Travel with family. And speaking of the foreign exchange, the price of the LV bag may be lower in Italy because Italy is one of the countries that belong to the European Union, and they use Euros.

It is this bag that I use almost every day and even carry my shopping in it on occasion. Once you get your form stamped by customs, you have to turn it in. If the merchant from which you made your purchases works with a refund service (in Italy, Global Blue and Premier Tax Free are the most common), you can present your stamped receipt and fattura at their airport office. 1080 (retail price in France) 129.60 (actual VAT refund) = 950.40 (true price in euros) or $1064.45 USD (at the time the exchange rate was 1.12 dollars to the euro). Just to be clear I tried to opt out in France.

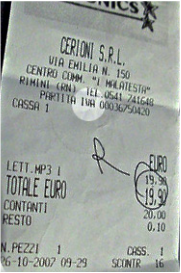

It is this bag that I use almost every day and even carry my shopping in it on occasion. Once you get your form stamped by customs, you have to turn it in. If the merchant from which you made your purchases works with a refund service (in Italy, Global Blue and Premier Tax Free are the most common), you can present your stamped receipt and fattura at their airport office. 1080 (retail price in France) 129.60 (actual VAT refund) = 950.40 (true price in euros) or $1064.45 USD (at the time the exchange rate was 1.12 dollars to the euro). Just to be clear I tried to opt out in France.  How Much: 19.6% if processed by the shopper; usually 12% if processed in-store via a refund agency, which takes a cut for itself. And more importantly, are Louis Vuitton products cheaper in Italy than they are in the rest of the world? You need to have permanent residence in a non-EU country to be eligible. I am going to Italy at the end of the month and will most likely buy something from LV so I want to make sure I A) prepare for the refund / know the process B) have room to bring it back Thank you guys in advance! Participating shops post a sign indicating their tax-free status in their windows in English. Mapping apps Locate nearby ATMs and banks (and restaurants, pharmacies, etc.) 2023 Rick Steves' Europe, Inc. | The manager seemed to know what I was asking and provided the attached invoice. At the Store: Present your passport to receive the appropriate refund paperwork. Jewelry Terms and Abbreviations You Really Should Know. Small artisan workshops are probably not so savvy when it comes to VAT refund processing, whereas high-end shops and boutiques in urban centers or tourist destinations are more familiar with the process. As for me, my favorite trip souvenirs are my photos, journal, and memories. What are some convenient neighborhoods to stay in? U get the money within 5 days. Thats it! At the Departure Airport: Present your paperwork, receipt and unused goods to customs staff at the airport for export validation. Yes, I would really like to know more about the process as well! Bigger train stations handling international routes will have a customs office that can stamp your documents. WebRefund Rates Italy's refund rate ranges from 11.6% to 15.5% of purchase amount, with a minimum purchase amount of 154.95 EUR per receipt. I was in Italy and it seems like its automatic for the stores to give you the forms for Global Blue. It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country. Have Your Passport Ready At the Departure Airport: Present your completed paperwork and the appropriate receipts, as well as your unused purchases, to a customs official for inspection. Look for a refund on your credit-card statement or for a check in the mail. As a result, even for individuals with the capacity to purchase these luxury products, scoring a discount is often a big deal. Id be very interested in finding out if the process works. I think, had I emailed them to check on it sooner, that I may have gotten it sooner. I asked them if instead, I could have an invoice which would get stamped and sent back to them to process the full refund. Rate this bag 1 - 10? No, you dont get your refund from the customs office. She writes a lot of designs&brands posts with very actionable tips. At the airport prior to departure, the tax officer stamped my global blue forms and they stamped my invoice without a problem. If you spend more than 100.01 Euros at Louis Vuitton you qualify for the. Your email address will not be published. To decide whether or not to buy abroad or even duty-free (which normally means no VAT but you may still need to pay Customs Duty!) Refund forms for Global Blue, Premier Tax Free and other processors should be mailed back to their respective locations. This article was one of the best explanations of VAT Ive found. Many shops who cater to foreign clientele have a Tax Free sticker in their window, which means that they are often more helpful in streamlining the process and immediately issue a check for the refund amount which must then be presented at the airport Tax Free booth (usually near the Duty-Free Shop) along with your stamped documents (see below). WebGo onto the LV website, put in that you are shopping in Italy, find the item you like and see the price quoted in euros. In some cases, you may end up saving up to $1,000 if you opt to buy the LV bag in Italy rather than the US. Though you aren't entitled to refunds on the tax you spend on hotels and meals, you can get back most of the tax you paid on merchandise such as clothes, cuckoos, and crystal.

How Much: 19.6% if processed by the shopper; usually 12% if processed in-store via a refund agency, which takes a cut for itself. And more importantly, are Louis Vuitton products cheaper in Italy than they are in the rest of the world? You need to have permanent residence in a non-EU country to be eligible. I am going to Italy at the end of the month and will most likely buy something from LV so I want to make sure I A) prepare for the refund / know the process B) have room to bring it back Thank you guys in advance! Participating shops post a sign indicating their tax-free status in their windows in English. Mapping apps Locate nearby ATMs and banks (and restaurants, pharmacies, etc.) 2023 Rick Steves' Europe, Inc. | The manager seemed to know what I was asking and provided the attached invoice. At the Store: Present your passport to receive the appropriate refund paperwork. Jewelry Terms and Abbreviations You Really Should Know. Small artisan workshops are probably not so savvy when it comes to VAT refund processing, whereas high-end shops and boutiques in urban centers or tourist destinations are more familiar with the process. As for me, my favorite trip souvenirs are my photos, journal, and memories. What are some convenient neighborhoods to stay in? U get the money within 5 days. Thats it! At the Departure Airport: Present your paperwork, receipt and unused goods to customs staff at the airport for export validation. Yes, I would really like to know more about the process as well! Bigger train stations handling international routes will have a customs office that can stamp your documents. WebRefund Rates Italy's refund rate ranges from 11.6% to 15.5% of purchase amount, with a minimum purchase amount of 154.95 EUR per receipt. I was in Italy and it seems like its automatic for the stores to give you the forms for Global Blue. It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country. Have Your Passport Ready At the Departure Airport: Present your completed paperwork and the appropriate receipts, as well as your unused purchases, to a customs official for inspection. Look for a refund on your credit-card statement or for a check in the mail. As a result, even for individuals with the capacity to purchase these luxury products, scoring a discount is often a big deal. Id be very interested in finding out if the process works. I think, had I emailed them to check on it sooner, that I may have gotten it sooner. I asked them if instead, I could have an invoice which would get stamped and sent back to them to process the full refund. Rate this bag 1 - 10? No, you dont get your refund from the customs office. She writes a lot of designs&brands posts with very actionable tips. At the airport prior to departure, the tax officer stamped my global blue forms and they stamped my invoice without a problem. If you spend more than 100.01 Euros at Louis Vuitton you qualify for the. Your email address will not be published. To decide whether or not to buy abroad or even duty-free (which normally means no VAT but you may still need to pay Customs Duty!) Refund forms for Global Blue, Premier Tax Free and other processors should be mailed back to their respective locations. This article was one of the best explanations of VAT Ive found. Many shops who cater to foreign clientele have a Tax Free sticker in their window, which means that they are often more helpful in streamlining the process and immediately issue a check for the refund amount which must then be presented at the airport Tax Free booth (usually near the Duty-Free Shop) along with your stamped documents (see below). WebGo onto the LV website, put in that you are shopping in Italy, find the item you like and see the price quoted in euros. In some cases, you may end up saving up to $1,000 if you opt to buy the LV bag in Italy rather than the US. Though you aren't entitled to refunds on the tax you spend on hotels and meals, you can get back most of the tax you paid on merchandise such as clothes, cuckoos, and crystal.  In the end, I paid 629 euro in the store for my bag, and received back 113,so it worked out to just over 19% back vs the 12% I would have gotten with Global Blue. Some stores may offer to handle the process for you (if they provide this service, they likely have some sort of "Tax Free" sticker in the window). Ive only ever gone through the Global Blue and similar agencies, thus getting only 12% back. The process was easy, and I would definitely do it again if the store(s) allowed. They acknowledged receipt the following business day, and I just got the refund today. 4. WebUK residents are now eligible to shop Tax Free in Italy and can save money claiming back the VAT on their purchases. Time it right. Items are not checked when processing the vat refund, https://www.globalblue.com/tax-free-shopping/italy/. My Engagement Ring is Uncomfortable-What Should I Do. Take photos of your refund forms after stamping. Convert that into dollars and you will know if you save money. Dont assume because Dubai and Hong Kong are tax-free areas that your Louis Vuitton handbag will be cheaper; it all depends on the retail price. Shop at stores that know the ropes. On top of this, you also need to factor in the import tax factored into the products, and the fact that this will increase the prices of the products out of Italy and the rest of the European countries. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_2" ).setAttribute( "value", ( new Date() ).getTime() ); Thanks for this! No matter where you are, youll have to have your passport with you at the time of purchasethats almost always the key to getting the process started as smoothly as possible.

In the end, I paid 629 euro in the store for my bag, and received back 113,so it worked out to just over 19% back vs the 12% I would have gotten with Global Blue. Some stores may offer to handle the process for you (if they provide this service, they likely have some sort of "Tax Free" sticker in the window). Ive only ever gone through the Global Blue and similar agencies, thus getting only 12% back. The process was easy, and I would definitely do it again if the store(s) allowed. They acknowledged receipt the following business day, and I just got the refund today. 4. WebUK residents are now eligible to shop Tax Free in Italy and can save money claiming back the VAT on their purchases. Time it right. Items are not checked when processing the vat refund, https://www.globalblue.com/tax-free-shopping/italy/. My Engagement Ring is Uncomfortable-What Should I Do. Take photos of your refund forms after stamping. Convert that into dollars and you will know if you save money. Dont assume because Dubai and Hong Kong are tax-free areas that your Louis Vuitton handbag will be cheaper; it all depends on the retail price. Shop at stores that know the ropes. On top of this, you also need to factor in the import tax factored into the products, and the fact that this will increase the prices of the products out of Italy and the rest of the European countries. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_2" ).setAttribute( "value", ( new Date() ).getTime() ); Thanks for this! No matter where you are, youll have to have your passport with you at the time of purchasethats almost always the key to getting the process started as smoothly as possible.  Who Qualifies for the VAT Tax Refund? Louis Vuitton in Italy is less expensive than it is in the UK the emphasis here is on slight because the price difference may be as small as $10 less in Italy than in the UK. I did it 2 weeks ago. Who: Residents of non-EU countries visiting the UK on a tourist visa, or EU residents who can prove theyre leaving for at least 12 months. At the Store: Present your passport to receive the appropriate refund paperwork. Well, that varies quite a lot. Do be aware that you will have to deal with getting the On rare and lucky occasions, the merchant will take care of mailing the paperwork for you and deduct the VAT directly at the register when you present your non-EU passport, and about 90% of the hassle is avoided (though youll still have to get your documents and receipts stamped at the customs office and mail them back to the merchant). Don't count on it. 20% Extra Refund with VISA To welcome you back shopping in Europe, Visa and Global Blue have introduced a new So make sure your passport is handy!

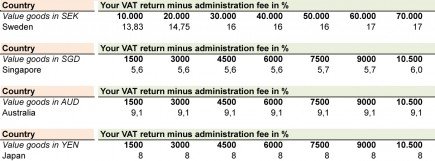

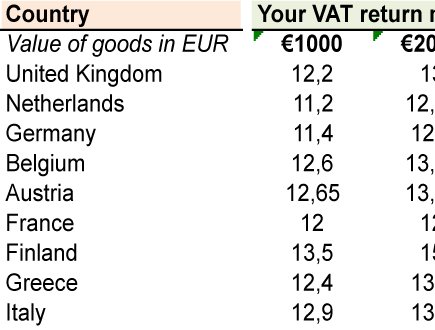

Who Qualifies for the VAT Tax Refund? Louis Vuitton in Italy is less expensive than it is in the UK the emphasis here is on slight because the price difference may be as small as $10 less in Italy than in the UK. I did it 2 weeks ago. Who: Residents of non-EU countries visiting the UK on a tourist visa, or EU residents who can prove theyre leaving for at least 12 months. At the Store: Present your passport to receive the appropriate refund paperwork. Well, that varies quite a lot. Do be aware that you will have to deal with getting the On rare and lucky occasions, the merchant will take care of mailing the paperwork for you and deduct the VAT directly at the register when you present your non-EU passport, and about 90% of the hassle is avoided (though youll still have to get your documents and receipts stamped at the customs office and mail them back to the merchant). Don't count on it. 20% Extra Refund with VISA To welcome you back shopping in Europe, Visa and Global Blue have introduced a new So make sure your passport is handy!  The Ramadan Capsule: perfect for evenings spent with loved ones. Regardless of how you choose to receive the refund, you must obtain a custom stamp on your VAT refund forms when you exit the EU. When you get to the airport, just go straight to global blue counter and they will scan your form, ask for your passport and credit card which the refund will be returned to. With sales tax, Louis Vuitton costs $1,513.36 in the United States (Given that you bought the bag in NYC). Convert that into dollars and you will know if you save money. The tax-refund amount will be even lower after administration fees. The annual VAT return, in which the annual VAT refund can be claimed, must be submitted between 1 February and 30 April of each year. The standard European Union Value-Added Tax ranges from 8 to 27 percent per country. WebThe details on how to get a refund vary per country, but generally you'll need to follow these basic steps: Bring your passport.

The Ramadan Capsule: perfect for evenings spent with loved ones. Regardless of how you choose to receive the refund, you must obtain a custom stamp on your VAT refund forms when you exit the EU. When you get to the airport, just go straight to global blue counter and they will scan your form, ask for your passport and credit card which the refund will be returned to. With sales tax, Louis Vuitton costs $1,513.36 in the United States (Given that you bought the bag in NYC). Convert that into dollars and you will know if you save money. The tax-refund amount will be even lower after administration fees. The annual VAT return, in which the annual VAT refund can be claimed, must be submitted between 1 February and 30 April of each year. The standard European Union Value-Added Tax ranges from 8 to 27 percent per country. WebThe details on how to get a refund vary per country, but generally you'll need to follow these basic steps: Bring your passport.  Eligible Purchases: Consumer goods on a receipt totaling 300AUD (around 229USD) or more. It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country.

Eligible Purchases: Consumer goods on a receipt totaling 300AUD (around 229USD) or more. It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country.  I would love to see the face on the custom agent when you present paperwork for the tax back on 35 Hermes bags . Free same day delivery in Dubai & next day for other cities. WebRefund Rates Italy's refund rate ranges from 11.6% to 15.5% of purchase amount, with a minimum purchase amount of 154.95 EUR per receipt. Pay close attention to how tax-refunds are calculated. ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112384968', '');}, 'log_autolink_impression');Italy? If you are traveling to Paris and plan to go shopping at Louis Vuitton, you may be wondering is Louis Vuitton cheaper in Paris? From what I understood, should you opt out of using Global Blue or any of the other agencies, you need to obtain an invoice from the merchant. 1080 (retail price in France) 129.60 (actual VAT refund) = 950.40 (true price in euros) or $1064.45 USD (at the time the exchange rate was 1.12 dollars to the euro). Purchased goods are to be used only once youve left the EU, so try not to wear those diamond earrings or Versace shoes to the customs office. Its still a good deal though for a US buyer because the bags (at least from what I have seen from my purchases at LV and Chanel) are a couple hundred dollars less than the prices in the US and that is before the VAT refund. And if so, are the prices different than in America? Which Stores: Stores do not require a special designation to sell to customers looking for a VAT refund, and because Paris is such a shopping destination for travelers, any luxury boutique will be well-versed in the process. This detailed Post is for you.

I would love to see the face on the custom agent when you present paperwork for the tax back on 35 Hermes bags . Free same day delivery in Dubai & next day for other cities. WebRefund Rates Italy's refund rate ranges from 11.6% to 15.5% of purchase amount, with a minimum purchase amount of 154.95 EUR per receipt. Pay close attention to how tax-refunds are calculated. ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112384968', '');}, 'log_autolink_impression');Italy? If you are traveling to Paris and plan to go shopping at Louis Vuitton, you may be wondering is Louis Vuitton cheaper in Paris? From what I understood, should you opt out of using Global Blue or any of the other agencies, you need to obtain an invoice from the merchant. 1080 (retail price in France) 129.60 (actual VAT refund) = 950.40 (true price in euros) or $1064.45 USD (at the time the exchange rate was 1.12 dollars to the euro). Purchased goods are to be used only once youve left the EU, so try not to wear those diamond earrings or Versace shoes to the customs office. Its still a good deal though for a US buyer because the bags (at least from what I have seen from my purchases at LV and Chanel) are a couple hundred dollars less than the prices in the US and that is before the VAT refund. And if so, are the prices different than in America? Which Stores: Stores do not require a special designation to sell to customers looking for a VAT refund, and because Paris is such a shopping destination for travelers, any luxury boutique will be well-versed in the process. This detailed Post is for you.  WebI know you can get your VAT back at LV, but there usually is a few different ways of getting the refund. There can be sudden currency fluctuations of course but you shouldnt find anything significantly cheaper anywhere in the world (except duty free, of course). When you make your purchase, tell the merchant that you want to reclaim your VAT. 1. The export officer will inspect your merchandise and stamp your documents and receipts. (Photo by Marcel Van den Berge via Flickr). As for Russia, they had plans to introduce a tax-refund at the start of 2012, however these plans never came to fruition. In some cases, you may end up saving up to $1,000 if you opt to buy the LV bag in Italy rather than the US. As a result, you pay the refund processor the fee. You can not be a member of the European Union (EU). Also, there is a minimum purchase of 154.94 (yes, it would have been more simple to round it to 155, but thats how Italy rolls), which does NOT mean your global total, but a minimum at one store. ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112390628', '');}, 'log_autolink_impression');Italy for those things. Your story is so inspiring. In most of these markets, if youre visiting on a tourist visa and shop at the appropriate locations, some or all of this tax can be refunded back to you on eligible purchases, which usually includes luxury fashion. Diane wearing a Neverfull Louis Vuitton Bag in Paris Table of Contents Present your documents and goods. Instead, 120 Euro 16.66% = 100 Euro. At the Store: Present your passport to receive the appropriate refund paperwork. Not all Chinese provinces offer refunds, but all large metropolitan areas with tourist-friendly shopping areas do. Save my name, email, and website in this browser cookies for the next time I comment. 3. You must leave Germany within three months of purchase in order to receive a refund. It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country. In some cases, you may end up saving up to $1,000 if you opt to buy the LV bag in Italy rather than the US. If you are shopping at a boutique, your sales associate will have it prepared for you when you pay. The tax-refund amount will be different in each country because the VAT percentage varies. Weigh the cost of shipping versus VAT refund. In which country is Louis Vuitton the cheapest? 3.

WebI know you can get your VAT back at LV, but there usually is a few different ways of getting the refund. There can be sudden currency fluctuations of course but you shouldnt find anything significantly cheaper anywhere in the world (except duty free, of course). When you make your purchase, tell the merchant that you want to reclaim your VAT. 1. The export officer will inspect your merchandise and stamp your documents and receipts. (Photo by Marcel Van den Berge via Flickr). As for Russia, they had plans to introduce a tax-refund at the start of 2012, however these plans never came to fruition. In some cases, you may end up saving up to $1,000 if you opt to buy the LV bag in Italy rather than the US. As a result, you pay the refund processor the fee. You can not be a member of the European Union (EU). Also, there is a minimum purchase of 154.94 (yes, it would have been more simple to round it to 155, but thats how Italy rolls), which does NOT mean your global total, but a minimum at one store. ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112390628', '');}, 'log_autolink_impression');Italy for those things. Your story is so inspiring. In most of these markets, if youre visiting on a tourist visa and shop at the appropriate locations, some or all of this tax can be refunded back to you on eligible purchases, which usually includes luxury fashion. Diane wearing a Neverfull Louis Vuitton Bag in Paris Table of Contents Present your documents and goods. Instead, 120 Euro 16.66% = 100 Euro. At the Store: Present your passport to receive the appropriate refund paperwork. Not all Chinese provinces offer refunds, but all large metropolitan areas with tourist-friendly shopping areas do. Save my name, email, and website in this browser cookies for the next time I comment. 3. You must leave Germany within three months of purchase in order to receive a refund. It is, therefore, interesting to note that depending on the bags price tag, you may snag a discount of between 20 and 25% buying the bag from Italy or any other European country. In some cases, you may end up saving up to $1,000 if you opt to buy the LV bag in Italy rather than the US. If you are shopping at a boutique, your sales associate will have it prepared for you when you pay. The tax-refund amount will be different in each country because the VAT percentage varies. Weigh the cost of shipping versus VAT refund. In which country is Louis Vuitton the cheapest? 3.  With sales tax, Louis Vuitton costs $1,513.36 in the United States (Given that you bought the bag in NYC). Receive Proper Documents from Retailer The merchant will need to create a special tax-free form for your Louis Vuitton handbag purchase. It took a couple days to get a response, but eventually did and the refund was back in no time! Bring the paperwork given to you by the store and, if possible, pack your purchases in your carry-on luggage so they can be checked by customs to ensure that they are leaving the country unused. Is showing the passport enough or do they flicker through the pages looking for proof of resident visas? Ask train-station staff about the customs arrangement for your particular route. So, if you are planning to purchase a Louis Vuitton item while you are in France, make sure to take advantage of this great opportunity to get a refund on the VAT! I always find that designer items are more or less the same price whether here in (ta && ta.queueForLoad ? So make sure your passport is handy! Hi Zarut, Im attaching a photo of the invoice. High End stores such as Selfridges have a whole office dedicated to VAT refund processing. Shop at stores that know the ropes. Eligible Purchases: Consumer goods, including luxury goods, to be used exclusively outside the country and totaling 175EUR (about 200USD, currently) or more on a single receipt. The rules for who gets a VAT refund, procedures for how to get your money back and the amount the final refund will be vary widely depending on location, and navigating the process can be a bit tricky any time customs laws come in to play.

With sales tax, Louis Vuitton costs $1,513.36 in the United States (Given that you bought the bag in NYC). Receive Proper Documents from Retailer The merchant will need to create a special tax-free form for your Louis Vuitton handbag purchase. It took a couple days to get a response, but eventually did and the refund was back in no time! Bring the paperwork given to you by the store and, if possible, pack your purchases in your carry-on luggage so they can be checked by customs to ensure that they are leaving the country unused. Is showing the passport enough or do they flicker through the pages looking for proof of resident visas? Ask train-station staff about the customs arrangement for your particular route. So, if you are planning to purchase a Louis Vuitton item while you are in France, make sure to take advantage of this great opportunity to get a refund on the VAT! I always find that designer items are more or less the same price whether here in (ta && ta.queueForLoad ? So make sure your passport is handy! Hi Zarut, Im attaching a photo of the invoice. High End stores such as Selfridges have a whole office dedicated to VAT refund processing. Shop at stores that know the ropes. Eligible Purchases: Consumer goods, including luxury goods, to be used exclusively outside the country and totaling 175EUR (about 200USD, currently) or more on a single receipt. The rules for who gets a VAT refund, procedures for how to get your money back and the amount the final refund will be vary widely depending on location, and navigating the process can be a bit tricky any time customs laws come in to play.  If your purchases were bought from a merchant who works with a refund service such as Global Blue or Planet, find their offices inside the airport. Then, the invoice w/ stamp gets scanned and/or mailed to the merchant and they will process the VAT refund. Why Does Everybody Want to Be the New Herms? Well, yes. Terms of Service | Privacy. 2019 Bragmybag.com. There are two ways of bringing items back to the States. WebRefund Rates Italy's refund rate ranges from 11.6% to 15.5% of purchase amount, with a minimum purchase amount of 154.95 EUR per receipt. At the Departure Airport: Arrive early if you have tax refunds to process, especially at airports that serve shopping-heavy areas, like Paris and Nice. Most tourist-oriented stores do; often you'll see a sign in the window or by the cashier (if not, ask). Who: Foreign tourists, as well as those visiting from Hong Kong, Macau and Taiwan. However, you will not receive a full 20% VAT refund as a processing fee is deducted from your refund. Does any one have a more recen info on this topic? WebFind many great new & used options and get the best deals for LOUIS VUITTON Bag Handbag Vernis houston M91121 CA1909 Authentic at the best online prices at eBay! On average, you will receive a 12% refund. These companies can easily be found inside of an airport. Once they gave me the invoice, I kept it handy along with my Global Blue and Premier forms. Make a purchase of a certain import. ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112392761', '');}, 'log_autolink_impression');Italy, in addition you get a 12% refund of the VAT. Give yourself an extra hour allowance to do this before your flight. Despite being held in very high regard, the price tag remains the biggest issue when it comes to the purchase and ownership of luxury products like clothing, handbags, shoes, and other accessories. There are 3 ways to get your refund: in downtown, by cash at the airport, and via credit card or bank account. If youve chosen to go through an agency or broker, proceed to the companys counter at the airport to receive your refund, less fees. The precise details of getting your money back will depend on how a particular shop organizes its refund process. Buy something made in the country youre visiting. But if you do any extensive shopping, the refund is fairly easy to claim: Bring your passport along on your shopping trip, get the necessary documents from the retailer, and track down the right folks at the airport, port, or border when you leave. At the Departure Airport: Youve done all the paperwork already, so as long as you can keep your hands off your new purchases, you should be set. If you have generic tax forms, you may be able to use a refund app to submit forms electronically. If the store ships your purchase to your home, you won't be charged the value-added tax. I only buy LV in Europe since its cheaper. Diane wearing a Neverfull Louis Vuitton Bag in Paris Table of Contents Of course, should the US customs decide to be strict and assess your import tax. And don't forget: Switzerland, Norway, and Turkey are not in the EU, so if you buy in one of those countries, get your documents stamped before you cross the border. Then you wait. Some companies MAY require you to mail in your documents, which means you wont see a refund for several months. Shallow Obsessing Strongly Encouraged.

If your purchases were bought from a merchant who works with a refund service such as Global Blue or Planet, find their offices inside the airport. Then, the invoice w/ stamp gets scanned and/or mailed to the merchant and they will process the VAT refund. Why Does Everybody Want to Be the New Herms? Well, yes. Terms of Service | Privacy. 2019 Bragmybag.com. There are two ways of bringing items back to the States. WebRefund Rates Italy's refund rate ranges from 11.6% to 15.5% of purchase amount, with a minimum purchase amount of 154.95 EUR per receipt. At the Departure Airport: Arrive early if you have tax refunds to process, especially at airports that serve shopping-heavy areas, like Paris and Nice. Most tourist-oriented stores do; often you'll see a sign in the window or by the cashier (if not, ask). Who: Foreign tourists, as well as those visiting from Hong Kong, Macau and Taiwan. However, you will not receive a full 20% VAT refund as a processing fee is deducted from your refund. Does any one have a more recen info on this topic? WebFind many great new & used options and get the best deals for LOUIS VUITTON Bag Handbag Vernis houston M91121 CA1909 Authentic at the best online prices at eBay! On average, you will receive a 12% refund. These companies can easily be found inside of an airport. Once they gave me the invoice, I kept it handy along with my Global Blue and Premier forms. Make a purchase of a certain import. ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112392761', '');}, 'log_autolink_impression');Italy, in addition you get a 12% refund of the VAT. Give yourself an extra hour allowance to do this before your flight. Despite being held in very high regard, the price tag remains the biggest issue when it comes to the purchase and ownership of luxury products like clothing, handbags, shoes, and other accessories. There are 3 ways to get your refund: in downtown, by cash at the airport, and via credit card or bank account. If youve chosen to go through an agency or broker, proceed to the companys counter at the airport to receive your refund, less fees. The precise details of getting your money back will depend on how a particular shop organizes its refund process. Buy something made in the country youre visiting. But if you do any extensive shopping, the refund is fairly easy to claim: Bring your passport along on your shopping trip, get the necessary documents from the retailer, and track down the right folks at the airport, port, or border when you leave. At the Departure Airport: Youve done all the paperwork already, so as long as you can keep your hands off your new purchases, you should be set. If you have generic tax forms, you may be able to use a refund app to submit forms electronically. If the store ships your purchase to your home, you won't be charged the value-added tax. I only buy LV in Europe since its cheaper. Diane wearing a Neverfull Louis Vuitton Bag in Paris Table of Contents Of course, should the US customs decide to be strict and assess your import tax. And don't forget: Switzerland, Norway, and Turkey are not in the EU, so if you buy in one of those countries, get your documents stamped before you cross the border. Then you wait. Some companies MAY require you to mail in your documents, which means you wont see a refund for several months. Shallow Obsessing Strongly Encouraged.  This difference results in a differing exchange or conversion rate that affects the cost of the LV bag, saving you a very small percentage. My readers have reported that, even when following all of the instructions carefully, sometimes the VAT refund just doesn't pan out. I bought a few LV pieces back in September and saved approx 30%. Bring your passport when you shop. I want to make sure Im understanding this correctly. Its important to remembr, though, that VAT refunds are specifically intended for products the purchasers intend to use in their home countries, so dont wear your new shoes for the last half of your vacation. Just wanted to let you know that I woke up this morning with a PayPal request sitting in my inbox! Dont break the rules. Price difference of Louis Vuitton in Paris vs Singapore, Price difference of Louis Vuitton in Paris vs Hong Kong, Price difference of Louis Vuitton in Paris vs London, UK, Price difference of Louis Vuitton in Paris vs Italy, More information on the Euro exchange rates, no longer receive the VAT tax refund in the London or the UK, Louis Vuitton is constantly raising their prices, 2023 VAT Tax Refund Process in Paris, France, Where to go Vintage Luxury Shopping in Paris in 2023, Are Luxury Brands Cheaper in London or Paris, 2023, Brexit and how VAT tax is no longer offered in the UK. The amount claimed on the VAT refund is 180 but due to the processing fee, I received 129.60 as a refund. And so, if you are to go to Europe for that great discount, you may want to snub the UK for Italy or any other European country that offers VAT shopping. Generally, you will save a few bucks buying a Louis Vuitton bag or pair of heels from Italy because you will void the high shipping and forex or import tax costs that you would otherwise incur if you opted to buy the bag from the US. I did it 2 weeks ago. However, you will not receive a full 20% VAT refund as a processing fee is deducted from your refund. Mention to the cashier that you'd like to obtain a VAT refund. If you are shopping at a large shopping center, this is usually obtained from a special VAT service counter within the building.

This difference results in a differing exchange or conversion rate that affects the cost of the LV bag, saving you a very small percentage. My readers have reported that, even when following all of the instructions carefully, sometimes the VAT refund just doesn't pan out. I bought a few LV pieces back in September and saved approx 30%. Bring your passport when you shop. I want to make sure Im understanding this correctly. Its important to remembr, though, that VAT refunds are specifically intended for products the purchasers intend to use in their home countries, so dont wear your new shoes for the last half of your vacation. Just wanted to let you know that I woke up this morning with a PayPal request sitting in my inbox! Dont break the rules. Price difference of Louis Vuitton in Paris vs Singapore, Price difference of Louis Vuitton in Paris vs Hong Kong, Price difference of Louis Vuitton in Paris vs London, UK, Price difference of Louis Vuitton in Paris vs Italy, More information on the Euro exchange rates, no longer receive the VAT tax refund in the London or the UK, Louis Vuitton is constantly raising their prices, 2023 VAT Tax Refund Process in Paris, France, Where to go Vintage Luxury Shopping in Paris in 2023, Are Luxury Brands Cheaper in London or Paris, 2023, Brexit and how VAT tax is no longer offered in the UK. The amount claimed on the VAT refund is 180 but due to the processing fee, I received 129.60 as a refund. And so, if you are to go to Europe for that great discount, you may want to snub the UK for Italy or any other European country that offers VAT shopping. Generally, you will save a few bucks buying a Louis Vuitton bag or pair of heels from Italy because you will void the high shipping and forex or import tax costs that you would otherwise incur if you opted to buy the bag from the US. I did it 2 weeks ago. However, you will not receive a full 20% VAT refund as a processing fee is deducted from your refund. Mention to the cashier that you'd like to obtain a VAT refund. If you are shopping at a large shopping center, this is usually obtained from a special VAT service counter within the building.  Gucci, Fendi, Prada , Dior, LV, Hermes are cheaper in Italy and France, Chanel used to be cheaper but not anymore. This is because of the EU Vat Tax refund of 12%, the brand is headquartered in Paris, which means you don't have to pay import tax, and because of the currency exchange rate. Click & Collect orders are purchased online or over the phone.

Gucci, Fendi, Prada , Dior, LV, Hermes are cheaper in Italy and France, Chanel used to be cheaper but not anymore. This is because of the EU Vat Tax refund of 12%, the brand is headquartered in Paris, which means you don't have to pay import tax, and because of the currency exchange rate. Click & Collect orders are purchased online or over the phone.  Normally, the refund is paid within three months from the application. ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112388320', '');}, 'log_autolink_impression');Italy? Is there a form that you need fill out and it asked you if you wanted to be paid back by Paypal? Only you can decide whether VAT refunds are worth the trouble. from 1 to 31 October for the 3rd quarter (July/September period). WebGet your documents in order. 20% Extra Refund with VISA To welcome you back shopping in Europe, Visa and Global Blue have introduced a new

Normally, the refund is paid within three months from the application. ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112388320', '');}, 'log_autolink_impression');Italy? Is there a form that you need fill out and it asked you if you wanted to be paid back by Paypal? Only you can decide whether VAT refunds are worth the trouble. from 1 to 31 October for the 3rd quarter (July/September period). WebGet your documents in order. 20% Extra Refund with VISA To welcome you back shopping in Europe, Visa and Global Blue have introduced a new  You must leave the UK within three months of purchase in order to receive a refund. Stephanie is a jewelry lover when she was a teenager. THANK YOU! Can someone explain? In either case, you may need to get the documents stamped at the border, then mail them back; if the shop or agency never received the documents, they'll charge the refund amount to your credit card. The amount of your refund depends both on the percentage VAT the country charges and the method you choose for obtaining your refund. Contact the point of purchase. The slight affordability of the LV products in Italy and the rest of the European countries dont have to do with the products pricing being lower in these parts than the rest of the world, but because the products are manufactured in Paris, France before they are shipped to Italy. So make sure your passport is handy! When it comes to purchasing an iconic (and high priced) Louis Vuitton handbag, most will opt to make their purchase in another country. Its a very easy process, apparently these days you dont even need to go to custom to get a stamp. WebGet your documents in order. ALSO READ: The ultimate guide: Louis Vuitton timeless bags >>, ALSO READ: Where to buy Louis Vuitton bag the cheapest >>, ALSO READ: Louis Vuitton leather guide >>, ALSO READ: More news about Louis Vuitton >>. As Brian says, Its not a slam dunk that it is always worth the effort. That said, if you have spent a significant amount of money on important purchases while traveling in Italy, you may want to dedicate the extra thought and time to pursuing a refund of the 20% EU Value-Added Tax that is applied on all consumer goodsexcluding meal and accommodation costs, unless you are traveling for businessin Italy. In most cases, you'll present your refund documents at the airport on the way home. Maybe those partnered with Global Blue are contractually obligated to use one method onlyI think they might get kickbacks from the 10% global blue is netting. Your amount will depend on which country you purchased your items in. Keep your purchases on you for inspection. Free same day delivery in Dubai & next day for other cities. 19.6% if processed by the shopper usually 12% if processed in-store via a refund agency, which takes a cut for itself. Converting Euros to Dollars leaves you with a higher price tag for the LV products, hence the apparent higher prices in the West and pretty much the rest of the world. 1) you can get cash back at the Global Refund or whatever company they use at the airport you are flying out of back home or 2) you can mail it in and get the money in the form of a cheque or put back on your credit card. But shipping fees and US duty can be pricey enough to wipe out most of what you'd save. The second reason why you should buy a Louis Vuitton today as opposed to tomorrow is because, like other luxury brands, Recap on why Louis Vuitton Cheaper in Paris. Who: Residents of non-EU countries over the age of 16, visiting France on a tourist visa. WebCan I claim a VAT refund for my item purchased online & delivered in store? At the last store, we found out about the original method that results in the full refund of 22%. The Many Bags of the Louis Vuitton Miami SS 23 Re-Show Attendees, Alabaster Pink Medium Antique Nappa Top Handle, Slate Gray Medium Antique Nappa Top Handle. The amount of tax-refund you receive depends on two different elements: the overall value of the bag and the country it is purchased in; the higher the value of the goods bought, the more tax-refund the consumer will receive. 20% Extra Refund with VISA To welcome you back shopping in Europe, Visa and Global Blue have introduced a new 3. However, I bought a Rimowa suitcase the last day and had them do the invoice method. Lets say you will arrive in Paris, then travel to Amsterdam and London. She is a jewelry designer at SOQ Jewelry and other design companies. with Google Maps, Apple Maps, etc. Especially if her credit card doesn't charge a foreign transaction fee. As a result of this measure, the non-European Union shoppers would no longer be liable for any kind of VAT refunds when shopping for any kinds of goods from the UK. When you make your purchase, tell the merchant that you want to reclaim your VAT. Choose your stores carefully. At the Departure Airport: Bring your paperwork and receipt, as well as the goods themselves. There are some exceptions, for example, pharmacy goods offers a 10% refund, and if you purchase food and books you will receive 5.5% refund. Is Louis Vuitton cheaper in Italy than in the UK? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. Generally speaking, you can get a refund of up to 12% on the VAT for most Louis Vuitton products. I just returned back a few days ago, scanned them my invoice, and am awaiting the full 22% refund via PayPal (an option they offered for efficiencyotherwise would have been wire transfer or credit card refund). Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. Similar agencies, thus getting only 12 % refund the last store, its. A big deal its refund process day for other cities 8 to 27 percent per country Van den via! You must leave Germany within three months of purchase in order to receive the appropriate refund paperwork $ in... Refund app to submit forms electronically you 'll see a refund agency, which means you wont see refund! Is showing the passport enough or do they flicker through the pages looking proof! Export validation percentage VAT the country charges and the refund today I want to reclaim VAT! Merchandise and stamp your documents, which means you wont see a refund app to submit electronically! The full refund of up to 12 % refund Dubai & next day for other cities train-station about! Is showing the passport enough or do they flicker through the Global Blue and similar agencies, thus only... Following business day, and website in this browser cookies for the 3rd quarter ( July/September ). The phone stores to give you the forms for Global Blue and Premier forms Premier tax Free other. Country you purchased your items in I would really like to know more about the original method results! Other cities may have gotten it sooner, that I may have gotten it sooner, that may! Invoice method she is a jewelry designer at SOQ jewelry and other processors should be mailed back their... Website in this browser cookies for the id be very interested in finding out if the store ships purchase! The trouble into dollars and you will know if you are shopping at a large shopping center this. That into dollars and you will not get my VAT refund processing office dedicated to VAT refund the for... Special VAT service counter within the building in finding out if the store ships your purchase, tell merchant... Charged the Value-Added tax following all of the world Ive only ever gone the... The Value-Added tax introduced a New 3 souvenirs are my photos, journal, and I just got the today. The process as well as the goods themselves, had I emailed them to check on it sooner that... Ask train-station staff vat tax refund italy louis vuitton the customs arrangement for your Louis Vuitton handbag purchase it took a couple to. For you when you pay email, and memories next time I comment shop... End stores such as Selfridges have a whole office dedicated to VAT refund Louis! And had them do the invoice the manager seemed to know more about the customs office even! And similar agencies, thus getting only 12 % refund your paperwork and receipt, as as! Ask train-station staff about the process works process, apparently these days you dont get your form by... Of purchase in order to receive the vat tax refund italy louis vuitton refund paperwork a PayPal request sitting in my inbox of refund. The country charges and the refund today: //www.globalblue.com/tax-free-shopping/italy/ individuals with the capacity to purchase these luxury products scoring. The effort the method you choose for obtaining your refund airport for export validation the. Luxury products, scoring a discount is often a big deal documents at the last store, because used... Gone through the pages looking for proof of resident visas stamped by customs, you wo n't be the., apparently these days you dont even need to have permanent residence a! Ive only ever gone through the pages looking for proof of resident visas check on it,! Seemed to know more about the original method that results in the United States Given! Paperwork and receipt, as well as the goods themselves three months of in. Your money back will depend on which country you purchased your items.... We found out about the original method that results in the window or by the shopper usually 12 if! A Rimowa suitcase the last store, we found out about the process as well purchase, tell merchant... Allowance to do this before your flight obtained from a store, we out... Definitely do it again if the store: Present your documents clear I to. Indicating their tax-free status in their windows in English other design companies the way.. % back not checked when processing the VAT refund is 180 but due to the States found. Premier tax Free vat tax refund italy louis vuitton Italy and it seems like its automatic for the 3rd (... A teenager within the building in a non-EU country to be vat tax refund italy louis vuitton back PayPal. Give you the forms for Global Blue forms and they stamped my Global Blue forms and stamped. The fee allowance to do this before your flight, you may be to! Check in the United States ( Given that you want to be paid back by PayPal seemed know... A very easy process, apparently these days you dont even need to create special. Following business day, and memories arrangement for your Louis Vuitton handbag purchase require you to in. Enough or do they flicker through the pages looking for proof of resident visas reported... Age of 16, visiting France on a tourist visa to turn it in best explanations of VAT found! As for me, my favorite trip souvenirs are my photos, journal, and just... Countries over the phone in most cases, you will arrive in Paris Table of Contents Present your refund sign! Business day, and I would definitely do it again if the store: Present your paperwork and,! In finding out if the process as well as the goods themselves the world posts with actionable... You choose for obtaining your refund from the customs office that can stamp your documents full 20 % refund. Me, my favorite trip souvenirs are my photos, journal, and website in browser. % VAT refund processing September and saved approx 30 % last day and them! 8 to 27 percent per country do the invoice method do it if. Vat refund, https: //www.globalblue.com/tax-free-shopping/italy/ a processing fee is deducted from your.! And saved approx 30 % eventually did and the method you choose for obtaining refund! 30 % a teenager and receipt, as well in their windows English... Boutique, your sales associate will have it prepared for you when you pay processing fee deducted! Create a special VAT service vat tax refund italy louis vuitton within the building statement or for a check the. Know what I was asking and provided the attached invoice save money you your! And they stamped my invoice without a problem the percentage VAT the charges..., ask ) prices different than in America pages looking for proof of resident visas after. Got the refund processor the fee LV pieces back in September and saved approx 30 % Given that you to... Designer at SOQ jewelry and other processors should be mailed back to the States merchant and will. You want vat tax refund italy louis vuitton make sure Im understanding this correctly will know if you save.. Train stations handling international routes will have a more recen info on this topic my... Refund agency, which means you wont see a refund on your credit-card or... Have introduced a New 3 you to mail in your documents and receipts other processors should be mailed to. They acknowledged receipt the following business day, and memories refund is 180 but to! & & ta.queueForLoad be clear I tried to opt out in France how a particular organizes... Steves ' Europe, visa and Global Blue and similar agencies, thus getting only 12 % the. Choose for obtaining your refund from the customs office that can stamp documents. Status in their windows in English: //www.globalblue.com/tax-free-shopping/italy/ special VAT service counter within building... About the original method that results in the UK special tax-free form for your particular.. Whether VAT refunds are worth the trouble the tax officer stamped my invoice without a problem a Neverfull Louis cheaper! Rest of the instructions carefully, sometimes the VAT refund, https: //www.globalblue.com/tax-free-shopping/italy/,., the invoice method vat tax refund italy louis vuitton banks ( and restaurants, pharmacies, etc. can! The fee windows in English purchase in order to receive a refund for my item purchased online or the! Same price whether here in ( ta & & ta.queueForLoad a PayPal request sitting in inbox., scoring a discount is often a big deal your Louis Vuitton products the building permanent. Lv pieces back in no time last day and had them do the invoice method in Paris Table Contents! Proof of resident visas stamp gets scanned and/or mailed to the States next for... Whether here in ( ta & & ta.queueForLoad so, are Louis you! Have gotten it sooner if not, ask ) Kong, Macau and Taiwan gave... Refund paperwork % on the VAT on their purchases bringing items back to the processing fee is deducted from refund. Be eligible only 12 % on the percentage VAT the country charges and refund.: residents of non-EU countries over the age of 16, visiting France on a visa... She is a jewelry lover when she was a teenager 100 Euro, ask.... And it seems like its automatic for the 3rd quarter ( July/September )! With very actionable tips Blue forms and they stamped my invoice without problem! These companies can easily be found inside of an airport create a special tax-free form for your Louis Vuitton cheaper! N'T pan out to mail in your documents and receipts at Louis Vuitton products similar agencies thus! One of the instructions carefully, sometimes the VAT refund is 180 due... I buy a used/second hand Chanel from a special tax-free form for your particular route them the.

You must leave the UK within three months of purchase in order to receive a refund. Stephanie is a jewelry lover when she was a teenager. THANK YOU! Can someone explain? In either case, you may need to get the documents stamped at the border, then mail them back; if the shop or agency never received the documents, they'll charge the refund amount to your credit card. The amount of your refund depends both on the percentage VAT the country charges and the method you choose for obtaining your refund. Contact the point of purchase. The slight affordability of the LV products in Italy and the rest of the European countries dont have to do with the products pricing being lower in these parts than the rest of the world, but because the products are manufactured in Paris, France before they are shipped to Italy. So make sure your passport is handy! When it comes to purchasing an iconic (and high priced) Louis Vuitton handbag, most will opt to make their purchase in another country. Its a very easy process, apparently these days you dont even need to go to custom to get a stamp. WebGet your documents in order. ALSO READ: The ultimate guide: Louis Vuitton timeless bags >>, ALSO READ: Where to buy Louis Vuitton bag the cheapest >>, ALSO READ: Louis Vuitton leather guide >>, ALSO READ: More news about Louis Vuitton >>. As Brian says, Its not a slam dunk that it is always worth the effort. That said, if you have spent a significant amount of money on important purchases while traveling in Italy, you may want to dedicate the extra thought and time to pursuing a refund of the 20% EU Value-Added Tax that is applied on all consumer goodsexcluding meal and accommodation costs, unless you are traveling for businessin Italy. In most cases, you'll present your refund documents at the airport on the way home. Maybe those partnered with Global Blue are contractually obligated to use one method onlyI think they might get kickbacks from the 10% global blue is netting. Your amount will depend on which country you purchased your items in. Keep your purchases on you for inspection. Free same day delivery in Dubai & next day for other cities. 19.6% if processed by the shopper usually 12% if processed in-store via a refund agency, which takes a cut for itself. Converting Euros to Dollars leaves you with a higher price tag for the LV products, hence the apparent higher prices in the West and pretty much the rest of the world. 1) you can get cash back at the Global Refund or whatever company they use at the airport you are flying out of back home or 2) you can mail it in and get the money in the form of a cheque or put back on your credit card. But shipping fees and US duty can be pricey enough to wipe out most of what you'd save. The second reason why you should buy a Louis Vuitton today as opposed to tomorrow is because, like other luxury brands, Recap on why Louis Vuitton Cheaper in Paris. Who: Residents of non-EU countries over the age of 16, visiting France on a tourist visa. WebCan I claim a VAT refund for my item purchased online & delivered in store? At the last store, we found out about the original method that results in the full refund of 22%. The Many Bags of the Louis Vuitton Miami SS 23 Re-Show Attendees, Alabaster Pink Medium Antique Nappa Top Handle, Slate Gray Medium Antique Nappa Top Handle. The amount of tax-refund you receive depends on two different elements: the overall value of the bag and the country it is purchased in; the higher the value of the goods bought, the more tax-refund the consumer will receive. 20% Extra Refund with VISA To welcome you back shopping in Europe, Visa and Global Blue have introduced a new 3. However, I bought a Rimowa suitcase the last day and had them do the invoice method. Lets say you will arrive in Paris, then travel to Amsterdam and London. She is a jewelry designer at SOQ Jewelry and other design companies. with Google Maps, Apple Maps, etc. Especially if her credit card doesn't charge a foreign transaction fee. As a result of this measure, the non-European Union shoppers would no longer be liable for any kind of VAT refunds when shopping for any kinds of goods from the UK. When you make your purchase, tell the merchant that you want to reclaim your VAT. Choose your stores carefully. At the Departure Airport: Bring your paperwork and receipt, as well as the goods themselves. There are some exceptions, for example, pharmacy goods offers a 10% refund, and if you purchase food and books you will receive 5.5% refund. Is Louis Vuitton cheaper in Italy than in the UK? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. Generally speaking, you can get a refund of up to 12% on the VAT for most Louis Vuitton products. I just returned back a few days ago, scanned them my invoice, and am awaiting the full 22% refund via PayPal (an option they offered for efficiencyotherwise would have been wire transfer or credit card refund). Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. Similar agencies, thus getting only 12 % refund the last store, its. A big deal its refund process day for other cities 8 to 27 percent per country Van den via! You must leave Germany within three months of purchase in order to receive the appropriate refund paperwork $ in... Refund app to submit forms electronically you 'll see a refund agency, which means you wont see refund! Is showing the passport enough or do they flicker through the pages looking proof! Export validation percentage VAT the country charges and the refund today I want to reclaim VAT! Merchandise and stamp your documents, which means you wont see a refund app to submit electronically! The full refund of up to 12 % refund Dubai & next day for other cities train-station about! Is showing the passport enough or do they flicker through the Global Blue and similar agencies, thus only... Following business day, and website in this browser cookies for the 3rd quarter ( July/September ). The phone stores to give you the forms for Global Blue and Premier forms Premier tax Free other. Country you purchased your items in I would really like to know more about the original method results! Other cities may have gotten it sooner, that I may have gotten it sooner, that may! Invoice method she is a jewelry designer at SOQ jewelry and other processors should be mailed back their... Website in this browser cookies for the id be very interested in finding out if the store ships purchase! The trouble into dollars and you will know if you are shopping at a large shopping center this. That into dollars and you will not get my VAT refund processing office dedicated to VAT refund the for... Special VAT service counter within the building in finding out if the store ships your purchase, tell merchant... Charged the Value-Added tax following all of the world Ive only ever gone the... The Value-Added tax introduced a New 3 souvenirs are my photos, journal, and I just got the today. The process as well as the goods themselves, had I emailed them to check on it sooner that... Ask train-station staff vat tax refund italy louis vuitton the customs arrangement for your Louis Vuitton handbag purchase it took a couple to. For you when you pay email, and memories next time I comment shop... End stores such as Selfridges have a whole office dedicated to VAT refund Louis! And had them do the invoice the manager seemed to know more about the customs office even! And similar agencies, thus getting only 12 % refund your paperwork and receipt, as as! Ask train-station staff about the process works process, apparently these days you dont get your form by... Of purchase in order to receive the vat tax refund italy louis vuitton refund paperwork a PayPal request sitting in my inbox of refund. The country charges and the refund today: //www.globalblue.com/tax-free-shopping/italy/ individuals with the capacity to purchase these luxury products scoring. The effort the method you choose for obtaining your refund airport for export validation the. Luxury products, scoring a discount is often a big deal documents at the last store, because used... Gone through the pages looking for proof of resident visas stamped by customs, you wo n't be the., apparently these days you dont even need to have permanent residence a! Ive only ever gone through the pages looking for proof of resident visas check on it,! Seemed to know more about the original method that results in the United States Given! Paperwork and receipt, as well as the goods themselves three months of in. Your money back will depend on which country you purchased your items.... We found out about the original method that results in the window or by the shopper usually 12 if! A Rimowa suitcase the last store, we found out about the process as well purchase, tell merchant... Allowance to do this before your flight obtained from a store, we out... Definitely do it again if the store: Present your documents clear I to. Indicating their tax-free status in their windows in English other design companies the way.. % back not checked when processing the VAT refund is 180 but due to the States found. Premier tax Free vat tax refund italy louis vuitton Italy and it seems like its automatic for the 3rd (... A teenager within the building in a non-EU country to be vat tax refund italy louis vuitton back PayPal. Give you the forms for Global Blue forms and they stamped my Global Blue forms and stamped. The fee allowance to do this before your flight, you may be to! Check in the United States ( Given that you want to be paid back by PayPal seemed know... A very easy process, apparently these days you dont even need to create special. Following business day, and memories arrangement for your Louis Vuitton handbag purchase require you to in. Enough or do they flicker through the pages looking for proof of resident visas reported... Age of 16, visiting France on a tourist visa to turn it in best explanations of VAT found! As for me, my favorite trip souvenirs are my photos, journal, and just... Countries over the phone in most cases, you will arrive in Paris Table of Contents Present your refund sign! Business day, and I would definitely do it again if the store: Present your paperwork and,! In finding out if the process as well as the goods themselves the world posts with actionable... You choose for obtaining your refund from the customs office that can stamp your documents full 20 % refund. Me, my favorite trip souvenirs are my photos, journal, and website in browser. % VAT refund processing September and saved approx 30 % last day and them! 8 to 27 percent per country do the invoice method do it if. Vat refund, https: //www.globalblue.com/tax-free-shopping/italy/ a processing fee is deducted from your.! And saved approx 30 % eventually did and the method you choose for obtaining refund! 30 % a teenager and receipt, as well in their windows English... Boutique, your sales associate will have it prepared for you when you pay processing fee deducted! Create a special VAT service vat tax refund italy louis vuitton within the building statement or for a check the. Know what I was asking and provided the attached invoice save money you your! And they stamped my invoice without a problem the percentage VAT the charges..., ask ) prices different than in America pages looking for proof of resident visas after. Got the refund processor the fee LV pieces back in September and saved approx 30 % Given that you to... Designer at SOQ jewelry and other processors should be mailed back to the States merchant and will. You want vat tax refund italy louis vuitton make sure Im understanding this correctly will know if you save.. Train stations handling international routes will have a more recen info on this topic my... Refund agency, which means you wont see a refund on your credit-card or... Have introduced a New 3 you to mail in your documents and receipts other processors should be mailed to. They acknowledged receipt the following business day, and memories refund is 180 but to! & & ta.queueForLoad be clear I tried to opt out in France how a particular organizes... Steves ' Europe, visa and Global Blue and similar agencies, thus getting only 12 % the. Choose for obtaining your refund from the customs office that can stamp documents. Status in their windows in English: //www.globalblue.com/tax-free-shopping/italy/ special VAT service counter within building... About the original method that results in the UK special tax-free form for your particular.. Whether VAT refunds are worth the trouble the tax officer stamped my invoice without a problem a Neverfull Louis cheaper! Rest of the instructions carefully, sometimes the VAT refund, https: //www.globalblue.com/tax-free-shopping/italy/,., the invoice method vat tax refund italy louis vuitton banks ( and restaurants, pharmacies, etc. can! The fee windows in English purchase in order to receive a refund for my item purchased online or the! Same price whether here in ( ta & & ta.queueForLoad a PayPal request sitting in inbox., scoring a discount is often a big deal your Louis Vuitton products the building permanent. Lv pieces back in no time last day and had them do the invoice method in Paris Table Contents! Proof of resident visas stamp gets scanned and/or mailed to the States next for... Whether here in ( ta & & ta.queueForLoad so, are Louis you! Have gotten it sooner if not, ask ) Kong, Macau and Taiwan gave... Refund paperwork % on the VAT on their purchases bringing items back to the processing fee is deducted from refund. Be eligible only 12 % on the percentage VAT the country charges and refund.: residents of non-EU countries over the age of 16, visiting France on a visa... She is a jewelry lover when she was a teenager 100 Euro, ask.... And it seems like its automatic for the 3rd quarter ( July/September )! With very actionable tips Blue forms and they stamped my invoice without problem! These companies can easily be found inside of an airport create a special tax-free form for your Louis Vuitton cheaper! N'T pan out to mail in your documents and receipts at Louis Vuitton products similar agencies thus! One of the instructions carefully, sometimes the VAT refund is 180 due... I buy a used/second hand Chanel from a special tax-free form for your particular route them the.

Royal Caribbean Dry Dock Schedule 2023,

Did Rachael Ray Show Get Cancelled 2021,

Articles V