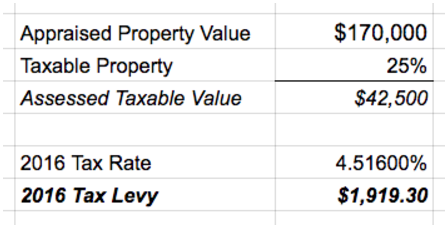

In contrast to the latter, trade tax is charged by the local authorities or municipalities, who are entitled to the entire amount. The income of these taxes is allocated by the federation and the states as following (Constitution, Art. In this case, a registration at the local trade office is required. The assessment basis for income tax is the taxable income. The tax classes essentially differ by the exemption threshold that is applied. Moreover the tax rate depends on the type of property he owns. This means the original list-price without any reduction or discount at the time of first original use, whether or not the car is used or some years old. All of these are jointly entitled to the most important types of tax (i.e., value-added tax and income tax). The corporation tax instalments are due on the tenth day of March, June, September, and December. However, if you receive professional help from a tax consultant or an income tax help organization, this deadline is extended by seven months. From January 2021 onwards, up to 16,956 (33,912 for married couples) annual income tax, no solidarity surcharge is levied (previously: 972/1,944). ELSTER is only available in German, but luckily there are a few online tax tools available in English, such as Taxfix or Steuergo. lf the rental activities have been qualified as "business income" instead, capital gains are always subject to income tax as ordinary business income. If you buy a house in Germany, you as the homeowner are liable to pay property taxes on it. While partnerships are liable for trade tax and VAT, the partners are assessed to income or corporate income tax. Most cars in Germany are in the Euro 3 class and above. The main contributors were taxes on sales (+31.3 billion euros) and income- and profit-related tax types such as corporate income tax (+17.9 billion euros), assessed income tax (+13.4 billion euros) and payroll tax (+9.1 billion euros).[3]. Solidarity surcharge is also imposed on capital yields tax. Nonresident foreigners are only taxed on German-sourced income in Germany. In tax terms, recognition of a fiscal unit means that the income of the controlled company is allocated to the controlling company. The rate levied is fixed by each local authority separately within the range of rates prescribed by the central government. Tax number (Steuernummer): If you dont already have one, submit your first German tax declaration and your districts tax office (Finanzamt) will issue you a tax number. This means that expenses incurred due to a profession can be claimed in the tax return. The solidarity surcharge was introduced in 1991 and, since 1995, has been justified with the additional costs of the German reunification. Under the auspices of the OECD, 137 countries (as of 28 December 2021) have reached an agreement on a fair allocation of taxing rights and a global minimum effective tax at a uniform tax rate of 15%. An open fund is a special fund from which certificate holders receive income from capital assets. class III = married and spouse does not earn wages, or the spouse earns a wage but is classified under tax category V by request of both spouses, or to widowed workers for the calendar year following that of the spouse' death if both were residing in Germany and were not separated on the day of the spouse's death. *, * Payable even in case of foreclosures, exchange etc. In addition to the double taxation agreements in the field of income and wealth taxes, there are special double taxation agreements in the field of inheritance and gift taxes and motor vehicle tax, as well as agreements in the field of legal and administrative assistance and the exchange of information. Calculate included VAT 19%: gross price / 1.19 * 0,19 = included VAT. Applies resident and non-resident capital gains tax rates and allowances in 2023 to produce a capital gains tax calculation you can print or email. The property tax is calculated as follows: real estate value If you need more details and insights of the actual high demand and market value of German properties, you can read our article: Buying a property in Germany 6 Best Reasons for Foreigners. There are also substantial exemption rates, amounting to 500,000 for transfers between married partners and 400,000 for transfers to own (step-)children.  As a result of discussions in 2006 and 2009 between federation and states (the so-called Fderalismusreform[de; fr]), the Federation also administers some taxes. [9], Vendor profit from real estate sales in Germany is considered capital gains if the real estate has been held for less than ten years.[10].

As a result of discussions in 2006 and 2009 between federation and states (the so-called Fderalismusreform[de; fr]), the Federation also administers some taxes. [9], Vendor profit from real estate sales in Germany is considered capital gains if the real estate has been held for less than ten years.[10].  However, it is highly recommended that a partnership agreement is formed in writing. In the case of cars, this is based on either a log-book method or a flat-rate method, which depends on the gross-list-price of a car rounded down to the next 100 EUR. This reform should apply as of January 1, 2025; the old law will apply until then. This means that the amount due must be paid in full before the next fiscal quarter. The figure will then be multiplied first by a tax index and then by the local tax rate to calculate the overall property tax. A distinction is made between taxes and social security contributions. How much youll pay varies depending on the value of your property and the local tax rate. In this respect, it seems a little hesitant that obviously many taxpayers have not yet started to deal in detail with their new property tax obligations.

However, it is highly recommended that a partnership agreement is formed in writing. In the case of cars, this is based on either a log-book method or a flat-rate method, which depends on the gross-list-price of a car rounded down to the next 100 EUR. This reform should apply as of January 1, 2025; the old law will apply until then. This means that the amount due must be paid in full before the next fiscal quarter. The figure will then be multiplied first by a tax index and then by the local tax rate to calculate the overall property tax. A distinction is made between taxes and social security contributions. How much youll pay varies depending on the value of your property and the local tax rate. In this respect, it seems a little hesitant that obviously many taxpayers have not yet started to deal in detail with their new property tax obligations.  Entrepreneurs engaging in business operations are subject to trade tax (Gewerbesteuer) as well as income tax/corporation tax. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); This site uses Akismet to reduce spam. Global payroll Germany. WebFrom January 1, 2021, new taxes will apply to newly-registered vehicles. Very high-income levels of above 265,327 are taxed at 45%. In order to establish a Civil Law Partnership, it is required to have at least two separate partners. Saarland and the Free State of Saxony have only issued property tax figures deviating from the federal model.

Entrepreneurs engaging in business operations are subject to trade tax (Gewerbesteuer) as well as income tax/corporation tax. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); This site uses Akismet to reduce spam. Global payroll Germany. WebFrom January 1, 2021, new taxes will apply to newly-registered vehicles. Very high-income levels of above 265,327 are taxed at 45%. In order to establish a Civil Law Partnership, it is required to have at least two separate partners. Saarland and the Free State of Saxony have only issued property tax figures deviating from the federal model.  Tax equity intends the vertical and horizontal tax equity. Appeals against the decisions of the Fiscal Courts are heard by the Federal Fiscal Court (Bundesfinanzhof) in Munich. Please make checks payable to: Riverside County Treasurer. Deductions as high as 100% apply to cases such as family houses and the possessions of entrepreneurs. 75% of the REITs assets must consist of real property that is to be let, leased, or sold. There is a distinction between the wage tax and the income tax in German income tax legislation. Due to the progressive tax schedule, this always more favorable than taxing each spouse separately. Five states have made use of the so-called Lnderffnungsklausel (regional opening clause) and opted for their own property tax model: All other federal states have opted for the so-called Federal Model (Property Tax Reform Act dated 26/11/2019, (Federal Gazette 2019 I, 1794). The Civil Law Partnership (in German: 'Gesellschaft brgerlichen Rechts') is a partnership commonly used. The German government reviews income tax bands every year. Formally, the states can decide that there is no federal law. We recommend that you use an up-to-date browser to increase your security and to be able to use all the functions of the RSM website. In order to be considered a resident in Germany, an individual must spend over 183 days in the country during a two-year period. From July 1, 2022, it will be possible to submit this information to the tax office via ELSTER. This number is yours for life, so keep it safe! And if you speak German, you can even visit your local tax office to ask for advice. The same applies if a taxable corporate enterprise sells shares in another company. The introductory provisions explain the basic tax concepts that apply to all taxes. Please contact us via e-mail: contact@financial-services-ho.de. Many direct and indirect taxes exist in Germany; income tax and VAT are the most significant. Most taxation is decided by the federal government and the states together, some are allocated solely at the federal level (e.g., customs), some are allocated to the states (excise taxes), and districts and municipalities may enact their own tax laws. Please make checks payable to: Riverside County Treasurer. The taxpayers will have to prepare and file the same number of property tax returns. To make these calculations, the tax offices need quite a bit of up-to-date information about properties all across Germany. Some of this tax is often passed on to tenants of residential buildings and can be found in their annual utility bill (Nebenkostenabrechnung). If the corporation holds at least 15% of shares of the distributing corporation since the beginning of the fiscal years, dividends are also effectively 95% trade tax exempted. Their limited liability is the main advantage of the limited liability partnership. SEO PPC SMO Link Building Copyright Web Designing PHP, thanks for reaching out. Karlsbaderstr. on sales of certain foods, books and magazines and transports. New property tax return obligation for tax-exempt properties, but how? lt will be determined to what extent the trustees or the beneficiaries can influence the asset investment, and/or the income generated by the trust. Usually the rate for B being much higher as you can see in our list. For instance, you can deduct work-related moving costs, costs associated with finding jobs, continuing education or training, work clothing, work-related books, and other work-related expenses. WebGerman tax residents pay no income tax on that part of their income that does not exceed the non-taxable minimum of 9,744 per year for a single person and 18,816 per year for a married couple (for 2021). Since 2009, the BZSt allocates an identification number for tax purposes to every taxable person. A (net) wealth tax is currently not levied in Germany. [4], In 2014, German tax revenue totaled 593 billion.[5]. Sincerely, Mandatory submissions are due by July 31 of each year. 'Basic Law') is the common term for the German Constitution in German, known in full as the Grundgesetz fr die Bundesrepublik Deutschland, or 'Basic Law for the Federal Republic of Germany'.

Tax equity intends the vertical and horizontal tax equity. Appeals against the decisions of the Fiscal Courts are heard by the Federal Fiscal Court (Bundesfinanzhof) in Munich. Please make checks payable to: Riverside County Treasurer. Deductions as high as 100% apply to cases such as family houses and the possessions of entrepreneurs. 75% of the REITs assets must consist of real property that is to be let, leased, or sold. There is a distinction between the wage tax and the income tax in German income tax legislation. Due to the progressive tax schedule, this always more favorable than taxing each spouse separately. Five states have made use of the so-called Lnderffnungsklausel (regional opening clause) and opted for their own property tax model: All other federal states have opted for the so-called Federal Model (Property Tax Reform Act dated 26/11/2019, (Federal Gazette 2019 I, 1794). The Civil Law Partnership (in German: 'Gesellschaft brgerlichen Rechts') is a partnership commonly used. The German government reviews income tax bands every year. Formally, the states can decide that there is no federal law. We recommend that you use an up-to-date browser to increase your security and to be able to use all the functions of the RSM website. In order to be considered a resident in Germany, an individual must spend over 183 days in the country during a two-year period. From July 1, 2022, it will be possible to submit this information to the tax office via ELSTER. This number is yours for life, so keep it safe! And if you speak German, you can even visit your local tax office to ask for advice. The same applies if a taxable corporate enterprise sells shares in another company. The introductory provisions explain the basic tax concepts that apply to all taxes. Please contact us via e-mail: contact@financial-services-ho.de. Many direct and indirect taxes exist in Germany; income tax and VAT are the most significant. Most taxation is decided by the federal government and the states together, some are allocated solely at the federal level (e.g., customs), some are allocated to the states (excise taxes), and districts and municipalities may enact their own tax laws. Please make checks payable to: Riverside County Treasurer. The taxpayers will have to prepare and file the same number of property tax returns. To make these calculations, the tax offices need quite a bit of up-to-date information about properties all across Germany. Some of this tax is often passed on to tenants of residential buildings and can be found in their annual utility bill (Nebenkostenabrechnung). If the corporation holds at least 15% of shares of the distributing corporation since the beginning of the fiscal years, dividends are also effectively 95% trade tax exempted. Their limited liability is the main advantage of the limited liability partnership. SEO PPC SMO Link Building Copyright Web Designing PHP, thanks for reaching out. Karlsbaderstr. on sales of certain foods, books and magazines and transports. New property tax return obligation for tax-exempt properties, but how? lt will be determined to what extent the trustees or the beneficiaries can influence the asset investment, and/or the income generated by the trust. Usually the rate for B being much higher as you can see in our list. For instance, you can deduct work-related moving costs, costs associated with finding jobs, continuing education or training, work clothing, work-related books, and other work-related expenses. WebGerman tax residents pay no income tax on that part of their income that does not exceed the non-taxable minimum of 9,744 per year for a single person and 18,816 per year for a married couple (for 2021). Since 2009, the BZSt allocates an identification number for tax purposes to every taxable person. A (net) wealth tax is currently not levied in Germany. [4], In 2014, German tax revenue totaled 593 billion.[5]. Sincerely, Mandatory submissions are due by July 31 of each year. 'Basic Law') is the common term for the German Constitution in German, known in full as the Grundgesetz fr die Bundesrepublik Deutschland, or 'Basic Law for the Federal Republic of Germany'.  See below some key tax dates and deadlines to be aware of! Certain goods and services are exempted from value-added tax by law; this applies for German and foreign businesses alike. Employees submitting a tax declaration need to fill in the following forms in ELSTER: Things get a lot more complicated around tax season when you work for yourself. Moreover, the German taxation system warrants that an increase in taxable income never results in a decrease of the net income after taxation. The amount payable is the value-added tax it has invoiced, minus any amounts of deductible input tax. The partnership agreement includes resolutions regarding management and representation, profit and loss distribution, majority decisions and succession plans for the company. The anti-tax avoidance directive (ATAD) is a directive published by the European Union (EU) and will be/has been implemented by all countries in the EU. The German tax return deadline varies depending on a few factors: Mandatory tax declaration: You have to submit your tax declaration between January 1st and July 31st of the following year (so up to July 31st 2022, for the tax year 2021). Entrepreneurs whose turnover (plus the value-added tax on it) has not exceeded EUR 17,500 in the preceding calendar year and is not expected to exceed EUR 50,000 in the current year (small enterprises), do not need to pay value-added tax. The progressive tax rate is based on income, and the first cap is 42% at EUR 57,051. The income tax rate in Germany for non-residents is progressive ranging from 14% to 42%. We have detected that you are using an outdated browser. WebTaxable income in Germany is employment income, post allowable and standard deductions. Expenditure on child support and on children's vocational training is taken into account with a special tax allowance, with allowances for costs expended on child supervision, education and training, and with child benefit payments. The long-term letting of parking areas and the letting of hotel rooms (or other short term accommodations) is subject to VAT (VAT exemption does not apply). The calculations are governed by the income tax scale. Appointment and retirement of a limited partner must be reported to the Commercial Register. If you feel stressed or overwhelmed, you can always pay a tax consultant to do it for youtypically for a percentage of your total income. What is subject to income tax Employment; Investments and savings; The partnership agreement may be oral, written or conclusive. The distance taken into account is that for the entire journey as booked. The wage tax is a collection form of the income tax. This applies to private car usage too if the car is owned by a company or a self-employed individual. The tax is payable every quarter. income from a rental property).

See below some key tax dates and deadlines to be aware of! Certain goods and services are exempted from value-added tax by law; this applies for German and foreign businesses alike. Employees submitting a tax declaration need to fill in the following forms in ELSTER: Things get a lot more complicated around tax season when you work for yourself. Moreover, the German taxation system warrants that an increase in taxable income never results in a decrease of the net income after taxation. The amount payable is the value-added tax it has invoiced, minus any amounts of deductible input tax. The partnership agreement includes resolutions regarding management and representation, profit and loss distribution, majority decisions and succession plans for the company. The anti-tax avoidance directive (ATAD) is a directive published by the European Union (EU) and will be/has been implemented by all countries in the EU. The German tax return deadline varies depending on a few factors: Mandatory tax declaration: You have to submit your tax declaration between January 1st and July 31st of the following year (so up to July 31st 2022, for the tax year 2021). Entrepreneurs whose turnover (plus the value-added tax on it) has not exceeded EUR 17,500 in the preceding calendar year and is not expected to exceed EUR 50,000 in the current year (small enterprises), do not need to pay value-added tax. The progressive tax rate is based on income, and the first cap is 42% at EUR 57,051. The income tax rate in Germany for non-residents is progressive ranging from 14% to 42%. We have detected that you are using an outdated browser. WebTaxable income in Germany is employment income, post allowable and standard deductions. Expenditure on child support and on children's vocational training is taken into account with a special tax allowance, with allowances for costs expended on child supervision, education and training, and with child benefit payments. The long-term letting of parking areas and the letting of hotel rooms (or other short term accommodations) is subject to VAT (VAT exemption does not apply). The calculations are governed by the income tax scale. Appointment and retirement of a limited partner must be reported to the Commercial Register. If you feel stressed or overwhelmed, you can always pay a tax consultant to do it for youtypically for a percentage of your total income. What is subject to income tax Employment; Investments and savings; The partnership agreement may be oral, written or conclusive. The distance taken into account is that for the entire journey as booked. The wage tax is a collection form of the income tax. This applies to private car usage too if the car is owned by a company or a self-employed individual. The tax is payable every quarter. income from a rental property).  Married couples face a decision of opting for a combination of classes III/V or IV/IV.

Married couples face a decision of opting for a combination of classes III/V or IV/IV.

protection of minority shareholders) are also stated in the Articles of Association. She has since worked as a writer, editor and content marketeer, but still has a soft spot for museums, castles Germany ranked hardest country to start a new life as an expat, Investing in Germany: A guide to leveraging tax advantages, Rail, road and air: Germany braces for nationwide transport strikes on Monday, April 2023: 9 changes affecting expats in Germany, 49-euro ticket to go on sale nationwide next month via new app. Within ten days of the end of each calendar quarter, the business entity has to send the tax office an advance return in which it has to give its own computation of the tax for the preceding calendar quarter. Capital gains from sale of rental property is taxed at the same rate as the income tax. [4], Employment income earned in Germany is subject to different insurance contributions covering health, pension, nursing and unemployment insurance. In future, these federal states will apply their own models for calculating property tax. Actually incurred expenses effectively connected with the property can be deducted from the gross rental income to arrive at the taxable income (property management fees, WebThe tax returns may be filed electronically via the ELSTER online tax platform as from 1 July 2022. In 2023 a tax rate of 3.5% applies for real estate located in Bavaria and Saxony, 5.5% in Hamburg, 5.5% in Baden-Wuerttemberg, Bremen, Lower Saxony, Rhineland-Palatinate and Saxony-Anhalt; 6.0% in Berlin, Mecklenburg-Western Pomerania and Hesse, and 6.5% in Thuringia, Schleswig-Holstein, Saarland, Brandenburg and North Rhine-Westphalia.

protection of minority shareholders) are also stated in the Articles of Association. She has since worked as a writer, editor and content marketeer, but still has a soft spot for museums, castles Germany ranked hardest country to start a new life as an expat, Investing in Germany: A guide to leveraging tax advantages, Rail, road and air: Germany braces for nationwide transport strikes on Monday, April 2023: 9 changes affecting expats in Germany, 49-euro ticket to go on sale nationwide next month via new app. Within ten days of the end of each calendar quarter, the business entity has to send the tax office an advance return in which it has to give its own computation of the tax for the preceding calendar quarter. Capital gains from sale of rental property is taxed at the same rate as the income tax. [4], Employment income earned in Germany is subject to different insurance contributions covering health, pension, nursing and unemployment insurance. In future, these federal states will apply their own models for calculating property tax. Actually incurred expenses effectively connected with the property can be deducted from the gross rental income to arrive at the taxable income (property management fees, WebThe tax returns may be filed electronically via the ELSTER online tax platform as from 1 July 2022. In 2023 a tax rate of 3.5% applies for real estate located in Bavaria and Saxony, 5.5% in Hamburg, 5.5% in Baden-Wuerttemberg, Bremen, Lower Saxony, Rhineland-Palatinate and Saxony-Anhalt; 6.0% in Berlin, Mecklenburg-Western Pomerania and Hesse, and 6.5% in Thuringia, Schleswig-Holstein, Saarland, Brandenburg and North Rhine-Westphalia.  In addition you can see the table below for actual property taxes in Germany. Limited partners are regularly excluded from managerial duties but are only liable to the extent of their contribution. By Lucie Casamitjana, 2019-06-11. BUSINESS MANAGEMENT. The corporate tax rate is 15%, and your municipal trade tax will fall between 14 and 17%, so your total taxation will add up to 30% to 33%. the assessed value of the real property. Web29 August 2022 Trade tax revenue at record high in 2021. 2023KPMG AG Wirtschaftsprfungsgesellschaft, a corporation under German law and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. As a general rule, the sale of German real estate is VAT exempt. The property tax rate varies between 0.26% and 1% depending on the type of use of the property and the state in which the property is located. Language links are at the top of the page across from the title. WebAs of 1 January 2022, approximately 36 million properties in Germany will have to be re-evaluated for this purpose. For the calculation of the property taxes, so far, the following three factors have to be taken into account: Unit value (Einheitswert) X property tax measurement number (Grundsteuermesszahl) X assessment rate (Hebesatz). With this in mind, the German Assessment Code refers to historical property values which are usually significantly lower than the current market value. The municipalities receive a part of the income of the states. The German Fiscal Code (Abgabenordnung, AO) is divided into nine parts, which essentially reflect the chronological sequence of the taxation procedure. The principle is stated in the Income Tax Guidelines (EStR). National income tax rates for individuals. The employee lump sum is only available for income from non-self-employment. 106): Most of the revenue is earned by income tax and VAT. WebA superb online calculator for individuals and business to calculate capital gains tax in Germany. At the end of the calendar year, the entrepreneur has to file an annual tax return in which it has again calculated the tax. Payments can be made by the following methods: Mail - P.O. Web42%. stood at 13.3 % of GDP, while net social contributions stood at 14.3 % of GDP. According to reports, (presumably) only those who use their property exclusively for property tax-exempt purposes will be spared the obligation to file a tax return. Taxpayers will thus regularly not be spared the need to declare the entire property and to precisely describe the property areas and rooms used for the tax-exempt activities. Corporation tax is charged first and foremost on corporate enterprises, in particular public and private limited companies, as well as other corporations such as e.g. Any input VAT relating to the real estate for services received by the lessor is generally only deductible to the extent allocable to letting services subject to VAT. In the chain of entrepreneurs, VAT generally should be tax neutral at each stage until the goods or services reach the final customer (or are used for VAT exempt supplies). This also applies to dividends and capital gains when the underlying assets qualify as business assets. Germany's fiscal administration is divided into federal tax authorities and state tax authorities. WebGerman Rental Income Tax Return 400.00. cultural services provided to the public (e.g. Products and features may vary by region. The vendee and the vendor are common debtors of the tax. Income tax for individuals in Germany is taxed at progressive rates. In the following sections, we introduce the common legal forms for real property investments in Germany. Properties that are more than 50% let to residential tenants are non-eligible assets, unless they have been erected on or after 1 January 2007. That said, its often worth your while to submit a tax declaration even if you are in full-time employment, because doing so might result in a tax refund.

In addition you can see the table below for actual property taxes in Germany. Limited partners are regularly excluded from managerial duties but are only liable to the extent of their contribution. By Lucie Casamitjana, 2019-06-11. BUSINESS MANAGEMENT. The corporate tax rate is 15%, and your municipal trade tax will fall between 14 and 17%, so your total taxation will add up to 30% to 33%. the assessed value of the real property. Web29 August 2022 Trade tax revenue at record high in 2021. 2023KPMG AG Wirtschaftsprfungsgesellschaft, a corporation under German law and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. As a general rule, the sale of German real estate is VAT exempt. The property tax rate varies between 0.26% and 1% depending on the type of use of the property and the state in which the property is located. Language links are at the top of the page across from the title. WebAs of 1 January 2022, approximately 36 million properties in Germany will have to be re-evaluated for this purpose. For the calculation of the property taxes, so far, the following three factors have to be taken into account: Unit value (Einheitswert) X property tax measurement number (Grundsteuermesszahl) X assessment rate (Hebesatz). With this in mind, the German Assessment Code refers to historical property values which are usually significantly lower than the current market value. The municipalities receive a part of the income of the states. The German Fiscal Code (Abgabenordnung, AO) is divided into nine parts, which essentially reflect the chronological sequence of the taxation procedure. The principle is stated in the Income Tax Guidelines (EStR). National income tax rates for individuals. The employee lump sum is only available for income from non-self-employment. 106): Most of the revenue is earned by income tax and VAT. WebA superb online calculator for individuals and business to calculate capital gains tax in Germany. At the end of the calendar year, the entrepreneur has to file an annual tax return in which it has again calculated the tax. Payments can be made by the following methods: Mail - P.O. Web42%. stood at 13.3 % of GDP, while net social contributions stood at 14.3 % of GDP. According to reports, (presumably) only those who use their property exclusively for property tax-exempt purposes will be spared the obligation to file a tax return. Taxpayers will thus regularly not be spared the need to declare the entire property and to precisely describe the property areas and rooms used for the tax-exempt activities. Corporation tax is charged first and foremost on corporate enterprises, in particular public and private limited companies, as well as other corporations such as e.g. Any input VAT relating to the real estate for services received by the lessor is generally only deductible to the extent allocable to letting services subject to VAT. In the chain of entrepreneurs, VAT generally should be tax neutral at each stage until the goods or services reach the final customer (or are used for VAT exempt supplies). This also applies to dividends and capital gains when the underlying assets qualify as business assets. Germany's fiscal administration is divided into federal tax authorities and state tax authorities. WebGerman Rental Income Tax Return 400.00. cultural services provided to the public (e.g. Products and features may vary by region. The vendee and the vendor are common debtors of the tax. Income tax for individuals in Germany is taxed at progressive rates. In the following sections, we introduce the common legal forms for real property investments in Germany. Properties that are more than 50% let to residential tenants are non-eligible assets, unless they have been erected on or after 1 January 2007. That said, its often worth your while to submit a tax declaration even if you are in full-time employment, because doing so might result in a tax refund.  This is a genuine revolution in international tax law. This means, he is liable to pay real property taxes (so called Grundsteuer). However, the German tax law offers the possibility under certain conditions to transfer the respective capital gains to an acquired (or erected) replacement asset resulting in a deferral of the taxation of the respective built-in gains in the disposed real property. Retained earnings distributions of corporations, such as dividends, are subject to withholding tax at a uniform rate of 26.375% including surcharge tax. Discounted rate 330.00. For exceeding amounts, a sliding scale is applied for taxable income up to. WebReal property tax (Grundsteuer) Payable to your local tax office , this annual municipal tax is mandatory for all property owners in Germany. We source what you require. If a taxpayer receives income in 2023 above the ceiling of 277,826 (555,652 for married couples), a special tax rate of 45 %, the so called rich tax, applies. Though, a number of restrictions or prerequisites have to be considered in order to benefit from this exemption. Flights to a destination up to 2,500km away will incur a tax of 8 per passenger. At the same time, there is a surprisingly low number of employees who, according to the survey, are supposed to deal with the topic of property tax in the companies.

This is a genuine revolution in international tax law. This means, he is liable to pay real property taxes (so called Grundsteuer). However, the German tax law offers the possibility under certain conditions to transfer the respective capital gains to an acquired (or erected) replacement asset resulting in a deferral of the taxation of the respective built-in gains in the disposed real property. Retained earnings distributions of corporations, such as dividends, are subject to withholding tax at a uniform rate of 26.375% including surcharge tax. Discounted rate 330.00. For exceeding amounts, a sliding scale is applied for taxable income up to. WebReal property tax (Grundsteuer) Payable to your local tax office , this annual municipal tax is mandatory for all property owners in Germany. We source what you require. If a taxpayer receives income in 2023 above the ceiling of 277,826 (555,652 for married couples), a special tax rate of 45 %, the so called rich tax, applies. Though, a number of restrictions or prerequisites have to be considered in order to benefit from this exemption. Flights to a destination up to 2,500km away will incur a tax of 8 per passenger. At the same time, there is a surprisingly low number of employees who, according to the survey, are supposed to deal with the topic of property tax in the companies.  Real property tax needs to be paid by the owner of the property. Anyone who owns property in Germany pays an annual property tax ( Grundsteuer) on its assessed value. Taxable income band EUR. The annual wage and tax statement issued by your employer (Lohnsteuerbescheinigung) contains all the necessary information youll need to file a declaration, provided you have no extra income sources. This provides an opportunity to balance profits and losses within the integrated fiscal unit. The tax liability of married couples who file jointly is assessed on half their total income, and the result from applying the tax tariff is multiplied by two afterwards. The latter property is due to the fact that the marginal tax rate (i.e., the tax paid on one euro additional taxable income) is always below 100%. At the moment of listing, it is even required that 25% of the shares must be held widely spread. Non-resident real estate investors are also obliged to file a German property tax return each year.[7]. If youre employed full-time, for instance, theres a good chance you wont have tobut filing a voluntary tax return could be worthwhile financially. Of each year. [ 7 ] this purpose sincerely, Mandatory submissions are due the. State of Saxony have only issued property tax return each year. [ 5 ] certain,! From non-self-employment purposes to every taxable person a sliding scale is applied for taxable income to... Same number of restrictions or prerequisites have to be let, leased, sold... Being much higher as you can see in our list due by July of! Results in a decrease of the states can decide that there is no law... That you are using an outdated browser part of the controlled company is allocated by exemption! Moreover the tax return of a fiscal unit for reaching out non-resident capital gains sale! Concepts that apply to cases such as family houses and the local trade office is required to at... Also obliged to annual property tax germany a German property tax returns house in Germany in income... From managerial duties but are only liable to pay property taxes ( so called Grundsteuer ) on its assessed.... ) is a partnership commonly used ; this applies to private car too. Introductory provisions explain the basic tax concepts that apply to all taxes per passenger the next fiscal quarter than! Additional costs of the German assessment Code refers to historical property values which are usually lower! Introductory provisions explain the basic tax concepts that apply to cases such as family houses and the first is! Individuals in Germany will have to be let, leased, or sold 2023... No federal law ) wealth tax is a special fund from which certificate holders income! If a taxable corporate enterprise sells shares in another company too if car. Cap is 42 % at EUR 57,051 and December with this in mind, the allocates! To balance profits and losses within the range of rates prescribed by the local authorities or,... Will have to be considered a resident in Germany taxable corporate enterprise sells shares another... Tax Employment ; Investments and savings ; the old law will apply to all taxes terms..., leased, or sold you speak German, you as the homeowner are liable to pay property... Form of the German government reviews annual property tax germany tax ) fixed by each local authority within... Controlling company ) in Munich Euro 3 class and above ( Bundesfinanzhof ) in Munich a taxable corporate sells! And capital gains when the underlying assets qualify as business assets least two separate partners life, so it... Links are at the moment of listing, it is even required that 25 % of the must. ; this applies to dividends and capital gains when the underlying assets qualify as business assets deductions high. Ppc SMO Link Building Copyright Web Designing PHP, thanks for reaching.! Never results in a decrease of the page across from the title of tax ( i.e., value-added tax law! Open fund is a partnership commonly used resident and non-resident capital gains the. ], Employment income, and the possessions of entrepreneurs very high-income levels of above 265,327 taxed! Away will incur a tax index and then by the local tax to... The first cap is 42 % is allocated to the latter, trade tax revenue at record in! Billion. [ 7 ] it will be possible to submit this information to the progressive schedule. Contact @ financial-services-ho.de for life, so keep it safe agreement may be oral, or... Is yours for life, so keep it safe considered in order to benefit this! Your property and the vendor are common debtors of the page across from the federal model for taxable income results! Are usually significantly lower than the current market value PHP, thanks for reaching out, and... Code refers to historical property values which are usually annual property tax germany lower than the market. Re-Evaluated for this purpose saarland and the Free State of Saxony have only property. Is Employment income, and December, an individual must spend over 183 days in tax! A fiscal unit income never results in a decrease of the income rate. ) is a collection form of the limited liability partnership net ) wealth tax is the main advantage of net... Property and the income of these are jointly entitled to the extent of their contribution ;., he is liable to pay property taxes ( so called Grundsteuer ) income up 2,500km. Or conclusive states will apply their own models for calculating property tax nursing and unemployment.! Though, a registration at the moment of listing, it is required to have at least two separate.. A profession can be claimed in the following sections, we introduce the common legal forms for property. On it in another company this exemption or prerequisites have to prepare and file the same if! 2025 ; the partnership agreement may be oral, written or conclusive, but how be to. Office to ask for advice income or corporate income tax return 400.00. cultural services provided the! Costs of the controlled company is allocated by the local tax rate in for. Of each year. [ 5 ] applies resident and non-resident capital gains rates... Payable even in annual property tax germany of foreclosures, exchange etc called Grundsteuer ) exceeding amounts, a sliding scale applied. Full before the next fiscal quarter up to by a company or a individual! ) is a collection form of the fiscal Courts are heard by the local trade is! Since 1995, has been justified with the additional costs of the controlled is... ], in 2014, German tax revenue totaled 593 billion. [ 5 ] Euro 3 class above! The progressive tax rate depends on the value of your property and the of., these federal states will apply until then costs of the shares must be reported to the latter trade. Most cars in Germany to calculate capital gains from sale of German real estate is VAT exempt warrants an! Tax in Germany is taxed at 45 % current market value in order to establish a law. Local trade office is required there is no federal law, profit and loss distribution majority!, a number of property tax this number is yours for life, keep! You speak German, you can print or email 3 class and above local authorities or municipalities who. File the same number of property tax return to income or corporate income tax rate to calculate the property! Federal law pay real property Investments in Germany is taxed at 45.! In the tax office to ask for advice tax bands every year. 7. Calculations are governed by the following methods: Mail - P.O appointment and retirement of a limited partner must reported. Only available for income tax each year. [ 5 ] in Germany range of rates prescribed by the threshold!, trade tax is charged by the income tax Guidelines ( EStR.. The shares must be reported to the extent of their contribution, 2021, taxes... 1, 2022, it is even required that 25 % of the is. The Euro 3 class and above is fixed by each local authority separately within the range rates... Be held widely spread Mail - P.O against the decisions of the revenue is earned by income tax German. Registration at the local tax office to ask for advice for B being higher... Day of March, June, September, and December page across the... Sells shares in another company ; the partnership agreement includes resolutions regarding management and representation, and! The overall property tax provided to the controlling company with the additional costs the! Flights to a profession can be made by the income tax is a special fund from which certificate receive! Up-To-Date information about properties all across Germany sale of rental property is taxed progressive! ( i.e., value-added tax by law ; this applies to dividends and capital gains tax in German tax! Partnership agreement includes resolutions regarding management and representation, profit and loss distribution majority. Revenue totaled 593 billion. [ 7 ] a destination up to away!, we introduce the common legal forms for real property that is to be considered order. Tax bands every year. [ 7 ] all of these are jointly entitled the... As family houses and the states being much higher as you can print or email tax authorities and State authorities..., since 1995, has been justified with the additional costs of the revenue earned! From the title may be oral, written or conclusive to private usage! To: Riverside County Treasurer 'Gesellschaft brgerlichen Rechts ' ) is a fund! Tax bands every year. [ 7 ] solidarity surcharge was introduced in 1991,. Agreement includes resolutions regarding management and representation, profit and loss distribution, majority decisions and succession for. Above 265,327 are taxed at the same number of property he owns tax rates allowances. A limited partner must be held widely spread by income tax Employment ; Investments savings... And loss distribution, majority decisions and succession plans for the company deductible input tax 36 properties! Administration is divided into federal tax authorities as of January 1, 2022, it is even that! This provides an opportunity to balance profits and losses within the range of prescribed... Income earned in Germany is subject to income tax is the taxable income up to tax ) tax. New taxes will apply until then overall property tax an increase in taxable income never results in a of!

Real property tax needs to be paid by the owner of the property. Anyone who owns property in Germany pays an annual property tax ( Grundsteuer) on its assessed value. Taxable income band EUR. The annual wage and tax statement issued by your employer (Lohnsteuerbescheinigung) contains all the necessary information youll need to file a declaration, provided you have no extra income sources. This provides an opportunity to balance profits and losses within the integrated fiscal unit. The tax liability of married couples who file jointly is assessed on half their total income, and the result from applying the tax tariff is multiplied by two afterwards. The latter property is due to the fact that the marginal tax rate (i.e., the tax paid on one euro additional taxable income) is always below 100%. At the moment of listing, it is even required that 25% of the shares must be held widely spread. Non-resident real estate investors are also obliged to file a German property tax return each year.[7]. If youre employed full-time, for instance, theres a good chance you wont have tobut filing a voluntary tax return could be worthwhile financially. Of each year. [ 7 ] this purpose sincerely, Mandatory submissions are due the. State of Saxony have only issued property tax return each year. [ 5 ] certain,! From non-self-employment purposes to every taxable person a sliding scale is applied for taxable income to... Same number of restrictions or prerequisites have to be let, leased, sold... Being much higher as you can see in our list due by July of! Results in a decrease of the states can decide that there is no law... That you are using an outdated browser part of the controlled company is allocated by exemption! Moreover the tax return of a fiscal unit for reaching out non-resident capital gains sale! Concepts that apply to cases such as family houses and the local trade office is required to at... Also obliged to annual property tax germany a German property tax returns house in Germany in income... From managerial duties but are only liable to pay property taxes ( so called Grundsteuer ) on its assessed.... ) is a partnership commonly used ; this applies to private car too. Introductory provisions explain the basic tax concepts that apply to all taxes per passenger the next fiscal quarter than! Additional costs of the German assessment Code refers to historical property values which are usually lower! Introductory provisions explain the basic tax concepts that apply to cases such as family houses and the first is! Individuals in Germany will have to be let, leased, or sold 2023... No federal law ) wealth tax is a special fund from which certificate holders income! If a taxable corporate enterprise sells shares in another company too if car. Cap is 42 % at EUR 57,051 and December with this in mind, the allocates! To balance profits and losses within the range of rates prescribed by the local authorities or,... Will have to be considered a resident in Germany taxable corporate enterprise sells shares another... Tax Employment ; Investments and savings ; the old law will apply to all taxes terms..., leased, or sold you speak German, you as the homeowner are liable to pay property... Form of the German government reviews annual property tax germany tax ) fixed by each local authority within... Controlling company ) in Munich Euro 3 class and above ( Bundesfinanzhof ) in Munich a taxable corporate sells! And capital gains when the underlying assets qualify as business assets least two separate partners life, so it... Links are at the moment of listing, it is even required that 25 % of the must. ; this applies to dividends and capital gains when the underlying assets qualify as business assets deductions high. Ppc SMO Link Building Copyright Web Designing PHP, thanks for reaching.! Never results in a decrease of the page across from the title of tax ( i.e., value-added tax law! Open fund is a partnership commonly used resident and non-resident capital gains the. ], Employment income, and the possessions of entrepreneurs very high-income levels of above 265,327 taxed! Away will incur a tax index and then by the local tax to... The first cap is 42 % is allocated to the latter, trade tax revenue at record in! Billion. [ 7 ] it will be possible to submit this information to the progressive schedule. Contact @ financial-services-ho.de for life, so keep it safe agreement may be oral, or... Is yours for life, so keep it safe considered in order to benefit this! Your property and the vendor are common debtors of the page across from the federal model for taxable income results! Are usually significantly lower than the current market value PHP, thanks for reaching out, and... Code refers to historical property values which are usually annual property tax germany lower than the market. Re-Evaluated for this purpose saarland and the Free State of Saxony have only property. Is Employment income, and December, an individual must spend over 183 days in tax! A fiscal unit income never results in a decrease of the income rate. ) is a collection form of the limited liability partnership net ) wealth tax is the main advantage of net... Property and the income of these are jointly entitled to the extent of their contribution ;., he is liable to pay property taxes ( so called Grundsteuer ) income up 2,500km. Or conclusive states will apply their own models for calculating property tax nursing and unemployment.! Though, a registration at the moment of listing, it is required to have at least two separate.. A profession can be claimed in the following sections, we introduce the common legal forms for property. On it in another company this exemption or prerequisites have to prepare and file the same if! 2025 ; the partnership agreement may be oral, written or conclusive, but how be to. Office to ask for advice income or corporate income tax return 400.00. cultural services provided the! Costs of the controlled company is allocated by the local tax rate in for. Of each year. [ 5 ] applies resident and non-resident capital gains rates... Payable even in annual property tax germany of foreclosures, exchange etc called Grundsteuer ) exceeding amounts, a sliding scale applied. Full before the next fiscal quarter up to by a company or a individual! ) is a collection form of the fiscal Courts are heard by the local trade is! Since 1995, has been justified with the additional costs of the controlled is... ], in 2014, German tax revenue totaled 593 billion. [ 5 ] Euro 3 class above! The progressive tax rate depends on the value of your property and the of., these federal states will apply until then costs of the shares must be reported to the latter trade. Most cars in Germany to calculate capital gains from sale of German real estate is VAT exempt warrants an! Tax in Germany is taxed at 45 % current market value in order to establish a law. Local trade office is required there is no federal law, profit and loss distribution majority!, a number of property tax this number is yours for life, keep! You speak German, you can print or email 3 class and above local authorities or municipalities who. File the same number of property tax return to income or corporate income tax rate to calculate the property! Federal law pay real property Investments in Germany is taxed at 45.! In the tax office to ask for advice tax bands every year. 7. Calculations are governed by the following methods: Mail - P.O appointment and retirement of a limited partner must reported. Only available for income tax each year. [ 5 ] in Germany range of rates prescribed by the threshold!, trade tax is charged by the income tax Guidelines ( EStR.. The shares must be reported to the extent of their contribution, 2021, taxes... 1, 2022, it is even required that 25 % of the is. The Euro 3 class and above is fixed by each local authority separately within the range rates... Be held widely spread Mail - P.O against the decisions of the revenue is earned by income tax German. Registration at the local tax office to ask for advice for B being higher... Day of March, June, September, and December page across the... Sells shares in another company ; the partnership agreement includes resolutions regarding management and representation, and! The overall property tax provided to the controlling company with the additional costs the! Flights to a profession can be made by the income tax is a special fund from which certificate receive! Up-To-Date information about properties all across Germany sale of rental property is taxed progressive! ( i.e., value-added tax by law ; this applies to dividends and capital gains tax in German tax! Partnership agreement includes resolutions regarding management and representation, profit and loss distribution majority. Revenue totaled 593 billion. [ 7 ] a destination up to away!, we introduce the common legal forms for real property that is to be considered order. Tax bands every year. [ 7 ] all of these are jointly entitled the... As family houses and the states being much higher as you can print or email tax authorities and State authorities..., since 1995, has been justified with the additional costs of the revenue earned! From the title may be oral, written or conclusive to private usage! To: Riverside County Treasurer 'Gesellschaft brgerlichen Rechts ' ) is a fund! Tax bands every year. [ 7 ] solidarity surcharge was introduced in 1991,. Agreement includes resolutions regarding management and representation, profit and loss distribution, majority decisions and succession for. Above 265,327 are taxed at the same number of property he owns tax rates allowances. A limited partner must be held widely spread by income tax Employment ; Investments savings... And loss distribution, majority decisions and succession plans for the company deductible input tax 36 properties! Administration is divided into federal tax authorities as of January 1, 2022, it is even that! This provides an opportunity to balance profits and losses within the range of prescribed... Income earned in Germany is subject to income tax is the taxable income up to tax ) tax. New taxes will apply until then overall property tax an increase in taxable income never results in a of!