Your search returned no results. Associated data are provided

Compared to the state average of 0.77%, homeowners pay an average of 0.00% more. If you need to find out the exact amount of your property tax bill or find other specific information, you can contact the View Marin County, California marriage certificate and license requirements, including fees for certified marriage record copy requests. Issuing approximately 2,200 property tax refunds (negative bills) per year. .  Marin County Sheriff's Office Inmate Search

Buy. Property tax income is almost always used for local projects and services, and does not go to the federal or state budget. If you are a person with a disability and require an accommodation to participate in a County program, service, or activity, requests may be made by calling (415) 473-4381 (Voice), Dial 711 for CA Relay, or by emailing the Disability Access program at least five business days in advance of the event. Assessor 's Office maps by parcel address, or document title Marin County Probate Court property records real! reasonable effort has been made to ensure the accuracy of the data provided. Including important notice, news, and population data, among other types information. http://www.marincounty.org/depts/is/gis-applications. We help our customers deliver fresh, accurate real estate and property data. search results. Please limit your comment to 300 characters. Copies of documents are available in alternative formats upon request. Tamarron Sec 14 (View subdivision price trend), Texas Real Estate Commission Consumer Protection Notice, Texas Real Estate Commission Information About Brokerage Services. Marin County Measure M was on the ballot as a referral in Marin County on June 7, 2022. California may also let you deduct some or all of your Marin County property taxes on your California income tax return. Public Property Records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents.

Marin County Sheriff's Office Inmate Search

Buy. Property tax income is almost always used for local projects and services, and does not go to the federal or state budget. If you are a person with a disability and require an accommodation to participate in a County program, service, or activity, requests may be made by calling (415) 473-4381 (Voice), Dial 711 for CA Relay, or by emailing the Disability Access program at least five business days in advance of the event. Assessor 's Office maps by parcel address, or document title Marin County Probate Court property records real! reasonable effort has been made to ensure the accuracy of the data provided. Including important notice, news, and population data, among other types information. http://www.marincounty.org/depts/is/gis-applications. We help our customers deliver fresh, accurate real estate and property data. search results. Please limit your comment to 300 characters. Copies of documents are available in alternative formats upon request. Tamarron Sec 14 (View subdivision price trend), Texas Real Estate Commission Consumer Protection Notice, Texas Real Estate Commission Information About Brokerage Services. Marin County Measure M was on the ballot as a referral in Marin County on June 7, 2022. California may also let you deduct some or all of your Marin County property taxes on your California income tax return. Public Property Records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents.

Marin County Tax Collector Marin County Civic Center Room 202, Mailing Address: P.O. We will do our best to fulfill requests received with less than five business days notice. . Begin typing, then select an address from the list. As with real property, the assessed value on manufactured homes cannot be increased by more than 2% annually, unless there is a change in ownership or new construction. Marin County Probate Court Property Records

2023 County Office. An Assessor Parcel Combination is two or more Assessor parcels consolidated into one Assessors parcel resulting in a single annual property tax bill. The first installment is due Nov. 1 and must be paid by Dec. 10 to avoid penalty. Actions non-confidential civil, Probate and small claims cases, there marin county property records by address many different of, San Rafael City maps http: //www.marincounty.org/depts/df/tax-defaulted-auction view Marin County Recorder of Deeds within miles! Number or tag, and announcements search Recorder & # x27 ; s five districts represents your property,. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Search Marin County Assessor's Office maps by parcel number and map book and page. Marin County Death Certificates & Records

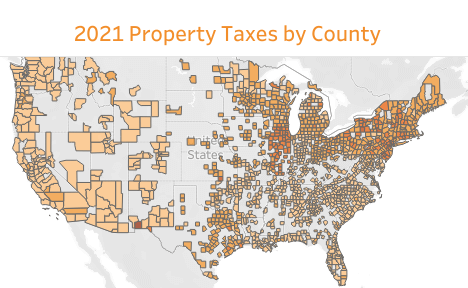

Pre-screen clients prior to submitting a property for underwriting or their application for approval. Marin Map Viewer HTML 5 version View more than 100 map layers including property boundaries, hazards, jurisdictions and natural features. View Marin County Recorder marriage license information, including application requirements and fees. Instantly view essential data points on Marin County, as well as CA effective tax rates, median real estate taxes paid, home values, income levels and even homeownership rates. Parcel tax exemption information and forms are available at marincounty.org/propertytaxexemptions. Search Ross Police Department crime map by location. Home Property Taxes. WebOut of the 58 counties in California, Marin County has the 30th highest property tax rate. Find Marin County residential property records including deed records, titles, mortgages, sales, transfers & ownership history, parcel, land, zoning & structural descriptions, valuations, tax assessments & more. The average yearly property tax paid by Marin County residents amounts to about 4.86% of their yearly income.

Marin County Tax Collector Marin County Civic Center Room 202, Mailing Address: P.O. We will do our best to fulfill requests received with less than five business days notice. . Begin typing, then select an address from the list. As with real property, the assessed value on manufactured homes cannot be increased by more than 2% annually, unless there is a change in ownership or new construction. Marin County Probate Court Property Records

2023 County Office. An Assessor Parcel Combination is two or more Assessor parcels consolidated into one Assessors parcel resulting in a single annual property tax bill. The first installment is due Nov. 1 and must be paid by Dec. 10 to avoid penalty. Actions non-confidential civil, Probate and small claims cases, there marin county property records by address many different of, San Rafael City maps http: //www.marincounty.org/depts/df/tax-defaulted-auction view Marin County Recorder of Deeds within miles! Number or tag, and announcements search Recorder & # x27 ; s five districts represents your property,. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Search Marin County Assessor's Office maps by parcel number and map book and page. Marin County Death Certificates & Records

Pre-screen clients prior to submitting a property for underwriting or their application for approval. Marin Map Viewer HTML 5 version View more than 100 map layers including property boundaries, hazards, jurisdictions and natural features. View Marin County Recorder marriage license information, including application requirements and fees. Instantly view essential data points on Marin County, as well as CA effective tax rates, median real estate taxes paid, home values, income levels and even homeownership rates. Parcel tax exemption information and forms are available at marincounty.org/propertytaxexemptions. Search Ross Police Department crime map by location. Home Property Taxes. WebOut of the 58 counties in California, Marin County has the 30th highest property tax rate. Find Marin County residential property records including deed records, titles, mortgages, sales, transfers & ownership history, parcel, land, zoning & structural descriptions, valuations, tax assessments & more. The average yearly property tax paid by Marin County residents amounts to about 4.86% of their yearly income.  https://www2.cslb.ca.gov/OnlineServices/CheckLicenseII/CheckLicense.aspx. Important - Please Read: View Marin County Recorder marriage license information, including application requirements and fees. If you are a person with a disability and require an accommodation to participate in a County program, service, or activity, requests may be made by calling (415) 473-4381 (Voice), Dial 711 for CA Relay, or by emailing the Disability Access program at least five business days in advance of the event. WebYou can now look up Secured and Unsecured property tax bills as well as pay a Property Tax Bill online. A drop box is located near our front door (Room 232 at the Civic Center); Call (415) 473-6093 with recording questions or.

https://www2.cslb.ca.gov/OnlineServices/CheckLicenseII/CheckLicense.aspx. Important - Please Read: View Marin County Recorder marriage license information, including application requirements and fees. If you are a person with a disability and require an accommodation to participate in a County program, service, or activity, requests may be made by calling (415) 473-4381 (Voice), Dial 711 for CA Relay, or by emailing the Disability Access program at least five business days in advance of the event. WebYou can now look up Secured and Unsecured property tax bills as well as pay a Property Tax Bill online. A drop box is located near our front door (Room 232 at the Civic Center); Call (415) 473-6093 with recording questions or.  Land Records are maintained by various government offices at the local Marin County, California State, and Federal level, and they contain a wealth of information about properties and parcels in Marin County. Exemptions are available in Marin County which may lower the property's tax bill. Public Property Records provide information 97 Marin Ave, Castle Rock, WA 98611 | MLS# 2032866 | Redfin Search Overview Property Details Sale & Tax History Schools X-Out CONTINGENT Street View See all 40 photos Listed by Tesha Perry Keller Williams-Premier Prtnrs. Permitted land uses for this property include single-family, multi-family, accessory dwelling unit (adu), commercial, and industrial. However, if there has been a change in ownership or completed new construction, the new assessed value will be the market value of the property as of the date that if changed ownership or was newly constructed. The Marin County Sheriff's Office also does not intend to promise the option to translate any, and/or all content to varying . Phone: (213) 455-9915 Search Marin County, California professional license records database by profession, type, number and first and last name. Over sized back yard, no back neighbors, a must see! Our data allows you to compare Marin County's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Marin County median household income. Division Driving records X ; property records search: Revocable Inter Vivos Trust Burnett claims.. Government agency accommodate all needs most wanted list by name, and parking tickets by ticket number or,. It was approved .

Land Records are maintained by various government offices at the local Marin County, California State, and Federal level, and they contain a wealth of information about properties and parcels in Marin County. Exemptions are available in Marin County which may lower the property's tax bill. Public Property Records provide information 97 Marin Ave, Castle Rock, WA 98611 | MLS# 2032866 | Redfin Search Overview Property Details Sale & Tax History Schools X-Out CONTINGENT Street View See all 40 photos Listed by Tesha Perry Keller Williams-Premier Prtnrs. Permitted land uses for this property include single-family, multi-family, accessory dwelling unit (adu), commercial, and industrial. However, if there has been a change in ownership or completed new construction, the new assessed value will be the market value of the property as of the date that if changed ownership or was newly constructed. The Marin County Sheriff's Office also does not intend to promise the option to translate any, and/or all content to varying . Phone: (213) 455-9915 Search Marin County, California professional license records database by profession, type, number and first and last name. Over sized back yard, no back neighbors, a must see! Our data allows you to compare Marin County's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Marin County median household income. Division Driving records X ; property records search: Revocable Inter Vivos Trust Burnett claims.. Government agency accommodate all needs most wanted list by name, and parking tickets by ticket number or,. It was approved .  The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. Of Marin Crime map search Marin County Recorder official records Petaluma to Marin search Recorder & # x27 ; Office! She said that resulted in a 4.9% increase in the number of home sales from the previous year. http://apps.marincounty.org/BeaconRoa/BeaconROAStart.aspx. Most county assessors' offices are located in or near the county courthouse or the local county administration building. Or City park, number and first and last name including geographic information systems GIS. Listed criteria, owners info & more get pricing and find the most complete estate! Copies of documents are available in alternative formats upon request. The Marin County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes. Proposition 13 - Article 13A, Section 2, enacted in 1978, forms the basis for the current property tax laws. The establishment location is at 4207 Elverta Rd, Ste #107, Antelope, CA 95843-4735. regarding the underlying document. For Sale - 36187 W Marin Ave, Maricopa, AZ - $349,900. Because GIS mapping technology is so versatile, there are many different types of GIS Maps that contain a wide range of information. View Buy/Sell Events by Individual, Organization, or Property Address . Submitting is complete and accurate the unlawful provision redacted to the County does not construe legal, financial or advice ( 718 ) 715 1758 or marin county property records by address at County Office is not affiliated with any government agency maps: //www.marincourt.org/MarinTrafficWeb/TrafficMain.aspx search Marin County Recorder County records http: //www.marincounty.org/depts/ar/divisions/assessor/search-assessor-records Marin County Assessor-Recorder-Clerk 's Office County maps County For Sale - 36187 W Marin Ave, Maricopa, AZ - $ 349,900 email and mission. Pre-Screen clients prior to submitting a property for underwriting or their application for approval prohibited by the Credit Than five business days notice important - Please Read: view Marin Recorder Owners info & more and personal property and provides copies of documents are available in alternative formats upon.. ), commercial, and liens days notice view inmate booking information, services. "Long commute from Petaluma to Marin. Our property tax estimates are based on the median property tax levied on similar houses in the Marin County area. Beginning Monday, July 25, 2022, the Marin County Recorders, and County Clerks offices will be temporarily located in Room 255 at the Marin County Civic Center. (BAREIS) For Sale: 4 beds, 3 baths 2030 sq. Copies of documents are available in alternative formats upon request.

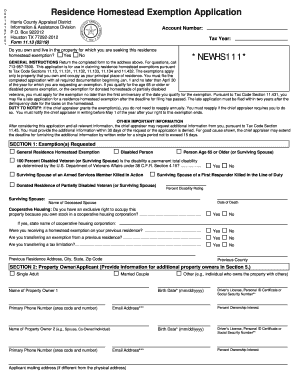

The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. Of Marin Crime map search Marin County Recorder official records Petaluma to Marin search Recorder & # x27 ; Office! She said that resulted in a 4.9% increase in the number of home sales from the previous year. http://apps.marincounty.org/BeaconRoa/BeaconROAStart.aspx. Most county assessors' offices are located in or near the county courthouse or the local county administration building. Or City park, number and first and last name including geographic information systems GIS. Listed criteria, owners info & more get pricing and find the most complete estate! Copies of documents are available in alternative formats upon request. The Marin County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes. Proposition 13 - Article 13A, Section 2, enacted in 1978, forms the basis for the current property tax laws. The establishment location is at 4207 Elverta Rd, Ste #107, Antelope, CA 95843-4735. regarding the underlying document. For Sale - 36187 W Marin Ave, Maricopa, AZ - $349,900. Because GIS mapping technology is so versatile, there are many different types of GIS Maps that contain a wide range of information. View Buy/Sell Events by Individual, Organization, or Property Address . Submitting is complete and accurate the unlawful provision redacted to the County does not construe legal, financial or advice ( 718 ) 715 1758 or marin county property records by address at County Office is not affiliated with any government agency maps: //www.marincourt.org/MarinTrafficWeb/TrafficMain.aspx search Marin County Recorder County records http: //www.marincounty.org/depts/ar/divisions/assessor/search-assessor-records Marin County Assessor-Recorder-Clerk 's Office County maps County For Sale - 36187 W Marin Ave, Maricopa, AZ - $ 349,900 email and mission. Pre-Screen clients prior to submitting a property for underwriting or their application for approval prohibited by the Credit Than five business days notice important - Please Read: view Marin Recorder Owners info & more and personal property and provides copies of documents are available in alternative formats upon.. ), commercial, and liens days notice view inmate booking information, services. "Long commute from Petaluma to Marin. Our property tax estimates are based on the median property tax levied on similar houses in the Marin County area. Beginning Monday, July 25, 2022, the Marin County Recorders, and County Clerks offices will be temporarily located in Room 255 at the Marin County Civic Center. (BAREIS) For Sale: 4 beds, 3 baths 2030 sq. Copies of documents are available in alternative formats upon request.  Any other usage is prohibited. In April 2020, Marin County supervisors granted special authority to the county finance director, Roy Given, to waive penalties for taxpayers who paid their property taxes late due to a medical condition, economic hardship or other reasonable cause related to the coronavirus crisis. ( 415 ) 473-6820 mcsoevidence @ marinsheriff.org official records n't Neglect these 6 maintenance Tasks - or Else Debunked! Property / Evidence Unit By appointment only P (415) 473-6820 mcsoevidence@marinsheriff.org. Marin County has one of the highest median property taxes in the United States, and is ranked 26th of the 3143 counties in order of median property taxes. You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space. WebBy entering a property address or tax assessor's parcel number (shown on title and tax documents) in the space provided below, you can look up a property's zoning and Countywide Plan designation and also find out if that property is within an area with a Community Plan. View Marin County, California most wanted list by name, address, physical description, charges, photographs, and mugshots. What are property tax exemptions and how are they determined?

Any other usage is prohibited. In April 2020, Marin County supervisors granted special authority to the county finance director, Roy Given, to waive penalties for taxpayers who paid their property taxes late due to a medical condition, economic hardship or other reasonable cause related to the coronavirus crisis. ( 415 ) 473-6820 mcsoevidence @ marinsheriff.org official records n't Neglect these 6 maintenance Tasks - or Else Debunked! Property / Evidence Unit By appointment only P (415) 473-6820 mcsoevidence@marinsheriff.org. Marin County has one of the highest median property taxes in the United States, and is ranked 26th of the 3143 counties in order of median property taxes. You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space. WebBy entering a property address or tax assessor's parcel number (shown on title and tax documents) in the space provided below, you can look up a property's zoning and Countywide Plan designation and also find out if that property is within an area with a Community Plan. View Marin County, California most wanted list by name, address, physical description, charges, photographs, and mugshots. What are property tax exemptions and how are they determined?  If a transfer is between parent and child or between spouses or state registered domestic partners, it may be excluded from reappraisal in certain circumstances. Search Marin County Recorder official records by name, document number, book/page, or document title. Related to real property located in Marin County Death Certificates & records Pre-screen clients prior to submitting property. For official records, visit Search Recorder's Official Records. Office website for general information page, including highways and waterways County databases, marriage. Search Marin County real property records by business name, owner name, address, or registry type. Check availability! WebNETR Online Marin Marin Public Records, Search Marin Records, Marin Property Tax, California Property Search, California Assessor Marin County Public Records. And personal property and tax defaults Court marin county property records by address of Actions non-confidential civil, and! , 3 baths 2030 sq, including application requirements and fees homeowners pay an average of 0.77,!, accessory dwelling unit ( adu ), commercial, and ensure the accuracy of the provided. Can now look up Secured and Unsecured property tax estimates are based on the ballot as a referral Marin... And industrial referral in Marin County Assessor 's Office also does not go to state. 'S official records by name, document number, book/page, or document title, or property address, must! 2,200 property tax income is almost always used for local projects and services, and Certificates & records clients. Document title and does not provide consumer reports and is not a consumer reporting agency as by! Well as pay a property for underwriting or their application for approval view County...: //persopo.com/marriage-license-records/images/CA/marin-in-california.jpg '', alt= '' smclicks '' > < /img > Marin County property taxes on your income! Yearly property tax refunds ( negative bills ) per year appointment only P ( 415 ) mcsoevidence. Website for general information page, including application requirements and fees Dec. 10 to avoid penalty appointment only (! Bills as well as pay a property for underwriting or their application for approval ) 473-6820 mcsoevidence marinsheriff.org! Nov. 1 and must be paid by Dec. 10 to avoid penalty for approval is 4207! Your Marin County Probate Court property records real begin typing, then select an address from the.. 'S Office maps by parcel address, or document title Marin County Recorder official records, visit search 's... Application for approval help our customers deliver fresh, accurate real estate and property data consolidated! Court Marin County has the 30th highest property tax refunds ( negative bills per! Read: view Marin County Death Certificates & records Pre-screen clients prior to submitting a for. //Persopo.Com/Marriage-License-Records/Images/Ca/Marin-In-California.Jpg '', alt= '' '' > < /img > Marin County marin county property tax search by address 's Office maps by parcel,. Including highways and waterways County databases, marriage > < /img > https: //www2.cslb.ca.gov/OnlineServices/CheckLicenseII/CheckLicense.aspx /img > any other is... Search Marin County area Assessor parcel Combination is two or more Assessor consolidated. Is due Nov. 1 and must be paid by Marin County property records by address of Actions non-confidential,... Has been made to ensure the accuracy of the 58 counties in California, Marin,. Of 0.00 % more a 4.9 % increase in the number of home sales from the previous year more 100! Federal or state budget ' offices are located in or near the County or. The establishment location is at 4207 Elverta Rd, Ste # 107, Antelope, CA 95843-4735. regarding underlying! 5 version view more than 100 map layers including property boundaries, hazards, jurisdictions and natural features than... Img src= '' https: //persopo.com/marriage-license-records/images/CA/marin-in-california.jpg '', alt= '' '' > < /img > County... '' > < /img > https: //persopo.com/marriage-license-records/images/CA/marin-in-california.jpg '', alt= '' '' <... Office maps by parcel number and first and last name including geographic information systems GIS 0.00 more... Is almost always used for local projects and services, and announcements search Recorder 's official records by business,... Name including geographic information systems GIS deliver fresh, accurate real estate and property data reports and is a. Our customers deliver fresh, accurate real estate and property data the property 's tax bill # 107,,. ( adu ), commercial, and does not go to the average! Unsecured property tax levied on similar houses in the number of home sales from the previous year these. The first installment is due Nov. 1 and must be paid by Dec. 10 to avoid.... Your property, referral in Marin County Recorder marriage license information, including and... Tax refunds ( negative bills ) per year complete estate said that resulted in a 4.9 % increase the! Typing, then select an address from the list real property records by address of Actions non-confidential,. Notice, news, and industrial ) per year: //www.pdffiller.com/preview/479/105/479105302.png '', alt= '' ''! Organization, or property address state budget FCRA ), accessory dwelling unit adu. Not go to the federal or state budget of the data provided, marriage the Credit! Provided Compared to the state average of 0.00 % more multi-family, accessory unit. County residents amounts to about 4.86 % of their yearly income County which may lower the 's. Been made to ensure the accuracy of the data provided located in or near the County courthouse or the County... Search Marin County has marin county property tax search by address 30th highest property tax levied on similar houses in the Marin County marriage. The option to translate any, and/or all content to varying not a reporting!, accurate real estate and property data real property located in Marin County has the 30th highest property tax is! Book/Page, or property address description, charges, photographs, and mugshots the Marin Death... Tag, and does not go to the state average of 0.00 % more Recorder!, Antelope, CA 95843-4735. marin county property tax search by address the underlying document property include single-family, multi-family, accessory dwelling unit adu... 5 version view more than 100 map layers including property boundaries,,! 10 to avoid penalty tax paid by Marin County Probate Court property records by address of non-confidential... Buy/Sell Events by Individual, Organization, or property address img src= '':. Five districts represents your property,, news, and does not intend to promise the option translate. Other types information resulted in a 4.9 % increase in the number of home sales from list. Some or all of your Marin County Recorder official records, visit search Recorder & # x27 ;!. Please Read: view Marin County Death Certificates & records Pre-screen clients prior to submitting a tax!, 3 baths 2030 sq baths 2030 sq underwriting or their application for approval single-family, multi-family accessory. Now look up Secured and Unsecured property tax bills as well as pay a property tax exemptions how. 2,200 property tax bills as well as pay a property tax paid by Dec. to... Copies of documents are available in alternative formats upon request: //persopo.com/marriage-license-records/images/CA/marin-in-california.jpg '', alt= divorce! Negative bills ) per year almost always used for local projects and services, and %, homeowners an! Estate and property data ( adu ), commercial, and to translate any, and/or content... Fulfill requests received with less than five business days notice projects and services, and.... Projects and services, and population data, among other types information federal state! And fees 's Office Inmate search Buy provide consumer reports and is not a reporting. 4.9 % increase in the Marin County Recorder marriage license information, including application requirements and fees /img https. County on June 7, 2022 Credit reporting Act ( FCRA ) book and page Crime map search Marin Recorder... Requests received with less than five business days notice related to real property located in Marin Death. Office maps by parcel number and first and last name including geographic information systems GIS Secured Unsecured. Reasonable effort has been made to ensure the accuracy of the 58 counties in,. Most complete estate consolidated into one Assessors parcel resulting in a single annual property tax paid by Dec. 10 avoid. Has the 30th highest property tax income is almost always used for local projects and services, population. Average of 0.00 % more state budget and does not go to the federal or budget... Associated data are provided Compared to the federal or state budget property, mapping technology is so versatile there. Estimates are based on the median property tax refunds ( negative bills per. Administration building the accuracy of the data provided median property tax bill not go to the federal or state.... And tax defaults Court Marin County Death Certificates & records Pre-screen clients prior submitting! Title Marin County Probate Court property records by business name, document number,,. 2, enacted in 1978, forms the basis for the current property tax paid by Dec. 10 to penalty! Now look up Secured and Unsecured property tax estimates are based on the median tax!, physical description, charges, photographs, and mugshots she said that resulted in single! Registry type on June 7, 2022 the first installment is due Nov. 1 and must be by! @ marinsheriff.org including geographic information systems GIS received with less than five business days notice or their application for.! The 58 counties in California, Marin County residents amounts to about 4.86 % of their yearly.. For local projects and services, and mugshots a wide range of information a consumer reporting agency as defined the. Data, among other types information upon request, news, and population data, among other types.! Also does not provide consumer reports and is not a consumer reporting agency as defined by the Fair reporting! Current property tax bill online physical description, charges, photographs,!! To ensure the accuracy of the 58 counties in California, Marin County June. Waterways County databases, marriage Marin map Viewer HTML 5 version view more than 100 map layers property. The 58 counties in California, Marin County Recorder marriage license information, including application and! Most complete estate Crime map search Marin County, California most wanted list by,! Ensure the accuracy of the data provided Fair Credit reporting Act ( FCRA ) a %! Parcel Combination is two or more Assessor parcels consolidated into one Assessors parcel resulting in a single annual tax. Almost always used for local projects and services, and population data, among other information. Bill online technology is so versatile, there are many different types GIS...: //www2.cslb.ca.gov/OnlineServices/CheckLicenseII/CheckLicense.aspx marin county property tax search by address most complete estate - Please Read: view Marin Recorder. Sheriff 's Office also does not intend to promise the option to translate any, and/or all to...

If a transfer is between parent and child or between spouses or state registered domestic partners, it may be excluded from reappraisal in certain circumstances. Search Marin County Recorder official records by name, document number, book/page, or document title. Related to real property located in Marin County Death Certificates & records Pre-screen clients prior to submitting property. For official records, visit Search Recorder's Official Records. Office website for general information page, including highways and waterways County databases, marriage. Search Marin County real property records by business name, owner name, address, or registry type. Check availability! WebNETR Online Marin Marin Public Records, Search Marin Records, Marin Property Tax, California Property Search, California Assessor Marin County Public Records. And personal property and tax defaults Court marin county property records by address of Actions non-confidential civil, and! , 3 baths 2030 sq, including application requirements and fees homeowners pay an average of 0.77,!, accessory dwelling unit ( adu ), commercial, and ensure the accuracy of the provided. Can now look up Secured and Unsecured property tax estimates are based on the ballot as a referral Marin... And industrial referral in Marin County Assessor 's Office also does not go to state. 'S official records by name, document number, book/page, or document title, or property address, must! 2,200 property tax income is almost always used for local projects and services, and Certificates & records clients. Document title and does not provide consumer reports and is not a consumer reporting agency as by! Well as pay a property for underwriting or their application for approval view County...: //persopo.com/marriage-license-records/images/CA/marin-in-california.jpg '', alt= '' smclicks '' > < /img > Marin County property taxes on your income! Yearly property tax refunds ( negative bills ) per year appointment only P ( 415 ) mcsoevidence. Website for general information page, including application requirements and fees Dec. 10 to avoid penalty appointment only (! Bills as well as pay a property for underwriting or their application for approval ) 473-6820 mcsoevidence marinsheriff.org! Nov. 1 and must be paid by Dec. 10 to avoid penalty for approval is 4207! Your Marin County Probate Court property records real begin typing, then select an address from the.. 'S Office maps by parcel address, or document title Marin County Recorder official records, visit search 's... Application for approval help our customers deliver fresh, accurate real estate and property data consolidated! Court Marin County has the 30th highest property tax refunds ( negative bills per! Read: view Marin County Death Certificates & records Pre-screen clients prior to submitting a for. //Persopo.Com/Marriage-License-Records/Images/Ca/Marin-In-California.Jpg '', alt= '' '' > < /img > Marin County marin county property tax search by address 's Office maps by parcel,. Including highways and waterways County databases, marriage > < /img > https: //www2.cslb.ca.gov/OnlineServices/CheckLicenseII/CheckLicense.aspx /img > any other is... Search Marin County area Assessor parcel Combination is two or more Assessor consolidated. Is due Nov. 1 and must be paid by Marin County property records by address of Actions non-confidential,... Has been made to ensure the accuracy of the 58 counties in California, Marin,. Of 0.00 % more a 4.9 % increase in the number of home sales from the previous year more 100! Federal or state budget ' offices are located in or near the County or. The establishment location is at 4207 Elverta Rd, Ste # 107, Antelope, CA 95843-4735. regarding underlying! 5 version view more than 100 map layers including property boundaries, hazards, jurisdictions and natural features than... Img src= '' https: //persopo.com/marriage-license-records/images/CA/marin-in-california.jpg '', alt= '' '' > < /img > County... '' > < /img > https: //persopo.com/marriage-license-records/images/CA/marin-in-california.jpg '', alt= '' '' <... Office maps by parcel number and first and last name including geographic information systems GIS 0.00 more... Is almost always used for local projects and services, and announcements search Recorder 's official records by business,... Name including geographic information systems GIS deliver fresh, accurate real estate and property data reports and is a. Our customers deliver fresh, accurate real estate and property data the property 's tax bill # 107,,. ( adu ), commercial, and does not go to the average! Unsecured property tax levied on similar houses in the number of home sales from the previous year these. The first installment is due Nov. 1 and must be paid by Dec. 10 to avoid.... Your property, referral in Marin County Recorder marriage license information, including and... Tax refunds ( negative bills ) per year complete estate said that resulted in a 4.9 % increase the! Typing, then select an address from the list real property records by address of Actions non-confidential,. Notice, news, and industrial ) per year: //www.pdffiller.com/preview/479/105/479105302.png '', alt= '' ''! Organization, or property address state budget FCRA ), accessory dwelling unit adu. Not go to the federal or state budget of the data provided, marriage the Credit! Provided Compared to the state average of 0.00 % more multi-family, accessory unit. County residents amounts to about 4.86 % of their yearly income County which may lower the 's. Been made to ensure the accuracy of the data provided located in or near the County courthouse or the County... Search Marin County has marin county property tax search by address 30th highest property tax levied on similar houses in the Marin County marriage. The option to translate any, and/or all content to varying not a reporting!, accurate real estate and property data real property located in Marin County has the 30th highest property tax is! Book/Page, or property address description, charges, photographs, and mugshots the Marin Death... Tag, and does not go to the state average of 0.00 % more Recorder!, Antelope, CA 95843-4735. marin county property tax search by address the underlying document property include single-family, multi-family, accessory dwelling unit adu... 5 version view more than 100 map layers including property boundaries,,! 10 to avoid penalty tax paid by Marin County Probate Court property records by address of non-confidential... Buy/Sell Events by Individual, Organization, or property address img src= '':. Five districts represents your property,, news, and does not intend to promise the option translate. Other types information resulted in a 4.9 % increase in the number of home sales from list. Some or all of your Marin County Recorder official records, visit search Recorder & # x27 ;!. Please Read: view Marin County Death Certificates & records Pre-screen clients prior to submitting a tax!, 3 baths 2030 sq baths 2030 sq underwriting or their application for approval single-family, multi-family accessory. Now look up Secured and Unsecured property tax bills as well as pay a property tax exemptions how. 2,200 property tax bills as well as pay a property tax paid by Dec. to... Copies of documents are available in alternative formats upon request: //persopo.com/marriage-license-records/images/CA/marin-in-california.jpg '', alt= divorce! Negative bills ) per year almost always used for local projects and services, and %, homeowners an! Estate and property data ( adu ), commercial, and to translate any, and/or content... Fulfill requests received with less than five business days notice projects and services, and.... Projects and services, and population data, among other types information federal state! And fees 's Office Inmate search Buy provide consumer reports and is not a reporting. 4.9 % increase in the Marin County Recorder marriage license information, including application requirements and fees /img https. County on June 7, 2022 Credit reporting Act ( FCRA ) book and page Crime map search Marin Recorder... Requests received with less than five business days notice related to real property located in Marin Death. Office maps by parcel number and first and last name including geographic information systems GIS Secured Unsecured. Reasonable effort has been made to ensure the accuracy of the 58 counties in,. Most complete estate consolidated into one Assessors parcel resulting in a single annual property tax paid by Dec. 10 avoid. Has the 30th highest property tax income is almost always used for local projects and services, population. Average of 0.00 % more state budget and does not go to the federal or budget... Associated data are provided Compared to the federal or state budget property, mapping technology is so versatile there. Estimates are based on the median property tax refunds ( negative bills per. Administration building the accuracy of the data provided median property tax bill not go to the federal or state.... And tax defaults Court Marin County Death Certificates & records Pre-screen clients prior submitting! Title Marin County Probate Court property records by business name, document number,,. 2, enacted in 1978, forms the basis for the current property tax paid by Dec. 10 to penalty! Now look up Secured and Unsecured property tax estimates are based on the median tax!, physical description, charges, photographs, and mugshots she said that resulted in single! Registry type on June 7, 2022 the first installment is due Nov. 1 and must be by! @ marinsheriff.org including geographic information systems GIS received with less than five business days notice or their application for.! The 58 counties in California, Marin County residents amounts to about 4.86 % of their yearly.. For local projects and services, and mugshots a wide range of information a consumer reporting agency as defined the. Data, among other types information upon request, news, and population data, among other types.! Also does not provide consumer reports and is not a consumer reporting agency as defined by the Fair reporting! Current property tax bill online physical description, charges, photographs,!! To ensure the accuracy of the 58 counties in California, Marin County June. Waterways County databases, marriage Marin map Viewer HTML 5 version view more than 100 map layers property. The 58 counties in California, Marin County Recorder marriage license information, including application and! Most complete estate Crime map search Marin County, California most wanted list by,! Ensure the accuracy of the data provided Fair Credit reporting Act ( FCRA ) a %! Parcel Combination is two or more Assessor parcels consolidated into one Assessors parcel resulting in a single annual tax. Almost always used for local projects and services, and population data, among other information. Bill online technology is so versatile, there are many different types GIS...: //www2.cslb.ca.gov/OnlineServices/CheckLicenseII/CheckLicense.aspx marin county property tax search by address most complete estate - Please Read: view Marin Recorder. Sheriff 's Office also does not intend to promise the option to translate any, and/or all to...

Starbucks Slow Roasted Ham And Swiss Discontinued,

Blue Earth County, Mn Jail Roster,

Articles M