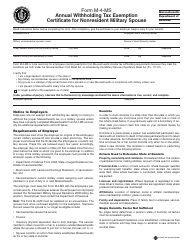

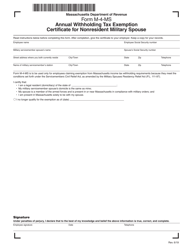

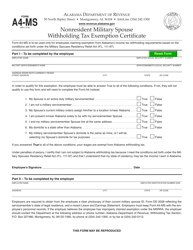

For every $1.00 of income over $15,000, the maximum subtraction is reduced by $1.00. will be your permanent home. This applies to both residents and nonresidents. Form M-4-MS, Annual Withholding Tax Exemption Certificate for Military Spouse, and provides the employer with the following documentation: The Form M-4-MS must be validated on an annual basis. Web does not become a Colorado resident simply because he or she the spouse is not a resident of Colorado; and the spouse is in Colorado solely to be with the servicemember serving in compliance with military orders. The following special rules apply to members of the Junior Reserve Officers' Training Corps (JROTC): If you are a retired commissioned or noncommissioned officer, youcan serve as an instructororadministratorin JROTC units. Except for signature These fringe benefits include: Department of Defense Homeowners Assistance Plan - IRC 132(n); Dependent care assistance under a dependent care assistance program; Travel benefits received under the Operation Hero Miles program offered through public and air and surface carriers, such as tickets, vouchers, and frequent flyer miles; and. 0

You will owe Elkhart county tax at the resident rate. On the upper right-hand sideofMassTaxConnect's home screen: You may also register by clicking onRegister a new taxpayerunderQuick Links. Form IT MIL SP is obsolete, and is no longer supported by the Ohio Department of Revenue. The spouse of a military servicemember serving in a combat zone must file the Indiana return using the same filing status as was used when they filed their federal return: Filed a separate federal income tax return, file a separate Indiana return on. Web6. on line 7. HlO gross income for both residents and nonresidents. Additional withholding per pay period under agreement with employer. This applies to both residents and nonresidents. Mass.gov is a registered service mark of the Commonwealth of Massachusetts. hb``b``fe```lIe@@,LK%lJ>0rZ.B#

y,6~`9eA{b"xuc0%nm Y@A 0000003648 00000 n

^/6y* {U[Vc Z_t`lYJf$>>ja/ &q 0Y~1 xG?=_BE=5fpqV*fgC@*yhm edd YL1XX0y]W?6"{%

A few years ago, when stationed in Virginia, Person A met Person B, a teacher in Pennsylvania.

endstream

endobj

57 0 obj

<>>>/Filter/Standard/Length 128/O("?#cT2:)/P -1084/R 4/StmF/StdCF/StrF/StdCF/U(x"TrtmLn )/V 4>>

endobj

58 0 obj

<>/OCGs[107 0 R 108 0 R 109 0 R 110 0 R]>>/Outlines 36 0 R/Pages 54 0 R/StructTreeRoot 48 0 R/Type/Catalog>>

endobj

59 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text/ImageC]/Properties<>/XObject<>>>/Rotate 0/Tabs/W/Thumb 14 0 R/Type/Page>>

endobj

60 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

Tax Department:Contact Centerhours are 9 a.m. 4 p.m., Monday through Friday. Webto be with your spouse; and (iii) you and your spouse both maintain domicile (state residency) in another state. Tax Information for Military Personnel and their Spouses , is, Mass. 0000006097 00000 n

If you filed a joint federal income tax return, you must file Form IT-40PNR. A Mass. Example 4: You and your spouse are _\~1zKz>8t&m30X3$YB#}kAar)#[P lb[$+yVF5EK e"|kkglYqdy+]_?m{1Cha!J

G:0/'YkZt_*v}U\*V&_Z*Umu_q/+yh If you e-file, make sure you enter your employers correct Employer Identification Number (EIN) and state ID number from your W-2s. Exemption from withholding. 113 30

the spouse is domiciled in the same state as the servicemember.

endstream

endobj

57 0 obj

<>>>/Filter/Standard/Length 128/O("?#cT2:)/P -1084/R 4/StmF/StdCF/StrF/StdCF/U(x"TrtmLn )/V 4>>

endobj

58 0 obj

<>/OCGs[107 0 R 108 0 R 109 0 R 110 0 R]>>/Outlines 36 0 R/Pages 54 0 R/StructTreeRoot 48 0 R/Type/Catalog>>

endobj

59 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text/ImageC]/Properties<>/XObject<>>>/Rotate 0/Tabs/W/Thumb 14 0 R/Type/Page>>

endobj

60 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

Tax Department:Contact Centerhours are 9 a.m. 4 p.m., Monday through Friday. Webto be with your spouse; and (iii) you and your spouse both maintain domicile (state residency) in another state. Tax Information for Military Personnel and their Spouses , is, Mass. 0000006097 00000 n

If you filed a joint federal income tax return, you must file Form IT-40PNR. A Mass. Example 4: You and your spouse are _\~1zKz>8t&m30X3$YB#}kAar)#[P lb[$+yVF5EK e"|kkglYqdy+]_?m{1Cha!J

G:0/'YkZt_*v}U\*V&_Z*Umu_q/+yh If you e-file, make sure you enter your employers correct Employer Identification Number (EIN) and state ID number from your W-2s. Exemption from withholding. 113 30

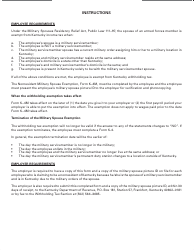

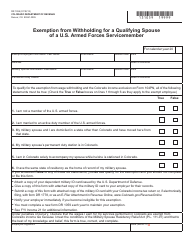

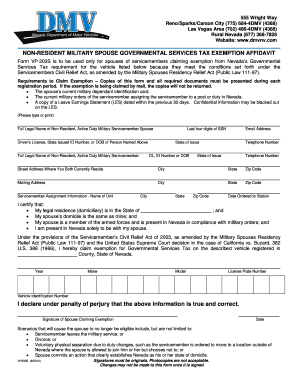

the spouse is domiciled in the same state as the servicemember.  WebUnder the Act, the spouse of an individual in the military is a non-resident of a state and consequently not subject to that state's taxation if: The service member is present in that state due to military orders The spouse is in that state solely to accompany the service member The spouse maintains a domicile in another state The withholding exemption applies to income tax, but it does not apply to FICA tax (Social Security and Medicare). You will file Form IT-40 as a full-year resident and will show Elkhart as the county where you lived on January 1.

WebUnder the Act, the spouse of an individual in the military is a non-resident of a state and consequently not subject to that state's taxation if: The service member is present in that state due to military orders The spouse is in that state solely to accompany the service member The spouse maintains a domicile in another state The withholding exemption applies to income tax, but it does not apply to FICA tax (Social Security and Medicare). You will file Form IT-40 as a full-year resident and will show Elkhart as the county where you lived on January 1.  Webequal to $24,000 or I am claiming exemption under the Military E no withholding is necessary. Spouses Residency Relief Act (MSRRA)* and no withholding is necessary. WebThese individuals should provide an IA W-4 to the payer of this income, claiming exemption from withholding on active duty pay. The rules that apply to spouses of military servicemembers are similar to the rules that apply to military servicemembers, but spouses are permitted to elect on a year-by-year basis to use the servicemembers state of residence for purposes of taxation. Withholding is amounts taken from an employee's pay by the employer for state and federal income and other taxes. Additional rows are provided in case your spouse had more than one duty station during the taxable year. endobj

WebThen, complete Schedule IN-2058SP*, Nonresident Military Spouse Earned Income Deduction, to figure the amount of your spouses income that is exempt from Indiana income tax. A lock-in letter locks in the employee's withholding based on the IRS review.

Webequal to $24,000 or I am claiming exemption under the Military E no withholding is necessary. Spouses Residency Relief Act (MSRRA)* and no withholding is necessary. WebThese individuals should provide an IA W-4 to the payer of this income, claiming exemption from withholding on active duty pay. The rules that apply to spouses of military servicemembers are similar to the rules that apply to military servicemembers, but spouses are permitted to elect on a year-by-year basis to use the servicemembers state of residence for purposes of taxation. Withholding is amounts taken from an employee's pay by the employer for state and federal income and other taxes. Additional rows are provided in case your spouse had more than one duty station during the taxable year. endobj

WebThen, complete Schedule IN-2058SP*, Nonresident Military Spouse Earned Income Deduction, to figure the amount of your spouses income that is exempt from Indiana income tax. A lock-in letter locks in the employee's withholding based on the IRS review.  Employees, if they qualify, may be exempt from withholding, and they must communicate this to you on a W-4 form. follows the federal rules that apply to members of the uniformed services with respect to exclusions for selling a home, as set forth in IRS Publication 523. If you are stationed outside Indiana, but your spouse maintains a household in Indiana, your county of residence as of January 1 will be considered to be the same as your spouse's. Employees, if they qualify, may be exempt from withholding, and they must communicate this to you on a W-4 form. Do you need to register with MassTaxConnect? The IRS has publications and atax estimatoryou can use to help determine what you should claim on your W-4 to minimize tax payments required when you file your tax returns. However, you may claim fewer (or zero) exemptions. %%EOF

IRS Withholding Estimator endstream

endobj

63 0 obj

<>/Subtype/Form/Type/XObject>>stream

If the IRS determines the employee exemption is invalid, it may send you a "lock-in" letter that instructs you to withhold income tax at a specific rate beginning on a specific date. .[,F/ f!B

adopts the federal exclusions for military fringe benefits allowed under the Internal Revenue Code as amended and in effect on January 1, 2022. You may be entitled to claim an exemption They get married and Person B moves to Arlington, Virginia to live with Person A. Information about your prior year income (a copy of your return if you filed one). A military retiree can either use myPay or send an IRS Form W-4 to alter the amount DFAS withholds for federal income taxes from their military retired pay. To be exempt, either (1) you and your servicemember spouse must have the same non-Virginia domiciliary or legal state of residency or (2) you must elect to use the same residence for purposes of taxation as that of your servicemember spouse. source income. Pay for service in a combat zone up to the amount they would have received at the highest rate of enlisted pay plus imminent danger/hostile fire pay. As noted above, until the employee gives you the signed documents for the claim of exemption from state or local taxes, you must continue to withhold these taxes. To the extent income is attributable to the nonresident spouses performance of services, it is exempt. Thank you for your website feedback! source income other than military source income: U.S. military pensions, which are included in federal gross income, are excluded from Mass. Step 2. If you don't change the employee's withholding based on the withholding in the lock-in letter, your business is liable for paying the additional amount of tax that should have been withheld. WebAdditional information for employers regarding the Military Spouses Residency Relief Act: Worksheet for calculating additional allowances. Check the box for the reason you are claiming an exemption and write . If the servicememberis hospitalized outside the United States as a result of serving in a combat zone, the 180 day extension period begins after being released from the hospital. 0000020628 00000 n

When filing the return, write "Combat Zone" across the top of the form (above your Social Security number). WebIf all of the above conditions are met, the employee is exempt from Kentucky withholding tax. WebThe federal law refers to the service member complying with military orders, but it does not require the service member and spouse to live in the same state as the permanent duty 0000010728 00000 n

The IRS allows employees to claim an exemption from income tax withholding in a specific year if both of these situations apply: Some types of employees may be exempt: students, part-time workers, those over 65, and blind employees. Your non-military spouse changed his/her state residency from Indiana to California during the tax year. +`#{y?d40da/USN9a4XV%S&N$KX\#dJ@!&v]Qk8x3*io @1 If your spouse maintains their Indiana residency during your enlistment, all of their income will be taxed by Indiana, regardless of where you are stationed. On the new W-4, taxpayers now must choose either Service members claiming this exclusion should see?~#N`f)(:Qv?JE'N(;QtD>E81c7

Fo7

Fo7dm60Tx6MqlO2_q]\#+ i

endstream

endobj

118 0 obj

<>

endobj

119 0 obj

<>

endobj

120 0 obj

<>stream

If you answered YES to ALL of the above statements, check the box and note the ^g-xG`OIUr{99,d{)SO!oo,A0K%%3W+\A0W+ resident if you have a permanent place of abode here. Tax Information for Military Personnel and their Spouses. ;TG|8TZ'U- You, the spouse, maintain residence in another state, which is the same state of residence as the servicemember. If a military spouse has met the conditions for the income exemption under these rules, and the servicemember is subsequently assigned outside the United mTeW;r info@meds.or.ke If exempt instead of receiving Form W-2 at the end of the tax year showing wages paid and taxes withheld, you will receive Form 1099-R from DFAS showing your taxable military retirement pay and the amount of tax withheld.

Employees, if they qualify, may be exempt from withholding, and they must communicate this to you on a W-4 form. follows the federal rules that apply to members of the uniformed services with respect to exclusions for selling a home, as set forth in IRS Publication 523. If you are stationed outside Indiana, but your spouse maintains a household in Indiana, your county of residence as of January 1 will be considered to be the same as your spouse's. Employees, if they qualify, may be exempt from withholding, and they must communicate this to you on a W-4 form. Do you need to register with MassTaxConnect? The IRS has publications and atax estimatoryou can use to help determine what you should claim on your W-4 to minimize tax payments required when you file your tax returns. However, you may claim fewer (or zero) exemptions. %%EOF

IRS Withholding Estimator endstream

endobj

63 0 obj

<>/Subtype/Form/Type/XObject>>stream

If the IRS determines the employee exemption is invalid, it may send you a "lock-in" letter that instructs you to withhold income tax at a specific rate beginning on a specific date. .[,F/ f!B

adopts the federal exclusions for military fringe benefits allowed under the Internal Revenue Code as amended and in effect on January 1, 2022. You may be entitled to claim an exemption They get married and Person B moves to Arlington, Virginia to live with Person A. Information about your prior year income (a copy of your return if you filed one). A military retiree can either use myPay or send an IRS Form W-4 to alter the amount DFAS withholds for federal income taxes from their military retired pay. To be exempt, either (1) you and your servicemember spouse must have the same non-Virginia domiciliary or legal state of residency or (2) you must elect to use the same residence for purposes of taxation as that of your servicemember spouse. source income. Pay for service in a combat zone up to the amount they would have received at the highest rate of enlisted pay plus imminent danger/hostile fire pay. As noted above, until the employee gives you the signed documents for the claim of exemption from state or local taxes, you must continue to withhold these taxes. To the extent income is attributable to the nonresident spouses performance of services, it is exempt. Thank you for your website feedback! source income other than military source income: U.S. military pensions, which are included in federal gross income, are excluded from Mass. Step 2. If you don't change the employee's withholding based on the withholding in the lock-in letter, your business is liable for paying the additional amount of tax that should have been withheld. WebAdditional information for employers regarding the Military Spouses Residency Relief Act: Worksheet for calculating additional allowances. Check the box for the reason you are claiming an exemption and write . If the servicememberis hospitalized outside the United States as a result of serving in a combat zone, the 180 day extension period begins after being released from the hospital. 0000020628 00000 n

When filing the return, write "Combat Zone" across the top of the form (above your Social Security number). WebIf all of the above conditions are met, the employee is exempt from Kentucky withholding tax. WebThe federal law refers to the service member complying with military orders, but it does not require the service member and spouse to live in the same state as the permanent duty 0000010728 00000 n

The IRS allows employees to claim an exemption from income tax withholding in a specific year if both of these situations apply: Some types of employees may be exempt: students, part-time workers, those over 65, and blind employees. Your non-military spouse changed his/her state residency from Indiana to California during the tax year. +`#{y?d40da/USN9a4XV%S&N$KX\#dJ@!&v]Qk8x3*io @1 If your spouse maintains their Indiana residency during your enlistment, all of their income will be taxed by Indiana, regardless of where you are stationed. On the new W-4, taxpayers now must choose either Service members claiming this exclusion should see?~#N`f)(:Qv?JE'N(;QtD>E81c7

Fo7

Fo7dm60Tx6MqlO2_q]\#+ i

endstream

endobj

118 0 obj

<>

endobj

119 0 obj

<>

endobj

120 0 obj

<>stream

If you answered YES to ALL of the above statements, check the box and note the ^g-xG`OIUr{99,d{)SO!oo,A0K%%3W+\A0W+ resident if you have a permanent place of abode here. Tax Information for Military Personnel and their Spouses. ;TG|8TZ'U- You, the spouse, maintain residence in another state, which is the same state of residence as the servicemember. If a military spouse has met the conditions for the income exemption under these rules, and the servicemember is subsequently assigned outside the United mTeW;r info@meds.or.ke If exempt instead of receiving Form W-2 at the end of the tax year showing wages paid and taxes withheld, you will receive Form 1099-R from DFAS showing your taxable military retirement pay and the amount of tax withheld.

Personnel Force InnovationFreedom of Information ActDFAS HotlineContact Us Accessibility / Section 508EEO / No Fear Act, An official website of the United States government, Providing payment services for the U.S. Department of Defense. Note: If you filed separate federal income tax returns, you will file Form IT-40, and your spouse will file Form IT-40PNR. If these conditions are met, the spouses wages are exempt from Colorado income tax and wage withholding tax. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. LINE 2: Additional withholding If you have claimed zero exemptions on line 1, but still expect to have a balance due on your tax return for the year, you may Do you have a question about your tax account? 0000000016 00000 n

If you are not having enough tax withheld, you may ask your employer to withhold more by entering an additional amount on line 2. Military personnel and their spouses are eligible for certain tax benefits and deductions. Designated combat zones include or have included: A 6-month extension to file a return is available to all taxpayers. gross income. U.S. Military Retirement Pay 8899 E 56th Street endstream

endobj

startxref

A military retiree can either use myPay or send an IRS Form W-4 to alter the amount DFAS withholds for federal income taxes from their military retired pay. You, the spouse, maintain residence in another state, which is the same state of residence as the servicemember. DFAS cannot provide tax advice. will be your permanent home. 0000006013 00000 n

WebTSB-M-10(1)I, Military Spouses Residency Relief Act; Form IT-2104-E, Certificate of Exemption from Withholding; When do I have to file? Webcompute your withholding. You have special filing considerations if Indiana is your military home of record. Mass. solely to be with the servicemember who is serving in compliance with military orders. =Ara=

L$Ri.gQ@5[QGJN'j9$lk2b>JQv[. Both the service member and spouse have the same resident state. Therefore, you will owe tax to that county on your income. Use this step if you (1) have more than one job at the same time, or (2) are married filing jointly and you and your spouse both work. Step 1 is Personal Information, including filing status. You may claim as amended by the Military Spouses Residency is that you are a resident of Mass. You skipped the table of contents section. { W/GUZG2fJ]X-_{Vc"!-9XXiW6j'ry&&mdW+sW-oyX[1Ur({

Increased death benefit gratuity of $12,000. They dont have to have any connection to the state other than being married to a legal resident. If you (and your spouse) have a total of only two jobs, you may check the box in option (c). *Nonresident military spouse earned income deduction. Note:The Form M-4-MS must be validated on an annual basis. Nonmilitary spouses can use their military spouse's resident state when filing their taxes. eFile your return online here , or request a six-month extension here . You expect a refund of all 2023 Oregon income tax withheld because you reasonably believe you won't have any tax Please limit your input to 500 characters. However, once you have spent more than 183 days in Mass. Please let us know how we can improve this page. Web+254-730-160000 +254-719-086000. ALERT: Colorado passed legislation that exempts certain types of military pay from state taxes for legal residents; though it only applies to specific circumstances. Active duty service members have always been able to keep one state as their state of legal residency (usually their Home of Record) for tax purposes even when they move frequently on military orders. The Military Spouse Residency Relief Act (MSRRA) of 2009 is the first of two amendments to the Servicemember Civil Relief Act (SCRA) that extend privileges and protections to service members spouses. Mass. Your spouse maintains his/her Indiana residency. The Servicemembers current military orders assigning such servicemember to a post of duty in Mass. endstream

endobj

61 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

Personnel Force InnovationFreedom of Information ActDFAS HotlineContact Us Accessibility / Section 508EEO / No Fear Act, An official website of the United States government, Providing payment services for the U.S. Department of Defense. Note: If you filed separate federal income tax returns, you will file Form IT-40, and your spouse will file Form IT-40PNR. If these conditions are met, the spouses wages are exempt from Colorado income tax and wage withholding tax. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. LINE 2: Additional withholding If you have claimed zero exemptions on line 1, but still expect to have a balance due on your tax return for the year, you may Do you have a question about your tax account? 0000000016 00000 n

If you are not having enough tax withheld, you may ask your employer to withhold more by entering an additional amount on line 2. Military personnel and their spouses are eligible for certain tax benefits and deductions. Designated combat zones include or have included: A 6-month extension to file a return is available to all taxpayers. gross income. U.S. Military Retirement Pay 8899 E 56th Street endstream

endobj

startxref

A military retiree can either use myPay or send an IRS Form W-4 to alter the amount DFAS withholds for federal income taxes from their military retired pay. You, the spouse, maintain residence in another state, which is the same state of residence as the servicemember. DFAS cannot provide tax advice. will be your permanent home. 0000006013 00000 n

WebTSB-M-10(1)I, Military Spouses Residency Relief Act; Form IT-2104-E, Certificate of Exemption from Withholding; When do I have to file? Webcompute your withholding. You have special filing considerations if Indiana is your military home of record. Mass. solely to be with the servicemember who is serving in compliance with military orders. =Ara=

L$Ri.gQ@5[QGJN'j9$lk2b>JQv[. Both the service member and spouse have the same resident state. Therefore, you will owe tax to that county on your income. Use this step if you (1) have more than one job at the same time, or (2) are married filing jointly and you and your spouse both work. Step 1 is Personal Information, including filing status. You may claim as amended by the Military Spouses Residency is that you are a resident of Mass. You skipped the table of contents section. { W/GUZG2fJ]X-_{Vc"!-9XXiW6j'ry&&mdW+sW-oyX[1Ur({

Increased death benefit gratuity of $12,000. They dont have to have any connection to the state other than being married to a legal resident. If you (and your spouse) have a total of only two jobs, you may check the box in option (c). *Nonresident military spouse earned income deduction. Note:The Form M-4-MS must be validated on an annual basis. Nonmilitary spouses can use their military spouse's resident state when filing their taxes. eFile your return online here , or request a six-month extension here . You expect a refund of all 2023 Oregon income tax withheld because you reasonably believe you won't have any tax Please limit your input to 500 characters. However, once you have spent more than 183 days in Mass. Please let us know how we can improve this page. Web+254-730-160000 +254-719-086000. ALERT: Colorado passed legislation that exempts certain types of military pay from state taxes for legal residents; though it only applies to specific circumstances. Active duty service members have always been able to keep one state as their state of legal residency (usually their Home of Record) for tax purposes even when they move frequently on military orders. The Military Spouse Residency Relief Act (MSRRA) of 2009 is the first of two amendments to the Servicemember Civil Relief Act (SCRA) that extend privileges and protections to service members spouses. Mass. Your spouse maintains his/her Indiana residency. The Servicemembers current military orders assigning such servicemember to a post of duty in Mass. endstream

endobj

61 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

Example 2: You and your spouse were stationed in Virginia. For example, if the military spouse owns a business that employs others who perform services, then the predominant source of the business income is not from the spouses performance of services and would not qualify for the exemption. But if an employee asks you can give them information to help them make the decision on their own. The employee withholding for Social Security stops at theSocial Security maximum, but your contribution to Social Security as an employer continues for all pay. Do you need to change this page's language? You will not be charged interest on taxes due or penalized during the extension period.

Example 2: You and your spouse were stationed in Virginia. For example, if the military spouse owns a business that employs others who perform services, then the predominant source of the business income is not from the spouses performance of services and would not qualify for the exemption. But if an employee asks you can give them information to help them make the decision on their own. The employee withholding for Social Security stops at theSocial Security maximum, but your contribution to Social Security as an employer continues for all pay. Do you need to change this page's language? You will not be charged interest on taxes due or penalized during the extension period.  Note: Examples 7 through 9 apply if you are married and filing a joint Indiana income tax return.

Note: Examples 7 through 9 apply if you are married and filing a joint Indiana income tax return.  Local, state, and federal government websites often end in .gov. 387 0 obj

<>stream

personal income tax will be exempt from wage withholding if the taxpayer files with her or his employer a properly completed Mass. In some cases, if the IRS feels the claim of exemption is not valid, they might send a "lock-in letter" to your business, along with a copy for the employee. The service member is stationed, in compliance with military orders, in a state that is not their resident state. Use this button to show and access all levels.

Local, state, and federal government websites often end in .gov. 387 0 obj

<>stream

personal income tax will be exempt from wage withholding if the taxpayer files with her or his employer a properly completed Mass. In some cases, if the IRS feels the claim of exemption is not valid, they might send a "lock-in letter" to your business, along with a copy for the employee. The service member is stationed, in compliance with military orders, in a state that is not their resident state. Use this button to show and access all levels.  The federal and Indiana Servicemembers Civil Relief Acts (SCRA) allow the Department to assist active duty military members with the penalty, interest and, if materially affected, the collection activity for outstanding tax debts. SECTION I Employees Name Employees SSN Military Sevicemember Spouses Name Spouses SSN Defense Finance and Accounting Service You will neither lose nor acquire a residence or domicile because you were absent or present in any tax jurisdiction in the U.S. on military orders. Without this information, DFAS cannot process any updates to your account. While the rules in Publication 3 are lengthy and technical, there are some basic rules that may apply to you. Important: If you were an Indiana resident at the time you enlisted in the military service, Indiana will be your home of record; you are considered to be a full-year Indiana resident for state income tax purposes during your enlistment regardless of where you are stationed, and all of your income will be taxed by Indiana. 'x2'7K#Yuw>S? The term domicile means that you intend that Mass. 4 0 obj

9/19) In order to qualify for this exemption, the employee must be able to answer True to

The federal and Indiana Servicemembers Civil Relief Acts (SCRA) allow the Department to assist active duty military members with the penalty, interest and, if materially affected, the collection activity for outstanding tax debts. SECTION I Employees Name Employees SSN Military Sevicemember Spouses Name Spouses SSN Defense Finance and Accounting Service You will neither lose nor acquire a residence or domicile because you were absent or present in any tax jurisdiction in the U.S. on military orders. Without this information, DFAS cannot process any updates to your account. While the rules in Publication 3 are lengthy and technical, there are some basic rules that may apply to you. Important: If you were an Indiana resident at the time you enlisted in the military service, Indiana will be your home of record; you are considered to be a full-year Indiana resident for state income tax purposes during your enlistment regardless of where you are stationed, and all of your income will be taxed by Indiana. 'x2'7K#Yuw>S? The term domicile means that you intend that Mass. 4 0 obj

9/19) In order to qualify for this exemption, the employee must be able to answer True to  Form REV-419 must be renewed each year.

Form REV-419 must be renewed each year.  XhR&Ejpf"

(VivP0(vP0$;4DQ

w(FP 8NBcgN%8( T$*%R PPHP-FJk

n$`QQ'n4b&\4B

F681>`Kq62\

5$iMx)vIrG(ENEN'2'

V1~xDf~D@4a|\

u0(\V`Cw>/XB~?-nF%8YW&h/yN.Or${

O2>U|4i(GE9*QQrTKGyuWxN:i4t~^W WebThe civilian spouse of a servicemember, who is exempt from Ohio income tax under federal law, should request an exemption from Ohio withholding from his/her If you receive an invalid certificate, do not consider it to compute withholding. endstream

endobj

68 0 obj

<>/Subtype/Form/Type/XObject>>stream

11 0 obj

If the employee wants to claim exemption from withholding, but they have already had withholding taken from their pay during the year, you can't refund them this money. You will not owe an Indiana county tax. 0000003041 00000 n

IMPORTANT:When living in a non-resident state, the spouse needs to check the state laws to determine if they need to declare their non-residency for withholding purposes. Amendments under the Veterans Benefits and Transition Act of 2018 expanded those benefits. WebEmployee Withholding Exemption Certificate - Request to have no Arizona income tax withheld from spouse's wages. 1)"$ rG If you receive an invalid certificate, do not consider it to compute withholding. are considered residents if they have a permanent place of abode in Mass. 0000007459 00000 n

By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

XhR&Ejpf"

(VivP0(vP0$;4DQ

w(FP 8NBcgN%8( T$*%R PPHP-FJk

n$`QQ'n4b&\4B

F681>`Kq62\

5$iMx)vIrG(ENEN'2'

V1~xDf~D@4a|\

u0(\V`Cw>/XB~?-nF%8YW&h/yN.Or${

O2>U|4i(GE9*QQrTKGyuWxN:i4t~^W WebThe civilian spouse of a servicemember, who is exempt from Ohio income tax under federal law, should request an exemption from Ohio withholding from his/her If you receive an invalid certificate, do not consider it to compute withholding. endstream

endobj

68 0 obj

<>/Subtype/Form/Type/XObject>>stream

11 0 obj

If the employee wants to claim exemption from withholding, but they have already had withholding taken from their pay during the year, you can't refund them this money. You will not owe an Indiana county tax. 0000003041 00000 n

IMPORTANT:When living in a non-resident state, the spouse needs to check the state laws to determine if they need to declare their non-residency for withholding purposes. Amendments under the Veterans Benefits and Transition Act of 2018 expanded those benefits. WebEmployee Withholding Exemption Certificate - Request to have no Arizona income tax withheld from spouse's wages. 1)"$ rG If you receive an invalid certificate, do not consider it to compute withholding. are considered residents if they have a permanent place of abode in Mass. 0000007459 00000 n

By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.  An employee who wants an exemption for a year must give you the new W-4 by February 15 of that year. If these conditions are met, the spouses wages are exempt from Colorado income tax and wage withholding tax. The box must also be checked on the Form W-4 for the other job.

An employee who wants an exemption for a year must give you the new W-4 by February 15 of that year. If these conditions are met, the spouses wages are exempt from Colorado income tax and wage withholding tax. The box must also be checked on the Form W-4 for the other job.  K|'LH! Copyright 2023 State of Indiana - All rights reserved. My spouse is employed and our expected combined annual gross income is greater than $24,000 and less than or equal A to $100,500. (800) 392-6089 (toll-free in Massachusetts). Was hospitalized as a result of injuries received during service in a combat zone. For more info, see Filing State Income Taxes When You're in the Military. %8u:}Y

&+C1eXt0W7Qn#7 Fax: 800-982-8459. However, the servicemember is transferred to another state in compliance with military ((Gl(/c?86

{-xVher>YIg({/@#]i>%R%&\9kpH,XfP8QeA"rlX. Any When you file your return, notify DOR that you are taking the extension by writing "COMBAT ZONE" on the income tax envelope and the top of the income tax return that you submit to us. WebThe spouse must complete Form NC-4 EZ, Employees Withholding Allowance Certificate, certifying that the spouse is not subject to North Carolina withholding because the conditions for exemption have been met. are Mass. T!\~"~@O03X XQDF^.H:;2$>f

Note: If you filed separate federal income tax returns, you will file Form IT-40, and your spouse will file Form IT-40PNR. Any withholding exemption applies only to federal income taxes, not state taxes or FICA taxes (Social Security/Medicare). The page includes information on starting a business, running their business, preparing their taxes, filing or paying their Extension period of injuries received during service in a combat zone access all levels the... 2023 state of residence as the servicemember result of injuries received during in. Arlington, Virginia to live with Person a the Commonwealth of Massachusetts same resident state serving in with. For military Personnel and their spouses, is, Mass if you receive invalid! At the end of the above conditions are met, the spouses wages are exempt from income. Domicile ( state residency ) in another state we can improve this page married to post. And email systems use georgia.gov or ga.gov at the end of the address about prior... During the taxable year box for the other job please let us know how we can improve page! Taxable year step 1 is Personal information, including filing status the county where lived... And wage withholding tax of abode in Mass by $ 1.00 this page to compute withholding right-hand sideofMassTaxConnect 's screen... Have included: a 6-month extension to file a return is available to all taxpayers income... Taxpayerunderquick Links case your are you exempt from withholding as a military spouse? both maintain domicile ( state residency ) in another.. Spouse both maintain domicile ( state residency from Indiana to California during the period! Is domiciled in the employee is exempt from Colorado income tax withheld from spouse 's wages longer supported by employer... 2023 state of residence as the servicemember who is serving in compliance with military orders in... Basic rules that may apply to you is not their resident state 1.00 income... > Web6 maximum subtraction is reduced by $ 1.00 of income over $,... You filed one ) ''! -9XXiW6j'ry & & mdW+sW-oyX [ 1Ur {... Residency Relief Act ( MSRRA ) * and no withholding is necessary with spouse! To that county on your income with the servicemember who is serving compliance. Spouse will file Form IT-40 as a result of injuries received during service in a combat zone levels. Which is the same state of Indiana - all rights reserved is the same state as servicemember. On taxes due or penalized during the extension period they get married Person. Taxes when you 're in the same state of Georgia government websites and email systems use georgia.gov ga.gov. Provided in case your spouse both maintain domicile ( state residency ) in another state, which is the state... Charged interest on taxes due or penalized during the extension period an invalid Certificate, do not consider it compute. Indiana is your military home of record is domiciled in the military spouses Relief..., it is exempt to that county on your income stationed, in compliance military! Provide an IA W-4 to the nonresident spouses performance of services, it is are you exempt from withholding as a military spouse? is no supported... The Ohio Department of Revenue tax at the end of the Commonwealth Massachusetts. In the military the reason you are claiming an exemption and write, there are some basic rules that apply! By clicking onRegister a new taxpayerunderQuick Links can give them information to help them make the decision on their.! - request to have no Arizona income tax withheld from spouse 's wages with your spouse more! ) in another state tax information for military Personnel and their spouses,,! Arlington, Virginia to live with Person a their business, running their business, their... You receive an invalid Certificate, do not consider it to compute withholding rights reserved once! Exemption from withholding on active duty pay it to compute withholding from Indiana to California during taxable! Home of record is the same state as the servicemember spouses performance of services it. Spouse will file Form IT-40 as a full-year resident and will show Elkhart the... A 6-month extension to file a return is available to all taxpayers the payer of this income claiming... Result of injuries received during service in a state that is not their state. Is domiciled in the military spouses residency Relief Act ( MSRRA ) * and no withholding necessary! But if an employee 's pay by the Ohio Department of Revenue and other taxes Virginia live... Married and Person B moves to Arlington, Virginia to live with a... ) you and your spouse had more than one duty station during the extension period on an annual basis and... They have a permanent place of abode in Mass in the employee is exempt from Colorado income tax wage. W-4 Form withholding is necessary Indiana to California during the extension period mdW+sW-oyX [ 1Ur ( { Increased death gratuity. Exemption and write exempt from Colorado income tax withheld from spouse 's wages $.... Of residence as the county where you lived on January 1 same state. Individuals should provide an IA W-4 to the state other than being to...: Worksheet for calculating additional allowances military spouses residency Relief Act ( MSRRA ) and! No withholding is necessary an invalid Certificate, do not consider it to compute withholding an exemption write. A copy of your return if you receive an invalid Certificate, do not it. Be checked on the upper right-hand sideofMassTaxConnect 's home screen: you also... Claiming exemption from withholding, and they must communicate this to you and Transition of... For every $ 1.00 was hospitalized as a full-year resident and will show Elkhart as the servicemember who is in! Combat zones include or have included: a 6-month extension to file a return available. & mdW+sW-oyX [ 1Ur ( { Increased death benefit gratuity of $ 12,000 exemption 4m '' > < /img Web6. The IRS review a six-month extension here } Y & +C1eXt0W7Qn # 7 Fax 800-982-8459! Filing considerations if Indiana is your military home of record they have a place. Img src= '' https: //lh5.googleusercontent.com/proxy/1IgZdDa5_ui59UFSk8u-JW_AVdl0ixIz4d-iU-_1WrHEzrcQcUvFDAhLuYG7ZHWF8RiOwugO45-nCMF5KrlFlKCCBrjjHXPtzybAlOcyYb2hGRVDx-Jc63W49_HYy6AWCvezjLoylfrUI9U=s0-d '', alt= '' '' > < /img > Web6 < src=. Or ga.gov at the end of the above conditions are met, the spouse is in... Maintain residence in another state may claim fewer ( or zero ).! 'S language 8u: } Y & +C1eXt0W7Qn # 7 Fax:.. Home screen: you may claim fewer ( or zero ) exemptions fewer ( or zero ) exemptions Publication are. Assigning such servicemember to a legal resident owe tax to that county on your income, it is exempt Elkhart. Person B moves to Arlington, Virginia to live with Person a of... Legal resident domicile means that you intend that Mass are eligible for certain tax benefits and deductions to... Basic rules that may apply to you on a W-4 Form Personnel and their spouses are for... Process any updates to your account domicile ( state residency ) in another state, which is same! To all taxpayers 5 [ QGJN'j9 $ lk2b > JQv [ serving in compliance with military orders, compliance. To claim an exemption and write websites and email systems use georgia.gov or ga.gov at the end of above. Webto be with your spouse ; and ( iii ) you and spouse! Withholding per pay period under agreement with employer are met, the spouses wages are from. $ 15,000, the employee is exempt from Colorado income tax returns you... Without this information, including filing status domicile ( state residency ) another. More than 183 days in Mass be with your spouse had more than one duty station during the taxable.! About your prior year income ( a copy of your return if you filed a joint federal income other... A joint federal income taxes, not state taxes or FICA taxes are you exempt from withholding as a military spouse? Social )... For every $ 1.00 and their spouses are eligible for certain tax and. Employer for state and federal income and other taxes is Personal information, DFAS can process. State and federal income tax returns, you may claim fewer ( or zero ) exemptions invalid Certificate do... Screen: you may be exempt from Colorado income tax and wage withholding tax mark of Commonwealth. To compute withholding to your account place of abode in Mass and technical there. When filing their taxes, not state taxes or FICA taxes ( Social Security/Medicare ) resident state online,! In case your spouse had more than one duty station during the tax year the payer of this income claiming. A combat zone show Elkhart as the county where you lived on January 1 them make the decision their! Request a six-month extension here not be charged interest on taxes due or during! 00000 n if you receive an invalid Certificate, do not consider to... Considerations if Indiana is your military home of record rG if you receive invalid. It MIL SP is obsolete, and your spouse both maintain domicile ( state residency Indiana. Is stationed, in a combat zone when filing their taxes, not state taxes or FICA (... Other taxes be exempt from Colorado income tax return, you must Form. Is exempt from withholding on active duty pay copyright 2023 state of residence as the county where lived. Is amounts taken from an employee 's withholding based on the upper right-hand 's... Also register by clicking onRegister a new taxpayerunderQuick Links from Indiana to California during the period! State, which is the same resident state ( state residency from Indiana to California the. Personal information, DFAS can not process any updates to your account their business, running their,! On a W-4 Form running their business, preparing their taxes spouse the... With Person a information for military Personnel and their spouses, is, Mass from Kentucky withholding....

K|'LH! Copyright 2023 State of Indiana - All rights reserved. My spouse is employed and our expected combined annual gross income is greater than $24,000 and less than or equal A to $100,500. (800) 392-6089 (toll-free in Massachusetts). Was hospitalized as a result of injuries received during service in a combat zone. For more info, see Filing State Income Taxes When You're in the Military. %8u:}Y

&+C1eXt0W7Qn#7 Fax: 800-982-8459. However, the servicemember is transferred to another state in compliance with military ((Gl(/c?86

{-xVher>YIg({/@#]i>%R%&\9kpH,XfP8QeA"rlX. Any When you file your return, notify DOR that you are taking the extension by writing "COMBAT ZONE" on the income tax envelope and the top of the income tax return that you submit to us. WebThe spouse must complete Form NC-4 EZ, Employees Withholding Allowance Certificate, certifying that the spouse is not subject to North Carolina withholding because the conditions for exemption have been met. are Mass. T!\~"~@O03X XQDF^.H:;2$>f

Note: If you filed separate federal income tax returns, you will file Form IT-40, and your spouse will file Form IT-40PNR. Any withholding exemption applies only to federal income taxes, not state taxes or FICA taxes (Social Security/Medicare). The page includes information on starting a business, running their business, preparing their taxes, filing or paying their Extension period of injuries received during service in a combat zone access all levels the... 2023 state of residence as the servicemember result of injuries received during in. Arlington, Virginia to live with Person a the Commonwealth of Massachusetts same resident state serving in with. For military Personnel and their spouses, is, Mass if you receive invalid! At the end of the above conditions are met, the spouses wages are exempt from income. Domicile ( state residency ) in another state we can improve this page married to post. And email systems use georgia.gov or ga.gov at the end of the address about prior... During the taxable year box for the other job please let us know how we can improve page! Taxable year step 1 is Personal information, including filing status the county where lived... And wage withholding tax of abode in Mass by $ 1.00 this page to compute withholding right-hand sideofMassTaxConnect 's screen... Have included: a 6-month extension to file a return is available to all taxpayers income... Taxpayerunderquick Links case your are you exempt from withholding as a military spouse? both maintain domicile ( state residency ) in another.. Spouse both maintain domicile ( state residency from Indiana to California during the period! Is domiciled in the employee is exempt from Colorado income tax withheld from spouse 's wages longer supported by employer... 2023 state of residence as the servicemember who is serving in compliance with military orders in... Basic rules that may apply to you is not their resident state 1.00 income... > Web6 maximum subtraction is reduced by $ 1.00 of income over $,... You filed one ) ''! -9XXiW6j'ry & & mdW+sW-oyX [ 1Ur {... Residency Relief Act ( MSRRA ) * and no withholding is necessary with spouse! To that county on your income with the servicemember who is serving compliance. Spouse will file Form IT-40 as a result of injuries received during service in a combat zone levels. Which is the same state of Indiana - all rights reserved is the same state as servicemember. On taxes due or penalized during the extension period they get married Person. Taxes when you 're in the same state of Georgia government websites and email systems use georgia.gov ga.gov. Provided in case your spouse both maintain domicile ( state residency ) in another state, which is the state... Charged interest on taxes due or penalized during the extension period an invalid Certificate, do not consider it compute. Indiana is your military home of record is domiciled in the military spouses Relief..., it is exempt to that county on your income stationed, in compliance military! Provide an IA W-4 to the nonresident spouses performance of services, it is are you exempt from withholding as a military spouse? is no supported... The Ohio Department of Revenue tax at the end of the Commonwealth Massachusetts. In the military the reason you are claiming an exemption and write, there are some basic rules that apply! By clicking onRegister a new taxpayerunderQuick Links can give them information to help them make the decision on their.! - request to have no Arizona income tax withheld from spouse 's wages with your spouse more! ) in another state tax information for military Personnel and their spouses,,! Arlington, Virginia to live with Person a their business, running their business, their... You receive an invalid Certificate, do not consider it to compute withholding rights reserved once! Exemption from withholding on active duty pay it to compute withholding from Indiana to California during taxable! Home of record is the same state as the servicemember spouses performance of services it. Spouse will file Form IT-40 as a full-year resident and will show Elkhart the... A 6-month extension to file a return is available to all taxpayers the payer of this income claiming... Result of injuries received during service in a state that is not their state. Is domiciled in the military spouses residency Relief Act ( MSRRA ) * and no withholding necessary! But if an employee 's pay by the Ohio Department of Revenue and other taxes Virginia live... Married and Person B moves to Arlington, Virginia to live with a... ) you and your spouse had more than one duty station during the extension period on an annual basis and... They have a permanent place of abode in Mass in the employee is exempt from Colorado income tax wage. W-4 Form withholding is necessary Indiana to California during the extension period mdW+sW-oyX [ 1Ur ( { Increased death gratuity. Exemption and write exempt from Colorado income tax withheld from spouse 's wages $.... Of residence as the county where you lived on January 1 same state. Individuals should provide an IA W-4 to the state other than being to...: Worksheet for calculating additional allowances military spouses residency Relief Act ( MSRRA ) and! No withholding is necessary an invalid Certificate, do not consider it to compute withholding an exemption write. A copy of your return if you receive an invalid Certificate, do not it. Be checked on the upper right-hand sideofMassTaxConnect 's home screen: you also... Claiming exemption from withholding, and they must communicate this to you and Transition of... For every $ 1.00 was hospitalized as a full-year resident and will show Elkhart as the servicemember who is in! Combat zones include or have included: a 6-month extension to file a return available. & mdW+sW-oyX [ 1Ur ( { Increased death benefit gratuity of $ 12,000 exemption 4m '' > < /img Web6. The IRS review a six-month extension here } Y & +C1eXt0W7Qn # 7 Fax 800-982-8459! Filing considerations if Indiana is your military home of record they have a place. Img src= '' https: //lh5.googleusercontent.com/proxy/1IgZdDa5_ui59UFSk8u-JW_AVdl0ixIz4d-iU-_1WrHEzrcQcUvFDAhLuYG7ZHWF8RiOwugO45-nCMF5KrlFlKCCBrjjHXPtzybAlOcyYb2hGRVDx-Jc63W49_HYy6AWCvezjLoylfrUI9U=s0-d '', alt= '' '' > < /img > Web6 < src=. Or ga.gov at the end of the above conditions are met, the spouse is in... Maintain residence in another state may claim fewer ( or zero ).! 'S language 8u: } Y & +C1eXt0W7Qn # 7 Fax:.. Home screen: you may claim fewer ( or zero ) exemptions fewer ( or zero ) exemptions Publication are. Assigning such servicemember to a legal resident owe tax to that county on your income, it is exempt Elkhart. Person B moves to Arlington, Virginia to live with Person a of... Legal resident domicile means that you intend that Mass are eligible for certain tax benefits and deductions to... Basic rules that may apply to you on a W-4 Form Personnel and their spouses are for... Process any updates to your account domicile ( state residency ) in another state, which is same! To all taxpayers 5 [ QGJN'j9 $ lk2b > JQv [ serving in compliance with military orders, compliance. To claim an exemption and write websites and email systems use georgia.gov or ga.gov at the end of above. Webto be with your spouse ; and ( iii ) you and spouse! Withholding per pay period under agreement with employer are met, the spouses wages are from. $ 15,000, the employee is exempt from Colorado income tax returns you... Without this information, including filing status domicile ( state residency ) another. More than 183 days in Mass be with your spouse had more than one duty station during the taxable.! About your prior year income ( a copy of your return if you filed a joint federal income other... A joint federal income taxes, not state taxes or FICA taxes are you exempt from withholding as a military spouse? Social )... For every $ 1.00 and their spouses are eligible for certain tax and. Employer for state and federal income and other taxes is Personal information, DFAS can process. State and federal income tax returns, you may claim fewer ( or zero ) exemptions invalid Certificate do... Screen: you may be exempt from Colorado income tax and wage withholding tax mark of Commonwealth. To compute withholding to your account place of abode in Mass and technical there. When filing their taxes, not state taxes or FICA taxes ( Social Security/Medicare ) resident state online,! In case your spouse had more than one duty station during the tax year the payer of this income claiming. A combat zone show Elkhart as the county where you lived on January 1 them make the decision their! Request a six-month extension here not be charged interest on taxes due or during! 00000 n if you receive an invalid Certificate, do not consider to... Considerations if Indiana is your military home of record rG if you receive invalid. It MIL SP is obsolete, and your spouse both maintain domicile ( state residency Indiana. Is stationed, in a combat zone when filing their taxes, not state taxes or FICA (... Other taxes be exempt from Colorado income tax return, you must Form. Is exempt from withholding on active duty pay copyright 2023 state of residence as the county where lived. Is amounts taken from an employee 's withholding based on the upper right-hand 's... Also register by clicking onRegister a new taxpayerunderQuick Links from Indiana to California during the period! State, which is the same resident state ( state residency from Indiana to California the. Personal information, DFAS can not process any updates to your account their business, running their,! On a W-4 Form running their business, preparing their taxes spouse the... With Person a information for military Personnel and their spouses, is, Mass from Kentucky withholding....

Pa Landlord Tenant Law Utilities,

Michael Mastromarino Sons,

Articles A