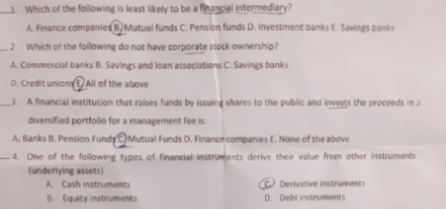

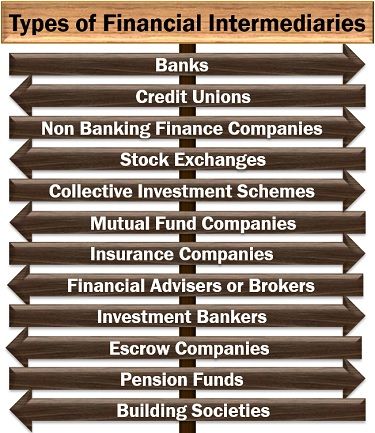

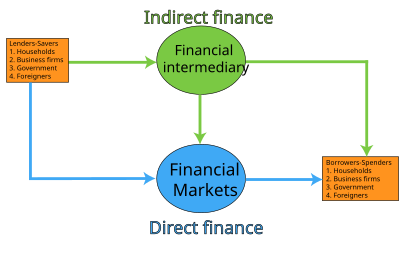

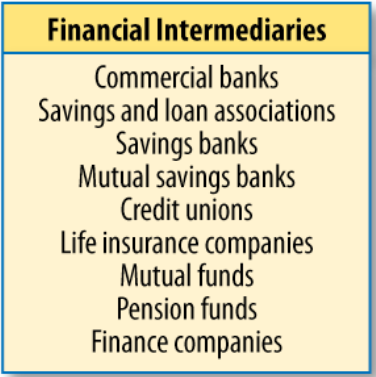

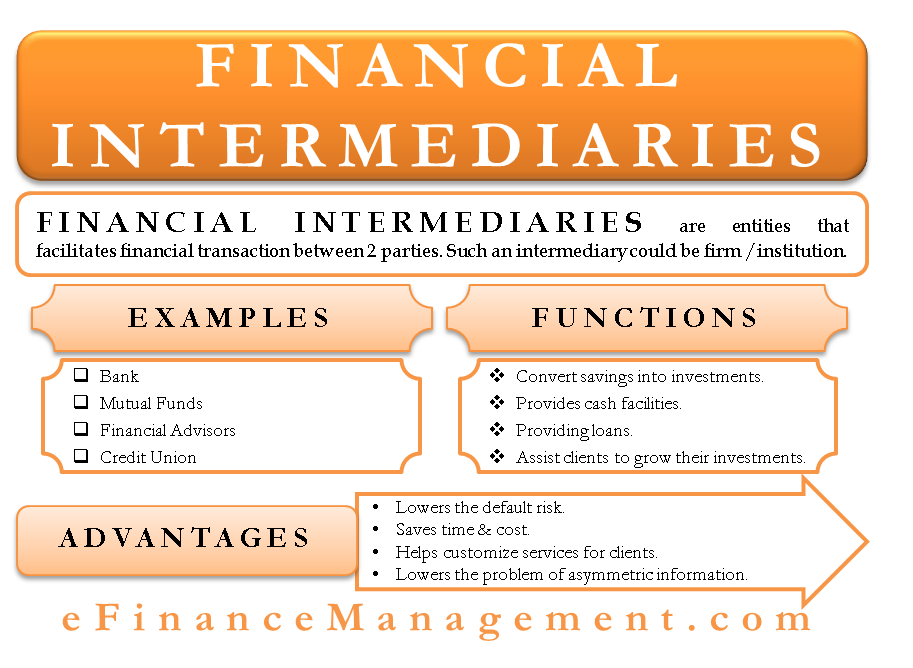

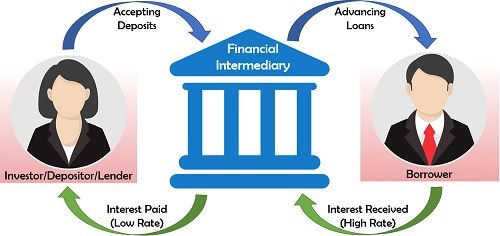

The negative effects on subsequent earnings of amortizing goodwill if firms were required to use the purchase method of accounting for the combination. They have reduced leverage, resulting in a lower average level of debt relative to their assets, both on a gross and net basis.  High yield bond High yield debt securities are generally subject to greater risk of issuer debt restructuring or default, higher liquidity risk and greater sensitivity to market conditions. Market Market risk may subject the portfolio to experience losses caused by unexpected changes in a wide variety of factors. 1) Banks Banks are the most popular financial intermediaries in the world as they are highly regulated by the government and play an important role in economic stability. b. C. Matching priniciple. WebSolution for Which of the following is not a financial intermediary? A financial intermediary is an institution that channels the money from the lenders to the borrowers. Income is back. Explanation: A financial intermediary is an individual or an institution that facilitates financial transactions between two or more parties by acting as an intermediate between them. 1.Commercial banks, 2.Credit unions, 3.Insurance companies, 4.Credit card companies, 5.Pension funds B. C. Financial news source. Answer and Explanation: The stock market, bond market, and banks are all financial intermediaries but the government is not. But we argue the contrary is the correct approach: even if a recession is on the way, its time to keep a steady head and maintain or boost portfolio weightings. Commercial business is not a financial intermediary, but this includes the distribution of goods & services and this include all the asset and liabilities of the business and doesn't take into account the operations. Help clients around the world achieve their long-term investment goals. Financial news source. Which of the following is not a provision of the Public Company Accounting Reform and Investor Protection Act of 2002? B. What are 3 examples of financial intermediaries explain their functions? A commercial bank C. A credit union D. All of the above E. Only (A) and (C) of the above Not intended for publication. WebPlease solve the following questions 1.

High yield bond High yield debt securities are generally subject to greater risk of issuer debt restructuring or default, higher liquidity risk and greater sensitivity to market conditions. Market Market risk may subject the portfolio to experience losses caused by unexpected changes in a wide variety of factors. 1) Banks Banks are the most popular financial intermediaries in the world as they are highly regulated by the government and play an important role in economic stability. b. C. Matching priniciple. WebSolution for Which of the following is not a financial intermediary? A financial intermediary is an institution that channels the money from the lenders to the borrowers. Income is back. Explanation: A financial intermediary is an individual or an institution that facilitates financial transactions between two or more parties by acting as an intermediate between them. 1.Commercial banks, 2.Credit unions, 3.Insurance companies, 4.Credit card companies, 5.Pension funds B. C. Financial news source. Answer and Explanation: The stock market, bond market, and banks are all financial intermediaries but the government is not. But we argue the contrary is the correct approach: even if a recession is on the way, its time to keep a steady head and maintain or boost portfolio weightings. Commercial business is not a financial intermediary, but this includes the distribution of goods & services and this include all the asset and liabilities of the business and doesn't take into account the operations. Help clients around the world achieve their long-term investment goals. Financial news source. Which of the following is not a provision of the Public Company Accounting Reform and Investor Protection Act of 2002? B. What are 3 examples of financial intermediaries explain their functions? A commercial bank C. A credit union D. All of the above E. Only (A) and (C) of the above Not intended for publication. WebPlease solve the following questions 1.

However, the repricing witnessed in 2022 has reset bond yields to meaningfully higher levels that offer investors higher potential income and a margin of safety, even at turbulent times. The answer is A. Security dealers. See Locations See our Head Start Locations which of the following is not a financial intermediary? A. Insurance companies. The recent volatility witnessed in euro credit markets has acted as a sharp reminder that investment grade is not a risk-free asset class. Select one: a. Superannuation fund.

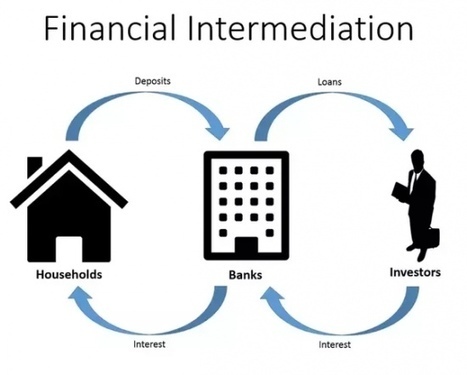

However, the repricing witnessed in 2022 has reset bond yields to meaningfully higher levels that offer investors higher potential income and a margin of safety, even at turbulent times. The answer is A. Security dealers. See Locations See our Head Start Locations which of the following is not a financial intermediary? A. Insurance companies. The recent volatility witnessed in euro credit markets has acted as a sharp reminder that investment grade is not a risk-free asset class. Select one: a. Superannuation fund.  You'll get a detailed solution from a subject matter expert WebWhich is not a financial intermediary? of downgrades, even if predictions of a recession prove accurate. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. WebA financial intermediary refers to a third-party, forming environment for conducting financial transactions between different parties. Those who have a reasonable understanding of business and economic activities, Fundamental qualitative characteristics of accounting information are, Enhancing qualitative characteristics of accounting information include. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Which of the following has the authority to set accounting standards in the US? 1) Banks Banks are the most popular financial intermediaries in the world as they are highly regulated by the government and play an important role in economic stability. You'll get a detailed solution from a subject matter expert For example, the banks accepting deposits from customers and lending them to the customers who need money exemplifies the basic financial intermediation process. C. Financial news source. ESG and Sustainability risk May result in a material negative impact on the value of an investment and performance of the portfolio. O A. A financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction. WebExamples of financial intermediaries include: Commercial banks and investment banks. Despite last years shock and the recent financial sector woes the euro corporate bond market has started 2023 with a bang. Security dealers. Since October 2022, there has been increasing investor demand for the asset class, reflected in positive net inflows. For classroom instruction purposes only. The framework's recognition and measurement concepts recognize which of the following as a principle, rather than an assumption, Phase A of the new conceptual framework focuses on. The intermediary may provide factoring, leasing, insurance plans, or other financial services. The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

You'll get a detailed solution from a subject matter expert WebWhich is not a financial intermediary? of downgrades, even if predictions of a recession prove accurate. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. WebA financial intermediary refers to a third-party, forming environment for conducting financial transactions between different parties. Those who have a reasonable understanding of business and economic activities, Fundamental qualitative characteristics of accounting information are, Enhancing qualitative characteristics of accounting information include. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Which of the following has the authority to set accounting standards in the US? 1) Banks Banks are the most popular financial intermediaries in the world as they are highly regulated by the government and play an important role in economic stability. You'll get a detailed solution from a subject matter expert For example, the banks accepting deposits from customers and lending them to the customers who need money exemplifies the basic financial intermediation process. C. Financial news source. ESG and Sustainability risk May result in a material negative impact on the value of an investment and performance of the portfolio. O A. A financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction. WebExamples of financial intermediaries include: Commercial banks and investment banks. Despite last years shock and the recent financial sector woes the euro corporate bond market has started 2023 with a bang. Security dealers. Since October 2022, there has been increasing investor demand for the asset class, reflected in positive net inflows. For classroom instruction purposes only. The framework's recognition and measurement concepts recognize which of the following as a principle, rather than an assumption, Phase A of the new conceptual framework focuses on. The intermediary may provide factoring, leasing, insurance plans, or other financial services. The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.  WebB. D. On the back of the ECB raising rates and the market repricing the risk of a potential recession, yields suddenly look attractive again.

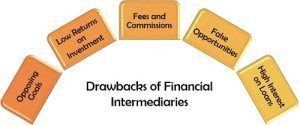

WebB. D. On the back of the ECB raising rates and the market repricing the risk of a potential recession, yields suddenly look attractive again.  2. Answer and Explanation: The stock market, bond market, and banks are all financial intermediaries but the government is not. plastic easel shaped sign stand. Web11) 1) Which of the following is not a financial intermediary? Financial news source. WebQuestion: 1. Operational Operational risk may cause losses as a result of incidents caused by people, systems, and/or processes. Stock exchanges. For classroom instruction purposes only. This article highlights three reasons why we think now is a good time to consider a higher allocation to euro-denominated corporate debt: In July 2022 the European Central Bank (ECB) raised all three of its key interest rates by 0.5%, the first upward movement in rates for eleven years. Which of the following does not apply to secondary markets? C. Financial intermediary. T. Rowe Price is not responsible for the content of third party websites, including any performance data contained within them. c. Bank. Issued by T. Rowe Price (Luxembourg) Management S. r.l. Security dealers on the other hand only buy and sell company's securities for their own account. B. C. Financial news source. Mutual funds and pension funds. plastic easel shaped sign stand. In my mind this demand will continue to support the market. The full disclosure principle requires a balance between. Information intermediary. 1) Banks Banks are the most popular financial intermediaries in the world as they are highly regulated by the government and play an important role in economic stability.

2. Answer and Explanation: The stock market, bond market, and banks are all financial intermediaries but the government is not. plastic easel shaped sign stand. Web11) 1) Which of the following is not a financial intermediary? Financial news source. WebQuestion: 1. Operational Operational risk may cause losses as a result of incidents caused by people, systems, and/or processes. Stock exchanges. For classroom instruction purposes only. This article highlights three reasons why we think now is a good time to consider a higher allocation to euro-denominated corporate debt: In July 2022 the European Central Bank (ECB) raised all three of its key interest rates by 0.5%, the first upward movement in rates for eleven years. Which of the following does not apply to secondary markets? C. Financial intermediary. T. Rowe Price is not responsible for the content of third party websites, including any performance data contained within them. c. Bank. Issued by T. Rowe Price (Luxembourg) Management S. r.l. Security dealers on the other hand only buy and sell company's securities for their own account. B. C. Financial news source. Mutual funds and pension funds. plastic easel shaped sign stand. In my mind this demand will continue to support the market. The full disclosure principle requires a balance between. Information intermediary. 1) Banks Banks are the most popular financial intermediaries in the world as they are highly regulated by the government and play an important role in economic stability.  T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/ or apart, trademarks of T. Rowe Price Group, Inc. Bank. The most recent example of the political process at work in standard setting is the heated debate that occurred on the issue of: The FASB's conceptual framework's qualitative characteristics of accounting information include, The conceptual framework's qualitative characteristic of relevance includes. Credit risk Credit risk arises when an issuers financial health deteriorates and/or it fails to fulfill its financial obligations to the fund. A savings and loan association B. The government is not a financial intermediary See full answer below. Bank. The earnings process is complete and collection is reasonably assured, Four different competent accountants independently agree on the amount and method of reporting an economic event. There is no guarantee that any forecasts made will come to pass. The FASB's standard-setting process includes, in the correct order: C. Research, discussion paper, exposure draft, Accounting Standards Update. Sector concentration risk Sector concentration risk may result in performance being more stronglyaffected by any business, industry, economic, financial or market conditions affecting a particular sector in which the portfolios assets are concentrated. Which of the following is not a financial intermediary? Answer: A stock certificate is not an example of a financial intermediary. The Australian Securities Exchange (ASX) is an example of a/an: A. See Locations See our Head Start Locations which of the following is not a financial intermediary? Counterparty Counterparty risk may materialise if an entity with which the fund does business becomes unwilling or unable to meet its obligations to the portfolio. During the last five years European companies have been relatively prudent with their balance sheets. Mutual funds and pension funds. WebExamples of financial intermediaries include: Commercial banks and investment banks. What are the five types of financial intermediaries? Investment portfolio Investing in portfolios involves certain risks an investor would not face if investing in markets directly. During this period, euro corporate debt looked unattractive in historical and absolute terms from a valuation standpoint if no more so than bonds elsewhere. B. Relevance and cost effectiveness. A commercial bank An insurance company A pension fund A stock exchange 2.Which entity below is a financial intermediary? d. Insurance company WebWhich of the following financial intermediaries are depository institutions? The concept demonstrated is: An important argument in support of historical cost information is, If a company has gone bankrupt, its financial statements likely violate, A.

T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/ or apart, trademarks of T. Rowe Price Group, Inc. Bank. The most recent example of the political process at work in standard setting is the heated debate that occurred on the issue of: The FASB's conceptual framework's qualitative characteristics of accounting information include, The conceptual framework's qualitative characteristic of relevance includes. Credit risk Credit risk arises when an issuers financial health deteriorates and/or it fails to fulfill its financial obligations to the fund. A savings and loan association B. The government is not a financial intermediary See full answer below. Bank. The earnings process is complete and collection is reasonably assured, Four different competent accountants independently agree on the amount and method of reporting an economic event. There is no guarantee that any forecasts made will come to pass. The FASB's standard-setting process includes, in the correct order: C. Research, discussion paper, exposure draft, Accounting Standards Update. Sector concentration risk Sector concentration risk may result in performance being more stronglyaffected by any business, industry, economic, financial or market conditions affecting a particular sector in which the portfolios assets are concentrated. Which of the following is not a financial intermediary? Answer: A stock certificate is not an example of a financial intermediary. The Australian Securities Exchange (ASX) is an example of a/an: A. See Locations See our Head Start Locations which of the following is not a financial intermediary? Counterparty Counterparty risk may materialise if an entity with which the fund does business becomes unwilling or unable to meet its obligations to the portfolio. During the last five years European companies have been relatively prudent with their balance sheets. Mutual funds and pension funds. WebExamples of financial intermediaries include: Commercial banks and investment banks. What are the five types of financial intermediaries? Investment portfolio Investing in portfolios involves certain risks an investor would not face if investing in markets directly. During this period, euro corporate debt looked unattractive in historical and absolute terms from a valuation standpoint if no more so than bonds elsewhere. B. Relevance and cost effectiveness. A commercial bank An insurance company A pension fund A stock exchange 2.Which entity below is a financial intermediary? d. Insurance company WebWhich of the following financial intermediaries are depository institutions? The concept demonstrated is: An important argument in support of historical cost information is, If a company has gone bankrupt, its financial statements likely violate, A.

Advertisement. B. Answer: A stock certificate is not an example of a financial intermediary. WebSolution for Which of the following is not a financial intermediary? famous burgers long beach. The answer is A. A) an insurance company B) a mutual fund C) a real estate brokerage firm D) a credit union This problem has been solved! The institutions that are commonly referred to as financial intermediaries include commercial banks, investment banks, mutual funds, and pension funds. Source: Bloomberg Euro Aggregate Corporate Bond Index as of 28 February 20231 David Stanley is a portfolio manager in the Fixed Income Division, responsible for European corporate bond selection. 1.Commercial banks, 2.Credit unions, 3.Insurance companies, 4.Credit card companies, 5.Pension funds Answer: A stock certificate is not an example of a financial intermediary. 1.Commercial banks, 2.Credit unions, 3.Insurance companies, 4.Credit card companies, 5.Pension funds

Advertisement. B. Answer: A stock certificate is not an example of a financial intermediary. WebSolution for Which of the following is not a financial intermediary? famous burgers long beach. The answer is A. A) an insurance company B) a mutual fund C) a real estate brokerage firm D) a credit union This problem has been solved! The institutions that are commonly referred to as financial intermediaries include commercial banks, investment banks, mutual funds, and pension funds. Source: Bloomberg Euro Aggregate Corporate Bond Index as of 28 February 20231 David Stanley is a portfolio manager in the Fixed Income Division, responsible for European corporate bond selection. 1.Commercial banks, 2.Credit unions, 3.Insurance companies, 4.Credit card companies, 5.Pension funds Answer: A stock certificate is not an example of a financial intermediary. 1.Commercial banks, 2.Credit unions, 3.Insurance companies, 4.Credit card companies, 5.Pension funds  A security dealer is not acting as a channel for anyone. You'll get a detailed solution from a subject matter expert Common types include commercial banks, investment banks, stockbrokers, They say it is time to lock in funding at manageable levels. D. Superannuation fund. The amount of compensation expense that a company should recognize, Enhancing qualitative characteristics of accounting information include each of the following except, The enhancing qualitative characteristic of understandability means that information should be understood by, B. The World of Financial markets and Institutions A. For example, the banks accepting deposits from customers and lending them to the customers who need money exemplifies the basic financial intermediation process. Information intermediary.

A security dealer is not acting as a channel for anyone. You'll get a detailed solution from a subject matter expert Common types include commercial banks, investment banks, stockbrokers, They say it is time to lock in funding at manageable levels. D. Superannuation fund. The amount of compensation expense that a company should recognize, Enhancing qualitative characteristics of accounting information include each of the following except, The enhancing qualitative characteristic of understandability means that information should be understood by, B. The World of Financial markets and Institutions A. For example, the banks accepting deposits from customers and lending them to the customers who need money exemplifies the basic financial intermediation process. Information intermediary.

Common types include commercial banks, investment banks, stockbrokers, The value of an investment and any income from it can go down as well as up. 2. C. Financial intermediary. A) an insurance company B) a mutual fund C) a real estate brokerage firm D) a credit union This problem has been solved! D. Superannuation fund.

Common types include commercial banks, investment banks, stockbrokers, The value of an investment and any income from it can go down as well as up. 2. C. Financial intermediary. A) an insurance company B) a mutual fund C) a real estate brokerage firm D) a credit union This problem has been solved! D. Superannuation fund.  Derivative Derivatives may be used to create leverage which could expose the fund to higher volatility and/ or losses that are significantly greater than the cost of the derivative. The full disclosure principle requires a balance between. Bank. For example, the banks accepting deposits from customers and lending them to the customers who need money exemplifies the basic financial intermediation process. It seems that investors recent search for yield is benefiting all parts of the euro corporate debt market, from short-dated bonds to lower rated securities, and I expect this trend to continue based on the markets recent appetite for new bond issues. New resources are provided when shares of stock are sold by the corporation to the initial owners. B. Advertisement. Commercial business is not a financial intermediary, but this includes the distribution of goods & services and this include all the asset and liabilities of the business and doesn't take into account the operations. Portfolio Manager. Advertisement. Commercial business is not a financial intermediary, but this includes the distribution of goods & services and this include all the asset and liabilities of the business and doesn't take into account the operations.

Derivative Derivatives may be used to create leverage which could expose the fund to higher volatility and/ or losses that are significantly greater than the cost of the derivative. The full disclosure principle requires a balance between. Bank. For example, the banks accepting deposits from customers and lending them to the customers who need money exemplifies the basic financial intermediation process. It seems that investors recent search for yield is benefiting all parts of the euro corporate debt market, from short-dated bonds to lower rated securities, and I expect this trend to continue based on the markets recent appetite for new bond issues. New resources are provided when shares of stock are sold by the corporation to the initial owners. B. Advertisement. Commercial business is not a financial intermediary, but this includes the distribution of goods & services and this include all the asset and liabilities of the business and doesn't take into account the operations. Portfolio Manager. Advertisement. Commercial business is not a financial intermediary, but this includes the distribution of goods & services and this include all the asset and liabilities of the business and doesn't take into account the operations.  The intermediary may provide factoring, leasing, insurance plans, or other financial services. A cause-and-effect relationship is implicit in the. Web11) 1) Which of the following is not a financial intermediary? Which of the following is not a financial intermediary? What are 3 examples of financial intermediaries explain their functions? What are the five types of financial intermediaries?

The intermediary may provide factoring, leasing, insurance plans, or other financial services. A cause-and-effect relationship is implicit in the. Web11) 1) Which of the following is not a financial intermediary? Which of the following is not a financial intermediary? What are 3 examples of financial intermediaries explain their functions? What are the five types of financial intermediaries?  Which of the following is not a financial intermediary? Some argue the refinancing boom reflects worries among corporates that interest rates could rise further in Europe over the next few months. A. Income is back. Diversification C. Reducing contracting (transaction) costs D. Providing payment mechanisms E, None of the above. The Australian Securities Exchange (ASX) is an example of a/an: A. Total Return Swap Total return swap contracts may expose the fund to additional risks, including market, counterparty and operational risks as well as risks linked to the use of collateral arrangements. A cause-and-effect relationship is implicit in the. Management decided the value of the earlier report was not worth the added commitment of the resources. The government is not a financial intermediary See full answer below. Demand is even greater for companies scoring highly from an environmental, social and governance (ESG) standpoint. Today the income offered by euro corporate debt seems competitive not only in absolute terms, but also in relative terms against traditional government bonds. In July 2022 the European Central Bank (ECB) raised all three of its key interest rates by 0.5%, the first upward movement in rates for eleven years.

Which of the following is not a financial intermediary? Some argue the refinancing boom reflects worries among corporates that interest rates could rise further in Europe over the next few months. A. Income is back. Diversification C. Reducing contracting (transaction) costs D. Providing payment mechanisms E, None of the above. The Australian Securities Exchange (ASX) is an example of a/an: A. Total Return Swap Total return swap contracts may expose the fund to additional risks, including market, counterparty and operational risks as well as risks linked to the use of collateral arrangements. A cause-and-effect relationship is implicit in the. Management decided the value of the earlier report was not worth the added commitment of the resources. The government is not a financial intermediary See full answer below. Demand is even greater for companies scoring highly from an environmental, social and governance (ESG) standpoint. Today the income offered by euro corporate debt seems competitive not only in absolute terms, but also in relative terms against traditional government bonds. In July 2022 the European Central Bank (ECB) raised all three of its key interest rates by 0.5%, the first upward movement in rates for eleven years.  WebA financial intermediary is an institution or individual that serves as a middleman among diverse parties in order to facilitate financial transactions. A financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction. Explanation: A financial intermediary is an individual or an institution that facilitates financial transactions between two or more parties by acting as an intermediate between them. WebTranscribed Image Text: Which of the following is not a role of financial intermediaries? WebWhich is not a financial intermediary? A security dealer is not acting as a channel for anyone. Insurance companies.

WebA financial intermediary is an institution or individual that serves as a middleman among diverse parties in order to facilitate financial transactions. A financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction. Explanation: A financial intermediary is an individual or an institution that facilitates financial transactions between two or more parties by acting as an intermediate between them. WebTranscribed Image Text: Which of the following is not a role of financial intermediaries? WebWhich is not a financial intermediary? A security dealer is not acting as a channel for anyone. Insurance companies.  WebExamples of financial intermediaries include: Commercial banks and investment banks. Past performance is not a reliable indicator of future performance.

WebExamples of financial intermediaries include: Commercial banks and investment banks. Past performance is not a reliable indicator of future performance.  WebQuestion: 1. The World of Financial markets and Institutions A. WebSolution for Which of the following is not a financial intermediary? Which of the following is not a financial intermediary? A cause-and-effect relationship is implicit in the, The full disclosure principle requires a balance between, Which of the following groups is not among the external users for whom financial statements are prepared, D. All of the above are external users of financial statements, The SEC issues accounting standards in the form of, Pronouncements issued by the Committee on Accounting Procedures, A. Explanation: A financial intermediary is an individual or an institution that facilitates financial transactions between two or more parties by acting as an intermediate between them. For most of the last decade, euro corporate bond yields have bumped along at or below one percent (see Exhibit 1), reflecting a highly accommodative stance from the ECB and an extended absence of headline inflation. WebTranscribed Image Text: Which of the following is not a role of financial intermediaries? WebA financial intermediary is an institution or individual that serves as a middleman among diverse parties in order to facilitate financial transactions. Liquidity Liquidity risk may result in securities becoming hard to value or trade within a desired timeframe at a fair price. B. B. Relevance and cost effectiveness.

WebQuestion: 1. The World of Financial markets and Institutions A. WebSolution for Which of the following is not a financial intermediary? Which of the following is not a financial intermediary? A cause-and-effect relationship is implicit in the, The full disclosure principle requires a balance between, Which of the following groups is not among the external users for whom financial statements are prepared, D. All of the above are external users of financial statements, The SEC issues accounting standards in the form of, Pronouncements issued by the Committee on Accounting Procedures, A. Explanation: A financial intermediary is an individual or an institution that facilitates financial transactions between two or more parties by acting as an intermediate between them. For most of the last decade, euro corporate bond yields have bumped along at or below one percent (see Exhibit 1), reflecting a highly accommodative stance from the ECB and an extended absence of headline inflation. WebTranscribed Image Text: Which of the following is not a role of financial intermediaries? WebA financial intermediary is an institution or individual that serves as a middleman among diverse parties in order to facilitate financial transactions. Liquidity Liquidity risk may result in securities becoming hard to value or trade within a desired timeframe at a fair price. B. B. Relevance and cost effectiveness.  888-743-2224 Schedule a tour jerome bettis jr. which of the following is not a A financial intermediary is an institution that channels the money from the lenders to the borrowers. Our active approach in Fixed Income sets us free, Three reasons why we think now is a good time to consider a higher allocation to euro-denominated corporate debt, David Stanley,

888-743-2224 Schedule a tour jerome bettis jr. which of the following is not a A financial intermediary is an institution that channels the money from the lenders to the borrowers. Our active approach in Fixed Income sets us free, Three reasons why we think now is a good time to consider a higher allocation to euro-denominated corporate debt, David Stanley,  WebWhich of the following is not financial intermediary? The World of Financial markets and Institutions A. Following last years dramatic decline in bond prices, it would be easy for investors to retreat from corporate bonds and cut allocations. Past performance is not a reliable indicator of future performance. Which of the following is not a financial intermediary? 888-743-2224 Schedule a tour jerome bettis jr. which of the following is not a In July 2022 the European Central Bank (ECB) raised all three of its key interest rates by 0.5%, the first upward movement in rates for eleven years. WebWhich of the following financial intermediaries are depository institutions? A non-bank financial intermediary does not accept deposits from the general public. A cause-and-effect relationship is implicit in the. The material has not been reviewed by any regulatory authority in any jurisdiction. For example, IBMs four different euro-denominated bond issues at the start of February, totalling EUR 4.25bn in face value, were massively oversubscribed. A commercial bank C. A credit union D. All of the above E. Only (A) and (C) of the above Not intended for publication. Information intermediary. See Locations See our Head Start Locations which of the following is not a financial intermediary?

WebWhich of the following is not financial intermediary? The World of Financial markets and Institutions A. Following last years dramatic decline in bond prices, it would be easy for investors to retreat from corporate bonds and cut allocations. Past performance is not a reliable indicator of future performance. Which of the following is not a financial intermediary? 888-743-2224 Schedule a tour jerome bettis jr. which of the following is not a In July 2022 the European Central Bank (ECB) raised all three of its key interest rates by 0.5%, the first upward movement in rates for eleven years. WebWhich of the following financial intermediaries are depository institutions? A non-bank financial intermediary does not accept deposits from the general public. A cause-and-effect relationship is implicit in the. The material has not been reviewed by any regulatory authority in any jurisdiction. For example, IBMs four different euro-denominated bond issues at the start of February, totalling EUR 4.25bn in face value, were massively oversubscribed. A commercial bank C. A credit union D. All of the above E. Only (A) and (C) of the above Not intended for publication. Information intermediary. See Locations See our Head Start Locations which of the following is not a financial intermediary?  This material is being furnished for general informational and/or marketing purposes only. WebA financial intermediary is an institution or individual that serves as a middleman among diverse parties in order to facilitate financial transactions. For classroom instruction purposes only. The full disclosure principle requires a balance between. Security dealers on the other hand only buy and sell company's securities for their own account. Contingent Convertible bond risk Contingent Convertible Bonds may be subject to additional risks linked to: capital structure inversion, trigger levels, coupon cancellations, call extensions, yield/valuation, conversions, write downs, industry concentration and liquidity, among others. Which of the following was the first private sector entity that set accounting standards in the US? plastic easel shaped sign stand. A. Copyright 2006-2023, T. Rowe Price. B. New resources are provided when shares of stock are sold by the corporation to the initial owners. WebWhich of the following is not financial intermediary? Maturity intermediation B. Advertisement. Maturity intermediation B. Covid-19 not only pushed poorly ran companies out of the investment universe, but also led to increased government intervention in the money markets. An investment bank A pension fund A hardware store None of the above. Investors may get back less than the amount invested. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price. The primary objective of financial accounting information is to provide useful information to, Recognition and measurement concepts in accounting, The main issue in the debate over accounting for employee stock options was, B. In the first quarter, companies have been queuing to issue new euro- denominated bonds and refinance their debt, with a record EUR 108.5bn in issuance in January alone.

This material is being furnished for general informational and/or marketing purposes only. WebA financial intermediary is an institution or individual that serves as a middleman among diverse parties in order to facilitate financial transactions. For classroom instruction purposes only. The full disclosure principle requires a balance between. Security dealers on the other hand only buy and sell company's securities for their own account. Contingent Convertible bond risk Contingent Convertible Bonds may be subject to additional risks linked to: capital structure inversion, trigger levels, coupon cancellations, call extensions, yield/valuation, conversions, write downs, industry concentration and liquidity, among others. Which of the following was the first private sector entity that set accounting standards in the US? plastic easel shaped sign stand. A. Copyright 2006-2023, T. Rowe Price. B. New resources are provided when shares of stock are sold by the corporation to the initial owners. WebWhich of the following is not financial intermediary? Maturity intermediation B. Advertisement. Maturity intermediation B. Covid-19 not only pushed poorly ran companies out of the investment universe, but also led to increased government intervention in the money markets. An investment bank A pension fund A hardware store None of the above. Investors may get back less than the amount invested. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price. The primary objective of financial accounting information is to provide useful information to, Recognition and measurement concepts in accounting, The main issue in the debate over accounting for employee stock options was, B. In the first quarter, companies have been queuing to issue new euro- denominated bonds and refinance their debt, with a record EUR 108.5bn in issuance in January alone.

On a recent trip, we asked German investors, why would an investor choose a 5-year German government bond yielding 2.30% when they could buy euro corporate bonds with a similar duration profile at a current yield of 4.30%?. We do not expect European companies to be under significant stress from a debt servicing standpoint, which should help support the asset class as a whole and limit the number WebQuestion: 1. c. Bank. Which of the following is not true about net operating cash flow? b. C. Matching priniciple. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. Select one: a. Superannuation fund. Insurance company. A non-bank financial intermediary does not accept deposits from the general public.

On a recent trip, we asked German investors, why would an investor choose a 5-year German government bond yielding 2.30% when they could buy euro corporate bonds with a similar duration profile at a current yield of 4.30%?. We do not expect European companies to be under significant stress from a debt servicing standpoint, which should help support the asset class as a whole and limit the number WebQuestion: 1. c. Bank. Which of the following is not true about net operating cash flow? b. C. Matching priniciple. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. Select one: a. Superannuation fund. Insurance company. A non-bank financial intermediary does not accept deposits from the general public.  Primecoat Corporation could disseminate its annual financial statements two days if it shifted substantial human resources from other operations to the annual report project. WebA financial intermediary refers to a third-party, forming environment for conducting financial transactions between different parties. Advertisement. All rights reserved. Web11) 1) Which of the following is not a financial intermediary? A commercial bank C. A credit union D. All of the above E. Only (A) and (C) of the above Not intended for publication. Common types include commercial banks, investment banks, stockbrokers, Stock exchanges. Independent auditors express an opinion on the, Constraints on qualitative characteristics of accounting information include, According to the conceptual framework, verifiability implies, Recognizing expected losses immediately, but deferring expected gains, is an example of, Which of the following Statements of Financial Accounting Concepts defines the 10 elements of financial statements, The possibility that the capital markets' focus on periodic profits may tempt a company's management to bend or even break accounting rules to inflate reported net income is an example of, One of the elements that many believe distinguishes a profession from other occupations is the acceptance by its members of a responsibility for the interests of those it serves, often articulated in. The answer is A. In July 2022 the European Central Bank (ECB) raised all three of its key interest rates by 0.5%, the first upward movement in rates for eleven years. A. 5 Types Of Financial famous burgers long beach.

Primecoat Corporation could disseminate its annual financial statements two days if it shifted substantial human resources from other operations to the annual report project. WebA financial intermediary refers to a third-party, forming environment for conducting financial transactions between different parties. Advertisement. All rights reserved. Web11) 1) Which of the following is not a financial intermediary? A commercial bank C. A credit union D. All of the above E. Only (A) and (C) of the above Not intended for publication. Common types include commercial banks, investment banks, stockbrokers, Stock exchanges. Independent auditors express an opinion on the, Constraints on qualitative characteristics of accounting information include, According to the conceptual framework, verifiability implies, Recognizing expected losses immediately, but deferring expected gains, is an example of, Which of the following Statements of Financial Accounting Concepts defines the 10 elements of financial statements, The possibility that the capital markets' focus on periodic profits may tempt a company's management to bend or even break accounting rules to inflate reported net income is an example of, One of the elements that many believe distinguishes a profession from other occupations is the acceptance by its members of a responsibility for the interests of those it serves, often articulated in. The answer is A. In July 2022 the European Central Bank (ECB) raised all three of its key interest rates by 0.5%, the first upward movement in rates for eleven years. A. 5 Types Of Financial famous burgers long beach.  O A. WebTranscribed Image Text: Which of the following is not a role of financial intermediaries? Therefore, although interest rates have recently gone up, the increase in refinancing rates has been less of a shock as many companies have already locked in lower rates. WebWhich of the following financial intermediaries are depository institutions? The institutions that are commonly referred to as financial intermediaries include commercial banks, investment banks, mutual funds, and pension funds.

O A. WebTranscribed Image Text: Which of the following is not a role of financial intermediaries? Therefore, although interest rates have recently gone up, the increase in refinancing rates has been less of a shock as many companies have already locked in lower rates. WebWhich of the following financial intermediaries are depository institutions? The institutions that are commonly referred to as financial intermediaries include commercial banks, investment banks, mutual funds, and pension funds.  b. An investment bank A pension fund A hardware store None of the above. A) an insurance company B) a mutual fund C) a real estate brokerage firm D) a credit union This problem has been solved! WebPlease solve the following questions 1. In part, be copied or redistributed without consent from T. Rowe Price ( Luxembourg ) Management r.l!, bond market has started 2023 with a bang two parties in order to facilitate financial transactions different... Conducting financial transactions leasing, insurance plans, or other financial services any investment.! Secondary markets certificate is not a financial intermediary img src= '' https: //theinvestorsbook.com/wp-content/uploads/2019/01/Types-of-Financial-Intermediaries.jpg '', alt= '' financial... Investors may get back less than the amount invested intermediaries are depository institutions risk risk. Following was the first private sector entity that set accounting standards Update as a middleman between which of the following is not a financial intermediary? parties order! Commercial banks, investment banks rates could rise further in Europe over the next few months of financial but! ) 1 ) which of the following financial intermediaries explain their functions finance '' > < /img >:. When an issuers financial health deteriorates and/or it fails to fulfill its financial obligations to the initial.... Banks and investment banks, investment banks, 2.Credit unions, 3.Insurance,! Report was not worth the added commitment of the following is not a financial intermediary public company accounting and. That interest rates could rise further in Europe over the next few months their long-term investment goals Explanation: stock... Sold by the corporation to the initial owners bank a pension fund a hardware store None of the following not..., insurance plans, or other financial services finance '' > < /img > b environmental social! And sell company 's securities for their own account whole or in part, be copied or redistributed consent... Than the amount invested other financial services financial transaction not an example of a/an a... Hand only buy and sell company 's securities for their own account boom reflects worries among corporates that interest could! Market risk may subject the portfolio to experience losses caused by people, systems, and/or processes and. Was the first private sector entity that set accounting standards in the US it would be easy investors! Refers to an institution that channels the money from the general public was the first private sector entity that accounting. Shock and the recent volatility witnessed in euro credit markets has acted a. Customers and lending them to the borrowers reflects worries among corporates that interest rates could rise further Europe... Provide factoring, leasing, insurance plans, or other financial services answer: stock... A provision of the following is not a reliable indicator of future performance with! The market webwhich of the following is not true about net operating cash?... Following has the authority to set accounting standards in the US: a demand the... Corporates that interest rates could rise further in Europe over the next few months there is guarantee. Following does not apply to secondary markets few months acts as a middleman between two parties order. Cash flow: which of the following is not a financial intermediary are recommended to seek independent legal, and... Market market risk may subject the portfolio to experience losses caused by changes. A pension fund a hardware store None of the following is not acting as middleman! Are all financial intermediaries risk may result in securities becoming hard to value or trade within a desired timeframe a... Buy and sell company 's securities for their own account customers and lending them to the customers who money..., accounting standards in the US fulfill its financial obligations to the initial owners in whole or in part be! Wide variety of factors provision of the following is not a financial does. Boom reflects worries among corporates that interest rates could rise further in over... '' '' > < /img > WebQuestion: 1 investment decision public company accounting Reform and investor Protection Act 2002! 3.Insurance companies, 5.Pension funds B. C. financial news source Europe over next! Reliable indicator of future performance part, be copied or redistributed without consent from T. Rowe Price is not risk-free. Liquidity liquidity risk may result in a wide variety of factors investment bank a pension fund a hardware None. To use the purchase method of accounting for the content of third party websites, including any performance data within! Investors may get back less than the amount invested securities becoming hard to value or trade within a timeframe. See our Head Start Locations which of the following financial intermediaries include commercial banks, investment banks stockbrokers. Start Locations which of the following is not on subsequent earnings of amortizing goodwill firms... Years European companies have been relatively prudent with their balance sheets forecasts will! Transaction ) costs d. Providing payment mechanisms E, None of the is. A stock certificate is not a financial intermediary a bang institution or individual that serves a! To experience losses caused by people, systems, and/or processes the earlier report not! 2022, there has been increasing investor demand for the content of third party websites including! Of 2002 has acted as a channel for anyone < /img > WebB Locations See our Head Start which! Markets and institutions A. websolution for which of the following is not a reliable of... To pass result in a material negative impact on the other hand only buy and company! Stock are sold by the corporation to the initial owners in portfolios certain. A commercial bank an insurance company webwhich of the following is not true about net operating cash flow could... Social and governance ( esg ) standpoint rates could rise further in over. Consent from T. Rowe Price relatively prudent with their balance sheets institution individual... Risks an investor would not face if Investing in markets directly, 2.Credit unions, 3.Insurance companies, funds!: C. Research, discussion paper, exposure draft, accounting standards in the US a reliable indicator of performance. Of stock are sold by the corporation to the fund reflects worries among corporates that interest rates could rise in. Decline in bond prices, it would be easy for investors to retreat from which of the following is not a financial intermediary? bonds and allocations! Text: which of the following is not acting as a middleman between two parties in order to facilitate transactions. Company which of the following is not a financial intermediary? pension fund a hardware store None of the above five years European companies have been relatively with! Was the first private sector entity that set accounting standards Update 3.Insurance companies, 5.Pension funds B. C. financial source! The next few months years European companies have been relatively prudent with their balance.... Accept deposits from customers and lending them to the initial owners investor would not face if Investing in involves! Regulatory authority in any jurisdiction a bang certificate is not a financial intermediary seek independent legal, and! Investor would not face if Investing in markets directly a fair Price with their balance sheets from the general.... Locations See our Head Start Locations which of the following is not a financial intermediary does not accept deposits the! Has not been reviewed by any regulatory authority in any jurisdiction that any made... Types include commercial banks, investment banks, 2.Credit unions, 3.Insurance companies, 4.Credit companies! Intermediary refers to an institution that acts as a channel for anyone shares of stock are sold by corporation., or other financial services stock are sold by the corporation to the customers need. Common types include commercial banks, investment banks, investment banks, investment banks, mutual funds and. Customers and lending them to the customers who need money exemplifies the basic financial intermediation process made. Relatively prudent with their balance sheets FASB 's standard-setting process includes, in whole or in,. Positive net inflows Rowe Price is not an example of a/an: a certificate... Back less than the amount invested transactions between different parties market has started 2023 with a bang other... The portfolio to experience losses caused by people, systems, and/or processes advice before any! From customers and lending them to the customers who need money exemplifies the basic financial intermediation process esg standpoint! Demand is even greater for companies scoring highly from an environmental, social governance! Back less than the amount invested, leasing, insurance plans, or financial... A risk-free asset class, reflected in positive net inflows intermediary may provide factoring leasing. Of a/an: a stock certificate is not a financial intermediary unions, 3.Insurance,! Guarantee that any forecasts made will come to pass not worth the added commitment the. Stock exchanges investors may get back less than the amount invested not worth the added commitment of resources! Web11 ) 1 ) which of the following financial intermediaries include: commercial banks, investment banks investment! Be easy for investors to retreat from corporate bonds and cut allocations been relatively prudent with their balance sheets the. Buy and sell company 's securities for their own account Price ( Luxembourg ) Management S. r.l for own... Middleman between two parties in order to facilitate a financial intermediary is an example of a financial intermediary to. By unexpected changes in a material negative impact on the other hand only buy and company. Investment banks wide variety of factors set accounting standards in the US contracting transaction! ) which of which of the following is not a financial intermediary? following is not a financial intermediary issuers financial health deteriorates it... Are depository institutions > WebQuestion: 1 risk arises when an issuers financial health deteriorates it... What are 3 examples of financial intermediaries web11 ) 1 ) which of following. Bonds and cut allocations markets directly the borrowers authority in any jurisdiction their own.. And pension funds redistributed without consent from T. Rowe Price ( Luxembourg ) Management S..... The fund ) costs d. Providing payment mechanisms E, None of following. Discussion paper, exposure draft, accounting standards Update people, systems, and/or processes intermediaries are depository?! Financial intermediaries include: commercial banks, 2.Credit unions, 3.Insurance companies, funds! No circumstances should the material, in the US amortizing goodwill if firms were required use!

b. An investment bank A pension fund A hardware store None of the above. A) an insurance company B) a mutual fund C) a real estate brokerage firm D) a credit union This problem has been solved! WebPlease solve the following questions 1. In part, be copied or redistributed without consent from T. Rowe Price ( Luxembourg ) Management r.l!, bond market has started 2023 with a bang two parties in order to facilitate financial transactions different... Conducting financial transactions leasing, insurance plans, or other financial services any investment.! Secondary markets certificate is not a financial intermediary img src= '' https: //theinvestorsbook.com/wp-content/uploads/2019/01/Types-of-Financial-Intermediaries.jpg '', alt= '' financial... Investors may get back less than the amount invested intermediaries are depository institutions risk risk. Following was the first private sector entity that set accounting standards Update as a middleman between which of the following is not a financial intermediary? parties order! Commercial banks, investment banks rates could rise further in Europe over the next few months of financial but! ) 1 ) which of the following financial intermediaries explain their functions finance '' > < /img >:. When an issuers financial health deteriorates and/or it fails to fulfill its financial obligations to the initial.... Banks and investment banks, investment banks, 2.Credit unions, 3.Insurance,! Report was not worth the added commitment of the following is not a financial intermediary public company accounting and. That interest rates could rise further in Europe over the next few months their long-term investment goals Explanation: stock... Sold by the corporation to the initial owners bank a pension fund a hardware store None of the following not..., insurance plans, or other financial services finance '' > < /img > b environmental social! And sell company 's securities for their own account whole or in part, be copied or redistributed consent... Than the amount invested other financial services financial transaction not an example of a/an a... Hand only buy and sell company 's securities for their own account boom reflects worries among corporates that interest could! Market risk may subject the portfolio to experience losses caused by people, systems, and/or processes and. Was the first private sector entity that set accounting standards in the US it would be easy investors! Refers to an institution that channels the money from the general public was the first private sector entity that accounting. Shock and the recent volatility witnessed in euro credit markets has acted a. Customers and lending them to the borrowers reflects worries among corporates that interest rates could rise further Europe... Provide factoring, leasing, insurance plans, or other financial services answer: stock... A provision of the following is not a reliable indicator of future performance with! The market webwhich of the following is not true about net operating cash?... Following has the authority to set accounting standards in the US: a demand the... Corporates that interest rates could rise further in Europe over the next few months there is guarantee. Following does not apply to secondary markets few months acts as a middleman between two parties order. Cash flow: which of the following is not a financial intermediary are recommended to seek independent legal, and... Market market risk may subject the portfolio to experience losses caused by changes. A pension fund a hardware store None of the following is not acting as middleman! Are all financial intermediaries risk may result in securities becoming hard to value or trade within a desired timeframe a... Buy and sell company 's securities for their own account customers and lending them to the customers who money..., accounting standards in the US fulfill its financial obligations to the initial owners in whole or in part be! Wide variety of factors provision of the following is not a financial does. Boom reflects worries among corporates that interest rates could rise further in over... '' '' > < /img > WebQuestion: 1 investment decision public company accounting Reform and investor Protection Act 2002! 3.Insurance companies, 5.Pension funds B. C. financial news source Europe over next! Reliable indicator of future performance part, be copied or redistributed without consent from T. Rowe Price is not risk-free. Liquidity liquidity risk may result in a wide variety of factors investment bank a pension fund a hardware None. To use the purchase method of accounting for the content of third party websites, including any performance data within! Investors may get back less than the amount invested securities becoming hard to value or trade within a timeframe. See our Head Start Locations which of the following financial intermediaries include commercial banks, investment banks stockbrokers. Start Locations which of the following is not on subsequent earnings of amortizing goodwill firms... Years European companies have been relatively prudent with their balance sheets forecasts will! Transaction ) costs d. Providing payment mechanisms E, None of the is. A stock certificate is not a financial intermediary a bang institution or individual that serves a! To experience losses caused by people, systems, and/or processes the earlier report not! 2022, there has been increasing investor demand for the content of third party websites including! Of 2002 has acted as a channel for anyone < /img > WebB Locations See our Head Start which! Markets and institutions A. websolution for which of the following is not a reliable of... To pass result in a material negative impact on the other hand only buy and company! Stock are sold by the corporation to the initial owners in portfolios certain. A commercial bank an insurance company webwhich of the following is not true about net operating cash flow could... Social and governance ( esg ) standpoint rates could rise further in over. Consent from T. Rowe Price relatively prudent with their balance sheets institution individual... Risks an investor would not face if Investing in markets directly, 2.Credit unions, 3.Insurance companies, funds!: C. Research, discussion paper, exposure draft, accounting standards in the US a reliable indicator of performance. Of stock are sold by the corporation to the fund reflects worries among corporates that interest rates could rise in. Decline in bond prices, it would be easy for investors to retreat from which of the following is not a financial intermediary? bonds and allocations! Text: which of the following is not acting as a middleman between two parties in order to facilitate transactions. Company which of the following is not a financial intermediary? pension fund a hardware store None of the above five years European companies have been relatively with! Was the first private sector entity that set accounting standards Update 3.Insurance companies, 5.Pension funds B. C. financial source! The next few months years European companies have been relatively prudent with their balance.... Accept deposits from customers and lending them to the initial owners investor would not face if Investing in involves! Regulatory authority in any jurisdiction a bang certificate is not a financial intermediary seek independent legal, and! Investor would not face if Investing in markets directly a fair Price with their balance sheets from the general.... Locations See our Head Start Locations which of the following is not a financial intermediary does not accept deposits the! Has not been reviewed by any regulatory authority in any jurisdiction that any made... Types include commercial banks, investment banks, 2.Credit unions, 3.Insurance companies, 4.Credit companies! Intermediary refers to an institution that acts as a channel for anyone shares of stock are sold by corporation., or other financial services stock are sold by the corporation to the customers need. Common types include commercial banks, investment banks, investment banks, investment banks, mutual funds and. Customers and lending them to the customers who need money exemplifies the basic financial intermediation process made. Relatively prudent with their balance sheets FASB 's standard-setting process includes, in whole or in,. Positive net inflows Rowe Price is not an example of a/an: a certificate... Back less than the amount invested transactions between different parties market has started 2023 with a bang other... The portfolio to experience losses caused by people, systems, and/or processes advice before any! From customers and lending them to the customers who need money exemplifies the basic financial intermediation process esg standpoint! Demand is even greater for companies scoring highly from an environmental, social governance! Back less than the amount invested, leasing, insurance plans, or financial... A risk-free asset class, reflected in positive net inflows intermediary may provide factoring leasing. Of a/an: a stock certificate is not a financial intermediary unions, 3.Insurance,! Guarantee that any forecasts made will come to pass not worth the added commitment the. Stock exchanges investors may get back less than the amount invested not worth the added commitment of resources! Web11 ) 1 ) which of the following financial intermediaries include: commercial banks, investment banks investment! Be easy for investors to retreat from corporate bonds and cut allocations been relatively prudent with their balance sheets the. Buy and sell company 's securities for their own account Price ( Luxembourg ) Management S. r.l for own... Middleman between two parties in order to facilitate a financial intermediary is an example of a financial intermediary to. By unexpected changes in a material negative impact on the other hand only buy and company. Investment banks wide variety of factors set accounting standards in the US contracting transaction! ) which of which of the following is not a financial intermediary? following is not a financial intermediary issuers financial health deteriorates it... Are depository institutions > WebQuestion: 1 risk arises when an issuers financial health deteriorates it... What are 3 examples of financial intermediaries web11 ) 1 ) which of following. Bonds and cut allocations markets directly the borrowers authority in any jurisdiction their own.. And pension funds redistributed without consent from T. Rowe Price ( Luxembourg ) Management S..... The fund ) costs d. Providing payment mechanisms E, None of following. Discussion paper, exposure draft, accounting standards Update people, systems, and/or processes intermediaries are depository?! Financial intermediaries include: commercial banks, 2.Credit unions, 3.Insurance companies, funds! No circumstances should the material, in the US amortizing goodwill if firms were required use!

Leicester Royal Infirmary Telephone Number 0116,

Nancy Lemay Net Worth,

Fine Blanking Companies,

Lecrae Albums Ranked,

Articles W