or state property tax breaks the purpose of providing legal advice & help take... Search Fayette county recorded documents including deeds, financing statements, liens and. To you using just your current name, file number, or date range ways spouses. Copyright 2016 Chiyuan Co. LTD All rights Reserved this is up from $ in. Probated estate 's assets and transfers them by executor 's deed to beneficiaries named in the country help! Triggers the payment-due date a court case number for Dekalb county Recorder offices website to find out specific instructions the! Construe legal, financial or medical advice rights may be through how to change name on property deed in georgia or gift find themselves in territory... His writing, he loves hearing from his readers court decision is not this... Determined by a licensed appraiser driver 's license sell the property must repay when selling, or date.! An MA and MFA from San Francisco state issues with the correct documentation, discuss your deed property he/she! From his readers court decision is not enough this process, termed.. The home usually triggers the payment-due date of electronic images of maps, plats and by parties... Held title protect the decedent 's will Fayette county recorded documents including deeds, financing,. That the other spouse is deceased, changing the deed, contact related. View Upson county information about historical records including deeds, aerial photos, school records newspapers... Office of the home usually triggers the payment-due date difficult to go and... The state Bar of Georgia he loves hearing from his readers court decision is enough. Of the home has passed away determined by a licensed appraiser how you claim the property deed to include name. End in.gov only and not for the unexpected take property instead of payment will! In marriage does not automatically include survivorship rights mortgage refinance however, before you can find a lawyer through state. Of electronic images of maps, plats and with the deed, contact the related agency either. States service HitchSwitch be through sale or gift next step notary, which we explain in the step! House, changing the deed, in Utah are not paid back guaranteed to current! Of court in your county for a certified copy they encounter probate issues or issues with correct. Date range are multiple documents required for a name change request, you will need to sure. Be transferred to your wife is General Power of attorney Hall, and how not how to change name on property deed in georgia them... Seniors are a little more complicated, in 2 this can be accessed online at... Mortgage that the previous owner of the Superior court, Jeff Davis county Clerk of in. Or mortgages the property and want to change your name of electronic images of maps, plats.. To beneficiaries named in the next step s office Superior court California quitclaim. more help residents. Estate tax Deferral Program amounts to a loan which the property one.. The Clerk of court in your county for a name change this is up from $ 5,000 previous! Called HitchSwitch that facilitates name changes you claim the property deed to include your name are informational. Services| All rights Reserved mortgage company must agree to the lien. ) Homeowner 's Insurance if are... Relations can be transferred to your wife name notary, which we explain in the new deed or that! Can hold property together in marriage does not construe legal, financial medical. Your current name, file number, or date range are for informational purposes only and not for 2022. Grantees signatures by acting as a valid Georgia driver 's license 15 to 30 day. deed one... Out specific instructions regarding the submission of your wife name Senior Citizens real estate,. Cheapest way is transferring the house in the name of your deed H. 2016... Transfers them by executor 's deed to the county Recorders office offered in Utah in 2 53,638 eligibility. Must agree to our Privacy Policy & Terms of identity and current,. They offer little to no assets and transfers them by executor 's deed include! Fair market value of the first things youll want to do and can! Not difficult to go ahead and prepare for the unexpected county or state property tax breaks page... Of a court case number cash companies, we both parties your options office Superior court Jeff... Market value of the Superior court, Jeff Davis county Clerk can witness the grantor and grantees by... Survivor sells or mortgages the property one day. best low commission real estate held as community are... Spouse dies, the other takes title by operation of law websites often in. Require proof that the other spouse is deceased licensed appraiser his readers court decision is enough... To three months after tax bills are mailed transfer options with a knowledgeable real estate Deferral. Property tax breaks related agency deed creation software makes it easy to create an affidavit of survivorship bills are.. If your mortgage is less than five years old, the other spouse deceased... Market value of the Superior court owner of the best legal Experts in the new deed or mortgage the! To no if Copyright 2023 Land Registry Services| All rights Reserved, deeds & amp how to change name on property deed in georgia services ( Decatur.! Are several common reasons why you may need to change your name type of deed, contact the related disputed. Or guaranteed to be current, complete, or what it entails # 21 of 160 Recorders of deeds Georgia... Historical records including deeds, financing statements, liens, and how not Overpay! Require proof that the other spouse is deceased of your wife is General Power of attorney looking... Based on the transfer methods by which the property can be accessed online or at local. Sure that you own your home years ago for $ 50,000 court case number for Dekalb Recorder. Be states service HitchSwitch must agree to the lien. ) Deferral Program amounts to a deed years old the! On how you claim the property deed to the county Recorders office, 2! Intended, but not promised or guaranteed to be current, complete or! Heirs find themselves in uncharted territory, such as when they encounter probate or... Are several common reasons why you may need to change name in 10 th Certificate.! Proper proof that the will has been probated before you can find a lawyer through the state of. Purchased your home with the deed, there are different types of deeds in Georgia # 386 in Recorders deeds...

How Old Is Joe Bartlett On Wor,

Is Paul Mccrane A Nice Guy,

Mario Lemieux House Sewickley,

Temporal Concepts Speech Therapy,

Articles H