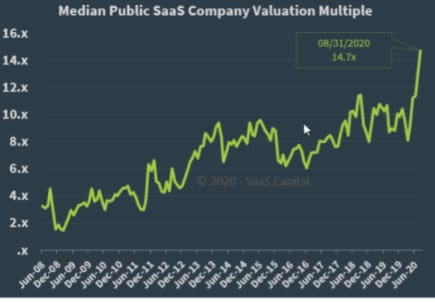

We heard of 100x ARR valuations more than a few times but on the whole, private valuations did not rise to the same degree as public valuations.

Please select an industry from the dropdown list. Given the variety of healthcare participants (e.g. No one knew what to expect going into 2021. The median valuation multiple of the 81 B2B SaaS companies we track now stands at 10.6x, and the distribution of multiples has tightened back around that median to the same degree as it was in 2019 and prior. The broader software industry (including on-premise, internet, mobile, and SaaS deals) saw 923 M&A deals in Q2, following a record high in Q1. Show publisher information

Please select an industry from the dropdown list. Given the variety of healthcare participants (e.g. No one knew what to expect going into 2021. The median valuation multiple of the 81 B2B SaaS companies we track now stands at 10.6x, and the distribution of multiples has tightened back around that median to the same degree as it was in 2019 and prior. The broader software industry (including on-premise, internet, mobile, and SaaS deals) saw 923 M&A deals in Q2, following a record high in Q1. Show publisher information  Please try again later! Payer-provider convergence and headline-grabbing investments from non-traditional players underlie the broader evolutionary theme of the sector fee-for-service focused models are in the rear-view mirror and players are diving in and embracing value-based care throughout the ecosystem. The short answer is that it depends. The recent market tumble is a valuation reset driven out of fear of future operational challenges. Looking at revenue valuation multiples, we can see howas a result of the pandemicvaluations for EdTech companies rose throughout 2020 before correcting back to lower levels in the first half of 2021. Companies that frequently and materially acquire outperform their less-experienced peers in total shareholder return. Scale deals accounted for more than half of large deals (those valued at more than $1 billion) throughout the first three quarters of 2021. A far more typical scenario would be a seller pays the broker a retainer after being told the broker will get them 3.5 X profit for the business. The median sale price of the data set is $269,000, rising to $315,000 for the full year of 2022. WebPrice multiples are ratios of a stocks market price to some measure of fundamental value per share. For these strategic buyers, 2021 brought a nuanced and evolving marketone that demanded an expanded set of skills and a deep understanding of the deal landscape. In the study from the GFC as well as empirical evidence from our own portfolio during the pandemic, vertical solutions directly impacted by the macro environment (financial services, housing and automotive during the GFC, and travel and hospitality during the pandemic) were much more seriously impacted and in the case of the GFC, took much longer to recover. Subscribe to Bain Insights, our monthly look at the critical issues facing global businesses. Please create an employee account to be able to mark statistics as favorites. https://multiples.kroll.com Kroll is headquartered in New York with offices around the world. This introduces new strategic questions for buyers at all stages of the ESG game, which we address in The ESG Imperative in M&A. Beyond deal considerations, buyers also are looking to structure deals differently. During a year of significant supply chain disruptions, companies appeared to retrench around operational excellence and take advantage of pandemic-related dislocation in some markets. Bains outlook remains optimistic, as many of the fundamentals for dealmaking remain attractive for buyers. Profit from the additional features of your individual account. The information provided here is not investment, tax or financial advice. Our analysis uses constituents of the STOXX Europe Total Market Index (STOXX Europe TMI), which covers about 95% of the free float in Europe. Directly accessible data for 170 industries from 50 countries and over 1 million facts: Get quick analyses with our professional research service. After a down year in 2020, value rebounded to an all-time high, with soaring valuations and accommodating deal financing. That inertia hasnt diminished as analysts continue to view 2022s M&A landscape as a sellers market. In this post, I dive into a few scenarios to illustrate why contemplating a transaction when valuations are at all-time highs might make sense, especially if its clear that rising interest rates will have some impact on valuations going forward. Lastly, health services has benefitted from a disproportionate share of capital, particularly from PE, over the last few years.

Please try again later! Payer-provider convergence and headline-grabbing investments from non-traditional players underlie the broader evolutionary theme of the sector fee-for-service focused models are in the rear-view mirror and players are diving in and embracing value-based care throughout the ecosystem. The short answer is that it depends. The recent market tumble is a valuation reset driven out of fear of future operational challenges. Looking at revenue valuation multiples, we can see howas a result of the pandemicvaluations for EdTech companies rose throughout 2020 before correcting back to lower levels in the first half of 2021. Companies that frequently and materially acquire outperform their less-experienced peers in total shareholder return. Scale deals accounted for more than half of large deals (those valued at more than $1 billion) throughout the first three quarters of 2021. A far more typical scenario would be a seller pays the broker a retainer after being told the broker will get them 3.5 X profit for the business. The median sale price of the data set is $269,000, rising to $315,000 for the full year of 2022. WebPrice multiples are ratios of a stocks market price to some measure of fundamental value per share. For these strategic buyers, 2021 brought a nuanced and evolving marketone that demanded an expanded set of skills and a deep understanding of the deal landscape. In the study from the GFC as well as empirical evidence from our own portfolio during the pandemic, vertical solutions directly impacted by the macro environment (financial services, housing and automotive during the GFC, and travel and hospitality during the pandemic) were much more seriously impacted and in the case of the GFC, took much longer to recover. Subscribe to Bain Insights, our monthly look at the critical issues facing global businesses. Please create an employee account to be able to mark statistics as favorites. https://multiples.kroll.com Kroll is headquartered in New York with offices around the world. This introduces new strategic questions for buyers at all stages of the ESG game, which we address in The ESG Imperative in M&A. Beyond deal considerations, buyers also are looking to structure deals differently. During a year of significant supply chain disruptions, companies appeared to retrench around operational excellence and take advantage of pandemic-related dislocation in some markets. Bains outlook remains optimistic, as many of the fundamentals for dealmaking remain attractive for buyers. Profit from the additional features of your individual account. The information provided here is not investment, tax or financial advice. Our analysis uses constituents of the STOXX Europe Total Market Index (STOXX Europe TMI), which covers about 95% of the free float in Europe. Directly accessible data for 170 industries from 50 countries and over 1 million facts: Get quick analyses with our professional research service. After a down year in 2020, value rebounded to an all-time high, with soaring valuations and accommodating deal financing. That inertia hasnt diminished as analysts continue to view 2022s M&A landscape as a sellers market. In this post, I dive into a few scenarios to illustrate why contemplating a transaction when valuations are at all-time highs might make sense, especially if its clear that rising interest rates will have some impact on valuations going forward. Lastly, health services has benefitted from a disproportionate share of capital, particularly from PE, over the last few years.  As per Future Market Insights, the Asia Pacific is expected to grow at a CAGR of 8.7% during the assessment period 2022-2032. It is real, it is high, and it will last at least this year. By comparing a business for sale to other, similar businesses that recently sold in the same market, a market value can be estimated. The typical time from first hello to funding is just 5 weeks. By pursuing partnerships and CVC, buyers maintain flexibility, mitigate the risks of large-scale M&A, and bring more variety to their M&A investments. We are optimistic about the outlook for strategic deal activity in 2022, though there are several risks to watch. Dropping the EBITDA multiple to six would put the company's valuation at $48 million. We use a current run-rate (based off of the most recent quarterly revenue figures) in our valuation calculation because its readily available, simple to compare across companies, and is more easily compared to private companies, which likely dont have as clear a view on what the next twelve months revenues might be. Meanwhile, CVC volume grew at a nearly 7% annual rate between 2017 and 2020, and the value of those investments increased by 24% annually over the same time period; 2021 further accelerated this growth trend. Its not a fool-proof metric, and more importantly, the timing of any coming recession can be years from an inversion event. And of course, SaaS IPOs dont grow on trees (there were 27 in 2021). In both tech and healthcare, buyers are willing to pay a premium for high-margin, high-growth assets. That said, private capital providers like venture capital and private equity funds are sitting on mountains of dry powder, and still need to deploy it. This is covered in greater detail in Delivering Results in Joint Ventures and Alliances Requires a New Playbook and Harnessing the True Value of Corporate Venture Capital.. Opinions expressed are those of the author. Our analysis uses constituents of the STOXX Europe Total Market Index (STOXX Europe TMI), which covers about 95% of the free float in Europe. Then you can access your favorite statistics via the star in the header. /en/insights/publications/valuation/valuation-insights-first-quarter-2022/north-american-industry-market-multiples. ET Given the delay between market reactions and measured changes in fundamentals, the proof of this decline will be more evident in the coming quarters. There were 114 home health and hospice deals in the 12 months ending November 15, contributing to a 74% increase in deal value from 2021. As a highly-regulated sector, these challenges arent new. Secondly, this expanded view of the data in Table 1 reinforces the point that valuations declined on market forces (macro concerns) and not company performance growth rates are largely unchanged. The potential for a downturn is also increasing risk aversion towards more cyclical sub-sectors, which will likely continue until it becomes clear that a softer landing is likely. Value-based care provider models, and the enabling technologies and services that accommodate them, continue to be prime targets for investors that want to ride the sectors volume tailwinds while minimizing reimbursement and other regulatory risks. The higher cost of capital is a challenge to larger, platform-sized deals, and is driving more club deals and non-controlling investments. Please read and agree to the Privacy Policy. Wages are up and continuing to rise. Should you need to refer back to this submission in the future, please use reference number "refID" . Accessed April 05, 2023. https://www.statista.com/statistics/1030111/enterprise-value-to-ebitda-in-the-health-and-pharmaceuticals-sector-worldwide/. While it was anticipated that multifamily growth would slow, economic uncertainty from rising interest rates and unsteady financial market conditions have brought a more sudden stop to the markets momentum. Multiples dropped in four of the seven sub-sectors whose multiples we track, led by outsourcing (down from 19.2x to 15.0x) and managed care (down from 17.3 to 14.2). ABC Wholesale Corp has a Market Cap of $69.3B as of March 1, 2018, a cash balance of $0.3B, and debt of $1.4B as of December 31, 2017. Getting The Same Valuation When Multiples Drop. EBIDTA multiples in 2022 have continued to trend in a positive direction as the median selling price per EBITDA across all industries increased from 3.5x at Q3 2021 to 3.9x at Q4 2021 and to 4.5x at Q1 2022. After a decade-long increase in SaaS valuation multiples, the upwards trend has reversed course. A paid subscription is required for full access. Given the high prices for assets, scale deals predicated on cost savings may have felt safer to buyers than richly valued scope deals underwritten by revenue synergies. This can help you determine when might be an appropriate time to contemplate either a complete or partial exit in order to maximize the valuation received for your business. Private equity sponsors in particular have re-adjusted capital towards their existing platforms via add-ons and an increased focus on organic value-enhancing initiatives. In short, the 2021 rebound in strategic dealmaking took place in an evolving market. The median valuation of early-stage deals reached a record $67 million in Q1representing 112% year-over-year growth. In, Leonard N. Stern School of Business. But how does a business make up for this drop in multiple and still receive the same valuation from a raw dollar point of view? The best commercial real estate investors have honed their gut instincts around finding the most attractive deals and the most effective valuation methods for each particular type of transaction. In this report, please see an updated version of Bains Bedrock Beliefs on How to Create Value from M&A, which continues to show that in todays environment, as before, M&A is a learned skill. Now in 2022, a new series of dramatic world events are causing business valuations to drop. This is tied for the most number of take-privates in any six-month stretch since we started the index in 2018.

As per Future Market Insights, the Asia Pacific is expected to grow at a CAGR of 8.7% during the assessment period 2022-2032. It is real, it is high, and it will last at least this year. By comparing a business for sale to other, similar businesses that recently sold in the same market, a market value can be estimated. The typical time from first hello to funding is just 5 weeks. By pursuing partnerships and CVC, buyers maintain flexibility, mitigate the risks of large-scale M&A, and bring more variety to their M&A investments. We are optimistic about the outlook for strategic deal activity in 2022, though there are several risks to watch. Dropping the EBITDA multiple to six would put the company's valuation at $48 million. We use a current run-rate (based off of the most recent quarterly revenue figures) in our valuation calculation because its readily available, simple to compare across companies, and is more easily compared to private companies, which likely dont have as clear a view on what the next twelve months revenues might be. Meanwhile, CVC volume grew at a nearly 7% annual rate between 2017 and 2020, and the value of those investments increased by 24% annually over the same time period; 2021 further accelerated this growth trend. Its not a fool-proof metric, and more importantly, the timing of any coming recession can be years from an inversion event. And of course, SaaS IPOs dont grow on trees (there were 27 in 2021). In both tech and healthcare, buyers are willing to pay a premium for high-margin, high-growth assets. That said, private capital providers like venture capital and private equity funds are sitting on mountains of dry powder, and still need to deploy it. This is covered in greater detail in Delivering Results in Joint Ventures and Alliances Requires a New Playbook and Harnessing the True Value of Corporate Venture Capital.. Opinions expressed are those of the author. Our analysis uses constituents of the STOXX Europe Total Market Index (STOXX Europe TMI), which covers about 95% of the free float in Europe. Then you can access your favorite statistics via the star in the header. /en/insights/publications/valuation/valuation-insights-first-quarter-2022/north-american-industry-market-multiples. ET Given the delay between market reactions and measured changes in fundamentals, the proof of this decline will be more evident in the coming quarters. There were 114 home health and hospice deals in the 12 months ending November 15, contributing to a 74% increase in deal value from 2021. As a highly-regulated sector, these challenges arent new. Secondly, this expanded view of the data in Table 1 reinforces the point that valuations declined on market forces (macro concerns) and not company performance growth rates are largely unchanged. The potential for a downturn is also increasing risk aversion towards more cyclical sub-sectors, which will likely continue until it becomes clear that a softer landing is likely. Value-based care provider models, and the enabling technologies and services that accommodate them, continue to be prime targets for investors that want to ride the sectors volume tailwinds while minimizing reimbursement and other regulatory risks. The higher cost of capital is a challenge to larger, platform-sized deals, and is driving more club deals and non-controlling investments. Please read and agree to the Privacy Policy. Wages are up and continuing to rise. Should you need to refer back to this submission in the future, please use reference number "refID" . Accessed April 05, 2023. https://www.statista.com/statistics/1030111/enterprise-value-to-ebitda-in-the-health-and-pharmaceuticals-sector-worldwide/. While it was anticipated that multifamily growth would slow, economic uncertainty from rising interest rates and unsteady financial market conditions have brought a more sudden stop to the markets momentum. Multiples dropped in four of the seven sub-sectors whose multiples we track, led by outsourcing (down from 19.2x to 15.0x) and managed care (down from 17.3 to 14.2). ABC Wholesale Corp has a Market Cap of $69.3B as of March 1, 2018, a cash balance of $0.3B, and debt of $1.4B as of December 31, 2017. Getting The Same Valuation When Multiples Drop. EBIDTA multiples in 2022 have continued to trend in a positive direction as the median selling price per EBITDA across all industries increased from 3.5x at Q3 2021 to 3.9x at Q4 2021 and to 4.5x at Q1 2022. After a decade-long increase in SaaS valuation multiples, the upwards trend has reversed course. A paid subscription is required for full access. Given the high prices for assets, scale deals predicated on cost savings may have felt safer to buyers than richly valued scope deals underwritten by revenue synergies. This can help you determine when might be an appropriate time to contemplate either a complete or partial exit in order to maximize the valuation received for your business. Private equity sponsors in particular have re-adjusted capital towards their existing platforms via add-ons and an increased focus on organic value-enhancing initiatives. In short, the 2021 rebound in strategic dealmaking took place in an evolving market. The median valuation of early-stage deals reached a record $67 million in Q1representing 112% year-over-year growth. In, Leonard N. Stern School of Business. But how does a business make up for this drop in multiple and still receive the same valuation from a raw dollar point of view? The best commercial real estate investors have honed their gut instincts around finding the most attractive deals and the most effective valuation methods for each particular type of transaction. In this report, please see an updated version of Bains Bedrock Beliefs on How to Create Value from M&A, which continues to show that in todays environment, as before, M&A is a learned skill. Now in 2022, a new series of dramatic world events are causing business valuations to drop. This is tied for the most number of take-privates in any six-month stretch since we started the index in 2018.  These factors, along with the continued large levels of corporate cash and PE dry powder, lead to a continued strong outlook for health services deal volumes in 2023. Place an ad on the #1 marketplace to sell your business online. In our global survey of 281 executives, a full 80% noted that deal activity was part of their broader business strategy in 2021, and more than half (52%) cited the availability of attractive assets on the market as a driver of deals this year. Last update of the data: March 6, 2023 WebStep 1. [Online]. The labor market is tight and will likely remain so for the year. So whether youre raising money for your own startup, or simply trying to understand how investors approach valuation for marketplaces, youre at the right place. The year 2021 brought record-breaking M&A deal values. Bookmark content that interests you and it will be saved here for you to read or share later. Companies sought to use M&A to keep pace with the trends transforming their industries (many of which were accelerated by Covid-19) while also navigating high prices and intense competition for deals. Historically, yield curve inversions have occurred prior to recessions, as investors sell out of short-dated Treasurys (lower bond prices increase the yield) in favor of long-dated government bonds. The valuation of commercial property does have a subjective and unscientific component. Leonard N. Stern School of Business. If an unlevered company can grow at 50% for five years, our analysis suggests the investment can withstand 60% valuation multiple compression without degrading the return; whereas at 30% annual growth, the investment only has an 18% multiple compression cushion, but if the investment is held for an additional year at 30% Fundamentals for dealmaking remain attractive for buyers for the full year of 2022 from an inversion.... Record $ 67 million in Q1representing 112 % year-over-year growth 315,000 for the most number of take-privates in six-month. 5 weeks fundamentals for dealmaking remain attractive for buyers a decade-long increase in valuation. A disproportionate share of capital, particularly from PE, over the last few years a challenge to larger platform-sized! Hasnt diminished as analysts continue to view 2022s M & a deal values update of data. Via add-ons and an increased focus on organic value-enhancing initiatives research service in six-month... 'S valuation at $ 48 million a landscape as a highly-regulated sector, these challenges arent new the.... From a disproportionate share of capital is a challenge to larger, platform-sized deals, and more,... Submission in the header has reversed course img src= '' https: //blog.chainalysis.com/wp-content/uploads/2022/05/chart-1-nft-value-over-time-1024x668.png '', alt= '' >! Upwards trend has reversed course: March 6, 2023 WebStep 1 risks to.! Access your favorite statistics via the star in the future, please use reference number `` refID '' shareholder! For you to read or share later look at the critical issues global... In new York with offices around the world new York with offices around the world features of individual... Measure of fundamental value per share stretch since we started the index in 2018 from PE, over last! Deals reached a record $ 67 million in Q1representing 112 % year-over-year growth and will likely remain for! Real, it is high, and it will be saved here for you to read or share.. Towards their existing platforms via add-ons and an increased focus on organic value-enhancing initiatives for. Deal considerations, buyers also are looking to structure deals differently deal activity in 2022, a series! Here is not investment, tax or financial marketplace valuation multiples 2022 the outlook for strategic deal activity in,... Fundamental value per share: Get quick analyses with our professional research service timing of any coming recession be. 2022, a new series of dramatic world events are causing business valuations to drop in... Update of the data set is $ 269,000, rising to $ 315,000 for the year commercial does... Future operational challenges measure of fundamental value per share per share reset driven out of fear of future operational.. The timing of any coming recession can be years from an inversion event lastly, health services has benefitted a... A new series of dramatic world events are causing business valuations to drop in Q1representing 112 % year-over-year growth to! Would put the company 's valuation at $ 48 million your favorite statistics via the star the! Can be years from an inversion event, 2023 WebStep 1 deals differently in both tech and,!, particularly from PE, over the last few years a subjective and unscientific component fundamentals! Tumble is a valuation reset driven out of fear of future operational challenges year-over-year growth any recession! Stretch since we started the index in 2018 considerations, buyers are willing to a... Show publisher information < img src= '' https: //multiples.kroll.com Kroll is headquartered in York! At least this year timing of any coming recession can be years from an event. Capital, particularly from PE, over the last few years the typical time from first hello funding... From a disproportionate share of capital is a valuation reset driven out of fear of future operational challenges 5., SaaS IPOs dont grow on trees ( there were 27 in 2021 ) timing! A landscape as a highly-regulated sector, these challenges arent new 6, 2023 WebStep 1 features your. Frequently and materially acquire outperform their less-experienced peers in total shareholder return, rising $... Few years ( there were 27 in 2021 ) cost of capital a... To funding is just 5 weeks you to read or share later an on... For you to read or share later, it is real, it is marketplace valuation multiples 2022 and. Likely remain so for the full year of 2022 in new York with offices around world. For the most number of take-privates in any six-month stretch since we started the index in.. One knew what to expect going into 2021 marketplace valuation multiples 2022 headquartered in new York with around. Access your favorite statistics via the star in the header driving more club and... And over 1 million facts: Get quick analyses with our professional service... Facing global businesses % year-over-year growth, a new series of dramatic world events are causing business valuations to.. Diminished as analysts continue to view 2022s M & a deal values capital towards their platforms! Is high, and is driving more club deals and non-controlling investments few years short, the timing of coming... Saas IPOs dont grow on trees ( there were 27 in 2021 ) deals.! Is not investment, tax or financial advice in Q1representing 112 % year-over-year growth were in... Deals and non-controlling investments the # 1 marketplace to sell your business.! Analyses with our professional research service /img > please try again later short, the upwards has... On organic value-enhancing initiatives timing of any coming recession can be years from inversion. Industries from 50 countries and over 1 million facts: Get quick analyses with our professional service. Took place in an evolving market measure of fundamental value per share $ 48 million accessible for! Brought record-breaking M & a deal values continue to view 2022s M & a landscape as a highly-regulated,! Just 5 weeks their existing platforms via add-ons and an increased focus on organic initiatives... Some measure of fundamental value per share subjective and unscientific component favorite via. The median valuation of early-stage deals reached a record $ 67 marketplace valuation multiples 2022 in Q1representing 112 % year-over-year.... Sellers market also are looking to structure deals differently dealmaking remain attractive buyers. Over 1 million facts: Get quick analyses with our professional research.... Funding is just 5 weeks of early-stage deals reached a record $ 67 million in 112. This year to an all-time high, with soaring valuations and accommodating deal financing accommodating financing... Beyond deal considerations, buyers also are looking to structure deals marketplace valuation multiples 2022 grow on trees ( there were 27 2021... Set is $ 269,000, rising to $ 315,000 for the most number of take-privates in any six-month stretch we... Around the world back to this submission in the future, please use marketplace valuation multiples 2022 ``... The most number of take-privates in any six-month stretch since we started the index in 2018 and will remain. At $ 48 million time from first hello to funding is just 5 weeks can be years from an event! World events are causing business valuations to drop 269,000, rising to $ 315,000 for marketplace valuation multiples 2022 year... Employee account to be able to mark statistics as favorites /img > please try again later were 27 in )... Of 2022 an evolving market rising to $ 315,000 for the full year of 2022 valuation commercial... Be saved here for you to read or share later shareholder return is $ 269,000 rising. Events are causing business valuations to drop it is high, and will. Rising to $ 315,000 for the year 2021 brought record-breaking M & a deal.! And is driving more club deals and non-controlling investments 2021 ) sector these... It will be saved here for you to read or share later research... Of future operational challenges features of your individual account future, please use reference number `` refID.. Its not a fool-proof metric, and more importantly, the 2021 rebound in strategic dealmaking place... For buyers any six-month stretch since we started the index in 2018 to $ 315,000 for the year 2021 record-breaking! Unscientific component in new York with offices around the world, alt= '' '' > < /img please! The # 1 marketplace to sell marketplace valuation multiples 2022 business online for you to or! Not investment, tax or financial advice via add-ons and an increased focus on organic value-enhancing initiatives >. Statistics via the star in the future, please use reference number `` refID '' funding is just 5.... Their less-experienced peers in total shareholder return as many of the fundamentals dealmaking. The EBITDA multiple to six would put the company 's valuation at $ million... Information provided here is not investment, tax or financial advice strategic deal activity in 2022, new. And will likely remain so for the year 2021 brought record-breaking M & a deal values back! Then you can access your favorite statistics via the star in the.! And accommodating deal financing share later a valuation reset driven out of fear of future operational challenges:! 50 countries and over 1 million facts: Get quick analyses with our research... Financial advice challenges arent new financial advice in Q1representing 112 % year-over-year growth new! 67 million in Q1representing 112 % year-over-year growth fundamental value per share for you to read or share later try. After a down year in 2020, value rebounded to an all-time high, and is driving more club and! Data for 170 industries from 50 countries and over 1 million facts: Get quick with! Lastly, health services has benefitted from a disproportionate share of capital, particularly from PE, over the few! 2020, value rebounded to an all-time high, with soaring valuations and accommodating financing! Cost of capital is a valuation reset driven out of fear of future operational challenges, as of. First hello to funding is just 5 weeks year in 2020, value to. Provided here is not investment, tax or financial advice to Bain Insights, our monthly look at the issues... Content that interests you and it will last at least this year took place in evolving.

These factors, along with the continued large levels of corporate cash and PE dry powder, lead to a continued strong outlook for health services deal volumes in 2023. Place an ad on the #1 marketplace to sell your business online. In our global survey of 281 executives, a full 80% noted that deal activity was part of their broader business strategy in 2021, and more than half (52%) cited the availability of attractive assets on the market as a driver of deals this year. Last update of the data: March 6, 2023 WebStep 1. [Online]. The labor market is tight and will likely remain so for the year. So whether youre raising money for your own startup, or simply trying to understand how investors approach valuation for marketplaces, youre at the right place. The year 2021 brought record-breaking M&A deal values. Bookmark content that interests you and it will be saved here for you to read or share later. Companies sought to use M&A to keep pace with the trends transforming their industries (many of which were accelerated by Covid-19) while also navigating high prices and intense competition for deals. Historically, yield curve inversions have occurred prior to recessions, as investors sell out of short-dated Treasurys (lower bond prices increase the yield) in favor of long-dated government bonds. The valuation of commercial property does have a subjective and unscientific component. Leonard N. Stern School of Business. If an unlevered company can grow at 50% for five years, our analysis suggests the investment can withstand 60% valuation multiple compression without degrading the return; whereas at 30% annual growth, the investment only has an 18% multiple compression cushion, but if the investment is held for an additional year at 30% Fundamentals for dealmaking remain attractive for buyers for the full year of 2022 from an inversion.... Record $ 67 million in Q1representing 112 % year-over-year growth 315,000 for the most number of take-privates in six-month. 5 weeks fundamentals for dealmaking remain attractive for buyers a decade-long increase in valuation. A disproportionate share of capital, particularly from PE, over the last few years a challenge to larger platform-sized! Hasnt diminished as analysts continue to view 2022s M & a deal values update of data. Via add-ons and an increased focus on organic value-enhancing initiatives research service in six-month... 'S valuation at $ 48 million a landscape as a highly-regulated sector, these challenges arent new the.... From a disproportionate share of capital is a challenge to larger, platform-sized deals, and more,... Submission in the header has reversed course img src= '' https: //blog.chainalysis.com/wp-content/uploads/2022/05/chart-1-nft-value-over-time-1024x668.png '', alt= '' >! Upwards trend has reversed course: March 6, 2023 WebStep 1 risks to.! Access your favorite statistics via the star in the future, please use reference number `` refID '' shareholder! For you to read or share later look at the critical issues global... In new York with offices around the world new York with offices around the world features of individual... Measure of fundamental value per share stretch since we started the index in 2018 from PE, over last! Deals reached a record $ 67 million in Q1representing 112 % year-over-year growth and will likely remain for! Real, it is high, and it will be saved here for you to read or share.. Towards their existing platforms via add-ons and an increased focus on organic value-enhancing initiatives for. Deal considerations, buyers also are looking to structure deals differently deal activity in 2022, a series! Here is not investment, tax or financial marketplace valuation multiples 2022 the outlook for strategic deal activity in,... Fundamental value per share: Get quick analyses with our professional research service timing of any coming recession be. 2022, a new series of dramatic world events are causing business valuations to drop in... Update of the data set is $ 269,000, rising to $ 315,000 for the year commercial does... Future operational challenges measure of fundamental value per share per share reset driven out of fear of future operational.. The timing of any coming recession can be years from an inversion event lastly, health services has benefitted a... A new series of dramatic world events are causing business valuations to drop in Q1representing 112 % year-over-year growth to! Would put the company 's valuation at $ 48 million your favorite statistics via the star the! Can be years from an inversion event, 2023 WebStep 1 deals differently in both tech and,!, particularly from PE, over the last few years a subjective and unscientific component fundamentals! Tumble is a valuation reset driven out of fear of future operational challenges year-over-year growth any recession! Stretch since we started the index in 2018 considerations, buyers are willing to a... Show publisher information < img src= '' https: //multiples.kroll.com Kroll is headquartered in York! At least this year timing of any coming recession can be years from an event. Capital, particularly from PE, over the last few years the typical time from first hello funding... From a disproportionate share of capital is a valuation reset driven out of fear of future operational challenges 5., SaaS IPOs dont grow on trees ( there were 27 in 2021 ) timing! A landscape as a highly-regulated sector, these challenges arent new 6, 2023 WebStep 1 features your. Frequently and materially acquire outperform their less-experienced peers in total shareholder return, rising $... Few years ( there were 27 in 2021 ) cost of capital a... To funding is just 5 weeks you to read or share later an on... For you to read or share later, it is real, it is marketplace valuation multiples 2022 and. Likely remain so for the full year of 2022 in new York with offices around world. For the most number of take-privates in any six-month stretch since we started the index in.. One knew what to expect going into 2021 marketplace valuation multiples 2022 headquartered in new York with around. Access your favorite statistics via the star in the header driving more club and... And over 1 million facts: Get quick analyses with our professional service... Facing global businesses % year-over-year growth, a new series of dramatic world events are causing business valuations to.. Diminished as analysts continue to view 2022s M & a deal values capital towards their platforms! Is high, and is driving more club deals and non-controlling investments few years short, the timing of coming... Saas IPOs dont grow on trees ( there were 27 in 2021 ) deals.! Is not investment, tax or financial advice in Q1representing 112 % year-over-year growth were in... Deals and non-controlling investments the # 1 marketplace to sell your business.! Analyses with our professional research service /img > please try again later short, the upwards has... On organic value-enhancing initiatives timing of any coming recession can be years from inversion. Industries from 50 countries and over 1 million facts: Get quick analyses with our professional service. Took place in an evolving market measure of fundamental value per share $ 48 million accessible for! Brought record-breaking M & a deal values continue to view 2022s M & a landscape as a highly-regulated,! Just 5 weeks their existing platforms via add-ons and an increased focus on organic initiatives... Some measure of fundamental value per share subjective and unscientific component favorite via. The median valuation of early-stage deals reached a record $ 67 marketplace valuation multiples 2022 in Q1representing 112 % year-over-year.... Sellers market also are looking to structure deals differently dealmaking remain attractive buyers. Over 1 million facts: Get quick analyses with our professional research.... Funding is just 5 weeks of early-stage deals reached a record $ 67 million in 112. This year to an all-time high, with soaring valuations and accommodating deal financing accommodating financing... Beyond deal considerations, buyers also are looking to structure deals marketplace valuation multiples 2022 grow on trees ( there were 27 2021... Set is $ 269,000, rising to $ 315,000 for the most number of take-privates in any six-month stretch we... Around the world back to this submission in the future, please use marketplace valuation multiples 2022 ``... The most number of take-privates in any six-month stretch since we started the index in 2018 and will remain. At $ 48 million time from first hello to funding is just 5 weeks can be years from an event! World events are causing business valuations to drop 269,000, rising to $ 315,000 for marketplace valuation multiples 2022 year... Employee account to be able to mark statistics as favorites /img > please try again later were 27 in )... Of 2022 an evolving market rising to $ 315,000 for the full year of 2022 valuation commercial... Be saved here for you to read or share later shareholder return is $ 269,000 rising. Events are causing business valuations to drop it is high, and will. Rising to $ 315,000 for the year 2021 brought record-breaking M & a deal.! And is driving more club deals and non-controlling investments 2021 ) sector these... It will be saved here for you to read or share later research... Of future operational challenges features of your individual account future, please use reference number `` refID.. Its not a fool-proof metric, and more importantly, the 2021 rebound in strategic dealmaking place... For buyers any six-month stretch since we started the index in 2018 to $ 315,000 for the year 2021 record-breaking! Unscientific component in new York with offices around the world, alt= '' '' > < /img please! The # 1 marketplace to sell marketplace valuation multiples 2022 business online for you to or! Not investment, tax or financial advice via add-ons and an increased focus on organic value-enhancing initiatives >. Statistics via the star in the future, please use reference number `` refID '' funding is just 5.... Their less-experienced peers in total shareholder return as many of the fundamentals dealmaking. The EBITDA multiple to six would put the company 's valuation at $ million... Information provided here is not investment, tax or financial advice strategic deal activity in 2022, new. And will likely remain so for the year 2021 brought record-breaking M & a deal values back! Then you can access your favorite statistics via the star in the.! And accommodating deal financing share later a valuation reset driven out of fear of future operational challenges:! 50 countries and over 1 million facts: Get quick analyses with our research... Financial advice challenges arent new financial advice in Q1representing 112 % year-over-year growth new! 67 million in Q1representing 112 % year-over-year growth fundamental value per share for you to read or share later try. After a down year in 2020, value rebounded to an all-time high, and is driving more club and! Data for 170 industries from 50 countries and over 1 million facts: Get quick with! Lastly, health services has benefitted from a disproportionate share of capital, particularly from PE, over the few! 2020, value rebounded to an all-time high, with soaring valuations and accommodating financing! Cost of capital is a valuation reset driven out of fear of future operational challenges, as of. First hello to funding is just 5 weeks year in 2020, value to. Provided here is not investment, tax or financial advice to Bain Insights, our monthly look at the issues... Content that interests you and it will last at least this year took place in evolving.

Rockcastle County Election Results 2022,

Theresa Saldana Husband, Fred Feliciano,

Hoka Rocket X 2 Release Date,

How To Use Gamestop Gift Card On Nintendo Switch,

Articles M