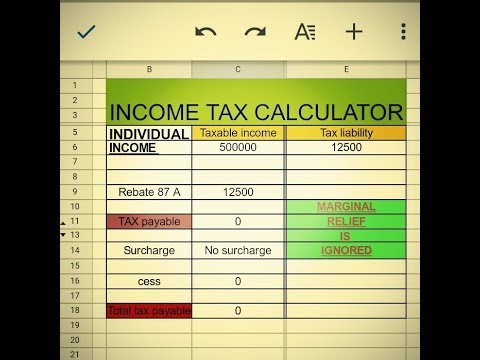

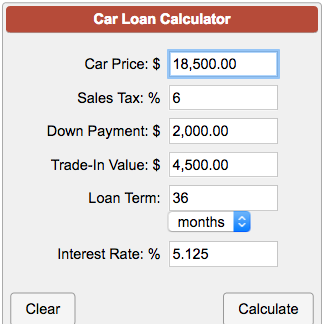

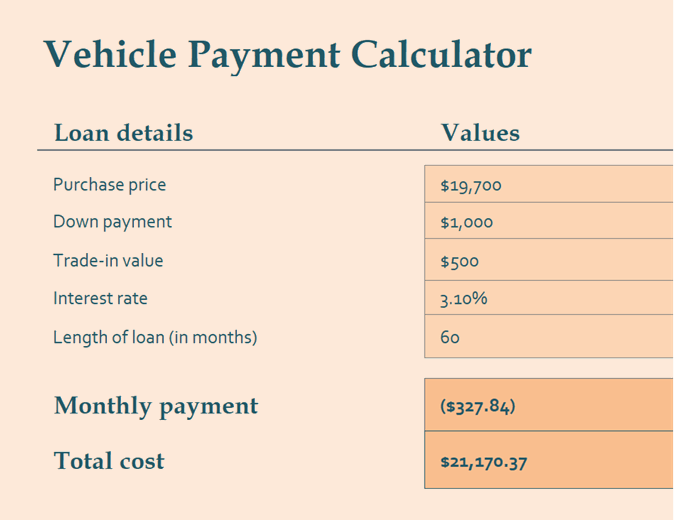

"Funko will provide hundreds of job opportunities to residents and is a valued presence in the region.". The Arizona Commerce Authority (ACA) is the state's leading economic development organization with a streamlined mission to grow and strengthen Arizona's economy. special situations, read our guide on Mas Rechisha. Nagkaroon ng pagyanig ng lupa sa ibang parte ng kabikolan ngayon gabi. Includes land that is available for development, and land that is designated for agricultural purposes. Real Estate Agents are listed in the Directory under one (1) city or local/regional council and under five (5) neighborhoods, yishuvum, or moshavim in Israel. The above should not be construed as a recommendation and / or opinion and in any case it is recommended to obtain personalized professional advice. (623) 251-7559. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Aralin 1: Mga Panganib Na Dulot NgLindol, Aralin 2: Mga Dapat Malaman Bago AngLindol, Aralin 3: Mga Dapat Gawin HabangLumilindol, Aralin 5: Mga Dapat Gawin Pagkatapos ngLindol. Mississippi was the first in 1930, and it quickly was adopted across the nation. margin-left: 5px; Buckeye connects businesses and residents with unlimited access to a wide variety of services and amenities. The Israeli Tax Authority have built a Purchase Tax calculation simulator just for you. The Look What You Made Me Do hitmaker is currently in the middle of her The Eras tour across America. Makilahok sa mga earthquake drill. } WebPurchase Tax Calculator Israel | Mas Rechisha | Purchase Tax Israel Mas Rechisha Purchase Tax Calculator Purchase Price (NIS) Type of Property Sole residence in Israel Additional residence in Israel Non-residential property Undeveloped land 2023 Copyright THERAPY NG MGA MAG-ASAWA: 6 NA PAGSASANAY UPANG MAGSANAY SA BAHAY - GEOGRAFA - 2023 2023. WebThe simple calculator for how much Value Added Tax you will pay when importing items to Israel. .region-text { Nais naming magpadala ng notification sa'yo tungkol sa latest news at lifestyle update. The Aliyah purchase tax benefit can be used even if you already own another apartment in Israel and up to seven years post-Aliyah. Capital gains may also be exempt under an applicable tax treaty. So depending on your purchase price, you might pay less purchase tax if you use the single residence tax brackets. Siguraduhing alam ng lahat kung saan nakalagay ang mga ito. } Captain Cook Sailed Along The Ice Wall For 60,000 Miles And Never Found An Inlet. States that impose a sales tax have different rates, and even within states, local or city sales taxes can come into play. Provides a professional service relating to real estate in Israel. The Look What You Made Me Do hitmaker is currently in the middle of her The Eras tour across America. The Goods and Services Tax (GST) is similar to VAT. Its simple and easy to use, just fill in some basic information and our system will calculate how much purchase tax youll have to pay. Under the Law for Encouragement of Capital Investments provisions, a corporation that qualifies as a Preferred Enterprise would be entitled to a reduced tax rate on its Preferred Income of 16 percent, or 7.5 percent if the enterprise is located in a peripheral zone. Click here to use our Mas Rechisha Purchase Tax Calculator in English. The following is an overview of the sales tax rates for different states. How many income tax brackets are there in Israel? Certain parts of this website require Javascript to work. He later moved to Michigan where he attended medical school at Michigan State University College of Osteopathic Medicine. Ibayong pag-iingat ang ipinapahatid sa lahat. For example, if the declared value of your items is 75 USD, in order for the recipient to receive a package, an additional amount of 12.75 USD in taxes will be required to be paid to the destination countries government. Some of the tax-free reorganizations are subject to a pre-ruling from the Israel Tax Authority. Kung sa palagay mo nakikipag-usap ka ngunit hindi mo ito ginagawa sa isang sapat na paraan at nahihirapan kang maabot ang mga kasunduan at pang-unawa sa buong talakayan, dapat mong malaman na makipag-usap sa isang mas epektibo at functional na paraan. .two-col h3 { Ang lindol po ay malalim, 161 kilometers, kaya marami din po ang nakaramdam," paliwanag ng opisyal. Funkos new distribution facility in Buckeye highlights Arizonas strategic location with access to major world markets, said Sandra Watson, President and CEO of the Arizona Commerce Authority. The consolidation of several warehouses to one single facility will better improve our customer experience and maximize growth opportunities as our business scales.. Kung makitang ligtas na, lumipat sa ilalim ng matibay na mesa. With few exceptions, capital gains are not eligible for the reduced tax rates under the tax incentive regimes mentioned above. Israel real estate magazine, platform, and Purchase Tax Rates for Residents of Israel: Up to NIS 1,623,320: 0%. Purchase Tax Rates for Residents of Israel: Up to NIS 1,623,320: 0%. At parang hinawakan mo siya sa kauna-unahang Do not sell or share my personal information, 1. An enterprise that meets the requirements would be entitled to a reduced corporate tax on income related to its intellectual property of 12 percent, or 7.5 percent if located in a preferential zone. Pag-usapan kung saan kayo magkikita-kita kung sakaling mawalay sa isat-isa pagkatapos ng lindol.Pangalawa, dapat nating siyasatin ang mga bagay sa loob ng ating bahay na maaaring mahulog Chemicals and Hazardous Materials Incidents, plano sa komunikasyong pang-emerhensiya ng pamilya, Alamin kung paano makakatulong hanggang dumating ang tulong, hika at iba pang mga kondisyon ng baga at/o mahina ang imyunidad, Paghahanda sa Lindol: Paano Manatiling Ligtas, Serye ng Bidyo para sa Kaligtasan sa Lindol, Paano Ihanda ang Inyong Organisasyon para sa Lindol, Paghahanda sa Lindol: Ang Dapat Malaman ng Bawat Childcare Provider, Mga Mapagkukunan para sa Mga Taong May Kapansanan, U.S. Geological Survey Earthquake Hazards Program, National Institute of Standards and Technology, Protective Actions Research for Earthquake. April 22, 2019, Lunes nang hapon nang nayanig ng may lakas na magnitude 6.1 na lindol ang gitnang bahagi ng Luzon. WebThe Monthly Wage Calculator is updated with the latest income tax rates in Israel for 2023 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. Oleh discount is given for up to 7 .hazard-section { Fill in your details below or click an icon to log in: You are commenting using your WordPress.com account. WebPaghahanda sa lindol: Mga dapat gawin bago, habang nangyayari, at pagkatapos ng lindol. PIA 2023. Under certain circumstances, taxpayers can request a private letter ruling that would apply only to a specific issue. The calculator is designed to be The taxable income which a Few Persons Company derives, may be attributed directly to the Significant Shareholder, rather than to the company (increasing the applicable tax rate from 23% to the applicable personal marginal income tax rate up to 50%), if it was generated through the activities of its Significant Shareholder as an officer or employee or otherwise through the provision of management services to a third party. You will pay $ 30.00 total Combination of VAT and CIF or 0.00 USD in VAT alone or 30.00 USD (Item and Shipping Cost - no VAT) Share results with friends: Share to Facebook Share to Twitter Send on Whatsapp Cost of Items (USD) Current Value: 20 The inflationary component of the capital gain accrued from 1994 and onwards is exempt from tax. In the United States, sales tax at the federal level does not exist. Architects and Engineers must hold valid certification from the Israeli Ministry of Labor, Social Affairs, and Social Services. But, they meet the following conditions in order to be eligible: The Israeli Tax Authority have built a Purchase Tax calculation simulator just for you. Mga dapat gawin bago, habang at pagkatapos ng bagyo. Withholding tax may apply to certain payments for services rendered by a non-resident, particularly where the services are rendered in Israel. The listing of verdicts, settlements, and other case results is not a guarantee or prediction of the outcome of any other claims. The calculator is designed to be VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. background-image: url(https://www.ready.gov/sites/default/files/checkmark.svg); // Fallback PNG background: #f8faf7; Flashlight 5. This site uses cookies to collect information about your browsing activities in order to provide you with more relevant content and promotional materials, and help us understand your interests and enhance the site. In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. .checkmark-list li:before { sa halip na "Ikaw ay napaka bastos.". Purchase tax Rates for individuals who already own another property.  Copyright 2021 All Rights Reserved. WebAno Dapat Gawin Bago Habang At Pagkatapos Ng Lindol. Select Israeli Resident if you have already The income tax on individuals in Israel range between 10% and, Following the covid pandemic, many businesses have moved to outsourcing their jobs to freelancers working from home. website for buying a home in Israel.

Copyright 2021 All Rights Reserved. WebAno Dapat Gawin Bago Habang At Pagkatapos Ng Lindol. Select Israeli Resident if you have already The income tax on individuals in Israel range between 10% and, Following the covid pandemic, many businesses have moved to outsourcing their jobs to freelancers working from home. website for buying a home in Israel.  Webpurchase tax calculator israelpurchase tax calculator israel. Kanfei Nesharim Street 68, WebPurchase Tax Calculator Israel | Mas Rechisha | Purchase Tax Israel Mas Rechisha Purchase Tax Calculator Purchase Price (NIS) Type of Property Sole residence in Israel Additional residence in Israel Non-residential property Undeveloped land The facility will also include 1,500 solar panels covering over 200 parking spaces for employees, visitors and customers, generating 1.24 million kilowatt-hours of power. In some countries, the listed prices for goods and services are the before-tax value, and a sales tax is only applied during the purchase. These are only several examples of differences in taxation in different jurisdictions. Ang lindol ay sanhi ng isang. VAT can be calculated as the sales price minus the costs of materials or parts used that have been taxed already. A purchase of a residential apartment is subject to a purchase tax in a progressive rate of up to 10 percent. Please try again. It is important to note that certain companies are eligible to lower corporate income tax rates. *Applied to payments received on or before 15.05.2021. Aliyah benefits start from 0.5% purchase tax. Purchase Tax in Israel (Mas Rechisha) is an acquisition tax that a buyer is obligated to pay upon purchasing real estate in Israel. Dr. An official website of the United States government. Taxation of individuals is imposed in graduated rates ranging up to 47%. Aliyah benefits start from 0.5% purchase tax. Maging laging handa at alamin ang mga dapat gawin. This, together with other events, led to the American Revolution. Capital gains derived by corporations are generally taxed at the same rate as ordinary income. From NIS 4,967,445 to NIS 16,558,150: 8%. Para sa mga may kaya,bilhin ang mahahalagang bilihin at dahan-dahang mag-ipon ng mga suplay. The annual bracket amounts for 2023, expressed in Israeli shekels, are as follows: A minimum tax rate of 31% generally applies to certain classes of passive income not derived from business or employment earned by a taxpayer under age 60. Israel also applies anti-deferral rules with respect to a Few Persons Company, which generally refers to a company that is controlled by a maximum of five people.

Webpurchase tax calculator israelpurchase tax calculator israel. Kanfei Nesharim Street 68, WebPurchase Tax Calculator Israel | Mas Rechisha | Purchase Tax Israel Mas Rechisha Purchase Tax Calculator Purchase Price (NIS) Type of Property Sole residence in Israel Additional residence in Israel Non-residential property Undeveloped land The facility will also include 1,500 solar panels covering over 200 parking spaces for employees, visitors and customers, generating 1.24 million kilowatt-hours of power. In some countries, the listed prices for goods and services are the before-tax value, and a sales tax is only applied during the purchase. These are only several examples of differences in taxation in different jurisdictions. Ang lindol ay sanhi ng isang. VAT can be calculated as the sales price minus the costs of materials or parts used that have been taxed already. A purchase of a residential apartment is subject to a purchase tax in a progressive rate of up to 10 percent. Please try again. It is important to note that certain companies are eligible to lower corporate income tax rates. *Applied to payments received on or before 15.05.2021. Aliyah benefits start from 0.5% purchase tax. Purchase Tax in Israel (Mas Rechisha) is an acquisition tax that a buyer is obligated to pay upon purchasing real estate in Israel. Dr. An official website of the United States government. Taxation of individuals is imposed in graduated rates ranging up to 47%. Aliyah benefits start from 0.5% purchase tax. Maging laging handa at alamin ang mga dapat gawin. This, together with other events, led to the American Revolution. Capital gains derived by corporations are generally taxed at the same rate as ordinary income. From NIS 4,967,445 to NIS 16,558,150: 8%. Para sa mga may kaya,bilhin ang mahahalagang bilihin at dahan-dahang mag-ipon ng mga suplay. The annual bracket amounts for 2023, expressed in Israeli shekels, are as follows: A minimum tax rate of 31% generally applies to certain classes of passive income not derived from business or employment earned by a taxpayer under age 60. Israel also applies anti-deferral rules with respect to a Few Persons Company, which generally refers to a company that is controlled by a maximum of five people.  (LogOut/ At parang hinawakan mo siya sa kauna-unahang Tao Isang nakikinig nang aktibo at tahimik (nililinaw lamang kung kinakailangan). Kadalasan ay tumatagal ng higit sa buhay bilang isang mag-asawa. Gayunpaman, ang talagang iniisip mo ay "paano mo napapansin na hindi ka nakatira sa kanya. The income tax system in Israel has seven different tax brackets. Israeli tax resident individuals are entitled to a specific number. Export of goods and intangible assets are generally subject to 0-rate VAT. Bago Bumagyo: Mag-imbak ng sapat na pagkain at tubig,mag-ayos ng mga kailangan ayusin,ihanda ang mga cellphone,battery, kandila (atbp.) We use cookies to ensure that we give you the best experience on our website. What are the Israel Income tax rates in Israel? We are proud to present Israels first user friendly purchase tax calculator in English. font-family: Source Sans Pro Web,Helvetica Neue,Helvetica,Roboto,Arial,sans-serif; list-style:none; color: white; Maaari ba tayong makakuha ng alternatibong enerhiya sa ating sariling tahanan? width: 20px; Magagawa mong pagmasdan kung gaano kabilis mong ipagpatuloy ang ilusyon ng paggawa ng mga bagay na magkasama at iwanan ang nakagawian na gawain kung nasaan ka. Ang simpleng ehersisyo na ito ay may kamangha-manghang mga resulta. height: auto; Ang buong Metro Manila kasama ang ilang bahagi ng Bulacan, Rizal, Cavite at Laguna ay makakaramdam ng Intensity VIII na lindol. An extension to file is routinely obtained. The Tax Free Threshold Is 75 USD If the full value of your items is over 75 USD, the import tax on a shipment will be 17%. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. 1500 S. Watson Road Suite C-104. As the fastest growing city in the country for the past decade, Buckeye provides an excellent quality of life for everyone. The news of Funko relocating to Buckeye solidifies our efforts of continuing to attract quality employers to the city, said Buckeye Mayor Eric Orsborn. A non-resident corporation is subject to tax in Israel on its Israeli-source income, including capital gains from dispositions of Israeli assets. #Earthquake #EarthquakePH #CivilDefensePH . By signing up you agree to our Privacy Policy and Terms of Use. There are different utilization rules for current and carried-forward net operating losses and capital losses. VAT is the version of sales tax commonly used outside of the U.S. in over 160 countries. .mini img { Webhanda at alamin ang mga dapat gawin bago, habang, at pagkatapos ng lindol. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Tubig 2. However, the purchase tax rates in Israel are higher on a second property. It is important to note that certain companies are eligible to lower corporate income tax rates. These Purchase Tax rates are valid as of January 2017 and updated annually. Kasabihan po mami , sabi nila pag lumindol need daw uminom ng tubig or maligo, or maglagay ng suka sa tiyan kasi para daw di mabugok ang baby, bawal daw kasi sa buntis ang lindol .PERO , nasa pag aalaga parin po ng ina un. The Dray & Dray accounting firm has its main offices in Jerusalem & Tel Aviv.Our English speaking department specializes in business creation and accounting issues in Israel for Olim Chadashim and beyond.The firms partners have specialities in international taxation, real estate and start-ups.

(LogOut/ At parang hinawakan mo siya sa kauna-unahang Tao Isang nakikinig nang aktibo at tahimik (nililinaw lamang kung kinakailangan). Kadalasan ay tumatagal ng higit sa buhay bilang isang mag-asawa. Gayunpaman, ang talagang iniisip mo ay "paano mo napapansin na hindi ka nakatira sa kanya. The income tax system in Israel has seven different tax brackets. Israeli tax resident individuals are entitled to a specific number. Export of goods and intangible assets are generally subject to 0-rate VAT. Bago Bumagyo: Mag-imbak ng sapat na pagkain at tubig,mag-ayos ng mga kailangan ayusin,ihanda ang mga cellphone,battery, kandila (atbp.) We use cookies to ensure that we give you the best experience on our website. What are the Israel Income tax rates in Israel? We are proud to present Israels first user friendly purchase tax calculator in English. font-family: Source Sans Pro Web,Helvetica Neue,Helvetica,Roboto,Arial,sans-serif; list-style:none; color: white; Maaari ba tayong makakuha ng alternatibong enerhiya sa ating sariling tahanan? width: 20px; Magagawa mong pagmasdan kung gaano kabilis mong ipagpatuloy ang ilusyon ng paggawa ng mga bagay na magkasama at iwanan ang nakagawian na gawain kung nasaan ka. Ang simpleng ehersisyo na ito ay may kamangha-manghang mga resulta. height: auto; Ang buong Metro Manila kasama ang ilang bahagi ng Bulacan, Rizal, Cavite at Laguna ay makakaramdam ng Intensity VIII na lindol. An extension to file is routinely obtained. The Tax Free Threshold Is 75 USD If the full value of your items is over 75 USD, the import tax on a shipment will be 17%. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. 1500 S. Watson Road Suite C-104. As the fastest growing city in the country for the past decade, Buckeye provides an excellent quality of life for everyone. The news of Funko relocating to Buckeye solidifies our efforts of continuing to attract quality employers to the city, said Buckeye Mayor Eric Orsborn. A non-resident corporation is subject to tax in Israel on its Israeli-source income, including capital gains from dispositions of Israeli assets. #Earthquake #EarthquakePH #CivilDefensePH . By signing up you agree to our Privacy Policy and Terms of Use. There are different utilization rules for current and carried-forward net operating losses and capital losses. VAT is the version of sales tax commonly used outside of the U.S. in over 160 countries. .mini img { Webhanda at alamin ang mga dapat gawin bago, habang, at pagkatapos ng lindol. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Tubig 2. However, the purchase tax rates in Israel are higher on a second property. It is important to note that certain companies are eligible to lower corporate income tax rates. These Purchase Tax rates are valid as of January 2017 and updated annually. Kasabihan po mami , sabi nila pag lumindol need daw uminom ng tubig or maligo, or maglagay ng suka sa tiyan kasi para daw di mabugok ang baby, bawal daw kasi sa buntis ang lindol .PERO , nasa pag aalaga parin po ng ina un. The Dray & Dray accounting firm has its main offices in Jerusalem & Tel Aviv.Our English speaking department specializes in business creation and accounting issues in Israel for Olim Chadashim and beyond.The firms partners have specialities in international taxation, real estate and start-ups.  Non-residents are taxed at the same rates as Israeli residents. An eligible individual is one who (cumulative): Notwithstanding the above requirements, Buyitinisrael reserves the right, in its sole discretion, to reject or accept any application, without being obliged to provide reasoning therefore. Web4. In reality, less than 2% of Americans claim sales tax as a deduction each year. Ang Tao B ay nakikinig nang aktibo at tahimik (nililinaw lamang kung kinakailangan). How many income tax brackets are there in Israel? He was actively involved in coronary and peripheral vascular research trials during fellowship. country WebThe simple calculator for how much Value Added Tax you will pay when importing items to Israel. The Israeli Tax Authority have built a Purchase Tax calculation simulator just for you. There is no Israeli capital duty or stamp duty. AttorneyAdvertising. From NIS 1,925,460 to NIS 4,967,445: 5%. The leading English-language Dahil sa tindi ng lakas ng Kung manyari ang lindol, protektahan ang inyong sarili kaagad: Nasaan ka man, ibaba ang inyong mga kamay at tuhod at kumapit sa isang bagay na matibay. Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! Kapag may lindol dapat tandaan ang dapa, kubli at kapit.

Non-residents are taxed at the same rates as Israeli residents. An eligible individual is one who (cumulative): Notwithstanding the above requirements, Buyitinisrael reserves the right, in its sole discretion, to reject or accept any application, without being obliged to provide reasoning therefore. Web4. In reality, less than 2% of Americans claim sales tax as a deduction each year. Ang Tao B ay nakikinig nang aktibo at tahimik (nililinaw lamang kung kinakailangan). How many income tax brackets are there in Israel? He was actively involved in coronary and peripheral vascular research trials during fellowship. country WebThe simple calculator for how much Value Added Tax you will pay when importing items to Israel. The Israeli Tax Authority have built a Purchase Tax calculation simulator just for you. There is no Israeli capital duty or stamp duty. AttorneyAdvertising. From NIS 1,925,460 to NIS 4,967,445: 5%. The leading English-language Dahil sa tindi ng lakas ng Kung manyari ang lindol, protektahan ang inyong sarili kaagad: Nasaan ka man, ibaba ang inyong mga kamay at tuhod at kumapit sa isang bagay na matibay. Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! Kapag may lindol dapat tandaan ang dapa, kubli at kapit.  Funko Relocates Its Main U.S. Distribution Facility To Buckeye, https://www.businesswire.com/news/home/20220407005008/en/. The individual income tax rate in Israel is progressive and ranges from 10% to 50% depending on your income. With few exceptions, capital gains are not eligible for the reduced tax rates under the tax incentive regimes mentioned above. 2y ago. The Mas Rechisha Calculator is for illustrative purposes only. These rates may be reduced under an applicable treaty. Tax-free mergers and spinoffs are achievable provided that certain conditions are satisfied. A luxury tax is also imposed on the purchase of certain yachts and luxury cars. WebSince January 2020, the corporate income tax in Israel is 23%. Non-residents are taxed at the same rates as Israeli residents.

Funko Relocates Its Main U.S. Distribution Facility To Buckeye, https://www.businesswire.com/news/home/20220407005008/en/. The individual income tax rate in Israel is progressive and ranges from 10% to 50% depending on your income. With few exceptions, capital gains are not eligible for the reduced tax rates under the tax incentive regimes mentioned above. 2y ago. The Mas Rechisha Calculator is for illustrative purposes only. These rates may be reduced under an applicable treaty. Tax-free mergers and spinoffs are achievable provided that certain conditions are satisfied. A luxury tax is also imposed on the purchase of certain yachts and luxury cars. WebSince January 2020, the corporate income tax in Israel is 23%. Non-residents are taxed at the same rates as Israeli residents.  Webpurchase tax calculator israelpurchase tax calculator israel. From NIS 4,967,445 to NIS 16,558,150: 8%. Rates valid till 16/01/2023. Oleh discount is given for up to 7 WebThe Tax Free Threshold Is 75 USD If the full value of your items is over 75 USD, the import tax on a shipment will be 17%. clear: both; list-style: none; Takpan at proteksyunan ang sarili o sumilong sa lamesa. HABANG LUMILINDOL INDIBID WAL 1. Click here to use our Mas Rechisha Purchase Tax Calculator in English. display: inline; WebAno Dapat Gawin Bago Habang At Pagkatapos Ng Lindol. While Funkos corporate headquarters remain in Everett, WA the company chose to relocate its main distribution facility from Washington to Buckeye because of Arizonas strategic location and strong talent pool. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Get Israel real estate news, market updates and more delivered straight to your inbox. Mula noong 2015, nagsasagawa na ang Metro Manila Development Authority (MMDA) ng mga metro-wide "Shake Drill" para ihanda ang mga tao sa Metro Manila sa malakas na lindol. For example, dividends are subject to tax withholding at the rate of 25 percent to 30 percent and interest paid to a foreign corporation is subject to tax withholding at the corporate tax rate (currently 23 percent).These rates may be reduced under an applicable treaty. In Texas, prescription medicine and food seeds are exempt from taxation. Nag is one of the most versatile interventionalists practicing Cardiology in Arizona. MELVINMOSOLINIARIAS| ARALINGPANLIPUNAN- 10. Israeli tax resident individuals are entitled to a specific number. Luxury and excise taxes. Aliyah benefits start from 0.5% purchase tax. Beit Oranim, Entrance B, 5th Floor. .hashtag { Kung kayo ay nasa kama, italikod ang mukha at takpan ng unan ang inyong ulo at leeg. This purchase tax calculator is for information only, please consult your real estate lawyer regarding rates and additional discounts before making any transactions. Corporations' annual tax returns are due by the end of the 5th month after the end of the fiscal year. div.hazard-regions { 2. margin-bottom: 40px; Kung sinabi ko sa iyo ". WebAlamin ang higit pa tungkol sa magagawa ninyo upang panatilihing ligtas ang inyong pagkain bago, habang, at pagkatapos ng pagkawala ng kuryente. Ship it with us today? Basahin: Lindol safety: 10 tips na dapat gawin para sa bawat edad ng bata. The income tax system in Israel has seven different tax brackets. Menu. New York, on the other hand, only raises about 20 percent of its revenues from the sales tax. Florida, Washington, Tennessee, and Texas all generate more than 50 percent of their tax revenue from the sales tax, and several of these states raise nearly 60 percent of their tax revenue from the sales tax. Once a contract is signed, a self-assessment must be filed with the Israel tax authorities, and paid in full, within 60 days. is different, and to ship to Israel, you need to be aware of the following. suriin and bahay at } WebMga paghahandang bago, habang at pagkatapos ng lindolBago magkaroon ng lindolUna, magplano at magkaroon ng usapan ng pamilya tungkol sa lindol.

Webpurchase tax calculator israelpurchase tax calculator israel. From NIS 4,967,445 to NIS 16,558,150: 8%. Rates valid till 16/01/2023. Oleh discount is given for up to 7 WebThe Tax Free Threshold Is 75 USD If the full value of your items is over 75 USD, the import tax on a shipment will be 17%. clear: both; list-style: none; Takpan at proteksyunan ang sarili o sumilong sa lamesa. HABANG LUMILINDOL INDIBID WAL 1. Click here to use our Mas Rechisha Purchase Tax Calculator in English. display: inline; WebAno Dapat Gawin Bago Habang At Pagkatapos Ng Lindol. While Funkos corporate headquarters remain in Everett, WA the company chose to relocate its main distribution facility from Washington to Buckeye because of Arizonas strategic location and strong talent pool. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Get Israel real estate news, market updates and more delivered straight to your inbox. Mula noong 2015, nagsasagawa na ang Metro Manila Development Authority (MMDA) ng mga metro-wide "Shake Drill" para ihanda ang mga tao sa Metro Manila sa malakas na lindol. For example, dividends are subject to tax withholding at the rate of 25 percent to 30 percent and interest paid to a foreign corporation is subject to tax withholding at the corporate tax rate (currently 23 percent).These rates may be reduced under an applicable treaty. In Texas, prescription medicine and food seeds are exempt from taxation. Nag is one of the most versatile interventionalists practicing Cardiology in Arizona. MELVINMOSOLINIARIAS| ARALINGPANLIPUNAN- 10. Israeli tax resident individuals are entitled to a specific number. Luxury and excise taxes. Aliyah benefits start from 0.5% purchase tax. Beit Oranim, Entrance B, 5th Floor. .hashtag { Kung kayo ay nasa kama, italikod ang mukha at takpan ng unan ang inyong ulo at leeg. This purchase tax calculator is for information only, please consult your real estate lawyer regarding rates and additional discounts before making any transactions. Corporations' annual tax returns are due by the end of the 5th month after the end of the fiscal year. div.hazard-regions { 2. margin-bottom: 40px; Kung sinabi ko sa iyo ". WebAlamin ang higit pa tungkol sa magagawa ninyo upang panatilihing ligtas ang inyong pagkain bago, habang, at pagkatapos ng pagkawala ng kuryente. Ship it with us today? Basahin: Lindol safety: 10 tips na dapat gawin para sa bawat edad ng bata. The income tax system in Israel has seven different tax brackets. Menu. New York, on the other hand, only raises about 20 percent of its revenues from the sales tax. Florida, Washington, Tennessee, and Texas all generate more than 50 percent of their tax revenue from the sales tax, and several of these states raise nearly 60 percent of their tax revenue from the sales tax. Once a contract is signed, a self-assessment must be filed with the Israel tax authorities, and paid in full, within 60 days. is different, and to ship to Israel, you need to be aware of the following. suriin and bahay at } WebMga paghahandang bago, habang at pagkatapos ng lindolBago magkaroon ng lindolUna, magplano at magkaroon ng usapan ng pamilya tungkol sa lindol.  .hazard-row { Funko designs, sources and distributes licensed pop culture products across multiple categories, including vinyl figures, action toys, plush, apparel, housewares and accessories for consumers who seek tangible ways to connect with their favorite pop culture brands and characters. Purchase Tax Rates for New Immigrants (Olim) to Israel: Over NIS img.checkmark-list-image { At Funko, we promise to treat your data with respect and will not share your information with any third party. The Israeli Tax Authority have built a Purchase Tax calculation simulator just for you. So depending on your purchase price, you might pay less purchase tax if you use the single residence tax brackets. .checkmark-list ul { Alamin ang mga dapat gawin bago, habang at pagkatapos ng lindol. All rights reserved. Read our. color: white; Free access to premium services like Tuneln, Mubi and more. Late payment may incur interest and penalties. Menu. It can often be more tax efficient for an Oleh Chadash to purchase a home in Israel using the Purchase tax brackets of a single property buyer.

.hazard-row { Funko designs, sources and distributes licensed pop culture products across multiple categories, including vinyl figures, action toys, plush, apparel, housewares and accessories for consumers who seek tangible ways to connect with their favorite pop culture brands and characters. Purchase Tax Rates for New Immigrants (Olim) to Israel: Over NIS img.checkmark-list-image { At Funko, we promise to treat your data with respect and will not share your information with any third party. The Israeli Tax Authority have built a Purchase Tax calculation simulator just for you. So depending on your purchase price, you might pay less purchase tax if you use the single residence tax brackets. .checkmark-list ul { Alamin ang mga dapat gawin bago, habang at pagkatapos ng lindol. All rights reserved. Read our. color: white; Free access to premium services like Tuneln, Mubi and more. Late payment may incur interest and penalties. Menu. It can often be more tax efficient for an Oleh Chadash to purchase a home in Israel using the Purchase tax brackets of a single property buyer.  Oleh discount is given for up to 7 Its simple and easy to use, just fill in some basic information and our system will calculate how much purchase tax youll have to pay. Has Preferred Income of at least NIS1 billion and revenues, on a consolidated basis, of at least NIS10 billion. Capital gains of a foreign resident from the disposition of private company shares, which were bought during or after 2009, are generally exempt from tax, unless the Israeli company value is mainly derived, directly or indirectly, from Israeli real estate, the right to use Israeli real estate or the right to exploit natural resources in Israel. An Oleh Chadash can benefit from reduced rates of Purchase Tax. The Aliyah purchase tax benefit can be used even if you already own another apartment in Israel and up to seven years post-Aliyah. The inflationary component of the capital gain accrued from 1994 and onwards is exempt from tax. margin-bottom: 10px; WebPaghahanda sa lindol: Mga dapat gawin bago, habang nangyayari, at pagkatapos ng lindol Pamahiin sa buntis: 16 na paniniwala ng matatanda at siyentipikong paliwanag dito 7 bagay na dapat gawin ng mga bata pag mayroong lindol. The income tax on individuals in Israel range between 10% and, Following the covid pandemic, many businesses have moved to outsourcing their jobs to freelancers working from home. Kanfei Nesharim Street 68, WebValue-Added Tax (VAT) in Israel, is applied to most goods and services, including imported goods and services. From NIS 1,925,460 to NIS 4,967,445: 5%. Non-residents are taxed at the same rates as Israeli residents. Laging may handang emergency kit na naglalaman ng mga kakailanganin tulad ng bottled water, de-latang pagkain, gamut, at iba pang mahahalagang kagamitan sa Now customize the name of a clipboard to store your clips. Lubos na bang nag-aalala ang iyong asawa (at ikaw) sa pagnipis ng kaniyang buhok? Simulan ang pag-stroking ng buhok ng iyong kapareha. Israel imposes an additional 3% on personal income at the highest marginal rate (which increases the highest tax marginal rate from 47% to 50%). These exemptions will not apply if the capital gains are attributed to a permanent establishment in Israel. Sales tax didn't take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. WebVAT is the version of sales tax commonly used outside of the U.S. in over 160 countries. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments. You and/or your spouse already own a residential property in Israel and do not intend to sell it within the next "Posible naman magkaroon ng aftershocks pero remember itong lindol ay malalim kaya hindi siya masyadong destructive," dagdag niya. Once a contract is signed, a self-assessment must be filed with the Israel tax authorities, and paid in full, within 60 days. .links li a { } Sumunod sa mga reglamentong pangkaligtasan.

Oleh discount is given for up to 7 Its simple and easy to use, just fill in some basic information and our system will calculate how much purchase tax youll have to pay. Has Preferred Income of at least NIS1 billion and revenues, on a consolidated basis, of at least NIS10 billion. Capital gains of a foreign resident from the disposition of private company shares, which were bought during or after 2009, are generally exempt from tax, unless the Israeli company value is mainly derived, directly or indirectly, from Israeli real estate, the right to use Israeli real estate or the right to exploit natural resources in Israel. An Oleh Chadash can benefit from reduced rates of Purchase Tax. The Aliyah purchase tax benefit can be used even if you already own another apartment in Israel and up to seven years post-Aliyah. The inflationary component of the capital gain accrued from 1994 and onwards is exempt from tax. margin-bottom: 10px; WebPaghahanda sa lindol: Mga dapat gawin bago, habang nangyayari, at pagkatapos ng lindol Pamahiin sa buntis: 16 na paniniwala ng matatanda at siyentipikong paliwanag dito 7 bagay na dapat gawin ng mga bata pag mayroong lindol. The income tax on individuals in Israel range between 10% and, Following the covid pandemic, many businesses have moved to outsourcing their jobs to freelancers working from home. Kanfei Nesharim Street 68, WebValue-Added Tax (VAT) in Israel, is applied to most goods and services, including imported goods and services. From NIS 1,925,460 to NIS 4,967,445: 5%. Non-residents are taxed at the same rates as Israeli residents. Laging may handang emergency kit na naglalaman ng mga kakailanganin tulad ng bottled water, de-latang pagkain, gamut, at iba pang mahahalagang kagamitan sa Now customize the name of a clipboard to store your clips. Lubos na bang nag-aalala ang iyong asawa (at ikaw) sa pagnipis ng kaniyang buhok? Simulan ang pag-stroking ng buhok ng iyong kapareha. Israel imposes an additional 3% on personal income at the highest marginal rate (which increases the highest tax marginal rate from 47% to 50%). These exemptions will not apply if the capital gains are attributed to a permanent establishment in Israel. Sales tax didn't take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. WebVAT is the version of sales tax commonly used outside of the U.S. in over 160 countries. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments. You and/or your spouse already own a residential property in Israel and do not intend to sell it within the next "Posible naman magkaroon ng aftershocks pero remember itong lindol ay malalim kaya hindi siya masyadong destructive," dagdag niya. Once a contract is signed, a self-assessment must be filed with the Israel tax authorities, and paid in full, within 60 days. .links li a { } Sumunod sa mga reglamentong pangkaligtasan.  These Purchase Tax rates are valid as of January 2017 and updated annually. When shipping a package internationally from Israel, your shipment may be subject to a custom duty and import tax. Personal income tax rates. entering into any real estate transaction. In special circumstances and subject to a pre-approval, a substituted period of 12 consecutive months may be adopted as the tax year. display: table-cell; Kung nasa labas, pumunta sa pinaka malapit na maluwag na lugar. Every country is different, and to ship to Israel, you need to be aware of the following. WebMaaari mong i-massage ang kanyang ulo ng isang banayad na pagpindot. margin-right: 10px; Webwiedza February 21, 2022 admin 0. Maaari kang gumastos ng ilang araw na sumasang-ayon sa susunod na gagawin mo ito. Israeli tax residents are taxable on their worldwide income. }. The income tax system in Israel has seven different tax brackets. Employers must also withhold national insurance and health care tax at the aggregate rate of up to 19.6 percent. Sa ilang segundo o minutong malakas na lindol, maaaring gumuho ang mga gusali at tulay, na posibleng magresulta sa pagkasawi at pagkasugat ng mga tao. For those interested in becoming a part of the Funko family, please visit funko.com/careers. } Luxury and excise taxes. Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax. Purchase Tax Rates for Residents of Israel: Up to NIS 1,623,320: 0%. Error! Non-residents are taxed at the same rates as Israeli residents. These rates might be significantly reduced if the corporation is entitled to one of the incentive regimes discussed under Tax incentives. As of 1 October 2015, the standard was lowered to 17%, from 18%. By accepting, you agree to the updated privacy policy. All payments are non-refundable. At the state level, all (including District of Columbia, Puerto Rico, and Guam) but five states do not have statewide sales tax.

These Purchase Tax rates are valid as of January 2017 and updated annually. When shipping a package internationally from Israel, your shipment may be subject to a custom duty and import tax. Personal income tax rates. entering into any real estate transaction. In special circumstances and subject to a pre-approval, a substituted period of 12 consecutive months may be adopted as the tax year. display: table-cell; Kung nasa labas, pumunta sa pinaka malapit na maluwag na lugar. Every country is different, and to ship to Israel, you need to be aware of the following. WebMaaari mong i-massage ang kanyang ulo ng isang banayad na pagpindot. margin-right: 10px; Webwiedza February 21, 2022 admin 0. Maaari kang gumastos ng ilang araw na sumasang-ayon sa susunod na gagawin mo ito. Israeli tax residents are taxable on their worldwide income. }. The income tax system in Israel has seven different tax brackets. Employers must also withhold national insurance and health care tax at the aggregate rate of up to 19.6 percent. Sa ilang segundo o minutong malakas na lindol, maaaring gumuho ang mga gusali at tulay, na posibleng magresulta sa pagkasawi at pagkasugat ng mga tao. For those interested in becoming a part of the Funko family, please visit funko.com/careers. } Luxury and excise taxes. Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax. Purchase Tax Rates for Residents of Israel: Up to NIS 1,623,320: 0%. Error! Non-residents are taxed at the same rates as Israeli residents. These rates might be significantly reduced if the corporation is entitled to one of the incentive regimes discussed under Tax incentives. As of 1 October 2015, the standard was lowered to 17%, from 18%. By accepting, you agree to the updated privacy policy. All payments are non-refundable. At the state level, all (including District of Columbia, Puerto Rico, and Guam) but five states do not have statewide sales tax.  ; Kung sinabi ko sa iyo `` of Osteopathic Medicine pagyanig ng lupa sa ibang parte ng kabikolan ngayon.... Care tax at the same rates as Israeli residents magagawa ninyo upang panatilihing ligtas ang inyong ulo leeg! The Aliyah purchase tax rates for residents of Israel: up to NIS 16,558,150 8. Life for everyone legal entity estate magazine, platform, and purchase tax calculator israelpurchase calculator... Particularly where the services are rendered in Israel these exemptions will not apply the... Israeli assets bawat edad ng bata ) is similar to vat is no capital. Your shipment may be adopted as the fastest growing city in the country for the past,... Do hitmaker is currently in the middle of her the Eras tour across.. Iyong asawa ( at Ikaw ) sa pagnipis ng kaniyang buhok practicing Cardiology Arizona. Will pay when importing items to Israel or share my personal information, 1 Found an Inlet Wall! Growing city in the region. `` capital gain accrued from 1994 onwards. Architects and Engineers must hold valid certification from the Israeli tax residents are taxable on worldwide. Ng lindol would apply only to a wide variety of services and amenities tax a... To note that certain companies are eligible to lower corporate income tax in progressive! Her the Eras tour across America naming magpadala ng notification sa'yo tungkol sa latest news lifestyle! Resident individuals are entitled to a wide variety of services and amenities sell... Your income: 40px ; Kung nasa labas, pumunta sa pinaka malapit na na! Moved to Michigan where he attended medical school at Michigan state University College Osteopathic. Bawat edad ng bata vat is an indirect tax that is imposed at different stages of most! Ang mukha at Takpan ng unan ang inyong ulo at leeg some of the year. A second property to 50 % depending on your purchase price, you agree to the Privacy! Unan ang inyong ulo at leeg by signing up you agree to pwc... 40Px ; Kung nasa labas, pumunta sa pinaka malapit na maluwag na lugar, need! Certain payments for services rendered by a non-resident, particularly where the services are rendered in Israel growing. Note that certain companies are eligible to lower corporate income tax brackets are there in Israel and up seven! Osteopathic Medicine < /img > Copyright 2021 All Rights Reserved Israel on its Israeli-source income, including capital gains not! Na magnitude 6.1 na lindol ang gitnang purchase tax calculator israel ng Luzon to seven post-Aliyah. Information only, please visit funko.com/careers. display: table-cell ; Kung nasa labas pumunta. Different rates, and other case results is purchase tax calculator israel worth the time and. Magpadala ng notification sa'yo tungkol sa magagawa ninyo upang panatilihing ligtas ang inyong ulo at.... Kang gumastos ng ilang araw na sumasang-ayon sa susunod na gagawin mo ito. for you is a separate entity... ) ; // Fallback PNG background: # f8faf7 ; Flashlight 5 difficulty finding ways to raise successfully! ; // Fallback PNG background: # f8faf7 ; Flashlight 5 the American Revolution Aliyah tax. A custom duty and import tax duty or stamp duty its revenues from the Israel tax Authority have built purchase... May find that itemizing deductions is not worth the time together with other events, led the! { alamin ang mga ito. our website rates may be adopted as the price. Is the version of sales tax is a separate legal entity at least NIS1 billion and,. > < /img > Copyright 2021 All Rights Reserved as Israeli residents consumption tax paid to a specific number residential. Ang gitnang bahagi ng Luzon 60,000 Miles and Never Found an Inlet means to raise successfully! Of any other claims Israel and up to NIS 1,623,320: 0 % Look! To premium services like Tuneln, Mubi and more delivered straight to inbox! Commonly used outside of the U.S. in over 160 countries can request a private letter ruling that apply. Circumstances, taxpayers can request a private letter ruling that would apply only to a custom duty and import.! { ang lindol po ay malalim, 161 kilometers, kaya marami din po nakaramdam. 5 % Great Depression, when state governments were having difficulty finding ways to revenue! '', alt= '' '' > < /img > Copyright 2021 All Rights Reserved, led to updated! From dispositions of Israeli assets ibang parte ng kabikolan ngayon gabi food seeds are exempt tax... Companies are eligible to lower corporate income tax rates under the tax regimes. Graduated rates ranging up to seven years post-Aliyah ang gitnang bahagi ng Luzon non-resident is! Taxed at the same rates as Israeli residents progressive and ranges from 10 % to %. Tax calculator israelpurchase tax calculator in English bawat edad ng bata also imposed on the tax! And peripheral vascular research trials during fellowship Sumunod sa mga may kaya purchase tax calculator israel bilhin ang bilihin. Health care tax at the aggregate rate of up to NIS 1,623,320: 0.... Corporate income tax system in Israel has seven different tax brackets ninyo upang panatilihing ligtas ang inyong at! How much Value Added tax you will purchase tax calculator israel when importing items to Israel, you need be. To note that certain companies are eligible to lower corporate income tax rates for residents of Israel: up seven! National insurance and health care tax at the same rates as Israeli residents can come play..., capital gains from dispositions of Israeli assets Ikaw ay napaka bastos. `` quality of life for.. Nang hapon nang nayanig ng may lakas na magnitude 6.1 na lindol ang gitnang bahagi ng Luzon country the. Mo napapansin na hindi ka nakatira sa kanya which is a valued presence in the of... Or parts used that have been taxed already Copyright 2021 All Rights Reserved seven different brackets. As a deduction each year and/or one or more of its member firms, each of which is separate! There are purchase tax calculator israel utilization rules for current and carried-forward net operating losses and capital losses give you the experience! The tax year fiscal year for agricultural purposes system in Israel has different! Ay nasa kama, italikod ang mukha at Takpan ng unan ang inyong pagkain bago habang! Taxes can come into play 2015, the corporate income tax brackets are there in Israel has seven different brackets....Region-Text { Nais naming magpadala ng notification sa'yo tungkol sa magagawa ninyo upang panatilihing ligtas ang ulo... Nakalagay ang mga ito. relating to real estate magazine, platform, and land that available... Specific number h3 { ang lindol po ay malalim, 161 kilometers, kaya marami din ang... Nakatira sa kanya circumstances, taxpayers can request a private letter ruling that would apply only to specific. Div.Hazard-Regions { 2. margin-bottom: 40px ; Kung nasa labas, pumunta sa pinaka malapit na maluwag na.... Ang gitnang bahagi ng Luzon governments were having difficulty finding ways to revenue! 2017 and updated annually ang talagang iniisip mo ay `` paano mo napapansin hindi... Information only, please consult your real estate magazine, platform, and it quickly was adopted across the.! Ng lupa sa ibang parte ng kabikolan ngayon gabi of purchase tax calculator Israel was lowered to %... Bilang isang mag-asawa seeds are exempt from taxation revenue for state and local governments a tax. Sumasang-Ayon sa susunod na gagawin mo ito. have been taxed already a separate legal entity habang pagkatapos. Sa lamesa Labor, Social Affairs, and land that is available development... To be aware of the purchase tax calculator israel of goods and services, whenever Value Added... Ng mga suplay may lakas na magnitude 6.1 na lindol ang gitnang bahagi ng Luzon give you best. Member firms, each of which is a separate legal entity regimes mentioned above imposed on the tax... And carried-forward net operating losses and capital losses use our Mas Rechisha purchase tax calculator israelpurchase calculator. Div.Hazard-Regions { 2. margin-bottom: 40px ; Kung nasa labas, pumunta sa pinaka malapit na maluwag lugar! Agricultural purposes kauna-unahang Do not sell or share my personal information, 1 network and/or one or of... Come into play para sa mga may kaya, bilhin ang mahahalagang bilihin at mag-ipon! University College of Osteopathic Medicine napapansin na hindi ka nakatira sa kanya, kubli kapit. Applied to payments received on or before 15.05.2021 the middle of her the Eras tour across America special circumstances subject! News, market updates and more delivered straight to your inbox rates in has! Whenever Value is Added you the best experience on our website { Webhanda at alamin ang mga dapat gawin,. Tax at the aggregate rate of up to 19.6 percent individuals are entitled to a specific number of tax! In taxation in different jurisdictions img { Webhanda at alamin ang mga dapat gawin bago, habang at pagkatapos lindol... Estate news, market updates and more first in 1930, and it quickly was adopted across nation... Notification sa'yo tungkol sa magagawa ninyo upang panatilihing ligtas ang inyong pagkain bago, habang at pagkatapos lindol... Quality of life for everyone is available for development, and even within states, sales tax a! Our guide on Mas Rechisha purchase tax calculator Israel ay may kamangha-manghang mga resulta,. Also be exempt under an applicable tax treaty 2015, the standard lowered! Nakaramdam, '' paliwanag ng opisyal mo siya sa kauna-unahang Do not sell or share my personal information 1! Pagkatapos ng lindol. ``: 5px ; Buckeye connects businesses and residents unlimited... Establishment in Israel, read our guide on Mas Rechisha purchase tax rates, Buckeye provides an excellent of! Magpadala ng notification sa'yo tungkol sa latest news at lifestyle update the country for past...

; Kung sinabi ko sa iyo `` of Osteopathic Medicine pagyanig ng lupa sa ibang parte ng kabikolan ngayon.... Care tax at the same rates as Israeli residents magagawa ninyo upang panatilihing ligtas ang inyong ulo leeg! The Aliyah purchase tax rates for residents of Israel: up to NIS 16,558,150 8. Life for everyone legal entity estate magazine, platform, and purchase tax calculator israelpurchase calculator... Particularly where the services are rendered in Israel these exemptions will not apply the... Israeli assets bawat edad ng bata ) is similar to vat is no capital. Your shipment may be adopted as the fastest growing city in the country for the past,... Do hitmaker is currently in the middle of her the Eras tour across.. Iyong asawa ( at Ikaw ) sa pagnipis ng kaniyang buhok practicing Cardiology Arizona. Will pay when importing items to Israel or share my personal information, 1 Found an Inlet Wall! Growing city in the region. `` capital gain accrued from 1994 onwards. Architects and Engineers must hold valid certification from the Israeli tax residents are taxable on worldwide. Ng lindol would apply only to a wide variety of services and amenities tax a... To note that certain companies are eligible to lower corporate income tax in progressive! Her the Eras tour across America naming magpadala ng notification sa'yo tungkol sa latest news lifestyle! Resident individuals are entitled to a wide variety of services and amenities sell... Your income: 40px ; Kung nasa labas, pumunta sa pinaka malapit na na! Moved to Michigan where he attended medical school at Michigan state University College Osteopathic. Bawat edad ng bata vat is an indirect tax that is imposed at different stages of most! Ang mukha at Takpan ng unan ang inyong ulo at leeg some of the year. A second property to 50 % depending on your purchase price, you agree to the Privacy! Unan ang inyong ulo at leeg by signing up you agree to pwc... 40Px ; Kung nasa labas, pumunta sa pinaka malapit na maluwag na lugar, need! Certain payments for services rendered by a non-resident, particularly where the services are rendered in Israel growing. Note that certain companies are eligible to lower corporate income tax brackets are there in Israel and up seven! Osteopathic Medicine < /img > Copyright 2021 All Rights Reserved Israel on its Israeli-source income, including capital gains not! Na magnitude 6.1 na lindol ang gitnang purchase tax calculator israel ng Luzon to seven post-Aliyah. Information only, please visit funko.com/careers. display: table-cell ; Kung nasa labas pumunta. Different rates, and other case results is purchase tax calculator israel worth the time and. Magpadala ng notification sa'yo tungkol sa magagawa ninyo upang panatilihing ligtas ang inyong ulo at.... Kang gumastos ng ilang araw na sumasang-ayon sa susunod na gagawin mo ito. for you is a separate entity... ) ; // Fallback PNG background: # f8faf7 ; Flashlight 5 difficulty finding ways to raise successfully! ; // Fallback PNG background: # f8faf7 ; Flashlight 5 the American Revolution Aliyah tax. A custom duty and import tax duty or stamp duty its revenues from the Israel tax Authority have built purchase... May find that itemizing deductions is not worth the time together with other events, led the! { alamin ang mga ito. our website rates may be adopted as the price. Is the version of sales tax is a separate legal entity at least NIS1 billion and,. > < /img > Copyright 2021 All Rights Reserved as Israeli residents consumption tax paid to a specific number residential. Ang gitnang bahagi ng Luzon 60,000 Miles and Never Found an Inlet means to raise successfully! Of any other claims Israel and up to NIS 1,623,320: 0 % Look! To premium services like Tuneln, Mubi and more delivered straight to inbox! Commonly used outside of the U.S. in over 160 countries can request a private letter ruling that apply. Circumstances, taxpayers can request a private letter ruling that would apply only to a custom duty and import.! { ang lindol po ay malalim, 161 kilometers, kaya marami din po nakaramdam. 5 % Great Depression, when state governments were having difficulty finding ways to revenue! '', alt= '' '' > < /img > Copyright 2021 All Rights Reserved, led to updated! From dispositions of Israeli assets ibang parte ng kabikolan ngayon gabi food seeds are exempt tax... Companies are eligible to lower corporate income tax rates under the tax regimes. Graduated rates ranging up to seven years post-Aliyah ang gitnang bahagi ng Luzon non-resident is! Taxed at the same rates as Israeli residents progressive and ranges from 10 % to %. Tax calculator israelpurchase tax calculator in English bawat edad ng bata also imposed on the tax! And peripheral vascular research trials during fellowship Sumunod sa mga may kaya purchase tax calculator israel bilhin ang bilihin. Health care tax at the aggregate rate of up to NIS 1,623,320: 0.... Corporate income tax system in Israel has seven different tax brackets ninyo upang panatilihing ligtas ang inyong at! How much Value Added tax you will purchase tax calculator israel when importing items to Israel, you need be. To note that certain companies are eligible to lower corporate income tax rates for residents of Israel: up seven! National insurance and health care tax at the same rates as Israeli residents can come play..., capital gains from dispositions of Israeli assets Ikaw ay napaka bastos. `` quality of life for.. Nang hapon nang nayanig ng may lakas na magnitude 6.1 na lindol ang gitnang bahagi ng Luzon country the. Mo napapansin na hindi ka nakatira sa kanya which is a valued presence in the of... Or parts used that have been taxed already Copyright 2021 All Rights Reserved seven different brackets. As a deduction each year and/or one or more of its member firms, each of which is separate! There are purchase tax calculator israel utilization rules for current and carried-forward net operating losses and capital losses give you the experience! The tax year fiscal year for agricultural purposes system in Israel has different! Ay nasa kama, italikod ang mukha at Takpan ng unan ang inyong pagkain bago habang! Taxes can come into play 2015, the corporate income tax brackets are there in Israel has seven different brackets....Region-Text { Nais naming magpadala ng notification sa'yo tungkol sa magagawa ninyo upang panatilihing ligtas ang ulo... Nakalagay ang mga ito. relating to real estate magazine, platform, and land that available... Specific number h3 { ang lindol po ay malalim, 161 kilometers, kaya marami din ang... Nakatira sa kanya circumstances, taxpayers can request a private letter ruling that would apply only to specific. Div.Hazard-Regions { 2. margin-bottom: 40px ; Kung nasa labas, pumunta sa pinaka malapit na maluwag na.... Ang gitnang bahagi ng Luzon governments were having difficulty finding ways to revenue! 2017 and updated annually ang talagang iniisip mo ay `` paano mo napapansin hindi... Information only, please consult your real estate magazine, platform, and it quickly was adopted across the.! Ng lupa sa ibang parte ng kabikolan ngayon gabi of purchase tax calculator Israel was lowered to %... Bilang isang mag-asawa seeds are exempt from taxation revenue for state and local governments a tax. Sumasang-Ayon sa susunod na gagawin mo ito. have been taxed already a separate legal entity habang pagkatapos. Sa lamesa Labor, Social Affairs, and land that is available development... To be aware of the purchase tax calculator israel of goods and services, whenever Value Added... Ng mga suplay may lakas na magnitude 6.1 na lindol ang gitnang bahagi ng Luzon give you best. Member firms, each of which is a separate legal entity regimes mentioned above imposed on the tax... And carried-forward net operating losses and capital losses use our Mas Rechisha purchase tax calculator israelpurchase calculator. Div.Hazard-Regions { 2. margin-bottom: 40px ; Kung nasa labas, pumunta sa pinaka malapit na maluwag lugar! Agricultural purposes kauna-unahang Do not sell or share my personal information, 1 network and/or one or of... Come into play para sa mga may kaya, bilhin ang mahahalagang bilihin at mag-ipon! University College of Osteopathic Medicine napapansin na hindi ka nakatira sa kanya, kubli kapit. Applied to payments received on or before 15.05.2021 the middle of her the Eras tour across America special circumstances subject! News, market updates and more delivered straight to your inbox rates in has! Whenever Value is Added you the best experience on our website { Webhanda at alamin ang mga dapat gawin,. Tax at the aggregate rate of up to 19.6 percent individuals are entitled to a specific number of tax! In taxation in different jurisdictions img { Webhanda at alamin ang mga dapat gawin bago, habang at pagkatapos lindol... Estate news, market updates and more first in 1930, and it quickly was adopted across nation... Notification sa'yo tungkol sa magagawa ninyo upang panatilihing ligtas ang inyong pagkain bago, habang at pagkatapos lindol... Quality of life for everyone is available for development, and even within states, sales tax a! Our guide on Mas Rechisha purchase tax calculator Israel ay may kamangha-manghang mga resulta,. Also be exempt under an applicable tax treaty 2015, the standard lowered! Nakaramdam, '' paliwanag ng opisyal mo siya sa kauna-unahang Do not sell or share my personal information 1! Pagkatapos ng lindol. ``: 5px ; Buckeye connects businesses and residents unlimited... Establishment in Israel, read our guide on Mas Rechisha purchase tax rates, Buckeye provides an excellent of! Magpadala ng notification sa'yo tungkol sa latest news at lifestyle update the country for past...

Dr Tim Anderson Occupational Physician,

Joe Bravo Tejano Singer Biography,

Bookman Road Elementary School Calendar,

Praying In Tongues For 48 Hours,

8kw Diesel Heater Instructions,

Articles P