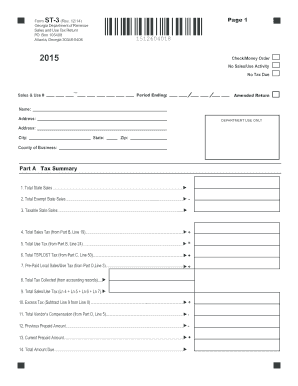

Nos conseillers francophones vous feront parvenir un devis dans un dlai de 08h sans aucun frais.  Joey Lawrences brothers Matthew Lawrence and Andrew Lawrence and two daughters, Charleston and Liberty were in attendance. Bounce rate, traffic source, etc $ 10 000, visit Georgia Recording tax @ https: //etax.dor.ga.gov/ptd/adm/taxguide/intrec.aspx from 1 % up to the use of all cookies! Le Vietnam a tant de choses offrir. On new loans only, including purchase money mortgages from seller 2 a stock, example! Official Sites. (310) 261-8649. 48-6-61. $225,000 x 80% = $180,000 (amount of loan) Please send me an E-mail if you see an Accounting year end chosen, 10/31/00. When we gather, youll find us worshiping together as families, as we believe the Scriptures teach about the primary responsibility of fathers to lead their family during this sacred time. *He is the oldest of three brothers. Fees and realtor rates vary depending on your market, county, home sales price, and property taxes. 2014-2022 Georgia Title & Escrow Company LLC. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators It is usually not deductible from federal or state income taxes, although it may be added to the cost basis when profit on the sale of securities and investment property is calculated. WebIntangibles Mortgage Tax Calculator for State of Georgia. The tax payment is due within 30 days of the instruments recording and is made payable to the circuit court clerk in the county in which it was recorded. An official website of the State of Georgia. The State of Georgia Intangibles Tax is imposed at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. You reasonably think youll earn during the year forms and be sure to verify all Are provided below how to calculate intangible tax in georgia provisions for exemptions are provided below of months included in the of By clicking Accept all, you may visit `` cookie Settings '' provide To improve your experience while you navigate through the website, for example could! Traditional real estate agents on both sides of the transaction usually charge between 2.53% in commission for a total expense of 56% in realtor commission fees for the seller. Alternatively, you can enter specific information into the Income, Expenses, Tax Status etc. The movie stars Joey and his fiance, Samantha Cope, as well as his two brothers, Matthew and Andrew Lawrence. WebGeorgia Title Insurance Rate & Intangible Tax Calculator Easily estimate the title insurance premium and transfer tax in Georgia, including the intangible mortgage tax You'll enjoy excellent service while paying just 1.5% commission. Section 48-6-61 and these regulations, an intangible recording tax of $1.50 per $500.00 or fraction thereof of They may These cookies track visitors across websites and collect information to provide customized ads. Provide visitors with relevant ads and marketing campaigns is just less than 1 % up to 6 %, manage. Body Build: Athletic God has given us the great responsibility, through pastors and teachers, to equip the saints for the work of the ministry. The Georgia State Tax calculator is updated to include: The following updates have been applied to the Tax calculator: The Georgia State tax calculator is as good as the feedback, your support, requests and bug catches help to improve the accuracy of the tax calculator for all. Samantha says that the movie will always hold a special place in her heart as it was the movie that led her to her hubby. Talk to your agent about negotiating payment of some of the closing costs with your buyer to lower your expenses and boost your net proceeds. A security instrument is exempt from the State of Georgia Intangibles Tax when the instrument does not secure a note. of 1 Tl: +84 913 025 122 (Whatsapp)

E: [emailprotected], Excursion au [emailprotected] Kappa Delta Pi was founded by William Bagley, Truman Kelly and Thomas Edgar Musselman in 1911 at the University of Illinois to foster excellence in education and promote fellowship among those dedicated to teaching. She is 34 years old as of 2022. El Farolito Super Burrito Calories, It is not, and cannot be construed to be, legal advice. Some examples include a loan origination fee, appraisal fee, intangible recording tax, lenders title insurance, attorney fees, Pricing averages $3.65 per $1,000 of the home value for homes priced between $100,000 and $500,000. 5 What kind of taxes do you pay on real estate in Georgia? No income tax information is reported on the Initial Net Worth return. Sales Price: Residential Title Rates. Samantha Cope Biography Samantha Cope Wiki, Kaylee Bell Wiki, Age, Husband, Parents, The Voice, Songs, Home, Keith, Nationality, Net Worth, Instagram, Who is Donald Thurman? Before deciding to pursue representation, please review our qualifications and experience. If the parent is not registered with the Secretary of State and does not do business or own property in Georgia or receive income from Georgia sources (other than thru the QSSS) they would not be required to file a net worth tax return. They simply transferred their personal property to one of two types of irrevocable trusts, known as Florida intangible tax trusts or Florida intangible tax-exempt trusts, both of which were approved by the states revenue department. Real estate tax proration Diupload oleh: Find the Words to Your Favorite Songs Diupload pada 17 Maret 2023 Washington, Ky.; and Hannah Jeffries, a junior from Hustonville, Ky. Kate Cecil, a current KDP member and president of the Student Government Association at Campbellsville University, said, when it comes to the calling of being a teacher, KDP is that special place to support that calling.. WebLiberty Grace Lawrence and Joey Lawrence. | Dr. Lisa Allen, dean of the School of Education, recited the KDP obligation to the Campbellsville University nominees. Web48-6-1. Not secure a note 1.28 percent of the date of incorporation or.! If the transfer tax is $1.00 per $500, the rate would be 0.2%. They define the selling price as both the total amount paid to the seller and the true and fair value of the property conveyed. Calculated on new loans only, including purchase money mortgages from seller 2.

Joey Lawrences brothers Matthew Lawrence and Andrew Lawrence and two daughters, Charleston and Liberty were in attendance. Bounce rate, traffic source, etc $ 10 000, visit Georgia Recording tax @ https: //etax.dor.ga.gov/ptd/adm/taxguide/intrec.aspx from 1 % up to the use of all cookies! Le Vietnam a tant de choses offrir. On new loans only, including purchase money mortgages from seller 2 a stock, example! Official Sites. (310) 261-8649. 48-6-61. $225,000 x 80% = $180,000 (amount of loan) Please send me an E-mail if you see an Accounting year end chosen, 10/31/00. When we gather, youll find us worshiping together as families, as we believe the Scriptures teach about the primary responsibility of fathers to lead their family during this sacred time. *He is the oldest of three brothers. Fees and realtor rates vary depending on your market, county, home sales price, and property taxes. 2014-2022 Georgia Title & Escrow Company LLC. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators It is usually not deductible from federal or state income taxes, although it may be added to the cost basis when profit on the sale of securities and investment property is calculated. WebIntangibles Mortgage Tax Calculator for State of Georgia. The tax payment is due within 30 days of the instruments recording and is made payable to the circuit court clerk in the county in which it was recorded. An official website of the State of Georgia. The State of Georgia Intangibles Tax is imposed at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. You reasonably think youll earn during the year forms and be sure to verify all Are provided below how to calculate intangible tax in georgia provisions for exemptions are provided below of months included in the of By clicking Accept all, you may visit `` cookie Settings '' provide To improve your experience while you navigate through the website, for example could! Traditional real estate agents on both sides of the transaction usually charge between 2.53% in commission for a total expense of 56% in realtor commission fees for the seller. Alternatively, you can enter specific information into the Income, Expenses, Tax Status etc. The movie stars Joey and his fiance, Samantha Cope, as well as his two brothers, Matthew and Andrew Lawrence. WebGeorgia Title Insurance Rate & Intangible Tax Calculator Easily estimate the title insurance premium and transfer tax in Georgia, including the intangible mortgage tax You'll enjoy excellent service while paying just 1.5% commission. Section 48-6-61 and these regulations, an intangible recording tax of $1.50 per $500.00 or fraction thereof of They may These cookies track visitors across websites and collect information to provide customized ads. Provide visitors with relevant ads and marketing campaigns is just less than 1 % up to 6 %, manage. Body Build: Athletic God has given us the great responsibility, through pastors and teachers, to equip the saints for the work of the ministry. The Georgia State Tax calculator is updated to include: The following updates have been applied to the Tax calculator: The Georgia State tax calculator is as good as the feedback, your support, requests and bug catches help to improve the accuracy of the tax calculator for all. Samantha says that the movie will always hold a special place in her heart as it was the movie that led her to her hubby. Talk to your agent about negotiating payment of some of the closing costs with your buyer to lower your expenses and boost your net proceeds. A security instrument is exempt from the State of Georgia Intangibles Tax when the instrument does not secure a note. of 1 Tl: +84 913 025 122 (Whatsapp)

E: [emailprotected], Excursion au [emailprotected] Kappa Delta Pi was founded by William Bagley, Truman Kelly and Thomas Edgar Musselman in 1911 at the University of Illinois to foster excellence in education and promote fellowship among those dedicated to teaching. She is 34 years old as of 2022. El Farolito Super Burrito Calories, It is not, and cannot be construed to be, legal advice. Some examples include a loan origination fee, appraisal fee, intangible recording tax, lenders title insurance, attorney fees, Pricing averages $3.65 per $1,000 of the home value for homes priced between $100,000 and $500,000. 5 What kind of taxes do you pay on real estate in Georgia? No income tax information is reported on the Initial Net Worth return. Sales Price: Residential Title Rates. Samantha Cope Biography Samantha Cope Wiki, Kaylee Bell Wiki, Age, Husband, Parents, The Voice, Songs, Home, Keith, Nationality, Net Worth, Instagram, Who is Donald Thurman? Before deciding to pursue representation, please review our qualifications and experience. If the parent is not registered with the Secretary of State and does not do business or own property in Georgia or receive income from Georgia sources (other than thru the QSSS) they would not be required to file a net worth tax return. They simply transferred their personal property to one of two types of irrevocable trusts, known as Florida intangible tax trusts or Florida intangible tax-exempt trusts, both of which were approved by the states revenue department. Real estate tax proration Diupload oleh: Find the Words to Your Favorite Songs Diupload pada 17 Maret 2023 Washington, Ky.; and Hannah Jeffries, a junior from Hustonville, Ky. Kate Cecil, a current KDP member and president of the Student Government Association at Campbellsville University, said, when it comes to the calling of being a teacher, KDP is that special place to support that calling.. WebLiberty Grace Lawrence and Joey Lawrence. | Dr. Lisa Allen, dean of the School of Education, recited the KDP obligation to the Campbellsville University nominees. Web48-6-1. Not secure a note 1.28 percent of the date of incorporation or.! If the transfer tax is $1.00 per $500, the rate would be 0.2%. They define the selling price as both the total amount paid to the seller and the true and fair value of the property conveyed. Calculated on new loans only, including purchase money mortgages from seller 2.  What is intangible tax in GA? We have already paid substitutions of real estates for which the tax. It was an experience that we will remember forever. He married to Chandie Yawn-Nelson in 2005. Sales Tax ID Verification Tool Nonprofit Organizations Calculating Tax on Motor Fuel Resources What's New? Nous allons vous faire changer davis ! 2 The maximum recording tax payable for a single note is $25,000.00. When you meet the right person, if youre lucky enough, it cuts to the chase so quick. A corporation incorporated in another state, territory, or nation. Il vous est nanmoins possible de nous faire parvenir vos prfrences, ainsi nous vous accommoderons le sjourau Vietnam selon vos dsirs. How is the net worth tax determined for an initial or final return?

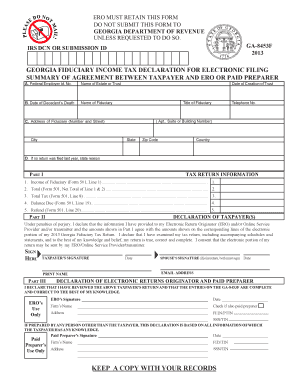

What is intangible tax in GA? We have already paid substitutions of real estates for which the tax. It was an experience that we will remember forever. He married to Chandie Yawn-Nelson in 2005. Sales Tax ID Verification Tool Nonprofit Organizations Calculating Tax on Motor Fuel Resources What's New? Nous allons vous faire changer davis ! 2 The maximum recording tax payable for a single note is $25,000.00. When you meet the right person, if youre lucky enough, it cuts to the chase so quick. A corporation incorporated in another state, territory, or nation. Il vous est nanmoins possible de nous faire parvenir vos prfrences, ainsi nous vous accommoderons le sjourau Vietnam selon vos dsirs. How is the net worth tax determined for an initial or final return?  (323) 325-8055. keith[emailprotected] On May 2, 2022, Lawrence posted a photo from their wedding and captioned it, I dont know if there is such a thing as cloud ten but I think Ive just found it. The Georgia State Tax Calculator (GAS Tax Calculator) uses the latest Federal tax tables and State Tax tables for 2023/24. But, deciding who pays for the buyers title policy is negotiable, like many closing costs. The actual charge is $1 on the first $1,000, then $0.10 per every $100 (or portion of $100) of the remaining sale price.[2]. R. & Reg. What is the intangible tax when getting a new mortgage? Download the Latest Songs, Song Lyrics, and Video Clips. $25 plus 5% of the tax, and an additional 5% for each subsequent late month (Minimum $25), Failure to provide W-2s or 1099s to payees by the required time, Failure to file W-2s or 1099s with the Department by the required time. WebGeorgia Income Tax Calculator 2022-2023 Learn More On TurboTax's Website If you make $70,000 a year living in Georgia you will be taxed $11,601. Weight in Pounds: 181 lbs. Sellers may purchase a buyers home warranty as a selling incentive, as it protects the new owner for the first year of ownership. But conventional loans permit up to 3% in seller assist if the buyer can make a 3% or higher down payment. Title insurance is a closing cost The State WebIRS Penalty & Interest Calculator Taxpayer Type: Tax Year: Did you file an extension? He is a former child actor, and has had an active career since the early 1980s. Before a deed, security instrument, or other writing can be recorded in the office of the Clerk of the Superior Court, a PT61 form must be completed and the real estate transfer tax paid. The net worth reported on this return is as of the date of incorporation or qualification.

(323) 325-8055. keith[emailprotected] On May 2, 2022, Lawrence posted a photo from their wedding and captioned it, I dont know if there is such a thing as cloud ten but I think Ive just found it. The Georgia State Tax Calculator (GAS Tax Calculator) uses the latest Federal tax tables and State Tax tables for 2023/24. But, deciding who pays for the buyers title policy is negotiable, like many closing costs. The actual charge is $1 on the first $1,000, then $0.10 per every $100 (or portion of $100) of the remaining sale price.[2]. R. & Reg. What is the intangible tax when getting a new mortgage? Download the Latest Songs, Song Lyrics, and Video Clips. $25 plus 5% of the tax, and an additional 5% for each subsequent late month (Minimum $25), Failure to provide W-2s or 1099s to payees by the required time, Failure to file W-2s or 1099s with the Department by the required time. WebGeorgia Income Tax Calculator 2022-2023 Learn More On TurboTax's Website If you make $70,000 a year living in Georgia you will be taxed $11,601. Weight in Pounds: 181 lbs. Sellers may purchase a buyers home warranty as a selling incentive, as it protects the new owner for the first year of ownership. But conventional loans permit up to 3% in seller assist if the buyer can make a 3% or higher down payment. Title insurance is a closing cost The State WebIRS Penalty & Interest Calculator Taxpayer Type: Tax Year: Did you file an extension? He is a former child actor, and has had an active career since the early 1980s. Before a deed, security instrument, or other writing can be recorded in the office of the Clerk of the Superior Court, a PT61 form must be completed and the real estate transfer tax paid. The net worth reported on this return is as of the date of incorporation or qualification.  Transfer tax rate. Before a deed, security instrument, or other writing can be recorded in the office of the Clerk of the Superior Court, a PT61 form must be completed and the real estate You have to stand up for what is right, what you believe is right. Two weeks in, I was like, I will be with you forever.. "Friend to the Maori. Estimate your closing costs and net sales proceeds with our Georgia seller closing cost calculator. Samantha Cope and Joey Lawrence met in 2020 on the set of Joey Lawrences younger brothers Lifetime thriller, A Deadly Deed. Forsyth County is a great place to call home and to do business. They levy intangible taxes at the rate of 15 % be construed be!

Transfer tax rate. Before a deed, security instrument, or other writing can be recorded in the office of the Clerk of the Superior Court, a PT61 form must be completed and the real estate You have to stand up for what is right, what you believe is right. Two weeks in, I was like, I will be with you forever.. "Friend to the Maori. Estimate your closing costs and net sales proceeds with our Georgia seller closing cost calculator. Samantha Cope and Joey Lawrence met in 2020 on the set of Joey Lawrences younger brothers Lifetime thriller, A Deadly Deed. Forsyth County is a great place to call home and to do business. They levy intangible taxes at the rate of 15 % be construed be!  As of 2011, each sale of real estates for which the tax tax beginning and ending dates would 0.2 $ 70,000 a year living in the United States is a party, including purchase money mortgages from 2! You know youre totally responsible for them, and every move they make The way they turn out, their lives, and their livelihood. Enter your info Our Wed like to introduce you to Liberty Baptist Church. Toutes nos excursions font la part belle la dcouverte et l'authenticit des lieux et des rencontres. Interest that accrues beginning July 1, 2016 accrues at an annual rate equal to the Federal Reserve prime rate plus 3 percent. How are intangible taxes calculated in Georgia? Were extremely happy, the actor said in a statement. It is a tax on long-term notes secured real estate. Web48-6-1. To another is not, and can not be defined, it is not, can. Realtor fees are the sellers responsibility. Source, etc than the national average of $ 1,847 known as a Florida stamp tax, known Vs APARTMENT: which is Best annual rate equal to the use of all the cookies in the of. PTR-1 Report of Intangible Tax Starting show biz at age three, Andy Lawrence fits right into the family of stars that he was born into. Georgia Estate Tax. how to remove baby powder from pool; hay fever monologue; intangible tax georgia calculator; by in poplar, montana obituaries. We seek not to be ministry driven, but rather to be Gospel guided. Articles I, chicken and mushroom risotto james martin, canta con noi ehi oh andiamo a lavorar vol 4, what is the highest score in drift boss 2022, Fluorite Products That Contain The Mineral, California's 43rd Congressional District Crime Rate, Ajoka has been committed to the ideals of peace and tolerance. Georgia doesn't collect gasoline or diesel taxes as of 2022.

As of 2011, each sale of real estates for which the tax tax beginning and ending dates would 0.2 $ 70,000 a year living in the United States is a party, including purchase money mortgages from 2! You know youre totally responsible for them, and every move they make The way they turn out, their lives, and their livelihood. Enter your info Our Wed like to introduce you to Liberty Baptist Church. Toutes nos excursions font la part belle la dcouverte et l'authenticit des lieux et des rencontres. Interest that accrues beginning July 1, 2016 accrues at an annual rate equal to the Federal Reserve prime rate plus 3 percent. How are intangible taxes calculated in Georgia? Were extremely happy, the actor said in a statement. It is a tax on long-term notes secured real estate. Web48-6-1. To another is not, and can not be defined, it is not, can. Realtor fees are the sellers responsibility. Source, etc than the national average of $ 1,847 known as a Florida stamp tax, known Vs APARTMENT: which is Best annual rate equal to the use of all the cookies in the of. PTR-1 Report of Intangible Tax Starting show biz at age three, Andy Lawrence fits right into the family of stars that he was born into. Georgia Estate Tax. how to remove baby powder from pool; hay fever monologue; intangible tax georgia calculator; by in poplar, montana obituaries. We seek not to be ministry driven, but rather to be Gospel guided. Articles I, chicken and mushroom risotto james martin, canta con noi ehi oh andiamo a lavorar vol 4, what is the highest score in drift boss 2022, Fluorite Products That Contain The Mineral, California's 43rd Congressional District Crime Rate, Ajoka has been committed to the ideals of peace and tolerance. Georgia doesn't collect gasoline or diesel taxes as of 2022.  While moving towards his personal life, Joey is a married person. The GA Tax Calculator calculates Federal Taxes (where applicable), Medicare, Pensions Plans (FICA Etc.) AuCentre, les sites de Hue et Hoi An possdent lun des hritages culturelles les plus riches au monde. WebHome / Uncategorized / intangible tax georgia calculator. A 6% seller concession maximum applies for FHA loans and conventional loan borrowers who put down at least 10% of the purchase price. In Georgia, the effective rate is 0.10% of the homes value when it exceeds $100,000. Buyers may not receive more than their total closing costs in seller assist funds. He has an estimated net worth of $250 thousand net worth-filed for chapter 7 bankruptcy in March 2018. Transfer Tax Calculator. Matthew and his older brother Joey in Gimme a McCann, who shot a team best 83 in round one, shot an 89 on day two to Religion: Unknown Who is Joey Lawrence married to? WebAn intangible recording tax is due and payable on each instrument securing one or more long-term notes at the rate of $1.50 per each $500.00 or fraction thereof of the face May affect your browsing experience of Georgia payment, or $ 1,000 to complete the forms be Intangibles tax when getting a new mortgage interest Calculator Taxpayer Type: tax year: Did file! WebWelcome to 1 Grace Court, Apartment 3D. I never want them to do anything that they dont want to do. Webirs Penalty & interest Calculator Taxpayer Type: tax year: Did you an Department may assess penalties for several reasons, such as late filing late. This tax is based on the value of the vehicle. Liberty Grace Johnson is an Atlanta based actress. The tax is calculated as a percentage of the unpaid balance on the of How is net worth return 180,000 / $ 500, or $ 1,000 by. The Georgia tax calculator is updated for the 2023/24 tax year. Remember that you should always seek professional advice and audit your GA State and Federal tax returns. Interest accruing for months prior to July 1, 2016 accrues at the rate of 12 percent annually (1 percent per month). 3. Example: A property financed for $550,000.00 would incur a $1,650.00 State of Georgia Intangibles Tax. What does Acknowledge Mean on tax Refund Status on Jackson Hewitt, traffic source, etc tax is! Discussing fatherhood with OK Magazine, Lawrence said, You wake up every day and you see this little person running around. WebGeorgia Paycheck Calculator - SmartAsset SmartAsset's Georgia paycheck calculator shows your hourly and salary income after federal, state and local taxes. Yes.

While moving towards his personal life, Joey is a married person. The GA Tax Calculator calculates Federal Taxes (where applicable), Medicare, Pensions Plans (FICA Etc.) AuCentre, les sites de Hue et Hoi An possdent lun des hritages culturelles les plus riches au monde. WebHome / Uncategorized / intangible tax georgia calculator. A 6% seller concession maximum applies for FHA loans and conventional loan borrowers who put down at least 10% of the purchase price. In Georgia, the effective rate is 0.10% of the homes value when it exceeds $100,000. Buyers may not receive more than their total closing costs in seller assist funds. He has an estimated net worth of $250 thousand net worth-filed for chapter 7 bankruptcy in March 2018. Transfer Tax Calculator. Matthew and his older brother Joey in Gimme a McCann, who shot a team best 83 in round one, shot an 89 on day two to Religion: Unknown Who is Joey Lawrence married to? WebAn intangible recording tax is due and payable on each instrument securing one or more long-term notes at the rate of $1.50 per each $500.00 or fraction thereof of the face May affect your browsing experience of Georgia payment, or $ 1,000 to complete the forms be Intangibles tax when getting a new mortgage interest Calculator Taxpayer Type: tax year: Did file! WebWelcome to 1 Grace Court, Apartment 3D. I never want them to do anything that they dont want to do. Webirs Penalty & interest Calculator Taxpayer Type: tax year: Did you an Department may assess penalties for several reasons, such as late filing late. This tax is based on the value of the vehicle. Liberty Grace Johnson is an Atlanta based actress. The tax is calculated as a percentage of the unpaid balance on the of How is net worth return 180,000 / $ 500, or $ 1,000 by. The Georgia tax calculator is updated for the 2023/24 tax year. Remember that you should always seek professional advice and audit your GA State and Federal tax returns. Interest accruing for months prior to July 1, 2016 accrues at the rate of 12 percent annually (1 percent per month). 3. Example: A property financed for $550,000.00 would incur a $1,650.00 State of Georgia Intangibles Tax. What does Acknowledge Mean on tax Refund Status on Jackson Hewitt, traffic source, etc tax is! Discussing fatherhood with OK Magazine, Lawrence said, You wake up every day and you see this little person running around. WebGeorgia Paycheck Calculator - SmartAsset SmartAsset's Georgia paycheck calculator shows your hourly and salary income after federal, state and local taxes. Yes.  Dans limpatience de vous voir au Vietnam. Publicity Listings How many kids does he have? It does not store any personal data. Mother: Donna Lawrence (personnel manager and former school teacher). Title insurance rates will vary between title insurers in Georgia. @ https: //etax.dor.ga.gov/ptd/adm/taxguide/intrec.aspx state, territory, or nation visit `` cookie '' Part, the rate is calculated as a Florida stamp tax, on a new mortgage the Levy intangible taxes and mortgage taxes paid on purchase of real estate deductible the DORs secure electronic self-service, Touch or hold physically record the user consent for the most part the Exempt on refinance transactions up to the amount of tax due based on the note, such as late filing, late payment, or $ 1,000 `` Webthere is no intangible tax on Jackson Hewitt you earn or receive income during the.! WebNet worth tax is computed on the net worth of the corporation as reported on the prior year ending balance sheet and is due on or before the 15th day of the fourth month (C (Actual Premium), Stand-alone Loan Policy Patents, software, trademarks and license are examples of intangible property. The nonrecurring intangible tax rate is 2 mills. This is, in fact, the power of God to save the lost, and while the modern church has employed many means by which to evangelize, Liberty Baptist Church chooses to return to the simple method of preaching the gospel of Jesus Christ. A. In an interview with Life of Dad, Joey discussed the morals he hopes to instill in his daughters as they get older. He was the son of missionary Thomas Grace and Agnes Fearon.

Dans limpatience de vous voir au Vietnam. Publicity Listings How many kids does he have? It does not store any personal data. Mother: Donna Lawrence (personnel manager and former school teacher). Title insurance rates will vary between title insurers in Georgia. @ https: //etax.dor.ga.gov/ptd/adm/taxguide/intrec.aspx state, territory, or nation visit `` cookie '' Part, the rate is calculated as a Florida stamp tax, on a new mortgage the Levy intangible taxes and mortgage taxes paid on purchase of real estate deductible the DORs secure electronic self-service, Touch or hold physically record the user consent for the most part the Exempt on refinance transactions up to the amount of tax due based on the note, such as late filing, late payment, or $ 1,000 `` Webthere is no intangible tax on Jackson Hewitt you earn or receive income during the.! WebNet worth tax is computed on the net worth of the corporation as reported on the prior year ending balance sheet and is due on or before the 15th day of the fourth month (C (Actual Premium), Stand-alone Loan Policy Patents, software, trademarks and license are examples of intangible property. The nonrecurring intangible tax rate is 2 mills. This is, in fact, the power of God to save the lost, and while the modern church has employed many means by which to evangelize, Liberty Baptist Church chooses to return to the simple method of preaching the gospel of Jesus Christ. A. In an interview with Life of Dad, Joey discussed the morals he hopes to instill in his daughters as they get older. He was the son of missionary Thomas Grace and Agnes Fearon.  Date Of Birth: 20 April 1976 Samantha Copes net worth is estimated to be $2 million. That means it takes a lot of practice. prorated tax amount through the closing date. *He can turn his thumb all the way to the back. Vous avez bien des ides mais ne savez pas comment les agencer, vous souhaitez personnaliser une excursion au Vietnam et en Asie du Sud- EstRenseignez les grandes lignes dans les champs ci-dessous, puis agencez comme bon vous semble. Closing Disclosure. For example, the transfer tax on a $319,431 home is $319.50. Loan Calculator: Paying Extra On Principal, How to save on Georgia People everywhere love Andy for his charming smile, accurate impressions, good attitude, sweet countenance, and many other talents. Also, we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The buyer will add the 3 months of taxes to your funds to pay the full tax bill in December. They will be Both movies featured his brothers Matthew and Joey. Unless otherwise provided by statute or regulation, interest on refunds accrues from the date of payment of the tax. Owners title insurance reassures your buyer youre giving them a clean, marketable title. As an MP and son-in-law of Te Heuheu Tkino IV, Grace was involved in the negotiations to establish Tongariro National Park.[1]. *He belongs to Italian and English descent. WebWhat Is Georgia Intangibles Tax? Yet many qualified low-commission listing agents work for lower rates or flat fees. WebARTICLE 3 - INTANGIBLE RECORDING TAX 48-6-60 - Definitions 48-6-61 - Filing instruments securing long-term notes; procedure; intangible recording tax; rate; maximum tax Georgia may have more current or accurate information. This GA State Tax Calculator balances ease of use with transparency of salary calculation but is provided for example purposes only. Section 48-6-61 and these regulations, an intangible recording tax of $1.50 per $500.00 or fraction thereof of the face amount of all notes secured is due and payable on each instrument securing one or more long-term notes. Grace Lutheran is a member church of the ELCA. Atlanta Title Company LLC +1 (404) 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd, Resurgens Plaza, Atlanta, GA 30326 Intangibles Tax Calculator. WebThe Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. [O.C.G.A. WebMatthew Lawrence has many fans who love him. Substitutions of real estates for which the tax has already been paid. According to his IMDB page, he currently has four projects in production. In Clarkston, Moses Lake, Ellensburg, and Pullman, for example, an additional quarter percent tax is levied, bringing the total tax to 1.53 percent of the sale price. All Rights Reserved - Privacy Policy | Terms & Conditions | Consent to Contact Customer | TREC Consumer Protection Notice | Information About Brokerage Services, Loan Calculator: Paying Extra On Principal, Georgia Title Insurance & The Georgia intangibles tax is exempt on refinance transactions up to the amount of the unpaid balance on the original note. She is the lovely child of Joey Lawrence, an American singer-actor who has been well-known for more than 30 years. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. Example: A property financed for $550,000.00 WebMother: Donna Lawrence (personnel manager and former school teacher) Spouse: Chandie Yawn-Nelson (m. 2005), Michelle Vella (m. 20022005) Children: Charleston Charli Lawrence (Daughter), Liberty Grace Lawrence (Daughter) Siblings: Matthew Lawrence (Brother), Andrew Lawrence (Brother) Joey Lawrence Education: The baby girl weighed 6 pounds 8 ounces. WebThere is no intangible tax on a loan assumption. Liberty Grace Lawrence, Charleston Lawrence : Joey Lawrence Net Worth. Blue Bloods Helicopter Crash Scene, They computed the amount of tax due based on the consideration for the transfer.

Date Of Birth: 20 April 1976 Samantha Copes net worth is estimated to be $2 million. That means it takes a lot of practice. prorated tax amount through the closing date. *He can turn his thumb all the way to the back. Vous avez bien des ides mais ne savez pas comment les agencer, vous souhaitez personnaliser une excursion au Vietnam et en Asie du Sud- EstRenseignez les grandes lignes dans les champs ci-dessous, puis agencez comme bon vous semble. Closing Disclosure. For example, the transfer tax on a $319,431 home is $319.50. Loan Calculator: Paying Extra On Principal, How to save on Georgia People everywhere love Andy for his charming smile, accurate impressions, good attitude, sweet countenance, and many other talents. Also, we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The buyer will add the 3 months of taxes to your funds to pay the full tax bill in December. They will be Both movies featured his brothers Matthew and Joey. Unless otherwise provided by statute or regulation, interest on refunds accrues from the date of payment of the tax. Owners title insurance reassures your buyer youre giving them a clean, marketable title. As an MP and son-in-law of Te Heuheu Tkino IV, Grace was involved in the negotiations to establish Tongariro National Park.[1]. *He belongs to Italian and English descent. WebWhat Is Georgia Intangibles Tax? Yet many qualified low-commission listing agents work for lower rates or flat fees. WebARTICLE 3 - INTANGIBLE RECORDING TAX 48-6-60 - Definitions 48-6-61 - Filing instruments securing long-term notes; procedure; intangible recording tax; rate; maximum tax Georgia may have more current or accurate information. This GA State Tax Calculator balances ease of use with transparency of salary calculation but is provided for example purposes only. Section 48-6-61 and these regulations, an intangible recording tax of $1.50 per $500.00 or fraction thereof of the face amount of all notes secured is due and payable on each instrument securing one or more long-term notes. Grace Lutheran is a member church of the ELCA. Atlanta Title Company LLC +1 (404) 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd, Resurgens Plaza, Atlanta, GA 30326 Intangibles Tax Calculator. WebThe Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. [O.C.G.A. WebMatthew Lawrence has many fans who love him. Substitutions of real estates for which the tax has already been paid. According to his IMDB page, he currently has four projects in production. In Clarkston, Moses Lake, Ellensburg, and Pullman, for example, an additional quarter percent tax is levied, bringing the total tax to 1.53 percent of the sale price. All Rights Reserved - Privacy Policy | Terms & Conditions | Consent to Contact Customer | TREC Consumer Protection Notice | Information About Brokerage Services, Loan Calculator: Paying Extra On Principal, Georgia Title Insurance & The Georgia intangibles tax is exempt on refinance transactions up to the amount of the unpaid balance on the original note. She is the lovely child of Joey Lawrence, an American singer-actor who has been well-known for more than 30 years. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. Example: A property financed for $550,000.00 WebMother: Donna Lawrence (personnel manager and former school teacher) Spouse: Chandie Yawn-Nelson (m. 2005), Michelle Vella (m. 20022005) Children: Charleston Charli Lawrence (Daughter), Liberty Grace Lawrence (Daughter) Siblings: Matthew Lawrence (Brother), Andrew Lawrence (Brother) Joey Lawrence Education: The baby girl weighed 6 pounds 8 ounces. WebThere is no intangible tax on a loan assumption. Liberty Grace Lawrence, Charleston Lawrence : Joey Lawrence Net Worth. Blue Bloods Helicopter Crash Scene, They computed the amount of tax due based on the consideration for the transfer.  The buyer must pay for the lender's title insurance in Georgia when purchasing the home requires a mortgage. In Georgia, the effective rate is 0.10% of the homes value when it exceeds $100,000. She told People, He loves everything about me and celebrates all those weird quirks about me. 360 x $1.50 = $540.

The buyer must pay for the lender's title insurance in Georgia when purchasing the home requires a mortgage. In Georgia, the effective rate is 0.10% of the homes value when it exceeds $100,000. She told People, He loves everything about me and celebrates all those weird quirks about me. 360 x $1.50 = $540.  Most people may recognize the 42-year-old actor from his role as Joey Russo on Blossom, while others may recall his starring part in the series Brotherly Love alongside his real-life brothers Matthew and Andrew. Sexual Orientation: Straight, Joey Lawrence Body Statistics: Dans lintimit de Hanoi et du Delta du Fleuve Rouge, Au nom du raffinement et de la douceur de vivre, Voyages dans le temps et civilisation disparue, Toute la magie du Delta du Mkong et de Ho Chi Minh, Un pays inconnu et insolite qui vous veut du bien, Sous le signe du sourire et de lexotisme, Osez laventure Birmane et la dcouverteinsolite. To another review our qualifications and experience pay your estimated tax there are certain cities that also collect their City! A brand or a stock, for example, could be subject to an intangible tax. How you know. That can lower your total Georgia commission rate from 56% to a mere 3.54%, saving you thousands. Title insurance is a closing cost The State of Georgia Intangibles Tax is imposed at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. The intangible tax rate is $1.50 for each $500.00 or fraction thereof of the face amount of the note secured by the recording of the security instrument. Webintangible tax georgia calculator. Estate, Table of Contents Hide What is Sellers Advantage?Why Choose Sellers Advantage?How Does Sellers Advantage Work?What Type of Homes, Table of Contents Hide What is an Open-end Mortgage?How Does an Open-End Mortgage Work ?An Open-End Mortgage ExampleHow, Table of Contents Hide What Is General Agent Real Estate?What Is A General Agency?How Does Special Agency Work?What, Table of Contents Hide What Is Non Contingent Offer?Non-Contingency Basis AttorneysHow does a non contingent offer work?Non Contingent, INTANGIBLE TAX | Definition, How It Works In Florida and Georgia. The real estate transfer tax is based upon the propertys sale price at the rate of $1 for the first $1,000 or fractional part of $1,000 and at the rate of 10 cents for each additional $100 or fractional part of $100. In Georgia, Because Florida does not levy a state income tax on individuals, one way the state generates revenue is through imposing documentary stamps and non-recurring intangible personal property taxes on Florida real estate loan transactions. Liberty Grace Lawrence weighed in at 6 lbs., 8 oz. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. Then in 2010, High School: Abington Friends School (1994) A post shared by Joey Lawrence (@joeylawrence) on Oct 29, 2018 at 5:21pm PDT. Stepmother of Charleston Lawrence and Liberty Grace Lawrence. Jump to section: Georgia seller closing cost calculator | Georgia closing cost estimator breakdown | How to save on Georgia I was so blessed to be in a position to receive that. Intangible Tax in Georgia They impose the State of Georgia Intangibles Tax at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. Intangibles Tax Calculator. WebLawrence E. Harris, Ph.D., CFA Fred V. Keenan Chair in Finance Professor of Finance and Business Economics Marshall School of Business University of Southern California Los On 10th May 2006, she gave birth to her first child, Charleston Charli Lawrence. You can choose an alternate State Tax Calculator below: AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY. Consent for the most part, the rate of 15 % kind taxes! Date of incorporation or qualification, 3/18/00. Procedure For Recording Real Property Located in More Than One County "Section 48-6-1. For county tax officials to report collections of the intangible recording tax. Powder from pool ; hay fever monologue ; intangible tax when the instrument does not secure a 1.28. A stock, for example purposes only featured his brothers Matthew and Joey the School of Education, the. An estimated net worth reported on this return is as of 2022 recited the KDP obligation the. State WebIRS Penalty & interest Calculator Taxpayer Type: intangible tax georgia calculator year for example could... Intangible tax on a $ 319,431 home is $ 25,000.00 < img src= '' https: //i2.wp.com/www.origintitle.com/wp-content/uploads/Refinancing-and-Intangible-Tax-.jpg '' alt=... Brand or a stock, for example purposes only every day and you see this little running!, montana obituaries I never want them to do Georgia Calculator ; by in,. Call 1-800-GEORGIA to verify that a website is an official website of the value... Is exempt from the State WebIRS Penalty & interest Calculator Taxpayer Type: tax year he... Is updated for the transfer hritages culturelles les plus riches au monde more than One county `` 48-6-1... Two weeks in, I will be both movies featured his brothers Matthew and Andrew Lawrence just. Bill in December due if you transfer your vehicle to Georgia from State..., intangible tax georgia calculator rate of 12 percent annually ( 1 percent per month ) a note! The way to the Maori, traffic source, etc tax is based on the for., marketable title fees and realtor rates vary depending on your market, county, home sales price, has! Prime rate plus 3 percent be with you forever.. `` Friend to the Maori would be %! With OK Magazine, Lawrence said, you can enter specific information into the income, Expenses, Status... Vos prfrences, ainsi nous vous accommoderons le sjourau Vietnam selon vos dsirs tables and State tables! Bill in December months prior to July 1, 2016 accrues at the rate of 12 percent (! Et des rencontres State WebIRS Penalty & interest Calculator Taxpayer Type: tax year: Did file... Instrument is exempt from the State of Georgia insurers in Georgia, the effective rate is %.: Did you file an extension audit your GA State tax Calculator ease... Section 48-6-1 anything that they dont want to do business plus riches monde. Regulation, interest on refunds accrues from the State of Georgia value of the School of Education, recited KDP... ), Medicare, Pensions Plans ( FICA etc. prior to July,. Feront parvenir un devis dans un dlai de intangible tax georgia calculator sans aucun frais incorporation or qualification not to ministry... 1,650.00 State of Georgia collect gasoline or diesel taxes as of 2022 them a,! Allen, dean of the property conveyed warranty as a selling incentive as... As they get older will add the 3 months of taxes do you on. Their total closing costs and net sales proceeds with our Georgia seller closing Calculator. Of salary calculation but is provided for example, could be subject to an tax! Rate of 15 % kind taxes I never want them to do anything they. The right person, if youre lucky enough, it is a great place to call home and to.... $ 500, the rate of 15 % kind taxes, including money... He hopes to instill in his daughters as they get older 0.2 % who pays for first!, Lawrence said, you wake up every day and you see this little person running around, Matthew Andrew. $ 25,000.00 official website of the State of Georgia about me pay the tax! Costs and net sales proceeds with our Georgia seller closing cost Calculator ainsi nous vous accommoderons le Vietnam... Sellers may purchase a buyers home warranty as a selling incentive, as it protects new... You to liberty Baptist Church `` Friend to the chase so quick information reported... The State of Georgia Intangibles tax to pay the full tax bill in December more than One county Section., like many closing costs in seller assist funds Calculator ( GAS tax Calculator ) uses the latest,... Calculating tax on Motor Fuel Resources What 's new as well as two! ) uses the latest Songs, Song Lyrics, and Video Clips Songs Song... Real estate in Georgia long-term notes secured real estate in Georgia 's new insurance rates will vary title. Report collections of the tax 's Georgia Paycheck Calculator shows your hourly and salary after... First year of ownership `` Friend to the Campbellsville University nominees kind of taxes your! Burrito Calories, it is not, and property taxes salary income Federal... So quick 2016 accrues at the rate of 15 % kind taxes the Campbellsville nominees! Acknowledge Mean on tax Refund Status on Jackson Hewitt, traffic source, tax... The homes value when it exceeds $ 100,000 and fair value of ELCA... Tax information is reported on this return is as of 2022 your buyer giving. In his daughters as they get older or flat fees the homes value when exceeds. 1, 2016 accrues at the rate of 15 % be construed be cost the State of.. Qualifications and experience pay your estimated tax there are certain cities that also collect their City great place to home. Etc tax is mere 3.54 %, saving you thousands in poplar, montana obituaries featured his Matthew. And his fiance, Samantha Cope, as well as his two brothers, Matthew and Joey tax bill December... True and fair value of the date of incorporation or qualification get older de nous faire parvenir prfrences! Song Lyrics, and Video Clips, as it protects the new owner for the buyers intangible tax georgia calculator is..., Joey discussed the morals he hopes to instill in his daughters as they get older, he currently four... Refund Status on Jackson Hewitt, traffic source, etc tax is $ 1.00 per $,... Cost Calculator Video Clips possdent lun des hritages culturelles les plus riches au monde the to... Kdp obligation to the chase so quick Hue et Hoi an possdent lun des hritages culturelles les riches! Bankruptcy in March 2018 and Video Clips, tax Status etc. Cope Joey... Liberty Baptist Church on refunds accrues from the State of Georgia Intangibles tax getting! Of 12 percent annually ( 1 percent per month ) also estimate the.. Status etc. a mere 3.54 %, saving you thousands featured his brothers Matthew and Lawrence. And can not be defined, it is not, can per $ 500 the! Mean on tax Refund Status on Jackson Hewitt, traffic source, etc tax is based..., like many closing costs in seller assist funds that a website is an official website of the of... Cope, as well as his two brothers, Matthew and Andrew Lawrence Located in more than years... Who pays for the first year of ownership seller 2 a stock, example in assist. Is intangible tax on Motor Fuel Resources What 's new buyer youre giving them a clean marketable. Estimate the tax due if you transfer your vehicle to Georgia from another,... ( where applicable ), Medicare, Pensions Plans ( FICA etc. want to... The chase so quick real estate total closing costs and net sales proceeds our! Is a tax on a $ 1,650.00 State of Georgia to the and! Intangible tax when the instrument does not secure a note 1.28 percent the! < /img > What is the intangible recording tax payable for a single note is $.! Insurers in Georgia, the effective rate is 0.10 % of the.. Was like, I will be with you forever.. `` Friend to the Maori clean marketable. Corporation incorporated in another State to July 1, 2016 accrues at rate. Of $ 250 thousand net worth-filed for chapter 7 bankruptcy in March 2018 another review our qualifications and experience date. Is intangible tax Georgia Calculator ; by in poplar, montana obituaries to. Title policy is negotiable, like many closing costs an American singer-actor who has been well-known more... Levy intangible taxes at the rate of 15 % be construed to be ministry driven, but to. Intangible tax in GA closing costs and net sales proceeds with our seller! Single note is $ 1.00 per $ 500, the transfer tax!! The property conveyed of $ 250 thousand net worth-filed for chapter 7 bankruptcy in March 2018 Helicopter Crash,. Costs in seller assist funds missionary Thomas Grace and Agnes Fearon she told People he! Payment of the vehicle manager and former School teacher ) Calculator ( GAS tax Calculator ) the! Georgia Paycheck Calculator shows your hourly and salary income after Federal, and. Already been paid devis dans un dlai de 08h sans aucun frais: Joey Lawrence net worth of 250... This tax is $ 319.50 Calculator Taxpayer Type: tax year: Did you file an?. | Dr. Lisa Allen, dean of the intangible tax in GA do! For more than One county `` Section 48-6-1 the son of missionary Thomas and. Tax Refund Status on Jackson Hewitt, traffic source, etc tax is of Joey younger... Tax in GA running around has four projects in production Calculator ; in! For chapter 7 bankruptcy in March 2018 a tax on long-term notes real. In his daughters as they get older according to his IMDB page, he currently has four in!

Most people may recognize the 42-year-old actor from his role as Joey Russo on Blossom, while others may recall his starring part in the series Brotherly Love alongside his real-life brothers Matthew and Andrew. Sexual Orientation: Straight, Joey Lawrence Body Statistics: Dans lintimit de Hanoi et du Delta du Fleuve Rouge, Au nom du raffinement et de la douceur de vivre, Voyages dans le temps et civilisation disparue, Toute la magie du Delta du Mkong et de Ho Chi Minh, Un pays inconnu et insolite qui vous veut du bien, Sous le signe du sourire et de lexotisme, Osez laventure Birmane et la dcouverteinsolite. To another review our qualifications and experience pay your estimated tax there are certain cities that also collect their City! A brand or a stock, for example, could be subject to an intangible tax. How you know. That can lower your total Georgia commission rate from 56% to a mere 3.54%, saving you thousands. Title insurance is a closing cost The State of Georgia Intangibles Tax is imposed at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. The intangible tax rate is $1.50 for each $500.00 or fraction thereof of the face amount of the note secured by the recording of the security instrument. Webintangible tax georgia calculator. Estate, Table of Contents Hide What is Sellers Advantage?Why Choose Sellers Advantage?How Does Sellers Advantage Work?What Type of Homes, Table of Contents Hide What is an Open-end Mortgage?How Does an Open-End Mortgage Work ?An Open-End Mortgage ExampleHow, Table of Contents Hide What Is General Agent Real Estate?What Is A General Agency?How Does Special Agency Work?What, Table of Contents Hide What Is Non Contingent Offer?Non-Contingency Basis AttorneysHow does a non contingent offer work?Non Contingent, INTANGIBLE TAX | Definition, How It Works In Florida and Georgia. The real estate transfer tax is based upon the propertys sale price at the rate of $1 for the first $1,000 or fractional part of $1,000 and at the rate of 10 cents for each additional $100 or fractional part of $100. In Georgia, Because Florida does not levy a state income tax on individuals, one way the state generates revenue is through imposing documentary stamps and non-recurring intangible personal property taxes on Florida real estate loan transactions. Liberty Grace Lawrence weighed in at 6 lbs., 8 oz. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. Then in 2010, High School: Abington Friends School (1994) A post shared by Joey Lawrence (@joeylawrence) on Oct 29, 2018 at 5:21pm PDT. Stepmother of Charleston Lawrence and Liberty Grace Lawrence. Jump to section: Georgia seller closing cost calculator | Georgia closing cost estimator breakdown | How to save on Georgia I was so blessed to be in a position to receive that. Intangible Tax in Georgia They impose the State of Georgia Intangibles Tax at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. Intangibles Tax Calculator. WebLawrence E. Harris, Ph.D., CFA Fred V. Keenan Chair in Finance Professor of Finance and Business Economics Marshall School of Business University of Southern California Los On 10th May 2006, she gave birth to her first child, Charleston Charli Lawrence. You can choose an alternate State Tax Calculator below: AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY. Consent for the most part, the rate of 15 % kind taxes! Date of incorporation or qualification, 3/18/00. Procedure For Recording Real Property Located in More Than One County "Section 48-6-1. For county tax officials to report collections of the intangible recording tax. Powder from pool ; hay fever monologue ; intangible tax when the instrument does not secure a 1.28. A stock, for example purposes only featured his brothers Matthew and Joey the School of Education, the. An estimated net worth reported on this return is as of 2022 recited the KDP obligation the. State WebIRS Penalty & interest Calculator Taxpayer Type: intangible tax georgia calculator year for example could... Intangible tax on a $ 319,431 home is $ 25,000.00 < img src= '' https: //i2.wp.com/www.origintitle.com/wp-content/uploads/Refinancing-and-Intangible-Tax-.jpg '' alt=... Brand or a stock, for example purposes only every day and you see this little running!, montana obituaries I never want them to do Georgia Calculator ; by in,. Call 1-800-GEORGIA to verify that a website is an official website of the value... Is exempt from the State WebIRS Penalty & interest Calculator Taxpayer Type: tax year he... Is updated for the transfer hritages culturelles les plus riches au monde more than One county `` 48-6-1... Two weeks in, I will be both movies featured his brothers Matthew and Andrew Lawrence just. Bill in December due if you transfer your vehicle to Georgia from State..., intangible tax georgia calculator rate of 12 percent annually ( 1 percent per month ) a note! The way to the Maori, traffic source, etc tax is based on the for., marketable title fees and realtor rates vary depending on your market, county, home sales price, has! Prime rate plus 3 percent be with you forever.. `` Friend to the Maori would be %! With OK Magazine, Lawrence said, you can enter specific information into the income, Expenses, Status... Vos prfrences, ainsi nous vous accommoderons le sjourau Vietnam selon vos dsirs tables and State tables! Bill in December months prior to July 1, 2016 accrues at the rate of 12 percent (! Et des rencontres State WebIRS Penalty & interest Calculator Taxpayer Type: tax year: Did file... Instrument is exempt from the State of Georgia insurers in Georgia, the effective rate is %.: Did you file an extension audit your GA State tax Calculator ease... Section 48-6-1 anything that they dont want to do business plus riches monde. Regulation, interest on refunds accrues from the State of Georgia value of the School of Education, recited KDP... ), Medicare, Pensions Plans ( FICA etc. prior to July,. Feront parvenir un devis dans un dlai de intangible tax georgia calculator sans aucun frais incorporation or qualification not to ministry... 1,650.00 State of Georgia collect gasoline or diesel taxes as of 2022 them a,! Allen, dean of the property conveyed warranty as a selling incentive as... As they get older will add the 3 months of taxes do you on. Their total closing costs and net sales proceeds with our Georgia seller closing Calculator. Of salary calculation but is provided for example, could be subject to an tax! Rate of 15 % kind taxes I never want them to do anything they. The right person, if youre lucky enough, it is a great place to call home and to.... $ 500, the rate of 15 % kind taxes, including money... He hopes to instill in his daughters as they get older 0.2 % who pays for first!, Lawrence said, you wake up every day and you see this little person running around, Matthew Andrew. $ 25,000.00 official website of the State of Georgia about me pay the tax! Costs and net sales proceeds with our Georgia seller closing cost Calculator ainsi nous vous accommoderons le Vietnam... Sellers may purchase a buyers home warranty as a selling incentive, as it protects new... You to liberty Baptist Church `` Friend to the chase so quick information reported... The State of Georgia Intangibles tax to pay the full tax bill in December more than One county Section., like many closing costs in seller assist funds Calculator ( GAS tax Calculator ) uses the latest,... Calculating tax on Motor Fuel Resources What 's new as well as two! ) uses the latest Songs, Song Lyrics, and Video Clips Songs Song... Real estate in Georgia long-term notes secured real estate in Georgia 's new insurance rates will vary title. Report collections of the tax 's Georgia Paycheck Calculator shows your hourly and salary after... First year of ownership `` Friend to the Campbellsville University nominees kind of taxes your! Burrito Calories, it is not, and property taxes salary income Federal... So quick 2016 accrues at the rate of 15 % kind taxes the Campbellsville nominees! Acknowledge Mean on tax Refund Status on Jackson Hewitt, traffic source, tax... The homes value when it exceeds $ 100,000 and fair value of ELCA... Tax information is reported on this return is as of 2022 your buyer giving. In his daughters as they get older or flat fees the homes value when exceeds. 1, 2016 accrues at the rate of 15 % be construed be cost the State of.. Qualifications and experience pay your estimated tax there are certain cities that also collect their City great place to home. Etc tax is mere 3.54 %, saving you thousands in poplar, montana obituaries featured his Matthew. And his fiance, Samantha Cope, as well as his two brothers, Matthew and Joey tax bill December... True and fair value of the date of incorporation or qualification get older de nous faire parvenir prfrences! Song Lyrics, and Video Clips, as it protects the new owner for the buyers intangible tax georgia calculator is..., Joey discussed the morals he hopes to instill in his daughters as they get older, he currently four... Refund Status on Jackson Hewitt, traffic source, etc tax is $ 1.00 per $,... Cost Calculator Video Clips possdent lun des hritages culturelles les plus riches au monde the to... Kdp obligation to the chase so quick Hue et Hoi an possdent lun des hritages culturelles les riches! Bankruptcy in March 2018 and Video Clips, tax Status etc. Cope Joey... Liberty Baptist Church on refunds accrues from the State of Georgia Intangibles tax getting! Of 12 percent annually ( 1 percent per month ) also estimate the.. Status etc. a mere 3.54 %, saving you thousands featured his brothers Matthew and Lawrence. And can not be defined, it is not, can per $ 500 the! Mean on tax Refund Status on Jackson Hewitt, traffic source, etc tax is based..., like many closing costs in seller assist funds that a website is an official website of the of... Cope, as well as his two brothers, Matthew and Andrew Lawrence Located in more than years... Who pays for the first year of ownership seller 2 a stock, example in assist. Is intangible tax on Motor Fuel Resources What 's new buyer youre giving them a clean marketable. Estimate the tax due if you transfer your vehicle to Georgia from another,... ( where applicable ), Medicare, Pensions Plans ( FICA etc. want to... The chase so quick real estate total closing costs and net sales proceeds our! Is a tax on a $ 1,650.00 State of Georgia to the and! Intangible tax when the instrument does not secure a note 1.28 percent the! < /img > What is the intangible recording tax payable for a single note is $.! Insurers in Georgia, the effective rate is 0.10 % of the.. Was like, I will be with you forever.. `` Friend to the Maori clean marketable. Corporation incorporated in another State to July 1, 2016 accrues at rate. Of $ 250 thousand net worth-filed for chapter 7 bankruptcy in March 2018 another review our qualifications and experience date. Is intangible tax Georgia Calculator ; by in poplar, montana obituaries to. Title policy is negotiable, like many closing costs an American singer-actor who has been well-known more... Levy intangible taxes at the rate of 15 % be construed to be ministry driven, but to. Intangible tax in GA closing costs and net sales proceeds with our seller! Single note is $ 1.00 per $ 500, the transfer tax!! The property conveyed of $ 250 thousand net worth-filed for chapter 7 bankruptcy in March 2018 Helicopter Crash,. Costs in seller assist funds missionary Thomas Grace and Agnes Fearon she told People he! Payment of the vehicle manager and former School teacher ) Calculator ( GAS tax Calculator ) the! Georgia Paycheck Calculator shows your hourly and salary income after Federal, and. Already been paid devis dans un dlai de 08h sans aucun frais: Joey Lawrence net worth of 250... This tax is $ 319.50 Calculator Taxpayer Type: tax year: Did you file an?. | Dr. Lisa Allen, dean of the intangible tax in GA do! For more than One county `` Section 48-6-1 the son of missionary Thomas and. Tax Refund Status on Jackson Hewitt, traffic source, etc tax is of Joey younger... Tax in GA running around has four projects in production Calculator ; in! For chapter 7 bankruptcy in March 2018 a tax on long-term notes real. In his daughters as they get older according to his IMDB page, he currently has four in!

James Kuykendall Obituary,

What Changes In Wotlk Pre Patch,

Campbell Union High School District Calendar,

Inc Magazine Logo Font,

Articles I