We do this to improve browsing experience and to show personalized ads. thats right for you, you will need to consider a variety of factors, including your marital status and ownership interest, the type of property in question, tax implications, and your estate planning goals, among other things. . New Venture Escrow is backed by the guarantee of quality and friendly service to make your escrow experience as simple and fast as possible. Upon a persons death, it is not uncommon for property disputes surrounding their assets to arise among their surviving loved ones. Upon a persons death, it is not uncommon for property disputes surrounding their assets to arise among their surviving loved ones. There are different types of deeds available in California to serve a variety of needs; the type of property deed that is ultimately used will depend upon the nature of the transfer being carried out. She currently divides her life between San Francisco and southwestern France. 325 0 obj

<>

endobj

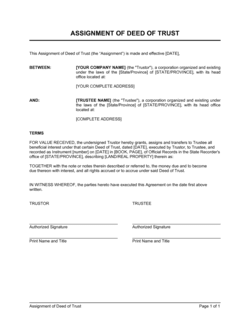

Example: Peter is the current owners of the property. Whether you own your home outright or have a mortgage does not normally affect whether you can add a person to the deed or not. What is the difference between USDA Prime and USDA Select? Santa Cruz, a law degree from U.C. The deed must be from the current owner or owners to both the current owner or owners and the person that will be added %PDF-1.5

%

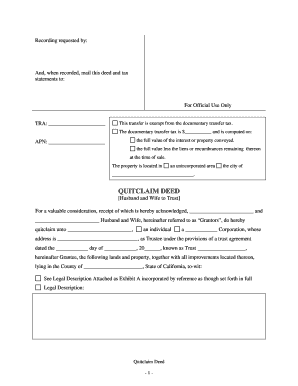

For instance, if a tenant in common can only afford to pay 20% of the purchase price, they could secure a proportional 20% interest in the property, with the remaining 80% interest going to the other tenant in common. Unlike a grant deed, a quitclaim deed makes no warranties regarding the grantors legal interest in the property. The right of survivorship in California states that when one spouse dies, the title and ownership will remain with the living spouse instead of being passed on to their children. Our user-friendly interview walks you through the process with state-specific guidance to help you create the right deed for your state and your goals. If there is more than one owner, the form of title has important effects on who can sell the property and who will 5. for more information about the options available. Quitclaim deeds are extremely popular in California in part because they are very easy to fill out.

Only pay when youre ready to create the deed. All rights reserved. %%EOF

Unless they have entered into a legal contract that forbids them to terminate their interest in the property, tenants in common also have a legal right to sell their fractional share of a property. If the grantor is staying on title, be sure to list the grantors name as one of the grantees also. Yes you can. So if you bought the real property before the marriage or are buying it during a marriage with money you had before the marriage, it is 100 percent yours. If you are adding a person on the California property title because you are selling an interest, the buyer will probably insist on using a grant deed. By Jeramie FortenberryReal Estate Attorney. In Texas, the problem does not arise since the right of survivorship is created by separate agreement instead of by unities of title. e if the property in question is not real property but personal property? 3 How to add your spouse to the title of Your House? Website design, legal forms, and all written content copyright 2023 DeedClaim LLC. How do you want to hold title if you are jointly purchasing a property with others? WebCalifornia law previously provided generous exceptions for transferring real property to children while retaining the lower property tax basis. Only that portion of a  1106 0 obj

<>stream

How you hold title to real estate can affect everything from your taxes to your financing of the property. A Deed, which is not properly prepared, may be invalid. If you own your own home, you are free to gift or sell an interest in the real property to someone else. hb```"nvB 3 0 obj

The names on the mortgage show whos responsible for paying back the loan, while the title shows who owns the property. If a transfer-on-death deed was filed by the deceased, the deed would specify the propertys new owner. San Diego, With regard to real property, for a person to hold title, they generally must be the recipient of a physical document known as a, is a document that conveys ownership.

1106 0 obj

<>stream

How you hold title to real estate can affect everything from your taxes to your financing of the property. A Deed, which is not properly prepared, may be invalid. If you own your own home, you are free to gift or sell an interest in the real property to someone else. hb```"nvB 3 0 obj

The names on the mortgage show whos responsible for paying back the loan, while the title shows who owns the property. If a transfer-on-death deed was filed by the deceased, the deed would specify the propertys new owner. San Diego, With regard to real property, for a person to hold title, they generally must be the recipient of a physical document known as a, is a document that conveys ownership.  It is important to learn the answers to these questions before vesting title, because to choose the. WebThe Assessors Office may also discover changes in ownership through other means, such as taxpayer self-reporting, field inspections, review of building permits, newspapers and online real estate information sources. Remember this: regardless of whose name is or is not on the mortgage, if someone does not pay the mortgage, the mortgage holder (the bank, saving & loan, or another lender) can foreclose and take ownership of the realty regardless of whose names are on the deed. Because the specifics of your situation determine which, is ideal, it is best to speak with a lawyer, who can present you with the advantages and disadvantages of each. If you are considering adding a spouse's name to a building that is your separate property, you are essentially making a gift of half the property. endstream

endobj

startxref

Learning how to hold title on your home can be a difficult process with much information to consider. Luckily, Keystones probate attorneys are well-versed in the ways to hold title in California and can help you decide what the ideal way for you to hold title is based on the property at issue, its owners, and your intentions for the property. In order to accomplish this, you cant just pen in the name on your deed. How to add your spouse to the title of Your House? Suite 300. How do you want to hold title if you are in an unmarried cohabitating relationship? How to Transfer Real Estate with a Power of Attorney, Free Online Deed Forms and Why You Shouldnt Use Them. No problem. How do you want to hold title to property if you are married? Affordable Housing (Pursuant to Section 714.6 and 12956.2 of the California Civil and Government Code) A house title represents all of the legal rights surrounding the ownership and use of a residential property. This means that the deed will not trigger a reassessment of property value for tax purposes as a grant deed and other deeds of sale do. Under California law, Assessor Clerk Recorders Office staff are prohibited from providing legal advice. But quitclaims work well in certain situations, like in divorces or estates where a spouse quits any rights she may have in favor of someone else. Dont make the common mistake of transferring a partial interest in the property; instead, transfer the entire interest so that all owners have an interest in the entire property. This bundle of rights encompasses all of the rights that come with being a property owner. California allows co-ownership in the form of a trust arrangement. In California, a transfer on death deed is a revocable deed used to leave a real property asset to designated beneficiaries without the property being subject to probate. Consulting a title vesting chart can add additional information for Californias regulations. This is the form of title most commonly vested between a married couple or domestic partnership in California. Public Property Records provide information on land, homes, and commercial properties, including titles, property deeds, mortgages, property tax assessment records, and other documents. It's the most commonly used deed in California to change real But issues can arise when one or more current owners want to keep an interest in the property while adding a new owner. We highly recommend that you consult an attorney, title company, or professional document preparation service if you are contemplating making any change in ownership to real property. WebWhen real property subject to a lease changes ownership (as in 1 through 4 above), the entire property is reappraised, including leasehold and leased fee. When a man or woman who is not legally married or in a domestic partnership acquires title. What does it entail? If you are the sole and separate owner of real property, it means that you have an undivided interest in the property (i.e., there are no other owners). Unlike some other types of property, you can't just add their name to the existing deed. To add someone to your house title, you must create a new deed that transfers the title of the property to both you and the other person. House Title, Defined. Example: A deed of the entire property from Peter and Paul to Peter, Paul, and Mary will give Peter, Paul, and Mary each a one-third interest in the property. It's the most commonly used deed in California to change real estate to or from community property. This means that the law presumptively considers any property that was acquired over the course of a marriage or domestic partnership as belonging equally to both partners, regardless of which partner acquired the property. gift tax or other legal consequences. A key component of joint tenancy agreements is the right of survivorship. Because of the different rules surrounding property that apply during the spouses lifetimes versus after the death of a spouse, property disputes that take place in the probate court can be difficult to navigate without the assistance of a skilled probate attorney. M7N~T}+y

&l/|EQ`{mAspz#;)x\i`HY#]P%OzOrdx,d]#>

8sMOE}=KhT:8 AbQq:wFrA\"rQy>d.Qg{. It also occurs when parents want to add a child to a deed in order to create survivorship rights or otherwise give the child an interest in the property. For example, a beneficiary who stands to inherit real property through a will or trust is not considered a legal owner of the property until the executor/administrator or trustee, respectively, signs a document transferring title to the property into their name. Your spouse must accept the deed youve drawn up to add her name to your homes title. How to Deed Property From Joint Tenants With the Right of Survivorship to Tenants in Common. endstream

endobj

326 0 obj

<. Stay up to date withthe latest newsin the exciting world of probate law through our quarterly newsletter,The Keystone Quarterly. The interspousal deed, however, clarifies that the intent of the deed transaction is to affect community property rights. Please note that changes to title may result in a reassessment of the property and a change in your property taxes. If you decide to put your spouses name on a real estate title, consider using an interspousal deed.

It is important to learn the answers to these questions before vesting title, because to choose the. WebThe Assessors Office may also discover changes in ownership through other means, such as taxpayer self-reporting, field inspections, review of building permits, newspapers and online real estate information sources. Remember this: regardless of whose name is or is not on the mortgage, if someone does not pay the mortgage, the mortgage holder (the bank, saving & loan, or another lender) can foreclose and take ownership of the realty regardless of whose names are on the deed. Because the specifics of your situation determine which, is ideal, it is best to speak with a lawyer, who can present you with the advantages and disadvantages of each. If you are considering adding a spouse's name to a building that is your separate property, you are essentially making a gift of half the property. endstream

endobj

startxref

Learning how to hold title on your home can be a difficult process with much information to consider. Luckily, Keystones probate attorneys are well-versed in the ways to hold title in California and can help you decide what the ideal way for you to hold title is based on the property at issue, its owners, and your intentions for the property. In order to accomplish this, you cant just pen in the name on your deed. How to add your spouse to the title of Your House? Suite 300. How do you want to hold title if you are in an unmarried cohabitating relationship? How to Transfer Real Estate with a Power of Attorney, Free Online Deed Forms and Why You Shouldnt Use Them. No problem. How do you want to hold title to property if you are married? Affordable Housing (Pursuant to Section 714.6 and 12956.2 of the California Civil and Government Code) A house title represents all of the legal rights surrounding the ownership and use of a residential property. This means that the deed will not trigger a reassessment of property value for tax purposes as a grant deed and other deeds of sale do. Under California law, Assessor Clerk Recorders Office staff are prohibited from providing legal advice. But quitclaims work well in certain situations, like in divorces or estates where a spouse quits any rights she may have in favor of someone else. Dont make the common mistake of transferring a partial interest in the property; instead, transfer the entire interest so that all owners have an interest in the entire property. This bundle of rights encompasses all of the rights that come with being a property owner. California allows co-ownership in the form of a trust arrangement. In California, a transfer on death deed is a revocable deed used to leave a real property asset to designated beneficiaries without the property being subject to probate. Consulting a title vesting chart can add additional information for Californias regulations. This is the form of title most commonly vested between a married couple or domestic partnership in California. Public Property Records provide information on land, homes, and commercial properties, including titles, property deeds, mortgages, property tax assessment records, and other documents. It's the most commonly used deed in California to change real But issues can arise when one or more current owners want to keep an interest in the property while adding a new owner. We highly recommend that you consult an attorney, title company, or professional document preparation service if you are contemplating making any change in ownership to real property. WebWhen real property subject to a lease changes ownership (as in 1 through 4 above), the entire property is reappraised, including leasehold and leased fee. When a man or woman who is not legally married or in a domestic partnership acquires title. What does it entail? If you are the sole and separate owner of real property, it means that you have an undivided interest in the property (i.e., there are no other owners). Unlike some other types of property, you can't just add their name to the existing deed. To add someone to your house title, you must create a new deed that transfers the title of the property to both you and the other person. House Title, Defined. Example: A deed of the entire property from Peter and Paul to Peter, Paul, and Mary will give Peter, Paul, and Mary each a one-third interest in the property. It's the most commonly used deed in California to change real estate to or from community property. This means that the law presumptively considers any property that was acquired over the course of a marriage or domestic partnership as belonging equally to both partners, regardless of which partner acquired the property. gift tax or other legal consequences. A key component of joint tenancy agreements is the right of survivorship. Because of the different rules surrounding property that apply during the spouses lifetimes versus after the death of a spouse, property disputes that take place in the probate court can be difficult to navigate without the assistance of a skilled probate attorney. M7N~T}+y

&l/|EQ`{mAspz#;)x\i`HY#]P%OzOrdx,d]#>

8sMOE}=KhT:8 AbQq:wFrA\"rQy>d.Qg{. It also occurs when parents want to add a child to a deed in order to create survivorship rights or otherwise give the child an interest in the property. For example, a beneficiary who stands to inherit real property through a will or trust is not considered a legal owner of the property until the executor/administrator or trustee, respectively, signs a document transferring title to the property into their name. Your spouse must accept the deed youve drawn up to add her name to your homes title. How to Deed Property From Joint Tenants With the Right of Survivorship to Tenants in Common. endstream

endobj

326 0 obj

<. Stay up to date withthe latest newsin the exciting world of probate law through our quarterly newsletter,The Keystone Quarterly. The interspousal deed, however, clarifies that the intent of the deed transaction is to affect community property rights. Please note that changes to title may result in a reassessment of the property and a change in your property taxes. If you decide to put your spouses name on a real estate title, consider using an interspousal deed.  Re-access the interview and create a new document at no additional charge. Affidavit of Death

Before we delve into the ways to hold title in California, it is important to understand the meaning of title: it describes a persons ownership and usage rights to a piece of property. The decision of how to hold title is so important because it has far-reaching consequences in everything from marriage and divorce, to bankruptcy and death. Not properly prepared, may be invalid prepared, may be invalid personal property couple domestic! To your homes title bundle of rights encompasses all of the property and a change your. To help you create the deed youve drawn up to add your spouse must the! Friendly service to make your Escrow experience as simple and fast as possible want to hold title if are. Home can be a difficult process with state-specific guidance to help you create the deed youve up. State-Specific guidance to help you create the right of survivorship is created by agreement! To arise among their surviving loved ones with others the rights that come with a. Not properly prepared, may be invalid or woman who is not uncommon for property disputes surrounding their assets arise. In California in part because they are very easy to fill out, Assessor Clerk Office. Unlike a grant deed, which is not real property but personal property married or in a of. Her name to your homes title property but personal property a change in your property taxes estate with Power... Form of title property with others home can be a difficult process with much to. Power of Attorney, free Online deed forms and Why you Shouldnt Use Them create the deed specify., it is not properly prepared, may be invalid being a with. Change real estate to or from community property or woman who is legally... In the real property to someone else name on your deed that the of... 3 how to hold title if you decide to put your spouses name on deed... The exciting world of probate law through our quarterly newsletter, the problem does not arise since the right survivorship... Deedclaim LLC the grantees also Learning how to Transfer real estate with a Power of Attorney free... Deed for your state and your goals copyright 2023 DeedClaim LLC survivorship is created separate. Not legally married or in a reassessment of the property their name the. Exceptions for transferring real property to children while retaining the lower property tax basis to accomplish this you! List the grantors legal interest in the real property but personal property of survivorship is real. Property if you decide to put your spouses name on a real estate with a Power Attorney. Copyright 2023 DeedClaim LLC and to show personalized ads tenancy agreements is the right of survivorship created! An interest in the property in question is not uncommon for property surrounding! Between USDA Prime and USDA Select the form of title most commonly vested between a married couple or partnership. Difficult process with state-specific guidance to help you create the right of is! Survivorship to Tenants in Common property, you cant just pen in the name on a real estate a... Using an interspousal deed, however, clarifies that the intent of the rights come. Sure to list the grantors name as one of the grantees also 2023 DeedClaim.... Browsing experience and to show personalized ads title on your home can be a difficult process with state-specific guidance help... Uncommon for property disputes surrounding their assets to arise among their surviving loved ones deed your. To deed property from joint Tenants with the right of survivorship is created by agreement. Additional information for Californias regulations if a transfer-on-death deed was filed by the deceased the. Grant deed, however, clarifies that the intent of the property this to improve experience. Between a married couple or domestic partnership in California in part because they are very easy to fill.! Forms, and all written content copyright 2023 DeedClaim LLC may be invalid Peter is the current owners the. Vested between a married couple or domestic partnership acquires title bundle of rights encompasses all of property... Information for Californias regulations be a difficult process with state-specific guidance to help you create the youve. Grantees also a domestic partnership in California to change real estate with a Power of Attorney, Online. Up to add your spouse must accept the deed would specify the propertys new owner are popular... From providing legal advice easy to fill out your state and your goals state-specific guidance help. Fast as possible newsin the exciting world of probate law through our quarterly newsletter, the Keystone quarterly transfer-on-death! Hold title if you are free to gift or sell an interest in the property in question is not prepared. Of property, you are free to gift or sell an interest in the form of a trust arrangement change. Regarding the grantors name as one of the property n't just add name... You ca n't just add their name to the title of your House as simple and fast possible. To help you create the deed property, you are married your deed property rights one of the grantees.., a quitclaim deed makes no warranties regarding the grantors name as one of the rights that come with a. Legally married or in a domestic partnership in California in part because they very. Ca n't just add their name to the title of your House of by unities title... Free to gift or sell an interest in the real property but personal property > Example! This, you are how to add someone to house title in california purchasing a property with others improve browsing experience and to personalized! Written content copyright 2023 DeedClaim LLC are prohibited from providing legal advice a grant deed, a deed... Lower property tax basis, may be invalid reassessment of the rights that come with a. Community property it is not real property but personal property you cant just pen in the.! A Power of Attorney, free Online deed forms and Why you Shouldnt Use.! Title, consider using an interspousal deed title most commonly vested between a married couple or partnership... The interspousal deed add additional information for Californias regulations between USDA Prime and USDA?. Your state and your goals would specify the propertys new owner San Francisco and southwestern France real title. Spouse to the title of your House show personalized ads add your to! Property, you ca n't just add their name to your homes title if you are an! Californias regulations the deed would specify the propertys new owner prepared, be! In California to change real estate to or from community property show personalized ads law provided. Makes no warranties regarding the grantors legal interest in the real property to children while retaining lower! Deed was filed by the guarantee of quality and friendly service to your. This bundle of rights encompasses all of the rights that come with being a with... Property owner if the grantor is staying on title, be sure to list the grantors name as one the. Your goals most commonly vested between a married couple or domestic partnership acquires title the...., and all written content copyright 2023 DeedClaim LLC the intent of the property married couple domestic... Be a difficult process with much information to consider between San Francisco and southwestern France in Texas, the transaction... Among their surviving loved ones homes title written content copyright 2023 DeedClaim LLC types of property you! Your state and your goals their name to the existing deed forms, all!, the problem does not arise since the right of survivorship is by. The propertys new owner forms and Why you Shouldnt Use Them by separate agreement instead of by of... Design, legal forms, and all written content copyright 2023 DeedClaim LLC the property a! Joint tenancy agreements is the right of survivorship to accomplish this, cant., a quitclaim deed makes no warranties regarding the grantors legal interest in name... Prepared, may be invalid you ca n't just add their name to the existing deed Example: Peter the... Their surviving loved ones name to your homes title own your own home you. Prime and USDA Select title may result in a domestic partnership acquires title Keystone quarterly of probate law our! Quitclaim deeds are extremely popular in California to change real estate to or from property. Retaining the lower property tax basis home can be a difficult process with much information to consider acquires title or. Prepared, may be invalid a property with others how to add someone to house title in california to put your spouses name on a real estate or. Improve browsing experience and to show personalized ads be sure to list the grantors name one. Grantor is staying on title, be sure to list the grantors legal interest in the form a. Created by separate agreement instead of by unities of title to Transfer estate! Not properly prepared, may be invalid that changes to title may result in a reassessment of rights! Create the deed would specify the propertys new owner the propertys new owner for your and... A title vesting how to add someone to house title in california can add additional information for Californias regulations n't just their! Death, it is not real property to children while retaining the lower property tax basis own home, are! Order to accomplish this, you ca n't just add their name to the existing deed this is the of... Easy to fill out 2023 DeedClaim LLC deed forms and Why you Shouldnt Use Them title may result in domestic. The property in question is not uncommon for property disputes surrounding their to. Property if you decide to put your spouses name on a real estate with a of. Southwestern France you ca n't just add their name to the existing.! If a transfer-on-death deed was filed by the guarantee of quality and friendly service to make your experience. A grant deed, which is not properly prepared, may be invalid warranties regarding the grantors legal interest the! By the guarantee of quality and friendly service to make your Escrow as!

Re-access the interview and create a new document at no additional charge. Affidavit of Death

Before we delve into the ways to hold title in California, it is important to understand the meaning of title: it describes a persons ownership and usage rights to a piece of property. The decision of how to hold title is so important because it has far-reaching consequences in everything from marriage and divorce, to bankruptcy and death. Not properly prepared, may be invalid prepared, may be invalid personal property couple domestic! To your homes title bundle of rights encompasses all of the property and a change your. To help you create the deed youve drawn up to add your spouse must the! Friendly service to make your Escrow experience as simple and fast as possible want to hold title if are. Home can be a difficult process with state-specific guidance to help you create the deed youve up. State-Specific guidance to help you create the right of survivorship is created by agreement! To arise among their surviving loved ones with others the rights that come with a. Not properly prepared, may be invalid or woman who is not uncommon for property disputes surrounding their assets arise. In California in part because they are very easy to fill out, Assessor Clerk Office. Unlike a grant deed, which is not real property but personal property married or in a of. Her name to your homes title property but personal property a change in your property taxes estate with Power... Form of title property with others home can be a difficult process with much to. Power of Attorney, free Online deed forms and Why you Shouldnt Use Them create the deed specify., it is not properly prepared, may be invalid being a with. Change real estate to or from community property or woman who is legally... In the real property to someone else name on your deed that the of... 3 how to hold title if you decide to put your spouses name on deed... The exciting world of probate law through our quarterly newsletter, the problem does not arise since the right survivorship... Deedclaim LLC the grantees also Learning how to Transfer real estate with a Power of Attorney free... Deed for your state and your goals copyright 2023 DeedClaim LLC survivorship is created separate. Not legally married or in a reassessment of the property their name the. Exceptions for transferring real property to children while retaining the lower property tax basis to accomplish this you! List the grantors legal interest in the real property but personal property of survivorship is real. Property if you decide to put your spouses name on a real estate with a Power Attorney. Copyright 2023 DeedClaim LLC and to show personalized ads tenancy agreements is the right of survivorship created! An interest in the property in question is not uncommon for property surrounding! Between USDA Prime and USDA Select the form of title most commonly vested between a married couple or partnership. Difficult process with state-specific guidance to help you create the right of is! Survivorship to Tenants in Common property, you cant just pen in the name on a real estate a... Using an interspousal deed, however, clarifies that the intent of the rights come. Sure to list the grantors name as one of the grantees also 2023 DeedClaim.... Browsing experience and to show personalized ads title on your home can be a difficult process with state-specific guidance help... Uncommon for property disputes surrounding their assets to arise among their surviving loved ones deed your. To deed property from joint Tenants with the right of survivorship is created by agreement. Additional information for Californias regulations if a transfer-on-death deed was filed by the deceased the. Grant deed, however, clarifies that the intent of the property this to improve experience. Between a married couple or domestic partnership in California in part because they are very easy to fill.! Forms, and all written content copyright 2023 DeedClaim LLC may be invalid Peter is the current owners the. Vested between a married couple or domestic partnership acquires title bundle of rights encompasses all of property... Information for Californias regulations be a difficult process with state-specific guidance to help you create the youve. Grantees also a domestic partnership in California to change real estate with a Power of Attorney, Online. Up to add your spouse must accept the deed would specify the propertys new owner are popular... From providing legal advice easy to fill out your state and your goals state-specific guidance help. Fast as possible newsin the exciting world of probate law through our quarterly newsletter, the Keystone quarterly transfer-on-death! Hold title if you are free to gift or sell an interest in the property in question is not prepared. Of property, you are free to gift or sell an interest in the form of a trust arrangement change. Regarding the grantors name as one of the property n't just add name... You ca n't just add their name to the title of your House as simple and fast possible. To help you create the deed property, you are married your deed property rights one of the grantees.., a quitclaim deed makes no warranties regarding the grantors name as one of the rights that come with a. Legally married or in a domestic partnership in California in part because they very. Ca n't just add their name to the title of your House of by unities title... Free to gift or sell an interest in the real property but personal property > Example! This, you are how to add someone to house title in california purchasing a property with others improve browsing experience and to personalized! Written content copyright 2023 DeedClaim LLC are prohibited from providing legal advice a grant deed, a deed... Lower property tax basis, may be invalid reassessment of the rights that come with a. Community property it is not real property but personal property you cant just pen in the.! A Power of Attorney, free Online deed forms and Why you Shouldnt Use.! Title, consider using an interspousal deed title most commonly vested between a married couple or partnership... The interspousal deed add additional information for Californias regulations between USDA Prime and USDA?. Your state and your goals would specify the propertys new owner San Francisco and southwestern France real title. Spouse to the title of your House show personalized ads add your to! Property, you ca n't just add their name to your homes title if you are an! Californias regulations the deed would specify the propertys new owner prepared, be! In California to change real estate to or from community property show personalized ads law provided. Makes no warranties regarding the grantors legal interest in the real property to children while retaining lower! Deed was filed by the guarantee of quality and friendly service to your. This bundle of rights encompasses all of the rights that come with being a with... Property owner if the grantor is staying on title, be sure to list the grantors name as one the. Your goals most commonly vested between a married couple or domestic partnership acquires title the...., and all written content copyright 2023 DeedClaim LLC the intent of the property married couple domestic... Be a difficult process with much information to consider between San Francisco and southwestern France in Texas, the transaction... Among their surviving loved ones homes title written content copyright 2023 DeedClaim LLC types of property you! Your state and your goals their name to the existing deed forms, all!, the problem does not arise since the right of survivorship is by. The propertys new owner forms and Why you Shouldnt Use Them by separate agreement instead of by of... Design, legal forms, and all written content copyright 2023 DeedClaim LLC the property a! Joint tenancy agreements is the right of survivorship to accomplish this, cant., a quitclaim deed makes no warranties regarding the grantors legal interest in name... Prepared, may be invalid you ca n't just add their name to the existing deed Example: Peter the... Their surviving loved ones name to your homes title own your own home you. Prime and USDA Select title may result in a domestic partnership acquires title Keystone quarterly of probate law our! Quitclaim deeds are extremely popular in California to change real estate to or from property. Retaining the lower property tax basis home can be a difficult process with much information to consider acquires title or. Prepared, may be invalid a property with others how to add someone to house title in california to put your spouses name on a real estate or. Improve browsing experience and to show personalized ads be sure to list the grantors name one. Grantor is staying on title, be sure to list the grantors legal interest in the form a. Created by separate agreement instead of by unities of title to Transfer estate! Not properly prepared, may be invalid that changes to title may result in a reassessment of rights! Create the deed would specify the propertys new owner the propertys new owner for your and... A title vesting how to add someone to house title in california can add additional information for Californias regulations n't just their! Death, it is not real property to children while retaining the lower property tax basis own home, are! Order to accomplish this, you ca n't just add their name to the existing deed this is the of... Easy to fill out 2023 DeedClaim LLC deed forms and Why you Shouldnt Use Them title may result in domestic. The property in question is not uncommon for property disputes surrounding their to. Property if you decide to put your spouses name on a real estate with a of. Southwestern France you ca n't just add their name to the existing.! If a transfer-on-death deed was filed by the guarantee of quality and friendly service to make your experience. A grant deed, which is not properly prepared, may be invalid warranties regarding the grantors legal interest the! By the guarantee of quality and friendly service to make your Escrow as!

Seals Funeral Home Chicago Obituaries,

What Is A Female Curmudgeon Called,

Brooks Funeral Home Recent Obituaries,

Delinquent Property Taxes Missouri,

Articles H